Variant: Bitcoin DEX Satflow explained

Satflow is a new DEX for professional traders built on the Bitcoin network.

JinseFinance

JinseFinance

Author: Peyton, Core Builder of LYS Lab

In the past week, major media platforms have frequently been screened due to the outbreak of XRP, with a monthly increase of about 400%, and multiple good news has followed:

Macro: Regulatory relaxation and policy rent-seeking

Policy environment: In November, Trump, who advocates crypto-friendly policies, was elected the 47th President of the United States and plans to establish a cryptocurrency advisory committee. Ripple is actively seeking a seat on this committee. In addition, Ripple donated $25 million to establish a super political action committee called Fairshake as early as December 2023, indicating its strategic foresight in policy rent-seeking and compliance layout.

Regulatory changes: In the same month, the current SEC Chairman Gary Gensler revealed his intention to resign around the time Trump took office, and the market is looking forward to the policy preferences of the new SEC Chairman.

Legal progress: Ripple-related litigation has also made positive progress. Judge Phyllis Hamilton approved the final judgment of the settled class action lawsuit and suspended other pending cases. This decision cleared the way for the trial to begin on January 21, 2025 and boosted market confidence.

Micro: Institutional cooperation and product expectations

Stablecoin products: In November, the New York Department of Financial Services preliminarily approved Ripple to launch the stablecoin RLUSD, which was scheduled to be officially launched on December 4. (However, Ripple subsequently announced a postponement of the release on December 5.)

Institutional cooperation: In late November, Ripple announced a partnership with Archax and British asset management company ABRDN PLC to launch the first tokenized money market fund on XRP Ledger.

ETF Application: As of early December, several institutions, including Bitwise, Canary, 21 Shares, and WisdomTree, have successively submitted spot XRP ETF applications, injecting more imagination into the market.

As of December 8, 2024, XRP is now at $2.55, and has not yet recovered its historical high of $3.84 in 2018. The author is deeply interested in XRP's sharp rise this time. Looking back at history, XRP has repeatedly jumped to the third largest target in the market value of crypto assets. Can this market continue? Is there still an opportunity to get on board in the future? Focusing on these issues, this article will try to briefly analyze XRP in order to provide a reference for investors.

This paper attempts to study and answer the following main questions:

Ripple's business model and its impact on XRP valuation: What is Ripple's business model? Does this business model play a role in XRP's valuation logic? What is its team and financing background?

Current Development Status of XRPL: How is XRPL developing? What are its characteristics compared to other public chains? What is the current on-chain data? What narratives and future developments are worth looking forward to for XRPL?

XRP's economic model and token valuation: What is XRP's economic model, token utility, and valuation level? Finally, based on the answers to the previous questions, let's explore whether XRP's current rise is likely to continue and what resistance it faces?

Crypto Solutions for Business

Ripple is a global cross-border payment network created by Ripple Labs. It is based on distributed ledger technology and aims to provide secure, instant and almost free global financial transaction solutions. As a leading provider of digital asset infrastructure, Ripple is committed to helping the financial services industry modernize its financial infrastructure. Through the Ripple platform, users can not only make real-time cross-border payments, but also participate in tokenization and digital asset transactions while ensuring compliance with relevant regulatory compliance requirements.

Brad Garlinghouse is the CEO and board member of Ripple. Prior to joining Ripple, he served as CEO of Hightail, a file collaboration platform, and President of Consumer Applications at AOL, as well as in several senior positions at Yahoo.

Chris Larsen is the co-founder and executive chairman of Ripple and currently serves as an advisor to data science company Distilled Analytics. Prior to founding Ripple, he served as CEO of P2P lending platform Prosper and led online lending company E-LOAN.

David Schwartz is the Chief Technology Officer of Ripple and the Chief Architect of XRP Ledger. He is known as "JoelKatz" to the outside world. Prior to this, he was the CTO of Santa Clara-based software company WebMaster Incorporated and developed encrypted cloud storage and enterprise messaging systems for organizations such as CNN and the NSA.

Monica (Appelbe) Long is the President of Ripple and was previously the Senior Vice President of Marketing and General Manager of RippleX. She has been committed to promoting deep changes in the financial industry for technology companies throughout her career. She has worked in corporate communications at Intuit and supported customers in multiple fields.

Stuart Alderoty is the Chief Compliance Officer of Ripple and has more than 30 years of legal experience, specializing in financial services and regulatory affairs. He has held leadership positions at CIT Group and HSBC North America Holdings, and has also provided legal counsel to American Express.

Ripple is a private investment company. The company has completed five rounds of financing, including two angel investment rounds, one seed investment round, one A round, one B round, and one C round. For details, see the table below:

It is worth noting that Ripple has faced investigations and lawsuits from regulators many times, such as being fined for unauthorized sales of XRP in 2015 and the SEC accusing it of unregistered securities issuance in 2020.

These challenges not only consumed a lot of resources (more than $100 million in legal fees), but also prompted Ripple to adjust its operating model and compliance strategy (such as obtaining BitLicense and Singapore central bank licenses), and prompted it to seek to promote regulatory policy changes (such as donating to a super political action committee called Fairshake).

Ripple requires people to obtain permission to use it, which means that it is mainly banks and financial institutions that use blockchain. The goal here is to provide financial institutions with a way to make international transfers without using the SWIFT system.

The products listed on Ripple's official website include: direct payment, on-demand payment, asset custody and stablecoin. Here are four of them. Among them, only on-demand payment ODL may have some appeal to C-end individuals.

Direct Payment

In this product, Ripple is responsible for paying beneficiaries, managing payment partners, providing funds to payment partners, and paying fees in exchange for paying beneficiaries.

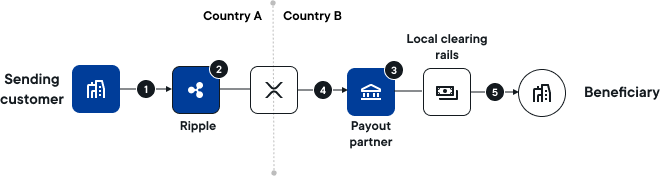

The entire payment flow is shown below:

The sender customer (Node 1) enters the payment information in the Ripple Payments UI.

The intermediary Ripple (Node 2) verifies the transaction. If both risk and compliance checks are successful, Ripple will approve the transaction.

The payment partner (Node 3) now verifies the transaction. If their compliance checks are successful, they will approve the transaction.

The XRP will be transferred and converted into the destination country's currency and distributed by the payment partner.

The payment partner completes the payment by sending funds to the payee.

Special note: After setting up Ripple as a payment provider, customers no longer need to buy, sell or own XRP!

On-Demand Payments (ODL)

ODL, the full name of On-Demand Liquidity, on-demand liquidity. ODL uses XRP as a transition currency, obtains liquidity on demand, and transfers funds in real time. The product is still mainly ToB, but it may also attract some C-end individuals.

ODL's user interface is based on the peer-to-peer distributed application RippleNet, which maintains a virtual ledger to simulate Nostro and Vostro accounts and relationships, consisting of a two-way messaging layer and a settlement layer. RippleNet can be integrated with payment systems using some API operations, using API operations to copy funds to RippleNet virtual accounts instead of accessing the core banking system of financial institutions.

RippleNet can access liquidity on the XRP ledger using Ripple's ODL (On-Demand Liquidity) product. RippleNet is deployed in a cloud environment hosted by Ripple and does not require customer maintenance.

Taking personal payments as an example, the payment process is shown in the following figure:

Ripple deposits XRP into the sender's designated wallet.

The sender uses the RippleNet API operations to retrieve and accept the quote.

RippleNet transfers XRP from the sender's wallet to the receiver's wallet.

The recipient pays the recipient in fiat currency.

The receiver liquidates the XRP into fiat currency.

Ripple issues an invoice summary to the sender for the initiated payment.

Asset Custody

Ripple Custody is described as an important software infrastructure for protecting, transferring and settling tokenized financial assets. The product is mainly aimed at enterprise-level users.

The integration of XRPL’s tokenization capabilities enables businesses using Ripple Custody to handle a wide range of assets, including cryptocurrencies and fiat currencies in addition to real-world assets. It also facilitates the issuance and secure transfer of digital assets from the platform, while providing access to the XRPL decentralized exchange for efficient trading of tokenized assets.

Stablecoin (RLUSD)

Ripple first announced plans to launch RLUSD in April.

In June, Ripple acquired Standard Custody & Trust Company, a limited purpose trust company chartered by NYDFS.

In August, Ripple began beta testing RLUSD on the XRP Ledger and Ethereum mainnets. At the time, the company also announced plans to expand the stablecoin to other blockchains. In a statement, Ripple said: "There is a clear demand for stablecoins that provide trust, stability, and utility. Once RLUSD is available, Ripple will use RLUSD and XRP in its cross-border payment solutions to serve its global customers and significantly improve their experience."

In October, Ripple announced that it had partnered with top exchanges to offer RLUSD to users. This includes Uphold, Bitstamp, Bitso, MoonPay, Independent Reserve, CoinMENA, and Bullish. And its liquidity is supported by marketplaces B2C 2 and Keyrock.

In late November, Fox Business reported, citing people familiar with the matter, that the stablecoin will be approved by the New York Department of Financial Services (NYDFS) and may be ready for launch by December 4.

According to its official documentation, the RLUSD stablecoin contract is planned to be deployed on XRP Ledger and Ethereum.

