Although my country has explicitly banned virtual currency transactions and related activities, from the perspective of global encryption, it is undeniable that Chinese people still occupy an important position in the market, but in recent years this position has gradually been invaded by the Western world. It is for this reason that foreign media have always paid attention to my country's policy trends and frequently turned their reporting horizons to my country's encryption industry.

For various reasons, some reports lack facts and are biased, and even seem a bit absurd. There are various subjective imaginations about my country. For example, an article in the Wall Street Journal mentioned that "crypto users in remote provinces in inland China will conduct private encryption transactions through self-service laundromats." The fact is that due to cultural differences, it is difficult to even see self-service laundromats, which are common overseas, in my country, let alone secret connections in stores.

Just recently, well-known overseas crypto media Bitcoin Magazine and Cointelegraph Magazine published articles by Daniel Batten and Yohan Yun respectively. Both reported and investigated my country's crypto industry. In their descriptions, my country has not banned the mining industry, crypto airdrops are developing rapidly in the local area, and VPNs and exchanges are bridges linking underground crypto.

01 The mining industry has not been banned?

In September 2021, my country promulgated the "Notice on the Rectification of Virtual Currency "Mining" Activities by the National Development and Reform Commission and Other Departments", which clearly prohibits the development of virtual currency "mining" under any name, strictly prohibits the investment and construction of new projects, and accelerates the orderly withdrawal of existing projects. After that, a large number of mining companies were cleared out, setting off a wave of Chinese miners going overseas.

At that time, almost all mainstream media, led by the New York Times, reported that China had banned virtual currency mining activities. In April this year, Bloomberg again published an article saying that Chinese mining companies were moving to Southeast Asia. But the reports of the two crypto media this time were quite different. Both put forward similar views, saying that "China has not banned the mining industry."

Bitcoin ESG researcher Daniel Batten believes that the policy only prohibits new mining, rather than legislative prohibition. He also used the policy enforcement power in different regions to illustrate, emphasizing that in underdeveloped areas, policy implementation is not in place and social resources dominate, so new mining activities have begun.

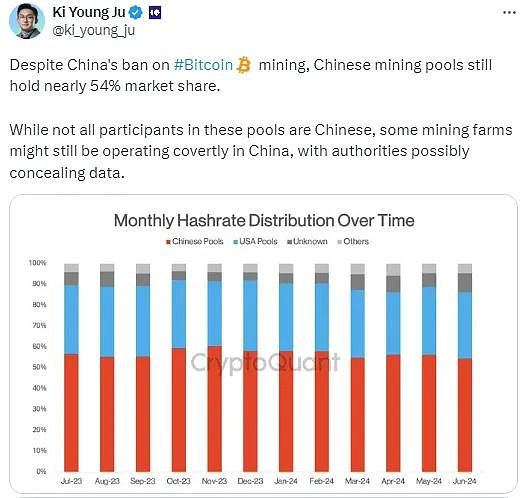

The data seems to support this conclusion. From the data point of view, China still accounts for at least 20% of the global hash rate. And the chart released by Ki Young Ju, founder of CryptoQuant in July showed that Chinese mining pools accounted for 54% of the global hash rate. He pointed out that "although not all participants in these mining pools are Chinese, some mines may still be operating secretly in China, but the data will not be made public."

Danie interviewed four independent mining organizations operating in China, including HashX Mining and three other unnamed institutions. All four mining companies said that they were actively encouraged by the Chinese authorities to help solve the problem of heat recovery and redundant renewable energy monetization, which means that to a certain extent, China is allowing a certain number of crypto miners to resume work. However, considering capital controls, the authorities have only resumed companies with small-scale mining operations and based on renewable energy.

Take the Inner Mongolia mining farm as an example. A mining machine dealer confirmed that "as the economy declines, heavy industry has left Inner Mongolia and Xinjiang, resulting in an oversupply of electricity." The government will encourage mining farms to operate here and promote the development of renewable energy to make profits. Specifically, the Inner Mongolia Bitcoin mining farm usually has only 200-500 mining machines, with a power generation capacity of about 1MW, all using clean energy such as hydropower, wind power or solar power.

The interview also revealed other situations. First, although a large amount of computing power has migrated to other countries (initially the United States and recently Ethiopia), a large amount of new computing power has also flowed into China since the Chinese "ban"; second, China no longer conducts off-grid mining operations. This type of mining is too inefficient and easily detected, which consumes baseload energy and does not meet the carbon neutrality vision proposed by the authorities. The direct impact is that the emission intensity of China's mining industry has been significantly reduced after the "ban"; third, mining mainly relies on hydropower and micro-hydropower. For example, in cities such as Xi'an, Wuhan, Beijing and Xining, the cost of hydropower generation will be very low during the rainy season.

It is worth noting that centralized grid-connected mining is becoming increasingly common, and retail mining still exists. Although the high electricity bills paid by individual miners mean that their profit level is low or even in a loss-making state, their primary purpose is to conduct foreign exchange, by transferring money out of China, exchanging it for ASIC and electricity costs, thereby generating BTC, and finally exchanging it for US dollars.

Daniel mentioned that for economic feasibility reasons, local provincial governments usually support gray areas that the central government does not support. He also emphasized that some provincial governments have issued valid "mining licenses" and mining companies can work with provincial governments in exchange for the right to use their recovered heat energy.

