Author: Konstantinos Tsoulos, Medium; Compiler: Deng Tong, Golden Finance

Abstract

Eigenlayer is introducing a powerful re-staking primitive; staked ETH can be "re-delegated" to secure other networks or applications.

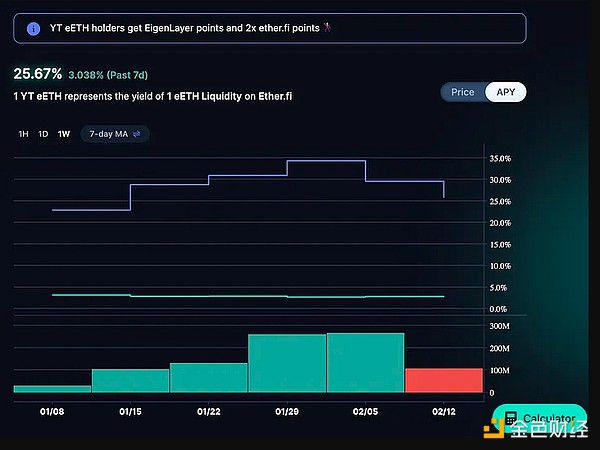

Similar to LST for Liquid Staking, the Liquidity Staking Token (LRT) protocol acts as an intermediary protocol, accepting ETH or LST funds and depositing them into Eigenlayer’s orchestrated list of services and returns a "receipt" of the deposited funds that can be used in DeFi.

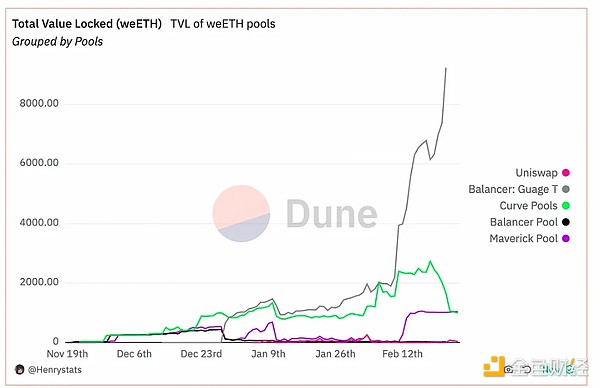

To date, Ether.fi has been a pioneer and TVL leader in the LRT protocol.

The introduction of restaking and LRT brings a range of opportunities for trading and risk-adjusted returns.

Re-staking magnifies slashing and technical risks due to the introduction of additional layers of infrastructure and smart contracts. Liquidity re-pledged token protocols add another layer of smart contract risk.

The popular stETH/ETH loop trade is expected to pass the baton to high APR LRT loop strategies in select venues.

wETH lending rates should eventually move higher, probably somewhere between the average staking and re-staking reward rates.

While companies like Aave and Compound may not be using LRT as collateral anytime soon, new credit markets like Morpho Blue, Euler v2 and Ajna are becoming the venue for leveraged re-hypothecation .

Interest rate swaps referencing wETH rates become imperative.

The emerging landscape of ETH credit markets is one of more fragmented liquidity, higher interest and interest rate volatility, and attractive cross-currency market arbitrage opportunities. The IPOR vision of DeFi credit hubs is more important than ever.

In recent months, liquidity rehypothecation and the emergence of new lending protocols have dominated the market narrative and attracted the attention of DeFi users and capital.

In this article, we briefly introduce restaking as a new DeFi primitive and consider the impact this powerful technology may have on the DeFi interest rate landscape in the coming years. As liquidity in credit markets becomes increasingly fragmented with the emergence of new lending protocols, we discuss the risks and opportunities presented by rehypothecation.

Feature layer and repositioning primitives

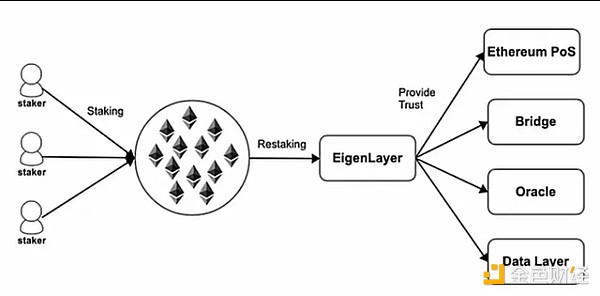

As the name suggests, re-pledge means "re-delegating" the pledged ETH, which secures the Ethereum PoS network to secure other networks or applications called Active Verification Service (AVS).