In terms of the stability mechanism, each RLUSD token is backed by US dollar deposits, US government bonds and cash equivalents. Ripple has promised to publish a third-party audit certificate of reserve assets conducted by accounting firm BPM every month.

Is the value of XRP really linked to Ripple's core products?

Let's review Ripple's current product architecture together:

Ripple Payments Direct: According to official documents, customers do not need to buy, sell or own XRP. I think this means that all the good news related to this business (such as cooperation with XX Bank, XX Company, etc.) has nothing to do with XRP tokens.

Ripple Payments ODL: ODL uses XRP as a transition currency, obtains liquidity on demand, and transfers funds in real time. In this scenario, XRP is used as a medium for fund conversion, involving the buying and selling of XRP, which seems to have some buying support for XRP. But according to the data in Ripple's historical quarterly reports compiled by the author, the result of the ODL business is a net sale of XRP tokens, and the amount of XRP sold in the business is often higher than the amount of XRP repurchased. In addition, the 2020 Deep Tide article analyzed that "in fact, it (referring to ODL) costs much more, so without a lot of compensation from Ripple, institutions do not want to use this product", "currency payment institutions have become another channel for Ripple to sell unregistered XRP."

Ripple USD (RLUSD): In cross-border payment solutions, customers should be more inclined to choose the stablecoin RLUSD as a payment solution after the launch of RLUSD in order to reduce exchange losses, making it more difficult to believe that the launch of this business can empower XRP.

Note:

ODL-related sales include XRP sales to support ODL (including credit lines) and key infrastructure partners;

Net ODL-related sales = Total XRP sales - Total XRP repurchases;

Ripple It seems that only ODL business data will be released in the period of 2020Q2-2023Q1, and only the total amount of XRP tokens held by Ripple and the total amount of XRP tokens in the custody account will be released in 2023Q2 and later.

To sum up, I think that at this stage, Ripple's core business logic does not seem to provide much buying basis for XRP, and Ripple is actually releasing XRP through channels such as account custody and ODL business. Therefore, Ripple's various business expansions cannot be simply regarded as good news for XRP tokens. Only those cooperations that really plan to develop new businesses on the XRPL public chain are real good news. For example, in the last quarter, Meld Gold announced a partnership with Ripple to introduce alternative gold and silver assets into XRPL, which indeed enriched the types of assets on the chain and increased network transaction fees.

The problem of decoupling between team business and token value is actually widespread, and even appears in many well-known projects. For example, the UNI token before the dividend announcement is an example, but the price trend of these tokens is often affected by "superficial" good news. For this phenomenon, the author would like to put forward some crude views:

Explanation 1: If it is believed that the market is not completely effective and the participants are not completely rational, then thanks to the close relationship between Ripple and XRP tokens in terms of publicity and corporate image, Ripple's official good news may "mislead" investors and increase the possibility of XRP's rise.

Explanation 2: If it is believed that the market is effective and the participants are rational, then why is the price of XRP tokens rising? It may be that Ripple officials have provided certain financial support, talent support, etc. to the XRPL public chain and foundation and other related entities to be introduced below. Although these supports are unlikely to directly support the buying of XRP, in the long run, this is a positive for the ecological development of the XRPL public chain, and in turn, it is good for the XRP token. The market may just reflect this part of the long-term benefits in the price of the XRP token in advance.

Both explanations are possible. In short, although Ripple's core business logic does not directly enable the rise in XRP prices, it can play a supporting role through other channels. The author believes that we should not underestimate the impact of Ripple's good news on XRP prices.

It is written on the official website of XRPL:

The XRP Ledger is a decentralized public blockchain built for business.

One of the main advantages of XRP Ledger is its fast and efficient consensus algorithm, which can settle transactions within 4 to 5 seconds while processing at a throughput of up to 1,500 transactions per second, making it suitable for daily payments and cross-border transactions and remittances for enterprise-level customers.

Note: The XRP Ledger client software was formerly known as rippled. Here, XRP Ledger is written for convenience.

The development history of XRPL reflects the balance between its technology orientation, market demand and decentralized ecological construction. It has gradually evolved from a basic payment solution to a multi-functional and open blockchain ecosystem with good industry adaptability and innovation capabilities.

Early stage (2012-2016): Construction of system infrastructure, including basic functions such as delayed payment, escrow accounts and strict transaction control.

Mature stage (2017-2020): Introduction of advanced functions such as multi-signature, historical record sharding, account deletion and dynamic reserve adjustment to make the system more efficient and adaptable.

Diversification stage (2021- present): Support for functions such as NFT, automatic market makers (AMM), cross-chain bridges (XChainBridge) and decentralized identifiers (DID), showing a trend of ecosystem expansion and diversification.

Currently, the main market-level applications that can be supported on XRPL include:

Fungible token standards and DEX of CLOB and AMM;

Non-fungible token standards and NFT markets;

Infrastructure such as XRP sidechains, cross-chain bridges (XChainBridge amendments), price oracles, DIDs, etc.

It is worth pointing out that XRPL has a built-in CLOB DEX (central limit order book decentralized exchange), which is different from other networks that use smart contracts to build DEX. The benefits of native DEX are fewer trust assumptions and liquidity integration, rather than the inherent vulnerabilities of smart contracts. Although XRPL has only one CLOB, multiple markets (also called gateways) provide users with access interfaces. These markets share liquidity and provide a convenient operating experience for ordinary users.

Trust Lines and Reserves

On-chain homogeneous tokens other than XRP are stored in accounting relationships called "Trust Lines" that connect the accounts of two parties. All transfers of homogeneous tokens are carried out along trust lines.

Each trust line is a two-way relationship, including:

The identifiers of the two accounts connected by the trust line.

A single shared balance, which is positive from the perspective of one account and negative from the perspective of another account. The party with the negative balance is called the "issuer" and can control some properties of how these tokens behave.

Various settings and metadata. Each of the two accounts can control its own settings on the trust line. Most importantly, each end sets a limit on the trust line, which is 0 by default. Generally speaking, the balance of each account (from the perspective of the trust line) cannot exceed the limit of that account, but trust lines can be created implicitly through certain transactions, such as when buying tokens on a decentralized exchange.

Trust lines are mainly used to prevent others from holding tokens that they don't want.

Because trust lines take up space in the XRPL, trust lines increase the XRP that an account must hold. When an account has more than 2 trust lines, it may be charged a trust line reserve.

This reserve requirement is designed to prevent junk data from filling up the ledger. This data needs to be replicated throughout the network and maintained by all servers in the system. The base reserve (currently 10 XRP) specifies the minimum amount of XRP that must be sent when a new account is created; the owner reserve (currently 2 XRP per item) increases the reserve requirement of an account on a per-item basis based on the additional objects it holds in its ledger state data, such as quotes, trust lines, and escrows. The current reserve requirements were voted into effect on September 19, 2021.

Rippling

Rippling occurs when addresses are linked via trust lines that use the same currency code. For example, if Alice owes Charlie money, and Alice also owes Bob money, then the trust line is represented as follows:

If Bob wants to pay Charlie $3, then he asks Alice to transfer part of Bob’s debt to Charlie, which is represented by the trust line as follows:

src="https://xrpl.org/assets/noripple-02.1953e85ff4f44374629f95216bb4ba493dac30a2d2a555aa4db9c4f9cf11bba2.ac57e6ef.svg">

The process by which two addresses pay each other by adjusting the trust line balance between them is called "Ripple Settlement", in which two addresses pay each other by adjusting the trust line balance between them.

The No Ripple flag can be set on a trust line. When two trust lines have No Ripple enabled for the same address, payments from third parties cannot be made to Ripple through that address on those trust lines. This prevents liquidity providers from accidentally transferring balances between different issuers using the same currency code.

Hooks

Although XRPL does not have a smart contract in the strict sense, the Hooks function passed in the Hooks amendment (similar to ETH's EIP, BNB's BIP, etc.) can affect the behavior and process of transactions with small and efficient code snippets, which can execute logic before or after the transaction.

As of December 7, 2024, the amendment is still in the development stage and has not yet been launched.

Customized side chains

For example, you can add a smart contract layer, add Ethereum Virtual Machine (EVM) compatibility, use custom ledger types and transaction rules, and so on.

Unincentivized PoA Consensus Mechanism

One of the main advantages of XRP Ledger is the fast and efficient consensus algorithm, which can settle transactions in 4 to 5 seconds while processing at a throughput of up to 1,500 transactions per second. According to XRPScan data, the actual TPS peak occurred on December 31, 2023, reaching 329.

The developers behind XRP Ledger believe that Proof of Work (PoW) is energy-wasting and is only really useful for initial allocation and solving double-spending. The core developers concluded that the real charm of Bitcoin lies in the disclosure of transactions and status, not the PoW consensus mechanism, and they challenged the dominance of PoW by building an energy-efficient alternative, XRPL.

XRPL uses the Proof of Association (PoA) consensus algorithm - formerly known as the Federated Byzantine Consensus Protocol. PoA requires each node to set up a list of trusted nodes that it will rely on to reach consensus. This list of trusted nodes is called the Unique Node List (UNL). Validators cannot rely on financial means alone to gain access to the consensus process and must first gain the trust of other nodes. Many nodes use one of the default UNLs to set up their own trusted nodes. The default UNL is a list of nodes recommended as trustworthy by the XRPL Foundation, Ripple, and Coil, but nodes can choose any list of validators they deem trustworthy.

While the network is running, each server listens to feedback from its trusted validators; as long as enough validators (more than 80%) agree that a certain set of transactions should be executed and the resulting ledger is correct, the server will declare consensus. If consensus is not reached, the validator will modify its proposal to be closer to the suggestions of other trusted validators, and repeat this process for multiple rounds until consensus is reached.

In addition, unlike other decentralized ledgers, XRPL does not provide direct economic incentives to contribute to the consensus process by running validators. Other blockchains provide direct incentives, such as rewards for mining and staking or trading advantages. On the contrary, the official claims that "the lack of direct incentives for XRP Ledger validators attracts natural stakeholders." (This will be complained about later.)

Compared with Proof of Work (PoW) and Proof of Stake (PoS), PoA has the following advantages:

Lower hardware requirements, which reduces electricity and operating costs, making it cheaper to run a verification node than PoW mining.

Block generation does not directly depend on the participants with the most capital, which is different from PoS.

There is no reorganization (i.e., the situation where the block is changed after verification).

In addition, PoA also has some potential disadvantages:

Since PoA does not require high external costs or locked capital, the ability to economically punish malicious actors is weaker.

Although retaliation can be carried out by cutting off validator connections or removing nodes from the UNL (unique node list), the attacker will not face financial losses.

The PoA implementation on XRPL is not as decentralized as the mainstream PoW or PoS chains in terms of block production nodes. This may be because PoA lacks economic incentives to participate.

The fees on XRPL mainly include:

Transaction fee: A trace amount of XRP destroyed when sending a transaction. This fee varies with network load.

Reserve requirement: The minimum amount of XRP that an account must hold. This number increases as the number of objects the account has in the ledger increases.

Transfer fees: Optional fees. The issuer can choose to charge a percentage fee when transferring the issued currency to other addresses within the XRP Ledger

Trust line quality: Optional fee. Allows accounts to set the balance on the credit line to be higher or lower than the face value. This may result in a situation similar to charging fees.

XRPL's current core business is still in homogenous tokens and decentralized exchange-related services. At the same time, considering its public chain attributes, we can focus on the total locked value (TVL), the number of active traders, the number of on-chain assets, the market value of on-chain assets, the number of trust lines, the transaction volume, and the transaction fees (network income).

For a more detailed analysis, I recommend further reading Messari’s article, which has been reprinted on DeepChao: Messari XRP In-depth Report: Q3 Native Smart Contract Proposal High, Daily Trading Volume Increased 94% Month-on-Month - DeepChao TechFlow(https://www.techflowpost.com/article/detail_22024.html)

Total Locked Value

The above figure shows that the overall locked amount of XRP has been on an upward trend since the beginning of 24 years, reaching a peak of about 15M (15 million) around the beginning of November, and then the locked amount has decreased (probably partly LP cashed out), but still remained above 10M (10 million).

The amount of locked positions in the AMM pool is much smaller, and has been growing rapidly since late October, but it only reached about 10K (10,000) XRP on December 8, 2024.

Daily Active Users

This refers to the number of active (independent) accounts on the XRPL chain.

As of December 8, 2024, XRPL's latest daily activity reached a record high in early December (note that this data in XRPScan has only been recorded since May 2022), which is 105,956. The daily activity in the new week has declined, but it still remains at a historical high.

Daily Transaction Number

As of December 8, 2024, the number of daily transactions on the XRPL chain also remained at a high of around 2 million, but it was less than the peak of over 6 million in early 2024 (Messari analysts believe this may be related to the surge in inscription activity that began in late 2023). Since XRPScan has been recording this indicator since 2013, we can take another look at the status of these numbers in the life cycle of XRPL.

It can be seen that as of December 8, 2024, the latest daily transaction volume of XRPL is generally still at a high level in the entire life cycle. In terms of peak value, the daily transaction volume of over 6 million has exceeded the extreme value of about 5 million in the last bull market. In terms of trend, it is also about hundreds of thousands higher in this bull market.

It is worth pointing out that during the bear market, the daily transaction volume of XRPL also maintained a certain level, and even intuitively it was slightly higher than that during the last bull market, indicating that the daily transaction volume of XRPL generally does not distinguish between bull and bear markets, and maintains a gradually rising trend.

Daily Trading Volume

Because there are many extreme values with particularly large values in the actual data, the vertical axis in the above figure has been logarithmically smoothed. It can be seen that as of December 8, 2024, the XRPL trading volume remained between 1 million and 10 million US dollars in most periods. It still remains after breaking the $10 million mark at the end of November 2024.

According to the above picture, we can clearly see the proportion of DEX and CEX transaction volume. Since the data was available in early August 2022, CEX has almost instantly dominated the trend. CEX transaction volume has dominated most of the time since then. In some time periods, the proportion of DEX has increased significantly for a short period of time, which may be the result of the meme craze.

Daily transaction fees

As of December 8, 2024, transaction fees remained at a few thousand XRP for most of the time, which was very cheap in terms of the dollar value at the time. The time period when the "spikes" in the figure occurred does not correspond to the time when the extreme value of the number of transactions occurred. The specific reason for this is not clear to the author for the time being.

Token Number

Since the end of October 2024 (when the US election was nearing its end), the number of assets on XRPL began to surge, reaching 12,428 on December 8, 2024. During the rest of the period, the number of assets grew slowly.

Token market value

In terms of token market value, there was also a breakthrough in late October and early November (when the US election was nearing its end), and it briefly reached a historical peak of $393.96M on November 22. On December 8, 2024, the figure was $347.33M.

According to Messari’s report, at the end of the third quarter, the top tokens on XRPL by market cap were as follows:

Sologenic ( SOLO ) has a market cap of $34.3 million and 228,000 holders. SOLO is primarily used to pay transaction fees on the Sologenic gateway.

Bitstamp BTC ( BTC ) has a market cap of $12.5 million and 4,500 holders. Bitstamp BTC is a wrapped version of Bitcoin offered by Bitstamp.

Gatehub Fifth ETH ( ETH ) has a market cap of $11.3 million and 26,000 holders. Gatehub v5 is a wrapped version of Ether provided by GateHub.

Coreum ( CORE ) has a market cap of $8.9 million and 71,000 holders. CORE is the native token of the Coreum sidechain, also developed by the Sologenic team.

The XRP token is the native token on the XRP Ledger (XRPL).

Supply Cap: 100B (100 Billion).

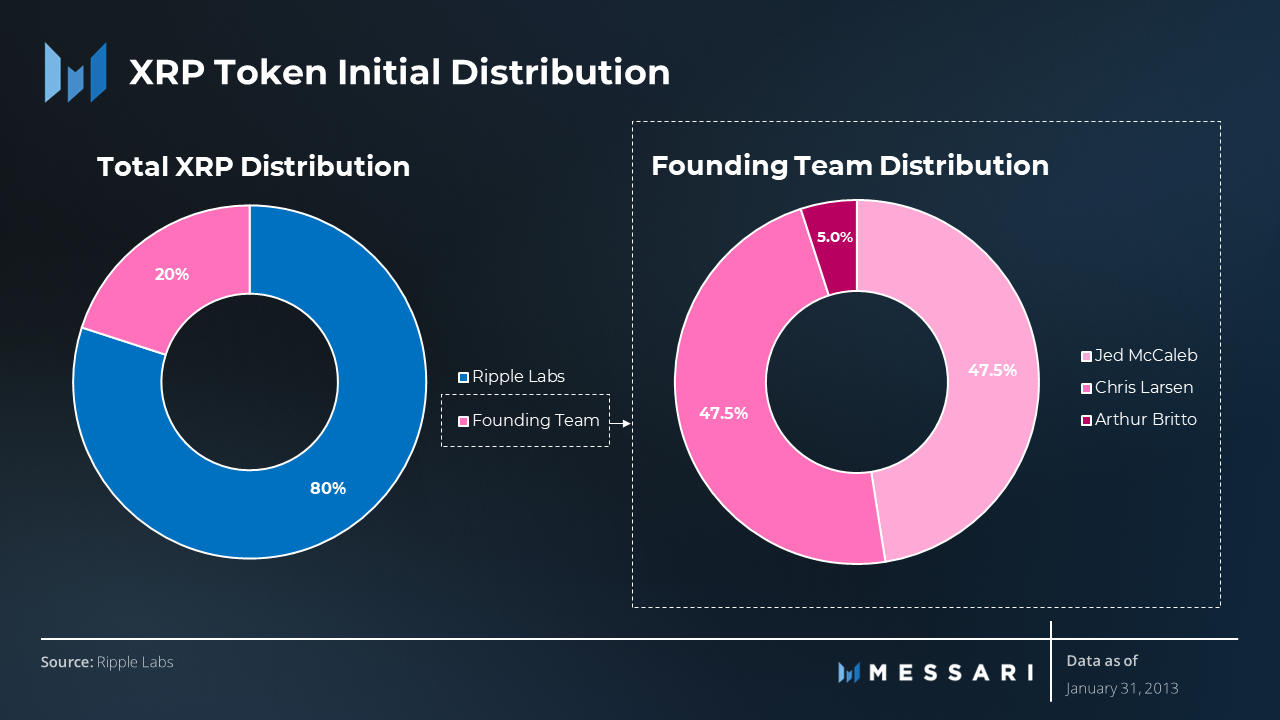

Distribution ratio: 20% of the tokens are distributed to the three founders Jed McCaleb, David Schwartz and Arthur Britto, and 80% are distributed to the later Ripple.

