Source: Zhibao

Abstract

At this meeting, the Federal Reserve maintained Interest rates remain unchanged.

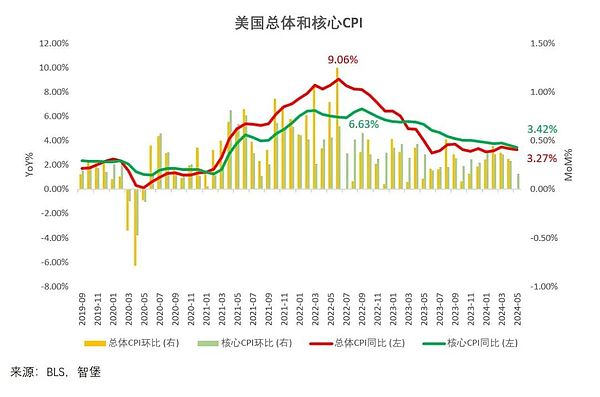

There is only one major change in the meeting statement, which is from "a lack of further progress" in the process of inflation falling at the last meeting to ( modest further progress)to reflect the improvement in inflation data (CPI) just released yesterday.

QT Taper is launched this month.

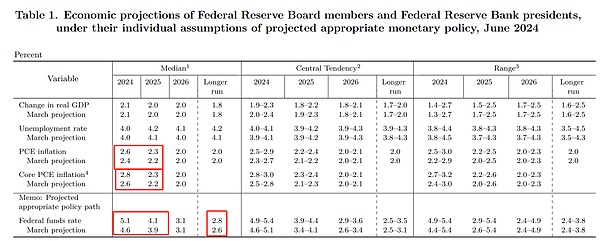

The overall change in economic forecasts is not significant. It is worth noting that the inflation forecast has been slightly increased, and since the PCE inflation data for May has been announced as 2.8%, This forecast revision gives the illusion that inflation improvement has been achieved.

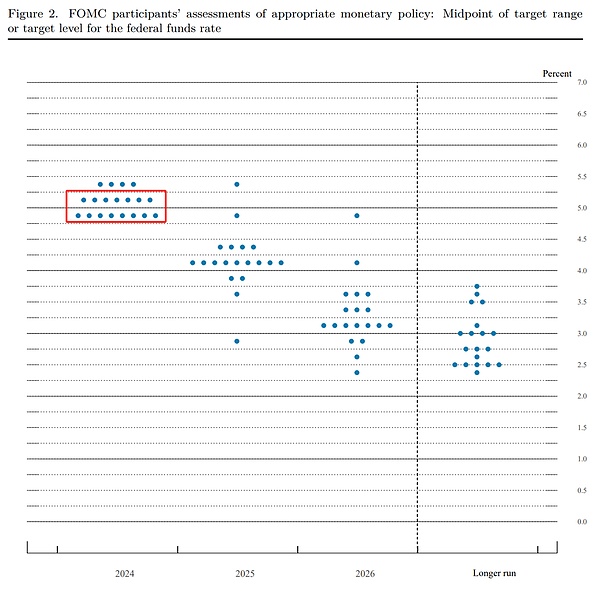

The interest rate dot plot fulfilled the "upward risk" in the previous March dot plot. 15 members believed that interest rates should be cut within the year and expressed their opinions oninterest rate cuts. Disagree on once or twice.

The long-term interest rate forecast was raised for two consecutive quarter-end meetings, reflecting the subtle changes in Fed officials’ expectations for the central level of long-term interest rates, butPowell downplayed it in the question and answer session at the press conference. The importance of this change.

The Dovish Bias in the press conference was significantly weakened. The main reason was still that the previously announced CPI data changed the tone of the press conference< strong>Perception and tone, the improvement in inflation data makes Powell appear more comfortable.

The U.S. stock market maintained its gains after the release of the inflation data but then fell slightly, while U.S. bond yields and the U.S. dollar index fell sharply strong>Recovery.

The author believes that the Federal Reserve may clarify the conditions for cutting interest rates in the second half of the year at the Jackson Hole meeting in August this year, and Powell will also receive more information by then. There is sufficient inflation data support.

Picture: Powell's purple tie pattern has changed to reflect modest further progress, from left to right this year Four meetings in the first half of the year.

Graphic: Improvement in inflation data This relieved Powell and changed the tone and atmosphere of the entire press conference.

Original statement (key changes in bold)

Recent indicators suggest that economic activity has continued to expand at a solid pace. Job gains have remained strong, and the unemployment rate has remained low. Inflation has eased over the past year but remains elevated. In recent months, there has been modest further progress toward the Committee's 2 percent inflation objective.

Recent indicators suggest that economic activity continues to expand at a solid pace. Job growth remains strong and the unemployment rate remains low. Inflation has eased over the past year but remains high. In recent months, there has been modest further progress towards achieving the Committee's 2 percent inflation target.

The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. The Committee judges that the risks to achieving its employment and inflation goals have moved toward better balance over the past year. The economic outlook is uncertain, and the Committee remains highly attentive to inflation risks.

The Committee seeks to achieve full employment and 2% inflation over the long term. The Committee judges that risks to achieving the employment and inflation targets have become better balanced over the past year. The economic outlook is uncertain and the Committee remains highly concerned about inflation risks.

In support of its goals, the Committee decided to maintain the target range for the federal funds rate at 5-1/4 to 5-1/2 percent. In considering any adjustments to the target range for the federal funds rate, the Committee will carefully assess incoming data, the evolving outlook, and the balance of risks. The Committee does not expect it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably toward 2 percent . In addition, the Committee will continue reducing its holdings of Treasury securities and agency debt and agency mortgage‑backed securities. The Committee is strongly committed to returning inflation to its 2 percent objective.

To support its objective, The Committee decided to maintain the target range for the federal funds rate at 5.25%-5.5%. In considering any changes to the target range for the federal funds rate, the Committee will carefully evaluate the data received, the evolving outlook, and the balance of risks. The committee does not expect to cut interest rates until it has greater confidence that inflation will continue to move towards 2%. Additionally, the Committee will continue to reduce its holdings of Treasury securities, agency debt, and agency mortgage-backed securities. The Committee remains firmly committed to returning inflation to its 2% objective.

In assessing the appropriate stance of monetary policy, the Committee will continue to monitor the implications of incoming information for the economic outlook. The Committee would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the Committee's goals. The Committee's assessments will take into account a wide range of information, including readings on labor market conditions, inflation pressures and inflation expectations, and financial and international developments.

In assessment The Committee will continue to monitor the impact of information received on the economic outlook when determining the appropriate stance of monetary policy. The Committee will be prepared to adjust the stance of monetary policy, as appropriate, if risks arise that could impede achievement of the Committee's objectives. The Committee's assessment will consider a wide range of information, including its interpretation of labor market conditions, inflationary pressures and inflation expectations, and financial and international developments.

Dot plot and economic forecasts

Along with the slight upward revision to inflation forecasts, interest rate forecasts were also revised upward.

After being raised in March, the long-term interest rate forecast will continue to be raised by 0.2% at this meeting.

One interest rate cut during the year (7th place) vs. 2 interest rate cuts (8th place)

Some interesting press conference details

Repeat the risk-balancing management posture again

We know that reducing policy restraint too soon or too much could result in a reversal of the progress we've seen on inflation . At the same time, reducing policy restraint too late or too little could unduly weaken economic activity and employment.

We know that reducing policy restraint too late or too little could unduly weaken economic activity and employment. reversal; at the same time, reducing policy tightening too late or too little could unduly weaken economic activity and employment.

Do the Fed’s interest rate forecasts reflect the newly updated economic data?

Data came out, I think it happened a couple meetings ago, a few meetings ago. So when that happens, when there's an important data print during the meeting, first day or second day, what we do is we make sure people remember that they have the ability to update, we tell them how to do that, and some people do, some people don't. Most people don't. And I'm not going to get into the specifics. But you have the ability to do that, so that what's in the SEP actually does reflect the data that we got today, to the extent you can reflect it in one day.

Federal Reserve officials will adjust their SEP forecasts for the day after the data is updated in real time! It's just that most people won't do it.

Answer reporters’ questions about the continuous increase in long-term interest rate forecasts

But I want to remember to point out that long run neutral rate of interest is a long run concept. It really is a theoretical concept, it can't be directly observed, and what it is is the interest rate that would hold the economy at equilibrium, maximum employment and price stability, for potentially years in the future where there are no shocks, so it's a little bit -- it's not something we observe today.

But back to your original question, people have been gradually writing it up because I just think people are coming it the view that rates aren't going to -- are less likely to go down to their prepandemic levels, which were very low by recent history measures.

Emphasis on the unobservable long-term equilibrium interest rate levels , but also frankly stated that many officials do believe that interest rates will not return to the historically low levels before the epidemic.

Answer the question about the purpose of the 25bp interest rate cut tube

I think if you know, if you look back in five or ten years, and try to pull out the significance to the US Economy of one twenty five basis point rate cut, you'd have quite a job on your hands. So that's not how we look at it. You know, really the whole rate path matters, and I do continue to think that when you know,when we do start to loosen policy, that will show up in a significant loosening in financial market conditions, and the market will price in what it prices in, I don't I have no way of saying we're not at that stage, so I don't know.

Looking back at past history, it would be difficult to analyze the impact of the 25bp interest rate cut, but I think the launch of easing will be reflected in the financial market environment (pan-easing), and the market will price it.

(The author puts a question mark here, in fact, the easing of financial conditions and related pricing require continuous forward guidance and easing commitments. If The interest rate cutting cycle will also become bumpy in the future - for example, if the interest rate cut fails to bring a signal of further interest rate cuts, then How does the market price more easing at that moment? )

Answer the question about where inflationary pressures lie

You know, in some parts of non housing services, you see elevated inflation still, and that's probably to do with it could be to do with wages, goods, prices have kind of fluctuated. There's been a surprising increase in import prices on goods, which is kind of hard to understand and, you know, may we've taken some signal from that, but you know, and of course, housing services, you're seeing, you're continuing to see high readings there.

Powell believes that the service industry (including housing and non-housing) deserves vigilance and wages are also high.

Wilfred

Wilfred

Wilfred

Wilfred JinseFinance

JinseFinance JinseFinance

JinseFinance Edmund

Edmund JinseFinance

JinseFinance Others

Others Others

Others Bitcoinist

Bitcoinist 链向资讯

链向资讯 Cointelegraph

Cointelegraph