Author: Balaji Srinivasan, former CTO of Coinbase and author of The Network State; Translated by: 0xjs@黄金财经

No election can pay off the US's $175 trillion debt. Only the printing press can.

Because as Musk, Dalio and others realize...The Western world is heading for a sovereign debt crisis worse than 2008. Just as they have been lying about Biden's Alzheimer's, they are also lying about how the economy is doing. So they will print a lot of money.

Look at the data and you can judge for yourself.

1. More emergency loans than in 2008

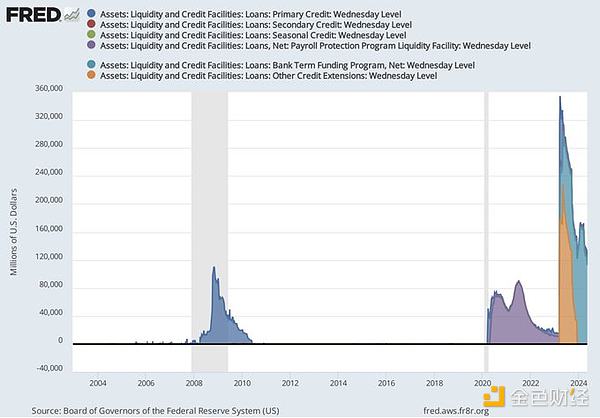

First, did you know that the Federal Reserve has issued more emergency loans in 2023 than during the 2008 financial crisis? The banking system has been kept alive by the US government first selling billions of dollars in bonds to financial institutions and then devaluing them through unexpected interest rate hikes.

Just look at this chart from the Fed. The blue bump on the bottom left is lending during the 2008 crisis. The purple is COVID. The giant orange/teal monster on the right represents the 2023 banking crisis. See how much higher it is than 2008?

2. Borrowing exceeds COVID-19

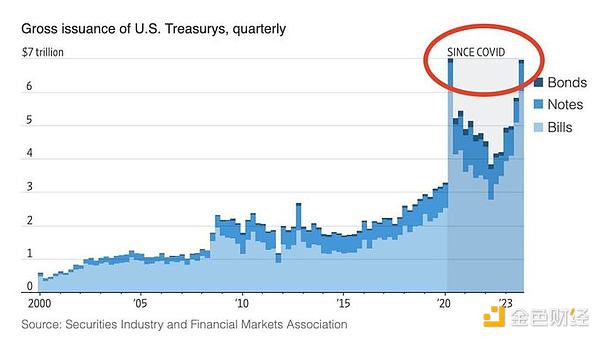

Second, did you know that the United States borrowed more during the Biden boom than during the COVID-19 pandemic? Let’s not discuss whether the COVID-19 pandemic should be considered a financial crisis. At least the borrowing rates during the pandemic were around 0%. But now the US government is borrowing historic amounts of money in peacetime… and at 5% interest! This is the behavior of a desperate person maxing out his credit card bill.

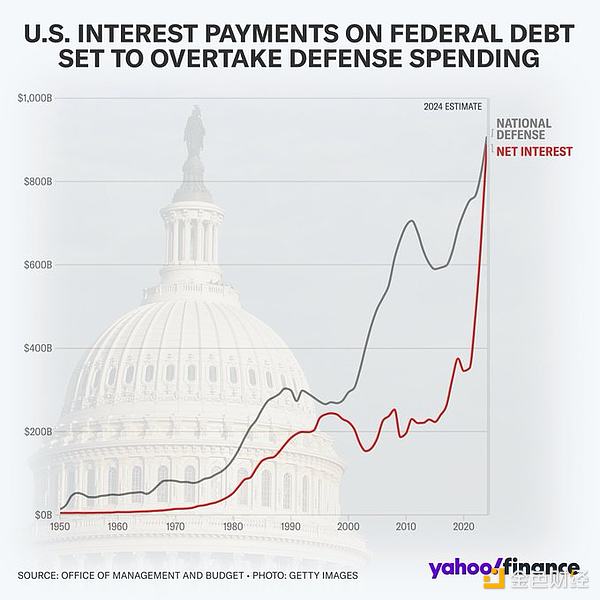

3. Interest payments exceed defense spending

Third, did you know that all this borrowing has made interest payments on the national debt the single largest expenditure of the government? More than defense, social security, or any other expenditure? As of 2024, the first use of all taxes (and printed dollars) is to pay bondholders. Even so, anyone who bought Treasuries (or other bonds) in the past few years is almost gone. For all wars and all welfare, it is buy now and pay later. As you can see from the chart, the time to pay is coming.

