In January 2023, VitaDAO, a decentralized organization focusing on research and drug discovery in the field of life and longevity, received US$4.1 million in financing led by traditional pharmaceutical giant Pfizer. This is a milestone event in the field of DeSci Biotech, and also brings DeSci into the mainstream view for the first time.

Different from DeFi’s closed-loop business model that can be achieved only by encrypting native assets, DeSci’s underlying assets come from off-chain and need to be closely connected with the real world off-chain. In combination, this not only involves the use of Web3 technology and token economic models to transform traditional Science (such as scientific research collaboration, funding acquisition, data sharing, achievement transformation, technology transfer, product commercialization, etc.), but also involves many off-chain issues such as privacy protection. , data security, IP property rights, product commercialization and compliance issues in the on-chain encryption world.

Since the field of DeSci is very broad, this article will take two iconic Biotech projects in the field of DeSci as examples - Molecule and VitaDAO. From the perspectives of entrepreneurs and investment and financing lawyers building the legal structure of Web3 projects, we explore possible paths for Biotech projects to enter Web3.

1. What is decentralized science (DeSci)

Decentralized Science (DeSci) is a movement that aims to establish a public infrastructure to fund, create, review, validate, store and disseminate scientific knowledge and research through fair and equal use of the Web3 technology stack . The movement aims to create an ecosystem that incentivizes researchers to share their research openly and receive credit for their work, while allowing anyone to easily learn about and contribute to research.

(ethereum.org/zh/desci)

DeSci It is not intended, nor is it possible, to solve all problems related to scientific research and development. Currently, DeSci is using the Web3 technology stack to solve early scientific research funding (on-chain DeFi liquidity), organizational governance forms (decentralized autonomy, open permissionless participation), and the transparency of scientific processes. (Openness of research data and results) issues.

DeSci is creating a more decentralized and distributed scientific research model (such as the autonomous operation of smart contracts and the decentralized governance of DAO organizations), allowing It can better resist the review and control of funds and scientific research results by central institutions, obtain diversified scientific research funds through a decentralized approach, open up channels for scientific research data silos and external communication, and provide repeatable incentives to create an environment that allows An ecological environment where scientific research and discovery thrive.

2. Biotech’s practice in DeSci

In In the field of biotech, early basic research is often the lifeline for subsequent clinical trials and drug development. However, it is usually constrained by many factors such as tight funding channels, complex legal ownership, and urgent commercialization of projects. This will lead to potential problems. Promising research projects are difficult to get off the ground. Academics refer to this problem of attrition between basic research and clinical trials as the “Valley of Death.”

In addition, the intellectual property IP and data assets related to the research institute itself are also an asset class that is highly illiquid, centralized bureaucracy and opaque, limiting leading to the development of scientific research.

Under this helpless situation, Molecule provides a fund-raising platform for early life science projects through the Web3 technology stack and builds a An open and transparent market for funding, collaborative R&D and IP property rights transactions.

Molecule’s slogan is: The future of medicine belongs to everyone.

(molecule.xyz/)

2.1 Molecule

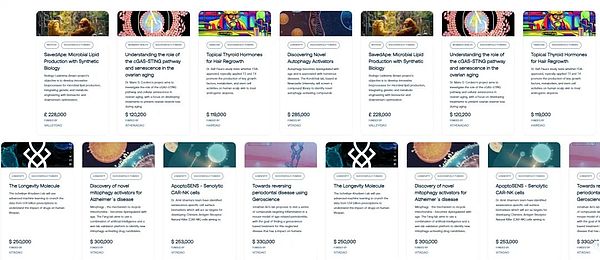

Molecule AG is a European-based company that built the decentralized Molecule Protocol platform to fund early-stage life science projects Funding, cooperative research and development and IP property rights transactions, currently about 12 scientific research projects have received funds on the platform.

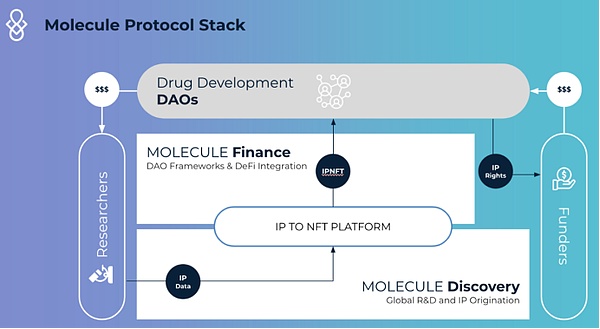

The infrastructure of the Molecule Protocol platform is built on Ethereum and includes two-tier systems: Marketplace Discovery and Molecule Finance.

A. Marketplace Discovery

In Marketplace, research People can publicly present their research projects and find global funders and collaborators to advance their projects. Investors and funding organizations can also access early-stage life science projects here and provide them with research funding and technical support.

This includes the longevity project of the University of Copenhagen that was subsequently transferred to VitaDAO in the form of IP-NFT.

(molecule.xyz/)

B. Molecule Finance

The Molecule Protocol platform enables fund providers to IP-NFTs can be purchased to raise funds for projects or integrated into DAOs managed for portfolios in specific disease treatment verticals.

Fund providers can provide funds and liquidity for scientific research projects by purchasing and holding IP-NFT, and IP-NFT holders can obtain researchers Research property rights and future results (such as intellectual property rights, royalties, data, etc.).

(An Open Bazaar for Drug Development: Molecule Protocol)

C. Molecule Ecology

So far, the MoleculeProtocol platform has built a relatively complete on-chain and off-chain DeSci through a modular open stack. ecology. It uses various DeFi components (Balancer, Gnosis) to build the liquidity of project funds, uses governance components (Moloch) to achieve collective participation in governance of patient communities, scientific researchers and investors, and uses DAO's Launchpad foundation Facilities Bio.xyz are used to raise early community funds and build community frameworks, use open scientific research experimental tools (The LAO) to further accelerate research and development, and use legal frameworks (OpenLaw) to protect the rights and interests of scientific research intellectual property IP off-chain and on-chain The rights and interests of investors and participants.

On June 13, 2022, Molecule completed a US$13 million seed round of financing. This round of financing was led by Northpond Ventures, with Backed VC, Shine Capital, Speedinvest and former Coinbase chief technology officer Balaji Srinivasan participated in the investment.

D. Summary

DeSci is not for, nor It is impossible to solve all problems related to scientific research and development. Molecule continues to use the Web3 technology stack to solve early scientific research funding (DeFi liquidity on the chain), organizational governance forms (decentralized autonomy, open permissionless participation), and transparency of scientific processes (research data and results). open) question.

Some people think that Molecule is more like the OpenSea of the DeSci track, but it is different from OpenSea of native assets on the transaction chain. The most important thing about the DeSci project is It is still the underlying scientific research projects and intellectual property IP data under the chain, and it is still necessary to incubate, govern, and promote the development of the underlying scientific research projects.

Therefore, VitaDAO, which was incubated by Molecule and focuses on the field of life and longevity, came into being.

2.2 VitaDAO

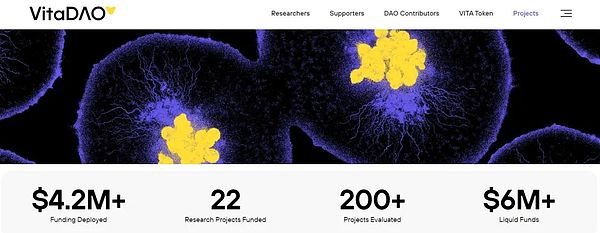

VitaDAO was officially established in June 2021 In March, it was advocated and launched by Molecule and is committed to building a decentralized and community governance platform focusing on anti-aging drugs and life longevity projects, aiming to accelerate the research and development of life and longevity and extend human lifespan and health lifespan.

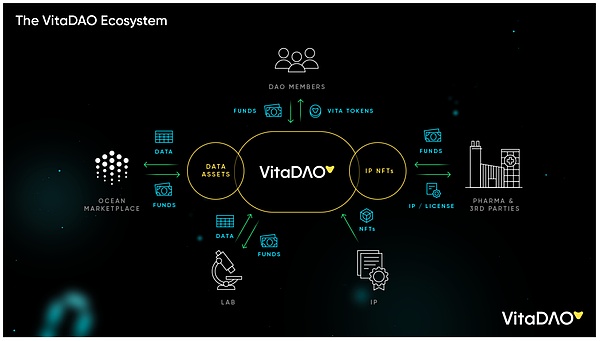

VitaDAO plays the role of a fund provider on the Molecule platform. It specifically provides funding for life and longevity projects and obtains intellectual property IP data through community fundraising. , and conduct decentralized governance through the DAO organizational method, becoming the world's first DAO focused on life and longevity.