Compared to Daniel's focus on mining, Cointelegraph's report focuses more on the overall industry, mentioning that mainland crypto users have used other methods to bypass the ban, and airdrops have achieved advanced industrialization. The following is part of its report:

02 VPN and exchanges become intermediaries

Lowell, a fresh graduate who is participating in cryptocurrency full-time, broke the news that social media or cryptocurrency exchanges provide P2P trading channels, and users can purchase cryptocurrency in RMB through bank transfers, WeChat Pay or Alipay. OKX and Binance are the two most popular exchanges. As shown in the figure below, Binance provides RMB P2P sales in China. "I can access both apps. I use an iPhone and can download them from Hong Kong or other countries' app stores," Lowell said, adding, "but Apple's mainland app store doesn't have these two apps." Compared with users abroad, app access in China is subject to a more stringent internet environment, with a system known as the "Great Firewall" blocking access to many popular domains such as Google and Facebook. Cointelegraph invited a source in mainland China to test access to cryptocurrency exchanges. The test confirmed that users could not access the Binance and OKX websites without using a VPN, but the mobile apps of these exchanges could be accessed without a VPN. Some projects, such as MakerDAO, prohibit users from using VPNs to access the protocol, mainly to circumvent prosecution by US regulators rather than Chinese regulators.

Zhao Wei, formerly CEO of Beijing-based analytics firm TokenInsight, later moved to Singapore to found the DeFi project BitU. He mentioned that using a VPN is almost second nature for mainland internet users.

"If you want to access Google or YouTube, VPN is essential," Zhao Wei said. The same is true for DeFi platforms, with Joshua Chu, co-chairman of the Hong Kong Web3 Association, mentioning that for platforms, providing P2P access to users is a "gray area" and regulators may crack down on overseas exchanges and their executives.

"Even if these actions are not always prosecuted, they can incur significant legal fees, especially when they enter China, such as the detention of Binance executives in Nigeria," said Joshua.

03 Airdrops are rapidly becoming an industry

Cryptocurrency trading in China is limited to P2P options, but that’s not the only way to acquire tokens.

Lowell has made a tidy profit from airdrops, including $50,000 from Ethena ENA events and $40,000 from StarkNet.

According to at least three local sources, China’s airdrop industry has reached a professional level.

Similar to how Bitcoin mining was once done privately in bedrooms with laptops but eventually grew into a large-scale industry as companies invested in professional equipment, the airdrop industry is investing in advanced technology and equipment to maximize profitability.

Zhao Wei attributes the rise of airdrops to the era of "mobile money making" during the epidemic, especially after the emergence of large-scale applications such as StepN. "When people began to discover that they could make money with their mobile phones, it was natural to think of using hundreds of mobile phones to make money at the same time."

Airdrop parties trade on emerging protocols through automatic robots and record them manually with multiple devices. Of course, the protocol will also be aware that users deploy robots to automatically trade and brush up to obtain airdrops, and will take measures to restrict them.

In the dynamic balance between the two, airdrop parties are taking new methods to bypass interception, and some Chinese airdrop parties will hire students to trade in order to repeat on-chain behavior as much as possible. "My friends make much more money than me in airdrops because they hire a large number of college students to trade for them," Lowell mentioned. "I have about 30 or 40 accounts, but they have 200."

04 Industry risks remain, CBDC is seen as an alternative

But in any case, any crypto business in China always has the risk of sudden closure.

Zhao Wei mentioned: "A very good friend of mine had a similar thing happen before. Just a notice can ban the business."

On the other hand, P2P traders are also at risk due to the lack of trusted intermediaries. They buy cryptocurrencies directly from strangers and usually don't know the source of these assets, which also brings the risk of unknowingly participating in money laundering or being convicted for being related to other illegal activities.

Because of such risks, Lowell said she prefers to deal with acquaintances, even if the options will be very limited. "When I trade with my friends, I know they won't do anything illegal and I won't be arrested. I prefer to sell USDT to people I know, but they don't always need it, so I also use exchanges," Lowell said.

Interestingly, although there are often rumors that my country will liberalize crypto trading, and Galaxy Digital CEO Mike Novogratz commented on this some time ago, the consistency of my country's policies makes this speculation almost impossible. In addition, the emergence of the digital RMB has also made overseas believe that China's cryptocurrency recovery is hopeless. Winston Ma, an adjunct professor of law at New York University, mentioned that "China believes that CBDC is the only legal digital currency, and all other digital currencies, including Bitcoin, cannot be used for payment. This is the decision of the Central Committee, and there is no more authoritative than this."

In response to the current policy relaxation in Hong Kong, Zhao Wei also gave his opinion that although transactions are still continuing, China's demand for cryptocurrencies is currently low, and Chinese citizens are not allowed to invest in virtual asset ETFs that have been opened unless they have temporary or permanent residence permits. "The trading volume is too poor because most people in mainland China or Hong Kong who are willing to buy Bitcoin or other cryptocurrencies have already done so through other channels."

05 Conclusion

Overall, although the two articles are still worth discussing, the summary has been verified and is more detailed than the previous descriptions of mainstream foreign media. Of course, no one knows the local market better than the Chinese, and overseas views are more or less mixed with their own values, but it's just for fun. After all, it's also interesting to understand other people's views on themselves.

JinseFinance

JinseFinance

JinseFinance

JinseFinance Xu Lin

Xu Lin Weiliang

Weiliang Catherine

Catherine Hui Xin

Hui Xin cryptopotato

cryptopotato Beincrypto

Beincrypto decrypt

decrypt Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph