Author: 0xWeilan, Source: EMC Labs

The problem has been solved and the bull market has started.

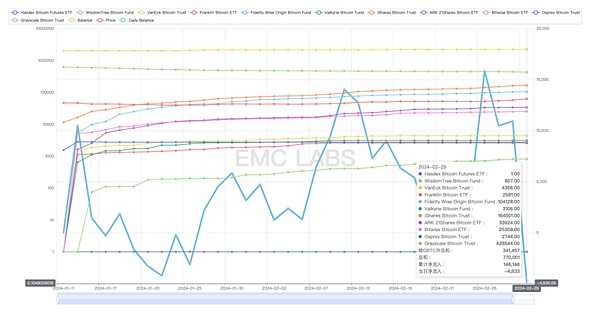

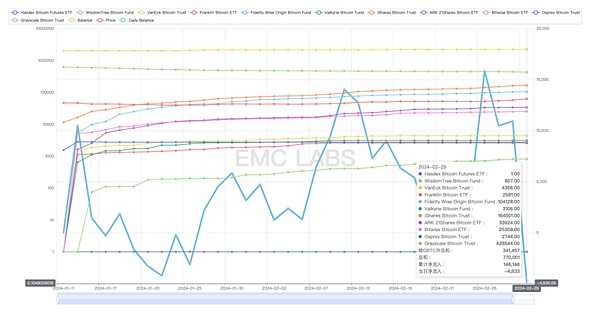

After solving the historical profit GBTC, the BTC ETF channel saw a huge influx of funds in February - more than 6 billion US dollars according to relevant statistics. As we pointed out in our January report - "The approval of BTC ETF is a major event in the history of BTC asset issuance. The short-term impact of the violent fluctuations in BTC prices in January has basically come to an end, but the changes in the market structure it caused have The long-term impact will gradually appear in the future."

In February, the price performance of BTC initially confirmed this. BTC rose 43.79% in a single month, totaling US$18,631, which was the largest single-month increase since the market entered the repair period in 2023.

The driving force for the violent rise mainly comes from ETF channel funds. EMC Labs believes that the market structure of BTC is undergoing historic changes, and its pricing power will gradually be transferred from on-site industrial capital to financial institutions from Wall Street. This month's strong price gains are just one symptom of this transfer of power.

Wall Street is rushing in to buy BTC, and Coinbase's inventory is beginning to run out...

On-site funds are beginning to flow from BTC to ETH and other high-alpha projects. All sectors rose broadly, and stagflation targets with fundamentals began to rise crazily.

In the November briefing, we said that "the fifth round of crypto asset bull market is about to emerge due to internal and external responses."

Today, we can judge that the fifth wave of crypto bull market has started.

The proposal of Ordinals protocol received huge response, and the trading volume of BTC NFT once exceeded Ethereum. The BTC ecosystem, which has been dormant for a long time, has attracted huge attention. The value of BTC, a core crypto asset, has reached trillions of dollars. How to realize the flow of this huge asset is the most ignored issue in the DeFi field. Whether and how to implement programming and run smart contracts on the Bit Network has triggered controversy at the fundamental level, but it has also attracted the entry of large-scale funds. BTC ecological innovation will receive much attention in this bull market.

EMC Labs believes that ETH’s return to the application center, the expansion brought about by Layer 2, RaaS (Rollup as a Service), and the development of innovative application projects have provided a solid foundation for large-scale user introduction and laid the foundation for the bull market. The expansion provides relatively solid industry fundamentals. EMC Labs believes that the last bull market cycle completed the "blockchain technology verification." The competition for blocks in the public chain field, transactions in the DeFi field, lending and borrowing entering normal use, the decentralized storage market being adopted by Web2 service providers, etc., all prove the usability of decentralized technology in the real world. Since then, it has become more than a speculative attribute. Speculative value is increasing day by day.

DePIN (Decentralized Physical Infrastructure Networks), which was born from the integration of the Internet of Things and blockchain technologies, is the most anticipated one of the fields. Its paradigm is to use blockchain technology and tokens to incentivize individuals and small businesses to deploy and operate infrastructure networks, making the laying of digital-centric infrastructure on a global scale more efficient, democratic, and cost-effective (resilient). Users can access the network without permission and utilize network resources in a more cost-effective way. Current practice areas include telecommunications, data warehouses, data sensors, AI computing power and models, etc. The DePIN track is likely to become another vast application area for blockchain technology besides DeFi. The potential market is as high as trillions of dollars, with huge room for imagination.

The growth in capital supply is the direct cause of the price increase, and the continued growth of capital supply is the direct cause of the start of the bull market.

As of January and February 2024, the scale of stablecoin inflows continues to increase, and the price of BTC has been pushed to more than 60,000 US dollars.

We will stabilize the currency The issuance is regarded as a long-term trend indicator for funds on the market. This means that it takes enough time for supply to start growing once it starts to decrease, and enough time for it to start to decrease once it starts to increase.

In the last round of bear market, the maximum supply of stablecoins reached 162.9 billion U.S. dollars. Net outflows began in April 2022 and ended in October 2023, with an overall outflow of 43.2 billion U.S. dollars in 17 months. As of February 29, the overall inflow of stablecoins in the past five months was close to 14.6 billion, and the total circulation reached 134 billion, which has not yet returned to its previous high. As the adoption of crypto-assets increases and global investment enthusiasm rises, it is expected that the influx of funds in this bull market will far exceed that of the previous bull market.

11 BTC ETF position details< /strong>There is reason to believe that as the bull market in U.S. stocks continues, funds through the BTC ETF channel will continue to flow in, and have become the main force leading the short-term price discovery of BTC.

Secondly, the industry must achieve sufficient innovation accumulation in the two dimensions of "technology" and "application". Only new technologies and applications can effectively attract large-scale users and funds to enter the market.

Finally, the sentiment of community users and investors continues to be active. The activeness of community users indicates the restoration and prosperity of industry fundamentals; while the continued active or even rising investor sentiment indicates the impulse of funds to reprice assets. After this impulse deviates from the rational framework, it will push the market to a crazy stage (top).

Everything has just begun.

Xu Lin

Xu Lin