Written by: 0xWeilan

After 15 years of development, BTC and Crypto industries have entered the stage of large-scale adoption from technology research and development and marginal market verification. From little-known and notorious to stormy and sunny, the path and form of its realization are often unexpected.

Everything seems accidental, but it seems inevitable.

Following the approval of BTC ETF in January, the US SEC unexpectedly announced the approval of 8 ETH ETFs on May 23. Because the market had previously assumed that the approval of ETH ETF would be delayed until the second half of the year, the unexpected positive news suddenly landed and pushed BTC and ETH, which were in a weak state, to rebound by more than 11.4% and 24.83% respectively.

In the long process of large-scale adoption of BTC and Crypto, the transformation of traditional finance and regulatory agencies has brought huge impetus to the development of the encryption industry and market. In terms of Crypto, the "unexpected" defection of the Democratic Party not only shows that the influence of 50 million Crypto holders in the United States cannot be underestimated, but also shows the policy impact brought about by the massive entry of traditional financial institutions represented by BlackRock.

US Policy

On May 23, the US House of Representatives passed the Financial Innovation and Technology for the 21st Century Act (also known as FIT21) with a high vote. In the long run, the passage of the FIT21 Act will promote the development of the Crypto industry far more than the approval and issuance of BTC ETF and ETH ETF.

For the crypto industry, the institutional affirmation and protection that the FIT21 Act will bring will have a far-reaching impact. The bill provides a path for blockchain projects to be launched safely and efficiently in the United States; it clarifies the regulatory boundaries of the U.S. Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) based on whether the regulated subject is a security or a commodity; it clarifies the regulation of cryptocurrency exchanges and protects U.S. investors by establishing and implementing trading rules.

After the House of Representatives passes it, the FIT21 bill will be submitted to the Senate for deliberation. If it is approved, it will be submitted to the President of the United States for deliberation. It will take time for the FIT21 bill to be approved, and it will take even longer to implement it. However, its breakthrough significance has been initially demonstrated. The institutional affirmation and promotion of the long-term development of the Crypto industry in the United States shows that the Crypto industry, which has resolved the legitimacy crisis, has become one of the key industries developed in the United States.

Macro Finance

In early May, the United States released economic data for April - the unemployment rate and non-farm employment data were far lower than market expectations, which led to an increase in expectations of interest rate cuts, pushing the U.S. dollar index down, and the three major U.S. stock indexes that fell sharply in April rebounded strongly. In addition, with the support of Nvidia's earnings report that exceeded expectations, the Nasdaq index rose 6.88% in a single month, recovering the losses in April and setting a new record high.

In May, the Nasdaq rose strongly by 6.88%, recovering all the losses in April and setting a new record high

In the middle of the month, the Federal Reserve continued to issue hawkish remarks, suppressing the expectations of the start and frequency of interest rate cuts, causing the market to fluctuate. However, the mild recession in some parts of the US economy has made market participants believe that interest rate hikes are unlikely to occur, and interest rate cuts are only a matter of time. Goldman Sachs expects that the start of the interest rate cut has been postponed from July to September, and the current market trend can be regarded as reflecting this expectation.

If there is no abnormal economic data in the future, it is expected that the bullish trend of US technology stocks will not change.

Crypto Market

In May, BTC opened at $60,621.20 and closed at $67,472.41, up $6,850.31 for the whole month, or 11.3%, with an amplitude of 25.54%.

BTC Monthly Trend

Unable to recover the April decline as strongly as the Nasdaq, BTC performed relatively weakly in May. After the huge shock, the trading volume failed to increase effectively, leaving long upper and lower shadows on the trend. The biggest gain was that it effectively recovered after falling out of the top box at the beginning of the month and returned to the shock range of $58,500 to $69,500.

Although the fundamentals of on-chain activities continue to deteriorate, the price has effectively rebounded, and the support from macro-finance, industry, and capital has temporarily put aside concerns about the end of the bull market.

BTC daily trend

In this cycle, the momentum of BTC's rise has gone through three stages, namely, inventory replenishment, speculation on the expected approval of BTC ETF, and capital inflow after the operation of BTC ETF. As of the end of May, except for the ETF channel, the inflow of funds on the market has slowed down significantly. EMC Labs judged that in May, the rebound of BTC prices was mainly driven by the linkage effect brought about by the strong rise of ETH.

There are signs that the industrial capital in the market is flowing from BTC to ETH, which can be confirmed by the increased trading volume of the ETH/BTC trading pair after May 15.

The trading volume of the ETH/BTC trading pair has increased significantly

The reverse flow of industrial capital indicates that the price discovery of BTC in the future market will be mainly determined by the inflow of funds from the BTC ETF channel and whether the existing funds in the market are sold.

During the progress of the bull market, long-term investors will gradually sell the BTC they hold in batches to the market, while short-term investors who are attracted by the price and aim to outperform the market in the short term will continue to increase their positions.

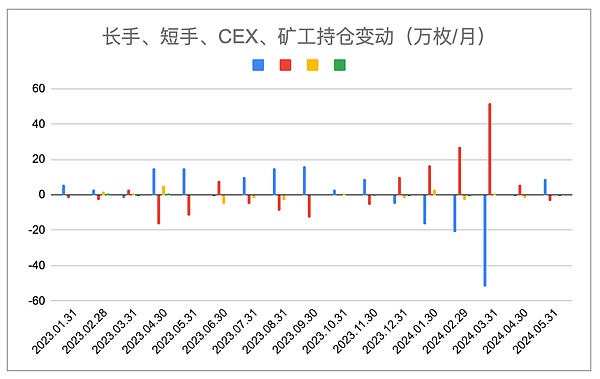

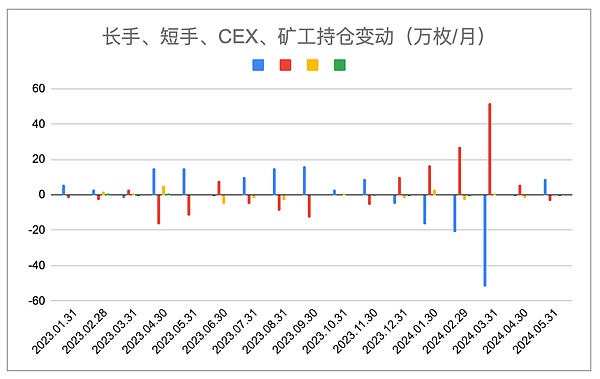

Since December, this trend of "from long to short" has continued until it reversed in May. This month, the long-hand group as a whole has changed from selling to accumulating, increasing 93,400 BTC, while short-handed people have begun to reduce their positions and sold 38,200 BTC.

Long-hand, short-hand, CEX, miner positions (EMC Labs chart)

In the first month after the halving, the miner group has seen both block rewards and transfer consumption income decline, with a sharp drop in income to $963 million (statistics from The Block). EMC Labs found that under the pressure of a sharp drop in income, miners were forced to make two moves this month for the coming year. One was to sell off the inventory and sell the accumulated 6,000 BTC to the market, and the other was to reduce the supply of computing power.

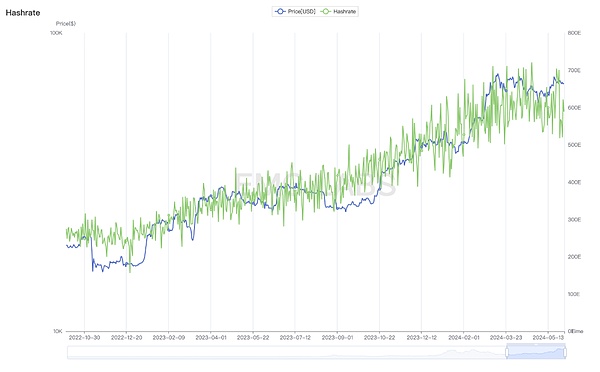

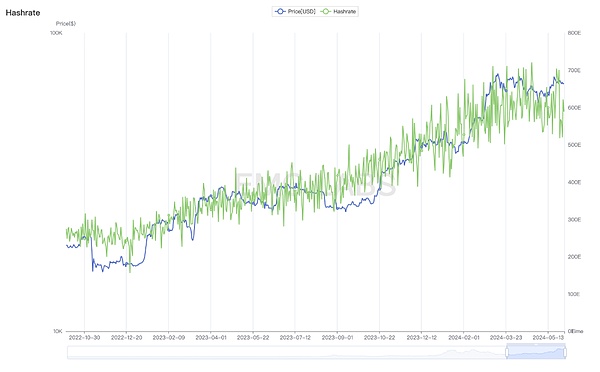

With the price drop, the Bitcoin network lost up to 28% of its computing power after reaching its peak on April 23.

Bit Network Computing Power Statistics

Currently, the miner group holds 1.8 million BTC. Since this round of bull market, there has been no large-scale selling. If the market falls in the future, in order to maintain the operation of the mine, the miner group may sell and push the market down in a weak equilibrium state.

Market Supply

As the bull market progresses, long-term investors gradually sell the BTC they hold in batches to the market, while short-term investors, attracted by the price and aiming to outperform the market in the short term, continue to increase their positions.