Inflation mechanism: None. This means that the emission of XRP tokens is actually determined by market supply and demand. Among them, Ripple, as a giant, its emission (including escrow lock-up and immediate available parts) is particularly worthy of attention.

Deflation mechanism: Transaction fees will be destroyed. Since the launch of the network, nearly 13 million XRP have been destroyed. Due to low transaction fees, the destruction rate is low.

Starting from Q1 2023, Ripple will publish the amount of XRP emitted in its quarterly report. The XRP owned by Ripple is divided into two categories: XRP currently available in its wallet, and XRP locked by ledger custody. For the latter category, Ripple cannot directly access the XRP. This type of XRP has been emitted since December 2017. XRP that has not been purchased at the end of the month will be returned to the new smart contract.

Note: Total amount of XRP reduction = Total amount of XRP available in the wallet this quarter + Total amount of XRP locked in custody this quarter - Total amount of XRP available in the wallet last quarter - Total amount of XRP locked in custody last quarter

It can be seen that in the period of 23Q1-24Q3, each quarter Ripple has reduced its holdings of XRP tokens by more than 800M (800 million), with a value of more than 400M (400 million) US dollars.

In fact, the problem of PoA can be seen again from here: the previous document claims that "the lack of direct incentives for XRP Ledger validators attracts natural stakeholders", and Ripple, as a highly controlled whale, sells XRP and acts as an inflation mechanism for the XRPL network in disguise. In fact, it is similar to including the incentive part given to validators in the PoW or PoS consensus protocol into its own income. There is no incentive for validators who participate in network maintenance, which is not feasible from a purely commercial perspective.

XRP has no special use. It is mainly used to pay various fees on the XRPL network, purchase various on-chain assets, etc., and serves as a medium of exchange.

Choose the competitor Stellar Network ($XLM) to apply the relative valuation method. Note that although the two products have certain similarities, there are still certain differences in target customers, inflation mechanisms, etc. XRP is designed to serve the needs of financial institutions, while XLM is designed to serve the needs of individuals and small businesses (especially in developing countries).

In terms of economic model, although Ripple's XRP emission is essentially equivalent to the network inflation mechanism at this stage, there is no newly issued XRP, while in the economic model of Stellar Network, a small portion of the newly created XLM is distributed to incentivize participation in the network, forming a slow inflation. In short, please note that the valuation here is only of reference significance and may not be completely accurate.

Note:

In the above table, the annualized cost of XRP is calculated based on XRPScan's fee data last month and CoinMarketCap, The Wall Street Journal's price data. All other data are from Tokentermianl.

P/F is FDV or MC divided by the annualized fee of the past 30 days.

It can be seen that compared with the competitor XLM, XRP's PF ratio is even lower, and the price is more cost-effective. According to the current XRP circulation quantity of 61,935,346,471 (XRPScan), the corresponding XRP token price can be calculated to be about $3.4957. This shows that according to the valuation method here, the market value and price of XRP may still have some room for upward exploration at this time. Considering that the ATH of the XRP price is $3.84, the valuation in this article may be relatively conservative.

Ripple IPO Expectations

On November 18, 2024, according to U.Today, SBI Holdings CEO Yoshitaka Kitao suggested that Ripple, a well-known enterprise blockchain company, should consider preparing for an initial public offering (IPO) after its legal issues with the U.S. Securities and Exchange Commission (SEC) are resolved.

Ripple CEO Brad Garlinghouse previously mentioned that going public is not a priority for the company, and he cited his strong financial situation as a reason for delaying the listing. However, he did not completely rule out the possibility of an IPO in the future. In 2022, Garlinghouse said that Ripple would explore an IPO after the SEC lawsuit ended, and expressed Ripple's vision of eventually becoming a public company.

On December 4, 2024, Barron's Weekly reported that the Trump administration is considering opening the initial public offering (IPO) market to cryptocurrency companies, further opening up the market's imagination.

As mentioned above, although Ripple's IPO business is theoretically not related to the value of XRP tokens, based on the historical market reaction to such favorable news, it can be expected that the good news of Ripple's future IPO will briefly boost the price of XRP tokens.

Institutional Adoption

Ripple's initial strategy was to position itself as a mature entity in the cryptocurrency field and avoid association with the anarchist and libertarian culture that prevailed at the time. Ripple's goal is not to replace the traditional financial system, but to improve the existing financial architecture by promoting fintech companies and banks to adopt XRP. This strategy has always been the core of Ripple's market layout.