4. Further depreciation of the dollar

Fourth, did you know that the dollar has depreciated by at least 25% in just four years? You probably know this from your own experience with inflation. But Larry Summers estimates that the decline in purchasing power is even greater than that, with an average annual figure of 18% if you take into account the sharp increase in loan repayments caused by rising interest rates. That’s well over 25% of the dollar’s value in four years.

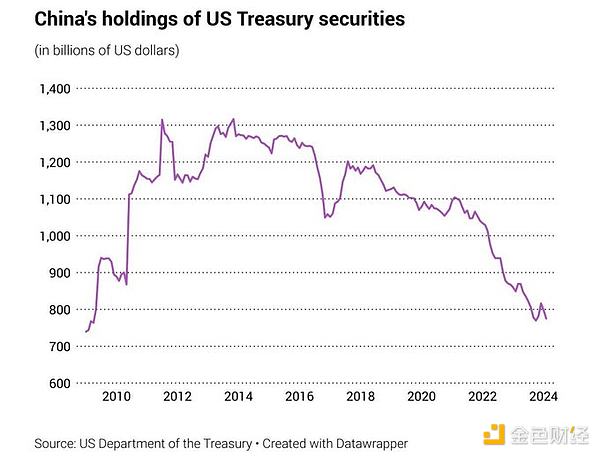

5. China Further Sells Treasuries

Next, did you know that China (the largest foreign buyer of Treasuries) has been selling off Treasuries at an accelerated pace? This is a bit technical, but China is an “outside investor” in the U.S., just like the new venture capitalists who invest in your tech company are outside investors. Even by buying just 5% of your equity (or in this case, debt), they set the price for everyone else. And signal strong external demand from people who don’t have to buy. But now external demand is collapsing:

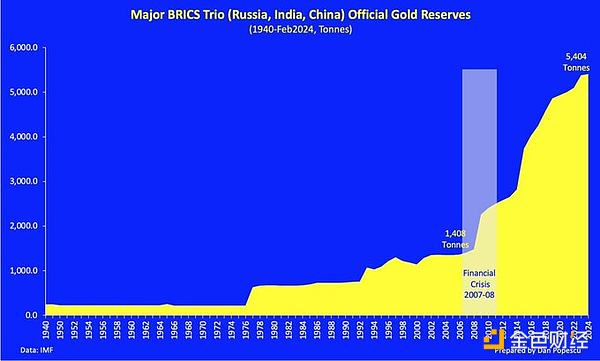

6. BRICS buy more gold

But isn’t the dollar a store of value? What else would other countries buy if not U.S. Treasuries? China is leading most of the countries outside the U.S. These countries have begun hoarding historic amounts of gold, while Western countries have been selling it. Please see:

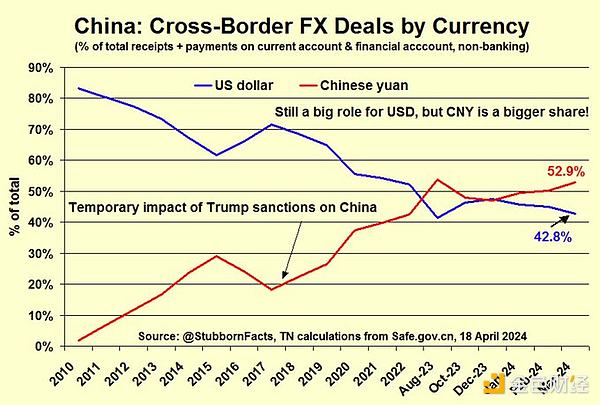

7. More de-dollarized than ever

Okay, so what about the dollar as a medium of exchange? Well, China — which, in case you didn’t know, is currently the number one trading partner for most of the world — has just switched to conducting cross-border foreign exchange transactions in RMB.

