Author: Cyrus Ip Source: coindesk Translation: Shan Ouba, Golden Finance

Real estate, as an asset class, has become a source of wealth growth, with many elderly people in Asia's first-tier cities such as Singapore and Hong Kong seeing their wealth soar due to rising property prices. While some of these generations may be cash-poor, they tend to own a lot of assets, primarily real estate.

In Hong Kong, for example, a parent who owns a property is likely to be a millionaire, even if it's just a tiny one-bedroom apartment. However, for younger generations, including millennials and Generation Z, super-high housing prices are not just a challenge, but a heavy financial burden. Many of these owners are burdened with long-term mortgages with high interest rates, making it difficult for them to climb the social ladder. In other words, rapid urbanization means that young people are unlikely to accumulate the same level of wealth through real estate as their parents did.

Although accumulating wealth through real estate may no longer be realistic for young people, many still see it as their only option because there aren't many obvious alternatives. As real estate markets continue to swell across cities across Asia, some people simply can’t keep up. Soon, they can find themselves caught in a spiral of financial decline.

Faced with this dilemma, some experts advocate for alternative investments like Bitcoin. Bitcoin is seen as a kind of “virtual real estate” that offers a unique opportunity for young investors: With a capped supply of 21 million units, Bitcoin is rarer than most real estate options. Its extremely liquid market allows investors to trade BTC at any time without the barriers associated with property ownership and high down payments. This makes Bitcoin an attractive investment option.

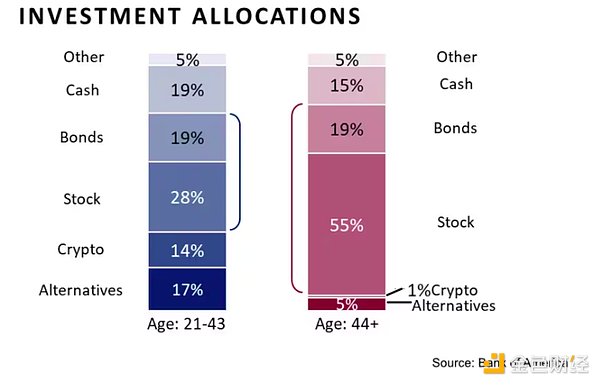

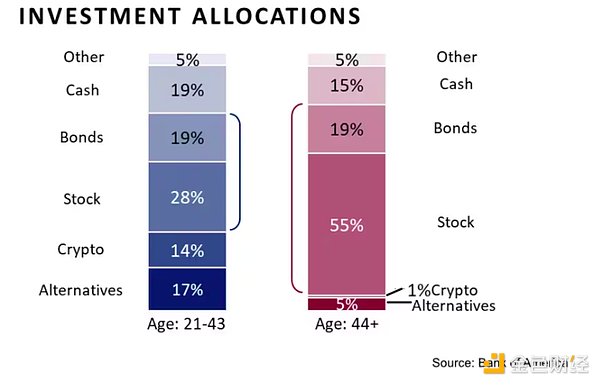

Within each generation, wealth often shifts and redistributes, and Bitcoin could play a key role in this shift. Data shows that young people, driven by their technological savvy, are generally more open to cryptocurrency investments. This generational shift suggests that Bitcoin could be critical to the transfer of wealth from older to younger generations.

Bitcoin represents a new area of wealth accumulation for the younger generation. Young investors might consider allocating funds to Bitcoin instead of chasing increasingly expensive real estate.

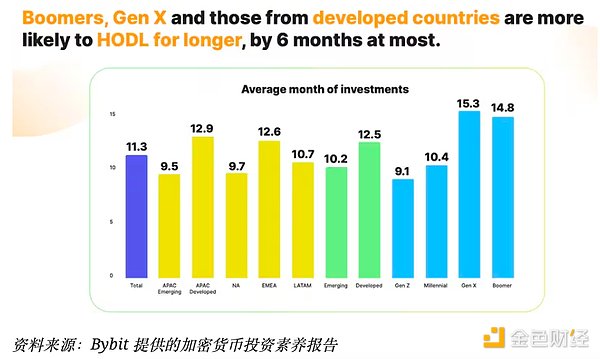

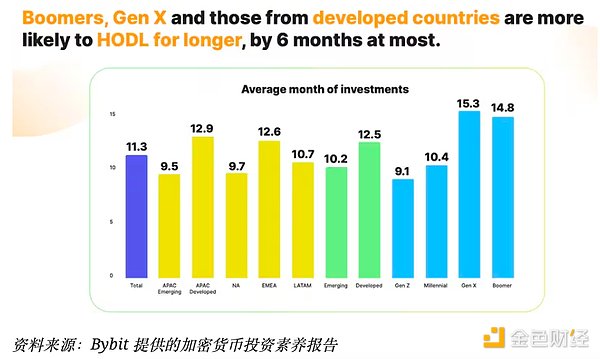

However, it is crucial to approach this investment with a long-term mindset – that is, with a willingness to hold Bitcoin as one would a residential property – rather than engaging in speculative trading. This responsible and prudent approach is key to building lasting wealth in an increasingly challenging financial environment.

Alex

Alex