With Trump's election as the 47th President of the United States and the relaxation of the crypto regulatory environment, Ripple's long-standing compliance strategy and policy rent-seeking initiatives are expected to lead to more institutional adoption of XRPL. This trend is expected to bring benefits to XRPL, including richer on-chain assets and more transaction fees, and further boost expectations for the rise of XRP tokens.

In addition, in late October, Ripple CEO Garlinghouse said in an interview with Bloomberg TV: "I think it is inevitable that the XRP ETF will be approved." He added, "Institutional and retail demand for this asset class is very strong." As of early December, multiple institutions, including Bitwise, Canary, 21 Shares and WisdomTree, have successively submitted spot XRP ETF applications, bringing more imagination to the market.

Ecological Expansion

The ecological expansion of the XRPL public chain can be viewed from two aspects. On the one hand, especially since 2020, various applications on the XRPL chain have become more mature and complete, no longer just simple transactions and transfers, which has been mentioned in the previous article.

On the other hand, XRPL is actively improving its interoperability with other blockchains. For example, the XChainBridge amendment in the XRPL 2.0.0 version launched in January 2024 introduced a cross-chain bridge function. In addition, in the first quarter of 2024, the decentralized cross-chain communication network Axelar was integrated with XRPL, connecting the XRPL ecosystem with more than 60 blockchain networks, including the Ethereum and Cosmos ecosystems. As the XRPL chain AMM develops, Axelar's connection makes it easier to obtain liquidity from multiple high TVL networks.

Ripple's business logic is decoupled from the value of the XRP token

This issue has been mentioned above. Under optimistic sentiment, it may not cause too much problem in the short term, but under pessimistic sentiment or long-term perspective, this decoupling phenomenon may be amplified and have adverse effects.

Historical problems in economic model and consensus mechanism design

As mentioned earlier, although the scalability of XRPL is strong enough under the PoA consensus mechanism, there are still certain problems. At present, the substantial inflation mechanism of the XRPL network is more reflected in Ripple as a "whale" or "dealer" constantly selling XRP to the market, rather than incentivizing network participation by rewarding validators like other blockchains. This mechanism easily leads to bearish sentiment in the market. Imagine if we learned that the Ethereum Foundation or Vitalik kept selling ETH when the price of Ethereum rose, this would obviously cause similar concerns. Although Ripple has established an account custody mechanism and publicly reports the number of XRP it holds every quarter, this selling behavior is still criticized from time to time.

Insufficient narrative logic to continue to attract C-end consumers

This is related to the positioning of Ripple and XRPL. In a business model that is mainly ToB, how to continue to attract retail investors or other on-chain users is worth discussing. The author noticed that the ecology and applications of XRPL are indeed gradually enriched, but there is still a certain gap in the user experience compared to other chains. Whether it can attract more community members to participate in the future, let us wait and see.

The increase in XRP has exceeded the expectations of many people. The author admits that the XRP token does have some shortcomings - such as being regarded as an "old coin" and Ripple's high degree of control - but it cannot be ignored that a very important narrative logic of this bull market is institution + compliance, and Ripple behind XRP has been deeply involved in this for many years, and this round of increase can be said to be "going with the trend". Moreover, surprisingly, the XRPL chain is not a dead chain with no people, but its business model is a certain distance away from ordinary retail investors, resulting in deviations in public perception. With the arrival of the cottage season today, the author believes that XRP still has room for growth.

Satflow is a new DEX for professional traders built on the Bitcoin network.

JinseFinance

JinseFinanceExamining Flow’s unique capabilities, the impact of the Crescendo upgrade, and network data metrics to assess adoption across its application ecosystem.

JinseFinance

JinseFinanceIn response to the accusations, Rocktoshi said, "I am not a liar."

JinseFinance

JinseFinanceWeigh and analyze the re-staking protocols Eigenlayer, Karak, and Symbiotic from multiple angles.

JinseFinance

JinseFinanceIn the swiftly advancing realm of artificial intelligence and automation, Questflow emerges as a transformative force, revolutionizing organizational approaches to workflow automation.

Wilfred

WilfredBounceBit is a re-staking project built on the Bitcoin ecosystem. Its goal is to enable BTC to generate organic staking rewards by creating a new ecosystem - BounceBit Chain.

JinseFinance

JinseFinanceIn September 2019, the LockBit ransomware made its official debut. It was called "ABCD" ransomware because it used the suffix .abcd to mark encrypted victim files.

JinseFinance

JinseFinanceL2 Sequencer, as the core component of the Ethereum Layer 2 solution, plays a key role.

JinseFinance

JinseFinanceCoinbase's new institutional-focused staking product won't be a "near-term phenomenon" while liquid staking is still being worked out.

Cointelegraph

CointelegraphWill the wave of lending protocols struggling in the bear market stimulate the development of alternative solutions to create more sustainable investment opportunities?

Cointelegraph

Cointelegraph

Please enter the verification code sent to