(VitaDAO.com)

A. Community Fundraising & Community Governance

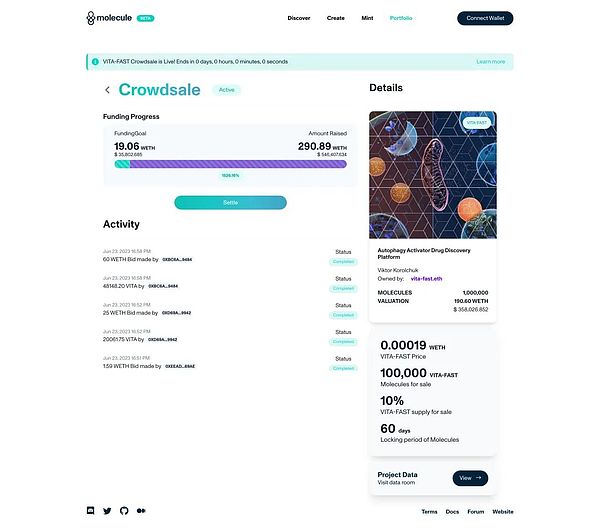

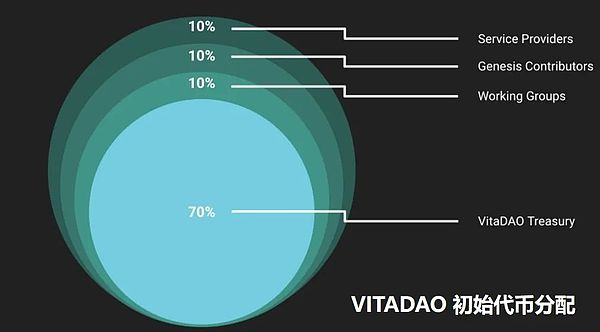

VitaDAO launched a community round of financing on June 23, 2021, and anyone can contribute by purchasing or actively participating in the community way to obtain VITA tokens and actively participate in the community governance of VitaDAO by holding VITA tokens.

VitaDAO currently has established multiple working groups to support the decentralized operation of DAO, including establishment governance, token economics, publicity, law, anti-aging science and operations The main work of the group includes funding early-stage scientific research projects or investing in start-up companies to obtain intellectual property IP data and equity.

(VitaDAO.com)

B. Business Model< /strong>

Although VitaDAO has implemented on-chain fundraising and on-chain governance, its main business model still comes from off-chain.

VitaDAO needs to commercialize the intellectual property IP and data assets obtained by funding scientific research projects (such as the authorized use of scientific research data, the transfer/authorization of intellectual property IP , cooperative research and development with medical institutions, etc.), the funds obtained further fill the DAO's treasury to support more projects, thus forming a virtuous cycle.

In August 2021, VitaDAO received the first IP-NFT of the MoleculeProtocol platform, an anti-aging and longevity project from the University of Copenhagen.

So far, VitaDAO has successfully funded 22 projects, with a total investment of more than US$4.2 million.

(VitaDAO Whitepaper)

C. Token Economy< /strong>

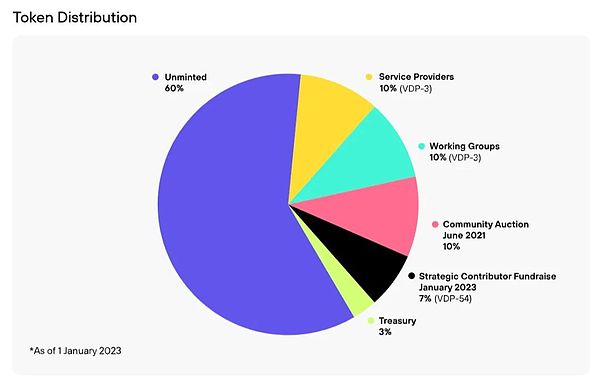

According to VitaDAO data, as of January 2023, 60% of these tokens have not yet been put on the market (Unminted). At its inception (June 2021), the community auctioned 10% of tokens, and in January 2023, in a $4.1 million financing led by traditional pharmaceutical giant Pfizer, 7% of tokens Replaced in the form of Token Sale. In addition, service providers, working groups, and treasuries received 10%, 10%, and 3% token shares respectively. Tokens that are not on the market are released at a rate of 0.4% every quarter.

VITA token holders enjoy governance rights rather than ownership of IP-NFT, but VITA tokens correspond to VitaDAO treasury assets (IP-NFT, life The value of scientific project equity, scientific research data) will also continue to increase with the increase in VitaDAO-funded projects, which has huge potential.

(VitaDAO.com)

D. Summary strong>

VitaDAO is the first Biotech DAO successfully incubated after Molecule built the Biotech ecosystem. This model has also won the support of mainstream traditional pharmaceutical giant Pfizer (Pfizer) recognition is of iconic significance and is worthy of reference for all DeSci projects.

Compared to Molecule, a relatively large and comprehensive life science discovery market, VitaDAO, a more segmented and focused DeSci operation, is easier to obtain funds. The attention can be superimposed on the resources of market segments in this field, thus forming a unique community in this field.

For example, VitaDAO, a community focused on the scientific research and development of "life and longevity", can: (1) gain attention and support from on-chain and off-chain capital liquidity; ( 2) Let patients voluntarily contribute data in exchange for hope for future cure and recovery; (3) More open science can attract talents and resources that focus on the development of life and longevity around the world, and help scientific research projects go through basic research, clinical trials, product commercialization, etc. various stages.

(VitaDAO Longevity Biotech Conference at Zuzalu 2023)

三, explore the feasible path for biotech projects to enter Web3

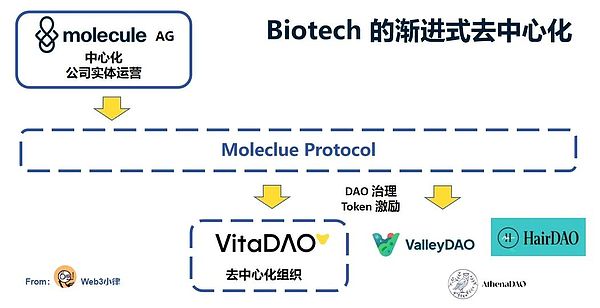

Many projects related to the real world are not completely decentralized at the beginning. It is still necessary to follow a gradual decentralization process from a company-like subject to a protocol subject.

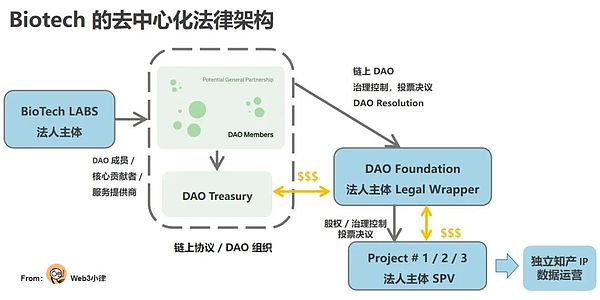

Especially for Biotech projects in the DeSci field, intellectual property IP and data assets still require off-chain entities to hold, operate, apply for patent protection, etc. And it needs to meet the regulatory compliance of intellectual property IP and data assets in each jurisdiction.

The Web3 paths of Molecule and VitaDAO are worth learning from.

3.1 Molecule - a progressive decentralization path from platform to protocol

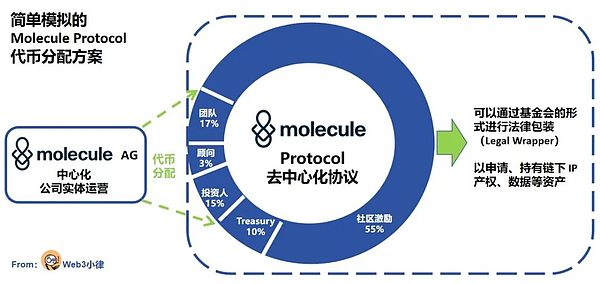

In the above case, Molecule AG is a European operating company that gradually transformed from centralized operations at the beginning to building the Molecule Protocol platform on Ethereum.

Centralized Molecule AG embeds various protocol components on the Molecule Protocol platform, such as Balancer, Gnosis, Moloch, The LAO, OpenLaw, Bio.xyz, etc. , after building its own on-chain and off-chain Biotech ecosystem, it transformed into the decentralized Molecule Protocol, gradually incubated VitaDAO, and subsequently obtained financing.

Although there is no news about the Molecule Protocol token economy, it is foreseeable that after the progressive decentralization transformation into Molecule Protocol, Molecule AG The positioning of the company entity will be transformed into a core contributor of Molecule Protocol, rather than an actual operator, and it may receive a corresponding 15%-20% token incentive in the subsequent token distribution.

3.2 VitaDAO - a decentralized organizational path initiated by the community

Looking back at VitaDAO advocated and initiated by Molecule, Molecule is more Most of them play the role of initiator rather than actual operator. The actual operations are undertaken by working groups elected by the community, and are operated based on the structure already established by Molecule.

It can be said that VitaDAO is a decentralized organization built on the basis of the Molecule community. The initial funds are provided by the community and will be subsequently run autonomously through the community.

Due to the decentralized nature of the VitaDAO community, its token distribution does not include centralized institutions as sponsors and investors (compare to the simulated Molecule Token distribution plan), the token distribution plan is more community-oriented.

(VitaDAO.com)

3.3 Biotech project enters Web3 Possible path

Because the intellectual property IP and data assets of Biotech projects still require off-chain legal entities to hold and maintain , the token economic system also needs the support of the participant ecosystem, so it is not realistic for Biotech projects to immediately achieve decentralization as soon as they enter Web3, even for companies like Molecule.

Biotech projects need to first operate in a centralized manner, establish their own participant ecosystem, and design a token distribution plan to incentivize ecological participants.

Token design needs to be clear: What can Web3 bring to Biotech projects?

Simply speaking, Web3 can incentivize community contributing members in the form of tokens at low cost and quickly form an ecological network effect.

In Web2, this can only be achieved by subsidizing users after the company raises large-scale financing from VC/PE, and this kind of To VC Non-To User operating methods may not be applicable to the current market environment.

For a community like VitaDAO that focuses on the scientific research and development of "life and longevity", it can quickly start projects and stimulate various ecological links through the design of the token economy. Among the participants, network effects are quickly formed: (1) incentives for investors and liquidity providers in scientific research projects; (2) incentives for patients who provide their own data; (3) incentives for helping scientific research projects through basic research, Incentives for members at various stages such as clinical trials and product commercialization.

After completing the ecological construction and designing a clear token economic plan, you can gradually switch to the governance operation mode of decentralized DAO. Therefore, we see that after the centralized Molecule AG builds a participant ecosystem, it gradually enters the decentralized Molecule Protocol protocol or the decentralized organization VitaDAO. This is a feasible path for Biotech to enter Web3.

After this, you can refer to the RWA model, where the DAO will set up a foundation/SPV to independently operate intellectual property IP and data to meet off-chain regulatory compliance. regulatory requirements.

4. Written at the end

DeSci may not be the only solution to the problems in the current field of scientific research, but it can provide A possible solution.

Although like any technological innovation, there are many risks in the DeSci field, such as the legal characterization of the DAO organization, the ownership of intellectual property IP data, investors on the chain, and Protection of the rights and interests of off-chain scientific researchers, etc., but you need to know:

DeSci is still in its infancy, and there are only a few scientific research projects and scientific DAOs in the blockchain With the attention of encryption leaders such as Buterin, Coinbase’s Brain, and Balaji, as well as the recognition of traditional pharmaceutical giant Pfizer, huge development space in this field is being opened.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance Hui Xin

Hui Xin Stanford Blockchain Review

Stanford Blockchain Review Bankless

Bankless Others

Others Bitcoinist

Bitcoinist 链向资讯

链向资讯 Bitcoinist

Bitcoinist Cointelegraph

Cointelegraph