Author: Eda Source: edatweets.eth Translation: Shan Ouba, Golden Finance

There is no doubt that Restaking is a key issue for Ethereum in 2024. The term was introduced by EigenLayer, a project that quickly became a hot topic in the Ethereum world.

A few months ago, I wrote about EigenLayer. A lot has happened since then and interest has grown exponentially. So I'll be back with another article that will dive into the following:

A comprehensive overview of EigenLayer: what it is and why you should care about it

Current status : What’s new at the moment

Risk: What should we pay attention to.

Part 1 - EigenLayer: A comprehensive overview

EigenLayer is a staking protocol that has received a lot of attention for its novel and innovative approach to the Ethereum space.

Let's first solve the problem EigenLayer wants to solve.

EigenLayer: Simplifying network bootstrapping

Proof-of-stake (PoS) networks typically require operators to run nodes and incentivize their efforts through token support. There are many complexities involved in launching such a network. Key among them are designing efficient tokens, ensuring their fair distribution, gaining market acceptance, regulation, etc. Together, these factors limit innovation at the infrastructure level.

That's where EigenLayer comes in - solving the challenges associated with infrastructure-level innovation.

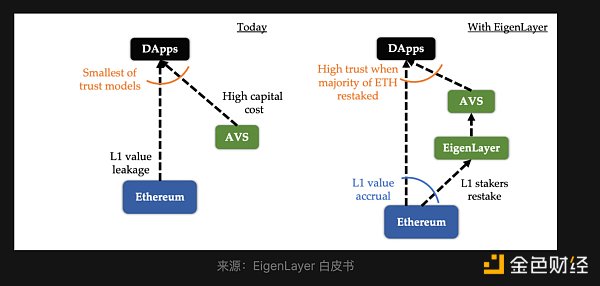

The core idea is to leverage Ethereum’s established economic trust as a foundation for building infrastructure components for advanced projects. To this end, EigenLayer redefines the bootstrapping process of the PoS network.

p>

How does EigenLayer work?

EigenLayer allows developers to leverage Ethereum’s existing economic security infrastructure, which includes validator sets and capital. This process leverages Ethereum’s already established security and simplifies the creation of new networks and services.

p>

The core is the concept of "re-pledge". By re-staking, EigenLayer can use the ETH and validator sets staked by Ethereum to other services and networks.

Why is this important?

Simplify the development of networks and services: EigenLayer simplifies the way to allow re-staking of ETH The process of establishing a new network. It provides these networks with immediate economic security and operational support without requiring developers to bootstrap these elements from scratch. This not only accelerates network development, but also lowers the barriers to entry and paves the way for a wider range of networks and services.

New staking opportunities: This model provides ETH stakers with new ways to use their assets, which may bring additional award.

Validator utilization: This model provides new opportunities for validators to leverage existing resources. By participating in multiple networks, they can maximize their utility and expand their earning potential.

Detailed overview: roles, mechanics and impacts

Here’s a closer look at how the system works:

Ethereum Staking

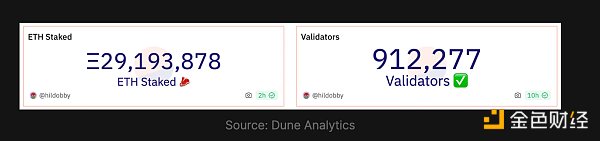

Currently, Ethereum The Ethereum network is secured by validators, who hold their ETH as a capital-based commitment to abide by the rules of Ethereum. Validators are responsible for storing data, processing transactions, and adding new blocks to the blockchain by running validator software. If they don't follow the rules, then they risk losing those ETH. To become a validator, a minimum of 32 ETH is required. However, for those unable to meet this threshold, there is an option to contribute a small amount of ETH by participating in a staking pool, which is like a group fund managed by others.

EigenLayer (re)pledge

EigenLayer goes one step further. It expands the role of validators, allowing them to participate in new networks and systems that require external operators. By doing so, stakers can earn additional rewards, increasing their participation in the Ethereum ecosystem and providing them with new ways to earn rewards.

Before we continue, let's clarify the participants and their roles.

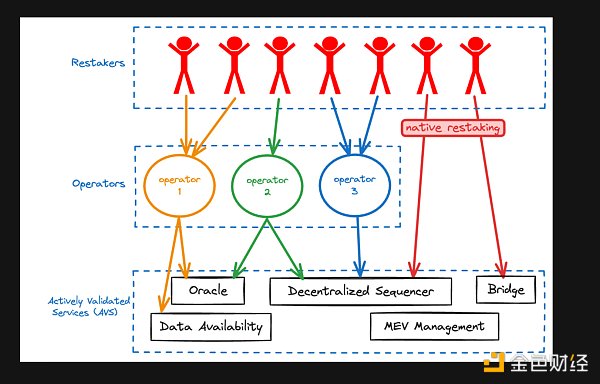

Participants and roles

Stakers: They are people who commit their ETH to support new networks and services. They have two choices:

Native re-staking: Stakeholders can operate independently by taking on the responsibility of contributing tokens and operating Ethereum validation nodes.

Delegation to operators (aka liquidity re-pledge): Pledgers can delegate their ETH to operators, key points Focus on financial support while operators handle technical requirements.

Operators: These actors manage and run the software built on top of EigenLayer. They play a vital role in maintaining the integrity of the network and are subject to penalties for any misconduct.

Services: These are networks and services run by operators - they are called Active Authentication Services (AVS) - Next Section will cover this in detail.

Service consumers: These are end users or applications that consume the services provided by EigenLayer.

I mentioned "networks and services", but what exactly do these categories fall into in the context of EigenLayer?

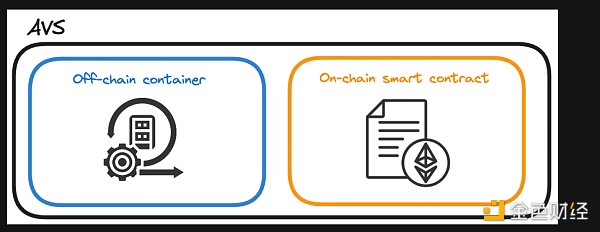

Understand Active Verification Service (AVS)

Active verification service requires an external operator to operate services of its network. Examples of AVS include data availability layers, decentralized sequencers, bridges, oracles, and more.

These services are not just passive entities; They have specific operational needs. This includes:

Certain node software requirements

Define the conditions under which curtailment (i.e. punishment for malicious behavior) occurs.

Slashing: Ensure EigenLayer's honesty

In EigenLayer, Collaboration between stakeholders and operators is crucial. When Stakers delegate their ETH, they explicitly trust the operator to act honestly.

To keep everyone honest, EigenLayer has a mechanism called "cutting". If operators do something they're not supposed to do, they may be penalized. This means they may lose some of their invested ETH.

AVS smart contract defines penalty conditions and punishes violations of the rules. For example, operators risk significant penalties for actions such as sidechain double-signing or bridges signing non-existent messages.

This mechanism ensures the integrity and credibility of the system.

Trust Bazaar: EigenLayer’s decentralized marketplace

In short, EigenLayer passes Taking Ethereum's trust (capital + validator set) and making its components available to anyone interested creates a decentralized trust marketplace. Through this mechanism, stakeholders can choose to provide new services that bring them additional benefits.

p>

Part 2 - Current status: Feature layer

Current mainnet online and total locked value< /h3>EigenLayer is rolling out its platform in multiple stages, first re-staking on mainnet and then introducing Operators, finally launched AVS.

They launched the re-staking function on the Ethereum mainnet in June 2023. As of this writing, 648,964.0315 ETH is staked (over $1 billion!) and you can follow it on the dashboard, which shows a breakdown of the coins.

This phase starts with adopting a protected approach, testing the protocol at various stages. EigenLayer now allows you to stake liquidity via multiple LSTs and native re-staking.

AVS World

Various teams are actively developing AVS, of which EigenLayer's EigenDA is a notable example. In addition to teams from Espresso, Witness Chain, Omni and Lagrange, you can learn more here.

Please note that AVS is generally not a consumer application, but a service required by consumer-facing applications. For example, oracles, shared sequences, and bridges. - We won’t delve into it for the sake of this article, but for the future.

EigenDA

EigenDA is a data availability service being built by EigenLayer and is also the first AVS launched on the Goerli test network.

This is part of the second phase of the release, which includes operators running EigenDA's verification service, demonstrating how the service runs on EigenLayer.

Currently, the release is limited to the testnet. EigenDA is especially important because it will be the first service on EigenLayer.

Notes on heavy pledge

Although "heavy pledge ” is a term used to describe staking ETH-denominated tokens on EigenLayer, but it is essentially a permissionless staking platform. The initial focus is on ETH as face value tokens, but could be expanded to other forms of assets, such as different tokens. This choice is made to support the Ethereum ecosystem, as well as ETH’s relatively low volatility. While the platform does not have to be tied to ETH and ETH-denominated tokens, the initial strategy is to start with these.

Part 3 - Risks and Reevaluating Ethereum Incentives

Reevaluating Incentives Measures

A few months ago, Vitalik wrote an article discussing the potential risks and implications of extending the Ethereum consensus mechanism beyond its original scope. The core message here is that while Ethereum’s consensus mechanism is a powerful tool for maintaining a decentralized and secure blockchain, using it for decisions beyond its intended purpose can create risks and challenges that can destabilize the system. sex and trust.

Similarly, Justin Drake gave a talk during Devconect discussing related issues and potential solutions. I highly recommend you watch this, it gives a very insightful overview of potential risks and mitigations (especially if you have some background in MEV).

? The key question in re-staking is how the staking protocol changes the incentives of Ethereum validators by providing rewards beyond the visibility of the core protocol, and whether this will change Ethereum’s fundamental value proposition.

For example:

The allure of the opportunity for additional income through re-staking may increase the demand for staked ETH, affecting the overall economics of the Ethereum network.

With high node requirements for the network and services, the potential for higher returns by participating in EigenLayer staking May make the option of staking alone less attractive - meaning not every validator may choose to provide better service in return. On the other hand, if different incentives are provided, it can make individual staking more competitive and capital efficient.

Admit that cutting edge technology like this may come with some initial challenges - hence my reservations about seeing such a difference The stuff is still very exciting. New ideas and possibilities abound.

Feature layer risks

Here are some risks worth noting and more background information:

Operator centralization

Fairness and reward distribution among operators

Operator misconduct and system security Risk

Complexity and trust issues of liquidity staking

Smart contract risks

Operator centralization

One of the main concerns with EigenLayer is the risk of operator centralization. This problem arises if there are high off-chain requirements for operators, which may result in resources and expertise being concentrated among a limited group of operators. This situation may make individual staking on Ethereum less attractive and feasible. In other words, solo staking may be discouraged if the reward for participating as a "delegated retaker" is higher than that of being a solo retryer.

Fairness and reward distribution among operators

A key aspect to consider is the fairness of reward distribution among operators. In EigenLayer, operators can choose from a variety of services, each offering different potential rewards. This setup could significantly change Ethereum’s current “fair” reward system, where each node earns a similar annual interest rate by staking ETH. Different reward structures may incentivize operators to focus on maximizing returns, making it difficult to maintain a balanced and fair environment for all network validators. Now, validators need to do more work to understand the project and reward structure - one month they can choose to join one AVS, then another, always looking for something better.

(Supplementary centralization argument - due to different reward distribution, for local retryers, the choice is delegated to the operator rather than Rather than running the software yourself, it might make sense to change the validator assignments on the core protocol.)

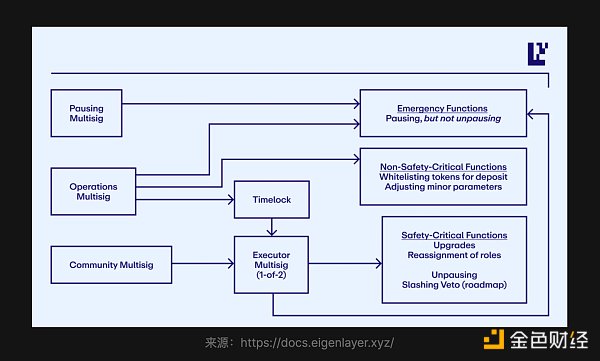

Operator misconduct and system security risks

The possibility of operator misconduct is a significant risk. Given that an operator can participate in multiple AVS, what happens if rewards > penalties. The operator can then choose to act dishonestly and be willing to lose shares. If the number of participating operators is small, they may come together to attack (Attack>Loss). (In some cases, you could imagine that the stake required to participate in AVS might exceed the 32 ETH needed to become an ETH validator, which might limit the number of operators).

Additionally, if the mechanism for rebalancing collateral in EigenLayer fails due to slow, delayed adjustments, or incorrect parameters, it may Exposing the system to various security risks. To offset this risk, EigenLayer proposes the “unbundling period” solution. This approach introduces a forced delay between the time a staker requests to withdraw their stake and the time they actually have access to it. (Here is an article from EigenLayer explaining their approach) The proposed solution seems to effectively address the vulnerability of malicious operators exiting prematurely. EigenLayer is actively improving this complex mechanism to enhance the safety and effectiveness of addressing this potential risk.

Complexity and trust issues of liquidity re-pledge

Complexity arises when a stakeholder uses an external operator and needs to choose an AVS - which AVS does the stakeholder want to support? EigenLayer's solution involves operators using different addresses for each combination of AVS they support (for example, an operator using 2 AVS could have 3 addresses: AVS 1, AVS 2, and both - explained here ). While this allows stakers to retain control over their stake, it introduces a layer of complexity in understanding which address represents which service or services. Additionally, as with any permissionless blockchain, the question of “can I trust the operator?” still remains.

Smart contract risks

Conclusion

There is still a lot of research to be done, including improvement AVS, putting these systems into practice, and designing the protocol in a way that reinforces Ethereum’s core values. While EigenLayer's solutions are promising, they must strike a balance between effectiveness and manageable complexity to ensure system reliability.

I've tried my best to avoid "ethereum alignment" that has become a meme, but still hope my message is clear. Do your best to avoid the new hype, vague terminology

It's exciting to see so many new things coming out of the Ethereum world with EigenLayer. Re-staking is one of the main narratives for Ethereum in 2024, and kudos to the EigenLayer team for keeping me excited.

JinseFinance

JinseFinance

JinseFinance

JinseFinance Wilfred

Wilfred ZeZheng

ZeZheng JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Coinlive

Coinlive  decrypt

decrypt Nulltx

Nulltx