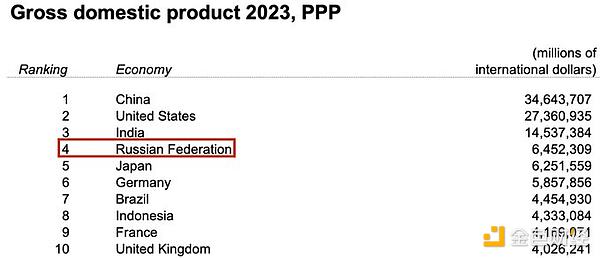

8. Sanctions are less effective than ever

Okay, but can't the dollar continue to be used as a sanction weapon? Don't countries need access to the US financial system? In fact, no. All the sanctions against Russia actually hurt Europe more than Russia. Europe needs Russian oil and gas, but Russia has other customers. So according to the World Bank (not a Russian source!), Russia just surpassed Japan to become the 4th largest global economy by GDP in terms of purchasing power parity.

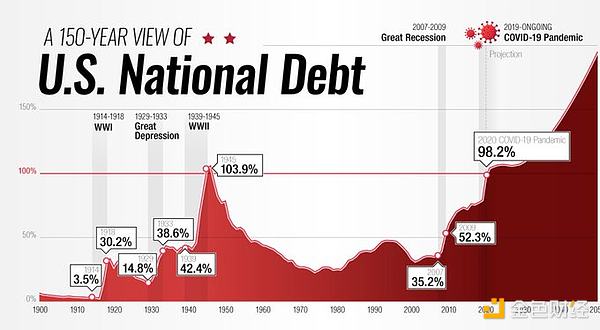

9. Peacetime Debt Approaches WWII

But what about the U.S. military? Can't it eventually go to war to protect the dollar? This is a long topic, but take a look at the chart below. Today, the United States is ostensibly in "peacetime." But its debt is comparable to that of WWII:

Again, this is another topic, but the United States has neither the funds nor the manufacturing base to launch a sustained military campaign against an adversary like China. You can't fight with your factories - especially when you have no money.

10. The real debt is larger than any empire in history

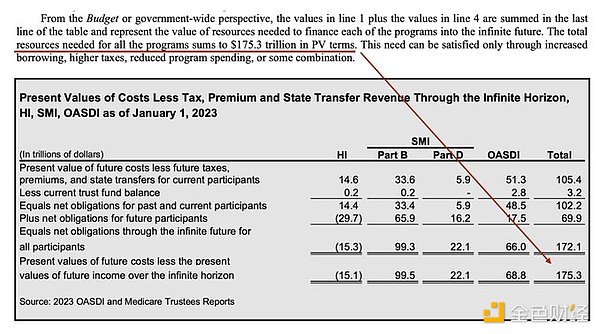

Finally, perhaps the most important number in this entire topic is $175.3 trillion. This is actually the real debt of the United States when you take into account all the benefits such as Social Security and Medicare. And this number itself is increasing rapidly. Don’t take my word for it, take the U.S. government’s February 2024 financial report:

$175.3 trillion is about the same as the $200 billion Druckenmiller has been using. The $175 trillion figure fits the bill Druckenmiller uses to represent the total debt of the U.S. government, factoring everything in. Of course, we are in Monopoly currency territory right now because: a) the entire federal government only took in about $2 trillion last year b) that number itself is affected by deficit spending c) the dollar is down about 25% in real terms since 2020 d) the $177 trillion in assets would plummet in value if liquidated e) ...or if there was a financial crisis, or both, then $175 trillion in debt is unpayable. The U.S. government doesn’t have nearly enough money to pay off what it owes. It has made promises to everyone from allies to retirees that it simply can’t deliver on. Staying in power amid this dereliction of duty is going to be so bad that most people can’t really comprehend.

The Dollar is Becoming Less Important

In short: I haven’t even started yet. I could show you many more charts, and many more videos from investors in bonds, real estate, and tech around the world who see what’s happening.

But if you’re honest, the dollar’s status is rapidly declining. It’s simply no longer the indispensable asset it once was. To summarize:

a) China doesn’t need dollars to trade, they use RMB instead of dollars.

b) The BRICS don’t need dollars to save, they buy gold instead of US bonds.

c) Russia doesn’t need dollars to survive, they are the 4th largest economy shut out of the US economy.

d) Yet the US needs as many countries as possible to accept dollars because it’s borrowing at levels beyond COVID, WWII, and any empire in history.

So, what happens next? I have some ideas, but first we need to agree on what’s going on.

Brian

Brian

Brian

Brian Alex

Alex Brian

Brian Brian

Brian Weiliang

Weiliang Miyuki

Miyuki Alex

Alex Brian

Brian Weiliang

Weiliang Joy

Joy