Since December, this "long to short" trend has continued until it reversed in May. This month, the long-term investors as a whole have changed from selling to accumulating, increasing by 93,400 BTC, while short-term investors have begun to reduce their positions and sell 38,200 BTC.

Long-hand, short-hand, CEX, miners' holdings (EMC Labs chart)

In the first month after the halving, the miners' block rewards and transfer consumption income both declined, and the income was greatly reduced to US$963 million (The Block statistics). EMC Labs found that under the pressure of a sharp drop in income, miners were forced to make two moves this month for the coming year. One was to sell the inventory and sell the accumulated 6,000 BTC to the market, and the other was to reduce the supply of computing power.

With the price drop, the Bitcoin network lost up to 28% of its computing power after reaching its peak on April 23.

Bitcoin Network Computing Power Statistics

Currently, the miners hold 1.8 million BTC. Since this round of bull market, there has been no large-scale selling. If the market falls in the future, in order to maintain the operation of the mine, the miners may sell and push the market in a weak equilibrium state downward.

Capital Flow

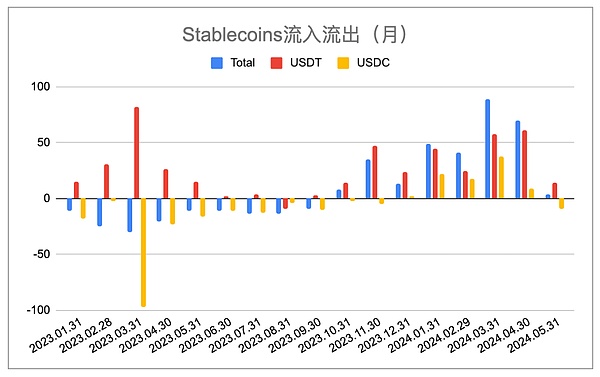

Since this cycle, stablecoins have achieved net inflows since October 2023 to boost the market. The scale of inflows hit the highest and new highs since this cycle in March and April this year, becoming an important force to undertake the liquidity shock caused by the large-scale BTC profit realization (the other force is the fiat currency funds in the BTC ETF channel).

By May, with the massive exchange of chips and violent market fluctuations, coupled with the delay of interest rate cuts, the inflow rate of funds in the stablecoin channel has dropped significantly. According to EMC Labs statistics, the inflow of stablecoin funds in May was only 341 million US dollars, far lower than 8.9 billion and 7 billion in March and April.

Monthly changes in the supply of major stablecoins (EMC Labs chart)

Comparing the two major stablecoins, USDT has an inflow of 1.394 billion this month, while USDC has recorded an outflow of 973 million for the first time in 5 months, showing that the trend changes of stablecoin channel funds in the US are more sensitive than those in Asia.

Flows of 11 BTC ETFs in May (Chart by SoSo Value)

EMC Labs observed the fiat currency funds in the ETF channel and found that outflows occurred on 5 of the 22 trading days in May, and net inflows were recorded on 17 trading days, with a net inflow of 19.05 billion US dollars for the whole month, far higher than the 3.41 US dollars inflow of the stablecoin channel.

As of the end of May, the assets held by 11 BTC ETFs in the United States have reached 58 billion US dollars, holding 852,256 BTC, accounting for 4.32% of the total supply, and are becoming an important force influencing the price of BTC.

Conclusion

In the April report, we judged that the market entered the bull market relay state, and the first wave of large-scale chip exchange (March to April) has already occurred. In May, both long and short hand transactions dropped sharply, the market supply resumed "from short to long", and the exchange's stock of BTC returned to the outflow state, indicating that the BTC market has entered a weak equilibrium state after the passionate release.

We maintain our judgment that there is a trend of capital migration from BTC to ETH in the market, and the "Ethereum time" will continue. The subsequent trend of BTC depends on the US macroeconomic data and the market voice of the Federal Reserve.

BTC, which is in a weak equilibrium state, does not actually need too much funds to drive upward. The possible buying power comes from the collateral effect brought by the approval of the ETH ETF on the one hand, and from the fiat currency funds in the BTC ETF channel on the other hand. With its continued growth in scale and the same pace as the Nasdaq, the fiat currency funds in the BTC ETF channel may become an independent force influencing the price of BTC.

Catherine

Catherine

Catherine

Catherine Miyuki

Miyuki Weiliang

Weiliang Alex

Alex Miyuki

Miyuki Alex

Alex Miyuki

Miyuki Weiliang

Weiliang Alex

Alex Miyuki

Miyuki