Author: Tina; Source: Shilian

The Ethereum Foundation recently sold off ETH again, which exacerbated the decline in ETH prices. So, how long can the Ethereum Foundation's funds last? What about the future of Ethereum?

I.ETHPrice Performance

In this round of bull market, BTC has broken through the historical high of the previous bull market, but ETH, as the world's second largest cryptocurrency, has not yet broken through the historical high.

The highest price in ETH history appeared in November 2021, at around US$4,800, while in this round of bull market, the highest price of ETH appeared in March this year, which was only around US$4,000.

The current price of ETH is around $2,400, which has fallen 40% from its high point in March. Compared with other altcoins that have fallen by 70%, ETH's 40% drop is already quite good.

However, as the pioneer of smart contracts and the second largest cryptocurrency, the market has placed too high expectations on Ethereum. For such a price performance, especially compared with BTC, there is such a big gap. ETH's performance is far below everyone's psychological expectations, which is of course difficult for holders to accept.

2. Ethereum Foundation continues to sell

In 2024, the Ethereum Foundation sold ETH at least 6 times. On August 24, the Foundation sold as many as 35,000 ETH.

From the above several sales records, after the Ethereum Foundation sold ETH, ETH basically fell, or sold to a staged high price many times. Some people ridiculed the Ethereum Foundation for being good at selling coins.

As a non-profit organization, the Ethereum Foundation (EF) is committed to supporting the development of Ethereum and related technologies. Its activities mainly focus on providing financial and non-financial support for innovative projects within the Ethereum community.

Therefore, the Ethereum Foundation itself is an organization that keeps spending money. It is normal to sell ETH to support the development of the Ethereum ecosystem. In the future, ETH will definitely be sold. In order to maximize profits, of course, the higher the price of ETH, the better.

But for ETH holders, the foundation's selling behavior will be interpreted as the project party is not optimistic about ETH, which shakes the confidence of the holders. The selling behavior further stimulates the decline of ETH. In the case of the continuous decline of ETH prices, the foundation's selling is undoubtedly adding insult to injury.

For the foundation's continued sale of ETH, some ETH holders even began to worry about how long the foundation can continue to sell it. Once the foundation sells all the ETH, what will it use to support the development of the Ethereum ecosystem?

On September 5, Justin Drake, a core researcher at the Ethereum Foundation, replied that the Ethereum Foundation's current annual budget is about 100 million US dollars. At the current price, there are still 650 million US dollars of ETH in the foundation's wallet. Roughly estimated, the Ethereum Foundation's fund reserves can cover 10 years of budget.

3. Spot Ethereum ETFs Continued Net Outflow

On July 23, the U.S. Securities and Exchange Commission (SEC) approved the application of 9 spot Ethereum ETFs, marking an important step for digital assets to enter the mainstream financial market in the United States, with a first-day trading volume of more than $1 billion.

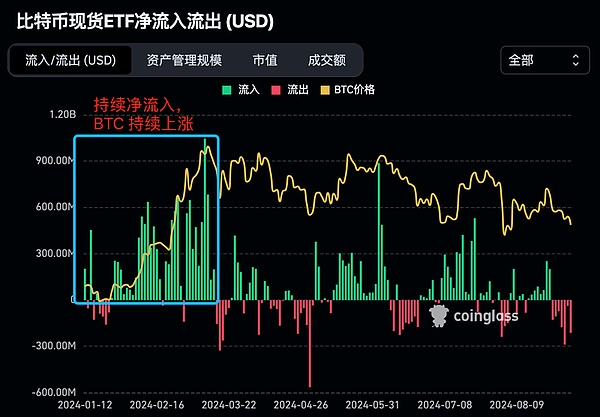

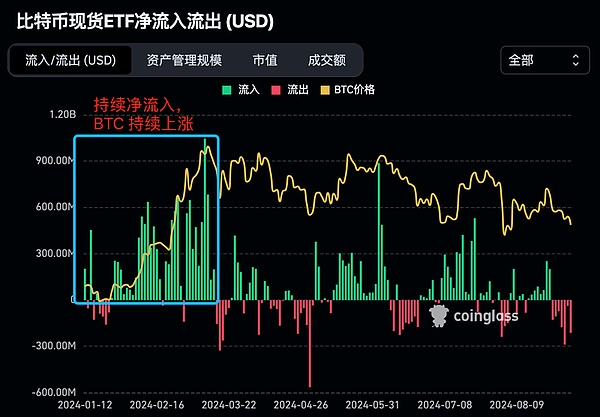

After the U.S. SEC approved the Bitcoin spot ETF, the price of Bitcoin continued to rise for two months, eventually reaching a historical high of $73,000 in mid-March.

