Author: Alex O’Donnell Source: coindesk Translation: Shan Ouba, Golden Finance

After years of regulatory resistance and countless revised registration documents, the spot Ethereum exchange-traded fund (ETF) has finally entered the market.

For the first time, publicly traded Ethereum (ETH) ETF shares will be listed on some of the most popular brokerage platforms in the United States, joining stocks such as Apple (AAPL) and SPDR S&P 500 ETF Trust (SPY).

The highly anticipated listing is a defining moment for the cryptocurrency market and an opportunity for millions of American institutional and retail investors. Here's what you need to know to make the most of it.

When will the spot Ethereum ETF be available?

The Chicago Board Options Exchange (CBOE) confirmed July 23rd as the launch date for five ETFs trading on its platform: the 21Shares Core Ethereum ETF, the Fidelity Ethereum Fund, the Invesco Galaxy Ethereum ETF, the VanEck Ethereum ETF, and the Franklin Ethereum ETF.

The other four spot ETH ETFs will trade on either Nasdaq or New York Stock Exchange (NYSE) Arca. Although those exchanges have yet to make an official announcement, they are widely expected to list on July 23rd as well.

Where can I buy Ethereum ETF shares?

The short answer: just about any major brokerage platform. Each of the ETH spot ETFs that came to market in the last week of July has received regulatory approval to trade on at least one major U.S. exchange—specifically, Nasdaq, New York Stock Exchange (NYSE) Arca, or Cboe BZX.

Everyday investors don’t trade directly on these exchanges. Instead, they rely on brokerage platforms (household names like Fidelity, E*TRADE, Robinhood, Charles Schwab, and TD Ameritrade) as intermediaries.

Once ETH ETF shares are listed on public exchanges, it is expected that all the well-known brokerage firms and other institutions will be able to facilitate trading.

What are my options and how do I know which one is best?

Nine spot ether ETFs are set to begin trading soon. In terms of the underlying mechanics, these funds are almost identical. Each ETF is sponsored by a reputable fund manager, holds spot ETH through a qualified custodian, and relies on a core group of professional market makers to create and redeem shares. They also all enjoy the same standard investor protections, including insurance against broker bankruptcy and cybersecurity risks.

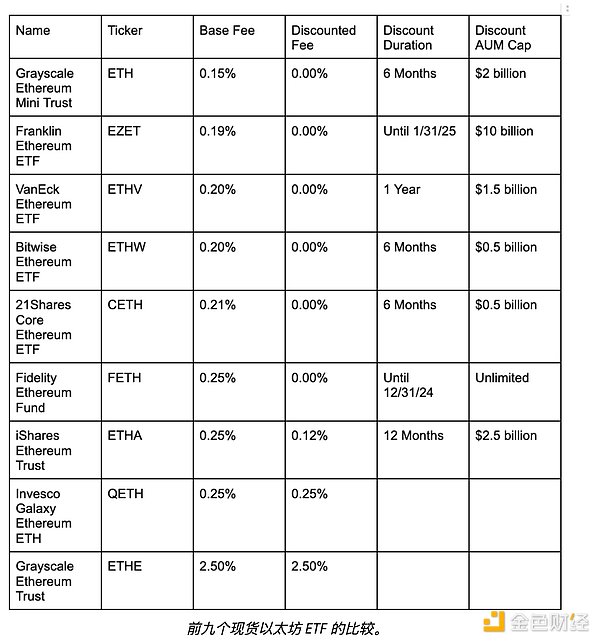

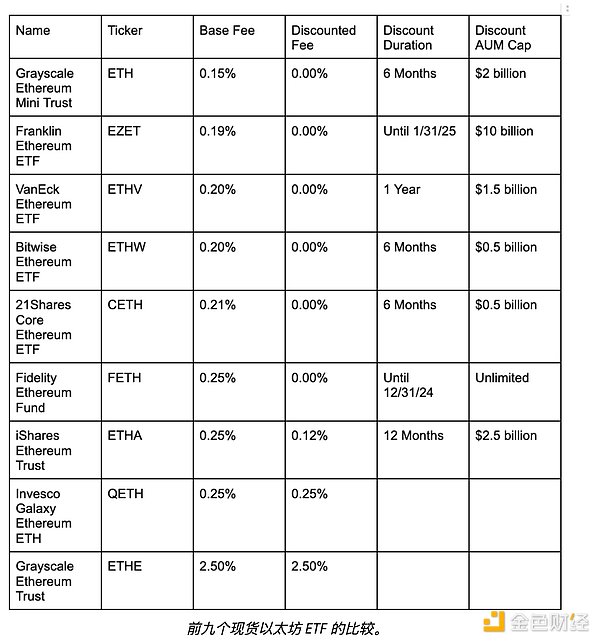

For most investors, the decision comes down to fees. Eight of the nine ETFs have management fees between 0.15% and 0.25%. The only exception is the Grayscale Ethereum Trust (ETHE), which began trading in 2017 under a different fund structure but still has a management fee of 2.5%.

Most, but not all, Ethereum ETFs are temporarily waiving or reducing fees to attract investors. Greyscale Ethereum Trust is once again the leader in this space, alongside the Invesco Galaxy Ethereum ETF (QETH).

Ironically, the clear leader in the fee race is also a Grayscale product. Grayscale Ethereum Mini Trust (ETH), a new fund created specifically for listing as an ETF, has a management fee of just 0.15%. Those fees will be waived entirely for the first six months after listing or until the fund reaches $2 billion in assets under management (AUM).

Another compelling option is Franklin Templeton’s Franklin Ethereum ETF (EZET). Its management fee of 0.19% is the second-lowest among its peers, and those fees will be waived entirely until January 2025 or until the fund reaches $10 billion in AUM.

Will Spot Ether ETFs Offer Staking?

The short answer is “no.” The longer answer is: “Maybe, but not anytime soon.”

To recap, staking involves depositing ETH into a validator node on Ethereum’s beacon chain. Staked ETH earns a percentage of network fees and other rewards, but also risks being “slashed” — or having the staked collateral seized — if validators misbehave or fail.

Staking is attractive because it can significantly increase returns. As of July 19, the annualized yield was about 3.7%, according to StakingRewards.com.

Earlier this year, several issuers, including Fidelity, BlackRock and Franklin Templeton, sought regulatory approval to add staking capabilities to spot ETH ETFs. The SEC rejected those requests.

The issue comes down to liquidity, according to several people who negotiated on condition of anonymity.It typically takes several days for staked ETH to be withdrawn from the Beacon chain. This is a problem for issuers, who need to redeem ETF shares on demand in a timely manner to access underlying fund assets.

Issuers are still exploring ways to add staking capabilities to existing ETH spot ETFs — possibly by maintaining a “buffer” of liquid spot ETH — but a viable plan is at least a few months away. Currently, ETH ETFs cannot be staked

JinseFinance

JinseFinance