By: Blockchain Knight

There has been a noticeable increase in network activity across the wider Ethereum ecosystem.

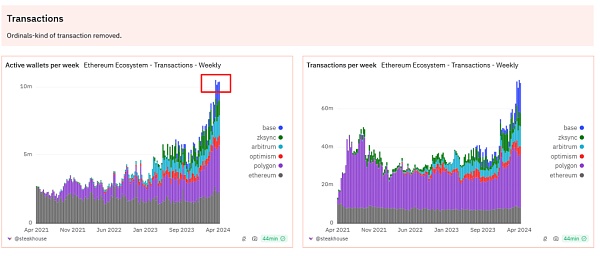

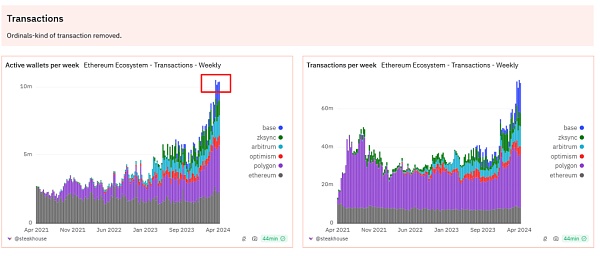

According to Dune Analytics, excluding addresses associated with Ordinals, there are over 10 million wallets actively using the mainnet and Ethereum second-layer solutions such as Base, Optimism, and Arbitrum.

This milestone is a direct result of the successful implementation of the Dencun upgrade in mid-March 2024.

This upgrade is one of many on Ethereum that effectively addresses pressing challenges, especially those related to scalability and gas fees.

With the surge in active wallets connected to various protocols deployed on the mainnet, sidechains, or off-chain rails, an analyst at X optimistically predicts that this number will increase from 10 million to 100 million in the upcoming bull cycle.

This surge will be accelerated by the enhancements brought by Dencun, which makes it cheaper for those using rollups to conduct second-layer transactions.

To do this, Dencun uses "blobs", a new transaction type, to store data that is not processed by the Ethereum Virtual Machine (EVM).

Blobs can be seen as a new data storage channel within the block, which helps to simplify block verification.

Remarkably, it has done this without compromising data availability, a huge boost for Ethereum layer 2 solutions that have integrated Dencun.

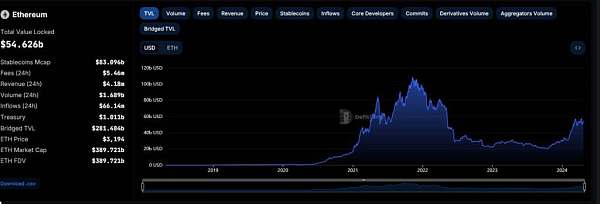

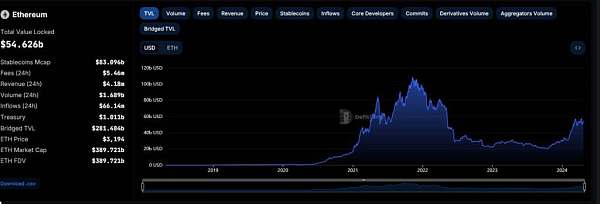

With falling gas fees and more efficient layer 2 platforms, Dencun has helped attract new users and revitalize the broader Ethereum ecosystem. This is also reflected in the increasing total value locked (TVL) on layer 2 portals and mainnets.

On average, leading layer 2 platforms such as Arbitrum and Optimism have seen double-digit growth over the past week, according to L2Beat.

To date, all layer 2 platforms manage over $39 billion in assets.

Parallel data from DefiLlama also highlights this growth. Over the past six months, the TVL of leading decentralized finance (DeFi) protocols has increased from around $20 billion to over $54 billion currently.

Despite these advances, challenges remain. Ethereum is fragile and cannot scale effectively when usage surges.

Therefore, gas fees are very likely to rise in the next bull run, especially when Ethereum prices rebound and break through $4,000 and all-time highs.

In addition, users (mainly meme coin deployers) may prefer to use alternatives such as Solana or Avalanche, thereby suppressing activity.

Nevertheless, Ethereum supporters remain positive.

As Crypto asset prices stabilize, most likely in line with the gains seen in the first quarter of 2024, more users will be keen to explore some of the top protocols launched on the mainnet or through second-layer platforms.

Miyuki

Miyuki