In view of this, many Ethereum holders are also full of expectations, believing that the approval of the spot Ethereum ETF will repeat the glory of the Bitcoin spot ETF and lead the ETH price to a new high.

However, although the approval of the spot Ethereum ETF is regarded as an epic positive, the ETH price did not rise as expected, and ETH continued to have a net outflow and the price continued to fall.

Of course, objectively speaking, ETH cannot be blamed entirely. The entire crypto market has been falling in recent months, and it is difficult for ETH to stabilize.

Fourth, Ethereum lacks innovation

The poor performance of ETH prices is also related to the lack of strong innovation in Ethereum in this round of bull market, which leads to insufficient market confidence in the future of Ethereum.

In the past two bull markets, Ethereum undoubtedly played a core role as a leader.

Taking the 1CO (Initial Coin Offering) bull market as an example, Ethereum opened an unprecedented new era. Anyone or project can easily issue cryptocurrency and create decentralized applications DApp on Ethereum, and it has also greatly promoted the popularization and application of blockchain technology and promoted the vigorous development of the entire cryptocurrency ecosystem.

Entering a new round of DeFi bull market, Ethereum has once again become a pioneer in leading the trend.

DeFi is reshaping the financial industry at an unprecedented speed. Through smart contract technology, DeFi platforms can provide users with financial services that do not require intermediaries, are highly transparent, and are easy to operate, lowering the threshold for financial services and enabling more people to enjoy the convenience of financial technology.

During the DeFi bull market, classic DeFi platforms such as Uniswap, AAVE, Compound, and Synthetix were born, all of which have become important infrastructure in the crypto industry.

However, in this round of crypto bull market, Ethereum lacks industry innovations that can compete with ICO and DeFi, and its future development is unclear. As Zhu Su said, the biggest problem with the Ethereum Foundation is that it is currently unable to provide a coherent roadmap and effective leadership for the ecosystem.

5. Transaction volume is diverted by Solana and Layer2

As the pioneer of smart contracts and the leader of public chains, Ethereum does not have an advantage in transaction gas fees and transaction confirmation speed compared with other public chains, which also gives other public chains an opportunity to rise.

For example, in the public chain ecosystem, Solana is far superior to Ethereum in terms of transaction confirmation speed and gas fees, which has led to many DePIN and AI projects choosing to create on the Solana public chain.

In addition to Solana and other Layer1 public chains diverting Ethereum mainnet transaction volume, Layer2 also diverts part of the Ethereum mainnet transaction volume, resulting in the continued sluggish Ethereum mainnet transaction volume and gas fees often falling below 1Gwei.

The Ethereum spot ETF has continued to have a net outflow, the Ethereum Foundation has sold off, the ecosystem lacks innovation, and there is no clear development roadmap in the future. The market is full of concerns about the future of Ethereum, and the price of ETH has not been able to go up.

In short, there are many people in the market who are pessimistic about ETH. In addition to the problems of the Ethereum ecosystem itself, it is also affected by the overall market conditions of the current crypto market. Except for Bitcoin, the amplitude of most altcoins has far exceeded that of ETH. It’s just that the market has given ETH too high expectations.

In addition, the Ethereum ecosystem is still worth looking forward to. For example, the Pectra upgrade is the next major milestone of Ethereum. It is expected to be launched in the first quarter of 2025. It will merge the Prague (execution layer) and Electra (consensus layer) updates. It is likely that the Pectra upgrade will start to be hyped in the fourth quarter of this year.

Anais

Anais