Author: Prajjval Tripathi; Compiler: Vernacular Blockchain

The Web3 economy is driven by use cases, innovation, hype, and trends. User activity is the basis for biasing weight toward any one of these aspects. Therefore, it is a key metric for assessing the growth potential of a project or an entire industry.

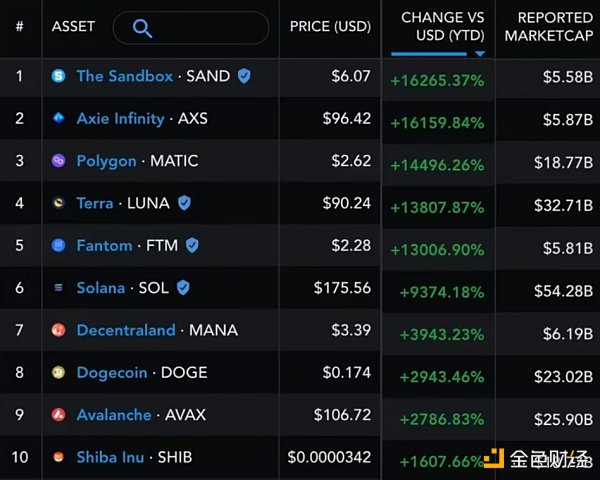

Trends determine price movements in the crypto market, especially in bull markets. We have all witnessed an unprecedented surge in the prices of metaverse and NFT projects in the last bull market. Leading gaming projects such as The Sandbox ($SAND) and Axie Infinity ($AXS) provided investors with returns of more than 16,000% at their peak in 2021.

What’s the point? Being ahead of the trend is one of the best ways to succeed in a bull market. I’m digging the top four trends that could repeat the P2E or metaverse boom in 2024.

Trend 1: Restaking

Science has yet to develop a technology that makes humans omnipresent (unless you’re a mystic disguised as degen). However, Restaking makes your funds omnipresent.

Introduced by EigenLayer, Restaking allows Ethereum holders to increase their returns by using their staked ETH to secure other protocols besides ETH. Ethereum holders have been staking ETH since the project came into being. Ethereum's staking market value has exceeded $223 billion. However, once staked, more than 16 million ETH tokens will be idle, protecting the security of the network.

In addition, EigenLayer allows users to earn points by staking Puffer ETH (Puffer Finance), rswETH (Swell Network), and ezETH (Renzo Protocol).

Restaking creates a win-win opportunity for holders and both parties of the protocol, unlocking additional wealth generation opportunities. This basically means that billions of dollars worth of ETH have entered active circulation. As more new projects go the EigenLayer route, restaking has the potential to become one of the top trends dominating the 2024 bull run.

Trend 2: Layer 3

The blockchain trilemma has been a huge challenge since the birth of the blockchain industry. The emergence of Layer 2 chains, such as Arbitrum, Polygon, and Avalanche, aims to improve scalability. Obviously, there is a lot of adoption of Layer 2 because they improve scalability and increase overall efficiency. The increased adoption of Layer 2 projects is reflected in the price increases of tokens such as MATIC (Polygon) during the last bull run.

Layer3 solutions aim to take scalability to the next level by introducing customization and interoperability in order to facilitate the deployment of dApps. As blockchain approaches mainstream adoption, the architecture must be flexibly designed to be future-ready. This is where L2 solutions step in.

Emerging decentralized exchanges (DEX) such as Syndr are developing their own L3 chains to facilitate institutional-grade derivatives trading with a Web2-like user experience, with the ultimate goal of accelerating adoption. It is only a matter of time before the L3 chain sees a similar rise in adoption and hype as L2.

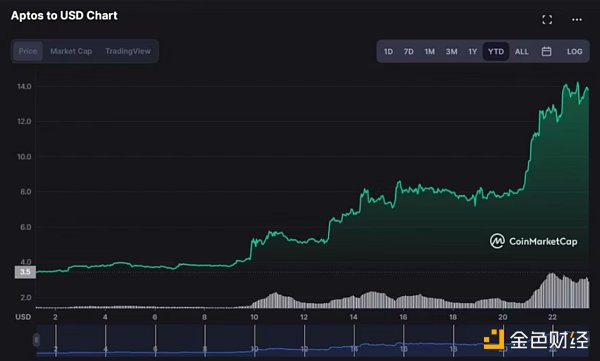

Trend 3: AI

In 2022, a small bull run led by artificial intelligence projects began, and this trend continued in the first half of 2023. Aptos, one of the top artificial intelligence projects in the crypto space, rose nearly 300% last year. This was when the crypto market cap was barely around $1 trillion.

2024 is expected to be one of the biggest bull markets (not speculation, just sentiment analysis), and AI projects may lead this year's parabolic rise.

Trend 4: DePin

DePin (short for Decentralized physical infrastructure network) is an innovative concept that aims to incentivize participation or contribution of resources to support blockchain networks. DePin allows innovators to launch projects and provide services by encouraging contributors to run peer-to-peer (P2P) hardware infrastructure networks.

Just like SocialFi rewards users for sharing their data, DePin rewards users for sharing unutilized hardware to support the network. Some of the top DePin projects include Render Network, Filecoin, and Theta Network.

Note: These are just trends extrapolated based on current sentiment based on crypto-led social media channels, hype, total locked value (TVL), user adoption, and market conditions.

Huang Bo

Huang Bo

Huang Bo

Huang Bo JinseFinance

JinseFinance Alex

Alex Olive

Olive Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph Bitcoinist

Bitcoinist