Author: Momir, IOSG Ventures Source: X, @momir_amidzic Translation: Shan Ouba, Golden Finance

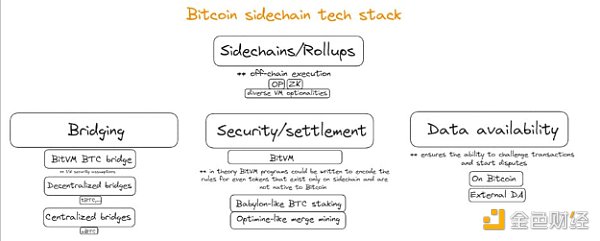

When considering Bitcoin’s second-layer solution, I started with a simplified model, focusing on three key design decisions:

1. How to bridge BTC?

2. How and to what extent to inherit Bitcoin’s security?

3. How to deal with the data availability (DA) problem?

1. Bridging BTC

- BitVM Bridge: A minimal trust bridge with a 1/N trust assumption would be the best solution, however there is no concrete bridge specification yet and there are some unresolved (but hopefully solvable) issues, such as the need for multi-signature operators to provide liquidity. The optimistic prediction is that we may see a BitVM bridge appear in at least 12 months, and the base case is within 24 months.

- Decentralized Bridge: Economically secure bridges (such as XCLAIM) are generally secure but not very scalable. In contrast, statistically secure bridges, such as large rotating multi-signature networks, currently seem to offer a better tradeoff.

- Centralized Bridges: While not ideal, they are a straightforward solution, and many Bitcoin sidechains today rely on simple custodial bridges.

2. Inheriting Bitcoin’s Security

This is where things get interesting.

- BitVM Programs: In theory, it is possible to write BitVM programs that encode the rules for tokens that only exist on the sidechain, which are not native to Bitcoin. This would not only allow for a minimally trusted BitVM bridge, but also allow for actual Rollups to be built on Bitcoin. Again, the technical risks cannot be ignored and a practical solution seems far away.

- PoS Sidechains using Babylon: Another option is to build a PoS sidechain using Babylon. Babylon is the first solution that can enable trustless Bitcoin staking, increasing the utility of BTC by leveraging BTC as an economic security layer for new PoS chains, similar to how Eigen allows the use of ETH as an economic security layer for new middleware and infrastructure.

- Merged Mining: Merged mining is another option, but raw merged mining has some inherent limitations, such as the inability to enforce certain behaviors on miners. Having a hybrid mechanism that requires miners to stake on a sidechain to increase participation, while giving the sidechain the ability to slash them, could be an interesting area of research.

3. Data Availability (DA)

Why is DA crucial? If we are talking about an optimistic design like BitVM, in order to be able to challenge and prove malicious transactions, users must have access to the data.

Bitcoin itself has a constraint of only being able to store 4MB of data every 10 minutes, making it a poor candidate for a DA layer (https://x.com/_weidai/status/1791134159706141117). Not to mention the unpredictability of costs and therefore uncertainty about whether data can be inserted into the next block.

Can there even be a Bitcoin Rollup if Bitcoin’s DA guarantees cannot be obtained?

DA is a topic of extensive discussion within the Ethereum community, with some leading community members insisting that anything using an external DA is not a true Ethereum Rollup.

By the same principle, anything using a non-Bitcoin DA is not a Bitcoin Rollup. However, Bitcoin sidechains may have to give in here and be more pragmatic, choosing alternatives such as Ethereum DA, Celestia, Eigen DA, or DA secured by staking BTC through Babylon.

Final point: What’s best for Bitcoin L1 (regarding the choice of settlement layer)?

In the long run, as less and less BTC is available to mine, Bitcoin miners will rely more on organic fees or secondary revenue sources. In other words, in order to maintain a high hash rate, Bitcoin must develop a sustainable fee market. Looking at the above alternatives, the solution that can most positively impact Bitcoin L1 security is, surprisingly, merged mining.

Specifically, BitVM (in combination with an external DA) and Babylon do not generate more transaction fees for Bitcoin miners. The former is an optimistic design that only needs to be executed on Bitcoin in a few cases, while the latter does increase the demand for BTC as an asset, but does not enhance the security of Bitcoin PoW.

Merged mining aligns well with enhancing Bitcoin security because it requires miners to compete for L1 block execution in order to build sidechain blocks and receive sidechain rewards. In other words, winning the next Bitcoin block is a prerequisite for building the next block of the sidechain.

Summary

With these simple modules, you can already create 18 unique sidechain combinations. Assuming there is no limit to how different modules can be combined, I personally think the best combination that may be achieved in the next two years is as follows:

- Bridge via BitVM

- Use Babylon to obtain BTC PoS security or some innovative merged mining method to extend Bitcoin PoW security

- Rely on an external DA, such as Ethereum or a DA powered by Babylon

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance Pr0phetMoggy

Pr0phetMoggy Catherine

Catherine Cointelegraph

Cointelegraph 链向资讯

链向资讯 Ftftx

Ftftx Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph