Source: Future Money

The overall market value of cryptocurrency is on an upward trend. As BTC sprints upward again and enters a new round of rising cycle, more AI projects will emerge in front of the public in the form of Meme issuance.

Crypto Market Summary

1. The concept of decentralized AI is still the mainstream narrative in the industry. AI with top endorsements is seeking market profits to interpret the feasibility of the business model; more AI projects will emerge in front of the public in the form of Meme issuance.

2. DeSci (decentralized science) is a narrative that was born at the same time as DePIN, but it was snatched away by DePIN in the early days of this year and has been tepid. At the end of this year, with CZ's attention to DeSci and the hot Meme market, the logic of relying on Meme to raise funds to complete scientific research has been established.

3. Solana ecology is still the most advanced Meme depression at present, and the revenue of Pump.fun protocol has reached 210 million US dollars. At the same time, Meme funds that use Meme as their main holdings and Meme as a means of fundraising have emerged, such as ai16z. This fund has become the largest Meme fund at present by effectively using the internal and external market rules of Pump.fun and the fundraising and profit-sharing rules of Daos.fun, with an investment return rate of up to 75 times.

4. As BTC sprints upward again and enters a new round of rising cycle, the Meme narrative is at risk of stalling in the near future, and investment should be cautious.

1 Market Overview

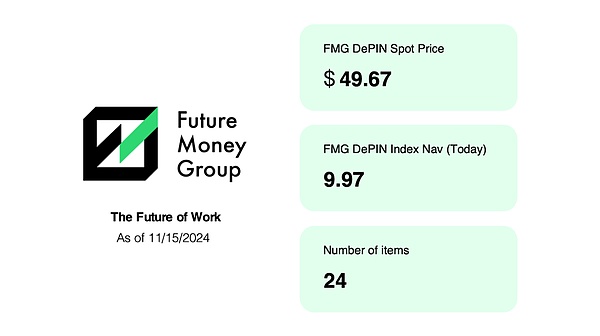

1.1 FutureMoney Group DePIN Index

The FutureMoney Group DePIN Index is a DePIN high-quality portfolio token index constructed by FutureMoney, which selects the most representative 24 DePIN projects. Compared with the last report, the Nav value has increased significantly, from 8.31 to 9.97. Spot Price has fallen back to a certain extent. This is because in this round of rise, BitTensor, which occupies a large Index position, has entered a period of shock, and the rise is not obvious, which is diluted by the rise of other holdings Render (59%), GRT (44%), AKT (60%), and AIOZ (68%). In general, we can feel that the AI concept is generally better than the DePIN concept, and AI application projects with actual landing scenarios will be better than large infrastructure projects.

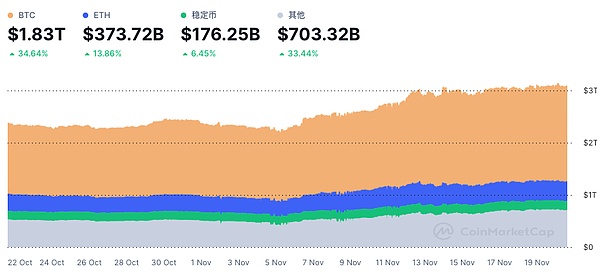

1.2 Crypto market data

From October 31 to November 15, the overall market value of cryptocurrencies showed a significant upward trend. From the previous 2.45 trillion US dollars to 3.03 trillion US dollars, it is close to the annual GDP value of France. In terms of market share, BTC remains the same as in October, still at 59.3%. At the same time, we see that the trading volume has increased significantly, from the previous $72.5 billion to the current $179.8 billion.

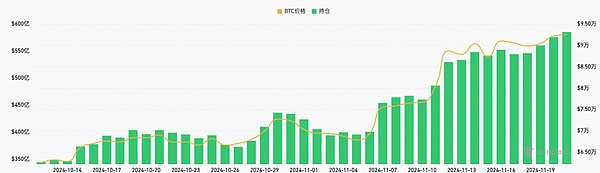

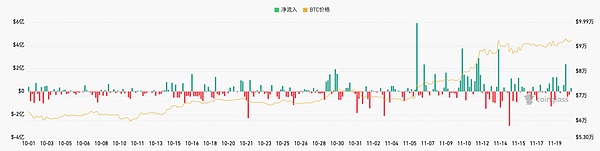

From the trend of Coinglass contract positions, since October 31, the open positions of BTC contracts on the entire network have increased significantly, from the highest of $43.5 billion last month to the current $58.5 billion, which fully demonstrates that OTC funds and non-BTC funds have bet on BTC in this round of increases.

At present, the entire BTC trend is in the Fomo stage. FMG previously predicted that Trump would be elected successfully, and Trump's election also brought great benefits to the entire industry. Referring to each bull market in the past, BTC tends to reach a new high within 8 to 16 months after halving, and has now entered an upward channel. In the past 15 days, BTC spot net inflows were $2.174 billion, and USDT net inflows were $3.284 billion.

Sponsored Business Content

1.3 CPI and other data and market reactions to market judgment

1. Macro level: As of now, there is no latest change in the unemployment rate in the United States, and the number of initial unemployment claims has increased from 216,000 on October 26 to 221,000 on November 9. As the Democratic Party is still in power, the Trump administration's series of proposals to boost the economy and employment rate have not yet formed policies. As Trump takes office, the performance of the unemployment rate will change significantly.

2. Crypto: In the past half month, BTC has continued to test new highs, rising to a record high of more than $94,000 on November 20, as reports that Donald Trump's social media company was negotiating to acquire crypto trading company Bakkt increased people's hopes for a cryptocurrency-friendly system under the Trump administration. IG market analyst Tony Sycamore attributed this to the benefits of Trump's trade negotiations and the optimism brought to the market on the first day of the listing of BlackRock's spot Bitcoin ETF's options product.

3. Sectors worth layout: The industry narrative has shifted rapidly in the past half month. During the period after BTC fell back from $68,000 to $94,000 for the first time, Meme represented by Solana ecology and AI concept, DeSci concept Meme began to become active. As a result, new gameplay such as Daos.fun and ai16z were born. In addition, ORA, an AI reasoning model project invested by FMG, took the lead in choosing Dex to launch and achieved an excellent result of $2 billion in FDV. On the one hand, it verifies that the decentralized AI theme is still the focus of the crypto market, and on the other hand, the Meme narrative will become one of the mainstream narratives in the industry in the foreseeable future.

In addition, the DeSci narrative that CZ has been promoting since his release from prison has also become the main scene of Meme.

2. Hot market news

2.1 Trump administration nominates Bitcoin supporter Howard Lutnick as US Secretary of Commerce

The Trump administration nominated Howard Lutnick, CEO of Wall Street bond trading giant Cantor Fitzgerald, as the next US Secretary of Commerce. Howard Lutnick holds hundreds of millions of dollars in Bitcoin and announced at a Bitcoin conference that Cantor Fitzgerald would launch a Bitcoin financing business. Cantor Fitzgerald has been custodial assets for Tether since the end of 2021.

2.2 The United States may use BTC as a strategic reserve

With some states in the United States proposing BTC strategic reserve bills, the possibility of the United States establishing BTC reserves is increasing. Against the backdrop of Trump's new government team, the possibility of these bills passing is very high. If the bills pass, it will definitely be a great boon to BTC. Just yesterday, CZ published a post revealing that countries are competing to buy BTC as strategic reserves, and no one wants to be the last country to enter. This shows that the trend of BTC as a reserve asset is accelerating, and it may become the focus of policy and market discussions in various countries in the coming months.

2.3 Solana releases new roadmap, market value hits new high

Solana co-founder releases the "Solana Roadmap", and the initial disclosure is that it will increase bandwidth and reduce latency, while other content is not yet known. At present, Solana chain is a very dynamic public chain of Meme coin. The two sides have a relationship of mutual achievement and shared honor and disgrace. With the SOL market value breaking through $116 billion to set a new high, it is hoped that the Sol and Meme ecosystems can be more stable and secure in the future.

2.4 Meme market capitalization accounts for 17.05% of the entire crypto market capitalization

According to the Q3 2024 industry report data released by CoinGecko, 15 narratives such as MemeCoin (17.05%), AI (9.66%) and RWA (6.47%) account for 71.7% (including 11.41% of Solana Memecoins and 1.83% of Base MemeCoins) of the crypto market share.

3. Regulatory environment

US President-elect Trump is considering appointing blockchain legal expert Teresa Goody Guillén as Chairman of the U.S. Securities and Exchange Commission (SEC). Guillén is currently a partner and co-head of the blockchain team at BakerHostetler Law Firm. She has worked at the SEC and represented blockchain companies and traditional companies in response to SEC enforcement actions.

Sources said that the Trump team hopes to choose a candidate who is pro-cryptocurrency and has a non-bureaucratic background to promote the SEC to implement a light regulatory policy and end the practice of "enforcement actions are regulation." Guillén is recognized by the industry for his deep securities law background and support for the crypto industry, and is considered to be able to quickly reform the SEC. It is expected that the candidate for SEC chairman will be determined before Thanksgiving. Guillén and other candidates, including former SEC Commissioner Paul Atkins and Robinhood Chief Legal Officer Dan Gallagher, will compete for the position.

The data in this article comes from: Coinglass, Rootdata, Coinmarketmap, X

Alex

Alex

Alex

Alex Joy

Joy Joy

Joy Brian

Brian Joy

Joy Joy

Joy Alex

Alex Brian

Brian Kikyo

Kikyo Brian

Brian