Against this backdrop, AVS is operating using the Ethereum Validator Service, "borrowing" the security and decentralization afforded by the proven decentralized network and Ethereum economic footprint. . On the supply side, ETH stakers and validators can decide to take on additional slashing risk by offering their staking and validator services to other decentralized networks, infrastructure, and applications in exchange for additional yields.

Eigenlayer: A market connecting validators and AVS

The re-staking primitive was introduced by the Eigenlayer protocol. Eigenlayer is essentially a marketplace for AVS and validator connections. EigenDA is expected to be the first AVS to go into production, leveraging Eingelayer’s staking to reduce L2 data availability costs. As of this writing, only about a dozen AVS have joined Eigenlayer.

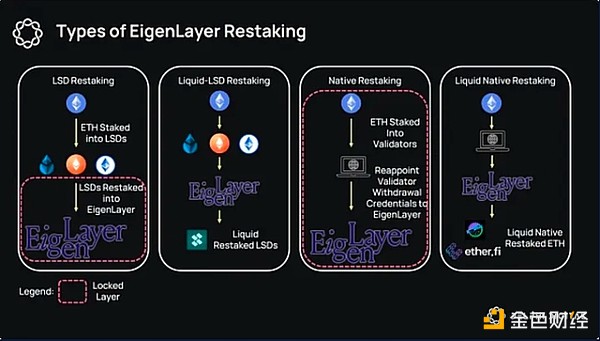

From a technical perspective, Eigenlayer is a set of smart contracts that interact with Ethereum staking. Currently in testnet, the protocol will allow users to select the services they are willing to protect from a list of installed AVS. Supports two forms of re-pledge:

Native re-pledge—Individual stakers can participate using their staking and validator infrastructure;

Liquidity re-staking—Liquidity Holders of staking tokens (LST) such as Lido stETH can simply deposit their liquid staking tokens into Eigenlayer.

With native re-staking, Eigenlayer finally introduces an intermediate step in the withdrawal process; instead of validators sharing withdrawal credentials with the Ethereum network, Instead, these details (and funds are deposited) are shared to an Eigenlayer smart contract called Eigenpod. At the Ethereum level, the Eigenpod contract address becomes the withdrawal address, and Eigenlayer controls the slashing conditions. In short, Eigenlayer acts as a middleware in the Ethereum staking technology stack.

If a slash occurs, Ethereum will be "notified" and the slashed assets will be withdrawn from Eigenlayer. In the case of liquidity re-staking, slashing is much simpler as it only requires LST holdings to “change hands” without the involvement of the Ethereum staking layer.

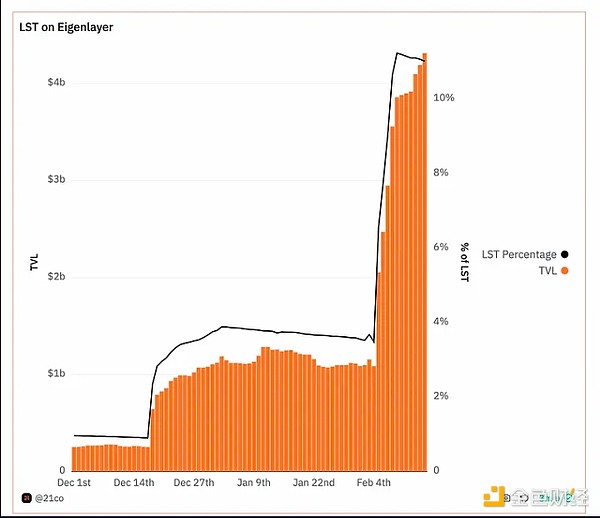

Eigenlayer is currently in the testnet stage and the mainnet is expected to launch sometime in the summer of 2024. With the introduction of “points” as a precursor to potential airdrops, Eigenlayer is a hot topic in the DeFi space right now. TVL has grown to $8 billion, while 10% of the circulating LST supply has been deposited in Eigenlayer.

10% of the LST supply has been deposited into Eigenlayer

Supported The AVS list, and the resulting range of returns, remains anyone's guess. Currently, depositors are only experimenting and there is no staking activity, and market participants are trying to price the value of the Eigenlayer airdrop.

Conversations with key players in the restaking ecosystem suggest that the launch of the Eigenlayer mainnet and the resulting "risk stratification" may offer rewards beyond stETH The chance of return is 5-15% higher. An additional note here is that the restaking rewards may be paid by some AVS in tokens other than ETH, resulting in greater fluctuations in the restaking yield.

Liquidity Staking Tokens — LRT

Similar to ETH staked on the Ethereum network, ETH staked on the feature layer cannot be used in DeFi, nor can it be completed Transfer before withdrawal process. The feature layer has a withdrawal queue with a waiting period of 7 days. Several protocols have emerged introducing Liquidity Reset Tokens (LRT), where users deposit ETH or LST into an intermediary protocol that acts as an “administrator” for AVS to reset it and returns a “receipt” of the deposit that can be used in DeFi ".

In addition to the obvious capital efficiency advantages of this structure, LRTs can also serve as an additional line of defense in the event of cuts.

With LRT, recollateralized positions are tokenized in liquid form, allowing liquidators to simply take over without enforcement Withdrawal (this reduces the security of AVS). Before mainnet launch, the LRT protocol simply accepted funds in exchange for Eigenlayer and protocol-specific points.

Type of re-pledge

Opportunity

The remortgage primitive can be said to be decentralized and ETH A great blessing. Rollups, other L1s, oracles, or any software service can "borrow" Ethereum's security. Through re-staking, Ethereum’s utility and value continues to increase.

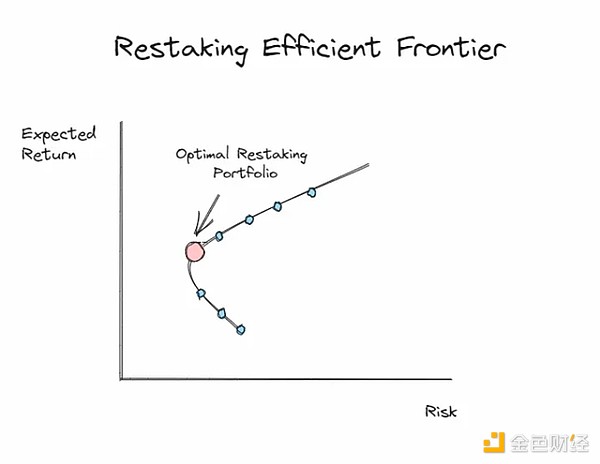

Once Eigenlayer goes live on mainnet, ETH holders will have access to a wide range of risk-adjusted return options.

The launch of LRT has opened up a vast world for transactions and profits.

These assets serve as collateral in credit markets, bringing new life to the popular rotating trade, which will now focus on rehypothecation and target larger APRs.

A new efficient area for ETH holders

Risk

< span style="color: rgb(0, 112, 192);">Due to the introduction of additional layers of infrastructure and smart contracts, restaking will obviously amplify haircuts and technical risks. Liquidity re-pledged token protocols add another layer of smart contract risk.

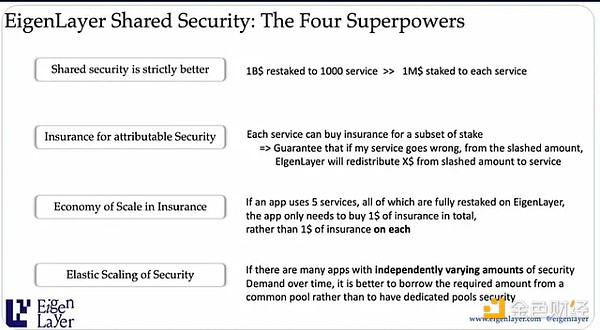

There are always pros and cons to “re-hyping”, especially if correct risk management principles are not applied. Vitalik’s 2023 post warned against overloading Ethereum’s (social) consensus and emphasized the importance of careful decision-making when reinvesting. A legitimate concern is that the restaking primitive may have "second-order effects" in that it may incentivize excessive risk-taking. The founder of Eignelayer dismissed these concerns as misplaced in an excellent post and introduced the concepts of pool safety and attribution safety.

Eigenlayer: "Concentrated and attributable security" or just overly risky?

In the specific case of DeFi and LRT, it is reasonable to expect that LRT decoupling will become more frequent and the risk of cascading liquidation events will increase. In this case, the LRT (and possibly LST) can act as a release valve.

Decoupling and liquidation undoubtedly create attractive opportunities, but may also lead to long-term ETH volatility and hinder institutions use. It currently appears that some of the reduction has not yet been implemented, suggesting that restakers will lose their 32 ETH staked amount entirely.

In this case, the impact on ETH price is not direct. While local re-hypothecaters whose ETH is slashed will be burned (deflation), a significant slash of re-hypothecated LST will essentially cause a transfer of ownership and potentially lead to selling pressure.

The potential dominance of a single LRT protocol, playing a "manager" role similar to Lido's list of eligible AVS for staking, may actually lead to less decentralization over time.

Drivers of wETH borrowing rates in the credit market

Deploy ETH in DeFi before re-pledge The opportunities are quite limited. With the addition of multiple LSTs (mainly stETH) as eligible collateral in the blue-chip credit market, and the introduction of high loan-to-value (LTV) ratios for related assets (such as stETH/ETH), leveraged staking became a major use case.

In the Shapella upgrade, the borrowed wETH can be used to play the "repeg" role of different LSTs. Borrowing wETH against wBTC collateral may also be used as a (rather inefficient) expression of a long BTC/ETH trade.

After the Shapella upgrade, the reduced risk of withdrawals and the subsequent elimination of the illiquidity premium, a "wash and repeat" strategy for leveraged investing using the LST protocol (depositing LST into the credit market, borrowing more of wETH and keeping it in the loop) becomes the only game in town.

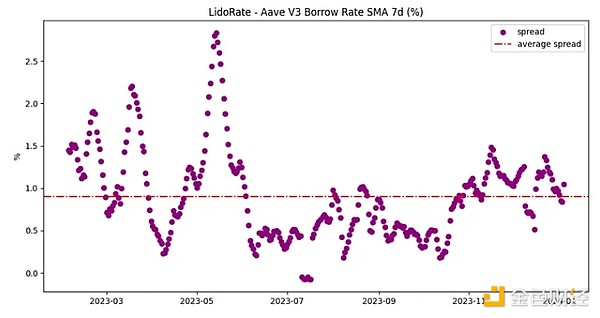

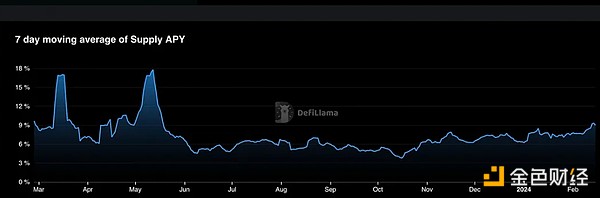

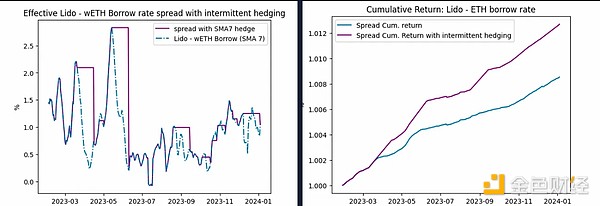

The spread between the Lido reward rate and the wETH borrowing rate has been one of the most concerning issues in the DeFi space.

stETH reward rate has become a cap on wETH borrowing rates, with the spread intermittently reversing in 2023.

Lido reward rate—the upper limit of ETH borrowing interest rate

As more and more people participate in transactions, More and more ETH is being staked (with the stake ratio reaching 25%), and activity on the network has generally remained subdued, with spreads continuing to decline over the last year.

It is reasonable to assume that the popular stETH/ETH cycle trading has most likely ended.

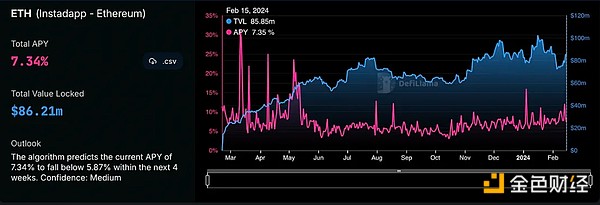

The historical evolution of ETH APY on one of the most popular one-click leverage staking platforms illustrates the above. Professional leveraged stakers are increasingly cycling through the Morpho Optimizer’s improved rates in an attempt to “squeeze” a few extra pips on each cycle.

stETH Has the cycle transaction ended?

LRT reward rate - the new gravity?

Re-staking essentially increases the upper limit on the rewards that ETH holders can earn. The natural question raised here is whether ETH lending rates will still be “limited” by the stETH reward rate, or whether restaking and the rates offered by LRT will become the new gravitational pull in the future.

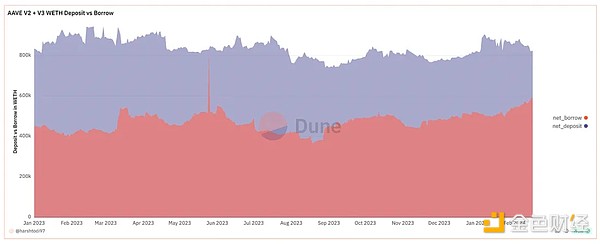

Purely by intuition, the ever-expanding opportunity set creates an increased need for leverage. wETH borrowing rates will eventually be allowed to settle at a higher rate, likely somewhere between the average staking and re-staking reward rates. The increased demand for wETH on Aave in recent weeks seems consistent with this view.

ETH demand on Aave has been increasing recently

Interest rates start to climb from here?

Nonetheless, a deeper analysis of the credit market landscape presents a more nuanced picture.

The subtle point here is that, after adjusting for risk, the promised additional returns are much less attractive and therefore are likely not to dominate flows from the outset.

Similar comments apply to the percentage of DeFi participants actively trading in LRT loops.

For context, of the total ETH supply, 25% is currently staked, with approximately 45% of that in the LST protocol. About 10% of the LST supply is currently stored in Eigenlayer and is only exposed to smart contract risk for the time being. Currently, the capital retention rate after mainnet launch is questionable.

More likely than not, companies like Aave and Compound won’t be offering LRT as collateral anytime soon.

The supply side of the wETH credit market pool is expected to attract more attention and capital and serve as a backstop against higher interest rates.

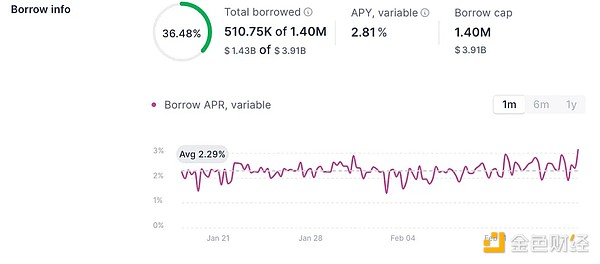

Historically, Aave and Compound have been very conservative in introducing assets. Risk aversion has become part of the DNA of traditional credit markets. Still, this ultimately hints at the fact that loan pool primitives are a fundamental part of these markets. The emergence of novel siled market designs (see Morpho Blue, Euler v2, Ajna) allows the permissionless onboarding of long-tail assets.

With the first LRT pool already launched on Morpho Blue, it is clear that the new credit market will be the place for leveraged re-hypothecation.

In short, the development pattern of the ETH credit market is:

Liquidity is more dispersed;

At least Raise interest rates across the board and increase interest rate volatility;

Cross-regional “arbitrage” opportunities.

Interest rate swaps referencing wETH rates become imperative.

ETH lending interest rate on Aave V3

Low Liquidity and New Assets Drive Morpho Blue Rates Higher

Fragmented Liquidity, “Smart” Loops, and DeFi’s Credit Center

Loop trading is not necessarily going away, It just keeps evolving.

Leveraged staking has become more competitive, requiring optimization of rate sources from different venues or intermittent locking of spreads.

Using interest rate swaps to intermittently lock in spreads can improve the APY of rotation strategies

The popular stETH/ETH round robin trade will soon pass the baton to “Leveraged Re-Staking”.

Cycling LRT/LST or LRT/ETH pairs will become the next niche high APR strategy for select venues.

Assuming the interest rate differential for borrowing and lending with wETH reverses decisively, and the spread with LRT remains attractive, increased demand for lending stETH in the future is a distinct possibility.

JinseFinance

JinseFinance

JinseFinance

JinseFinance Joy

Joy Stratos

Stratos Bitcoinist

Bitcoinist Bitcoinist

Bitcoinist Bitcoinist

Bitcoinist Bitcoinist

Bitcoinist Cointelegraph

Cointelegraph Bitcoinist

Bitcoinist Bitcoinist

Bitcoinist