Article author: Franklin Templeton

Article translation: Block unicorn

Fungible tokens play an important role as economic pillars in any decentralized network. The fungible nature of an asset refers to the ability of an asset to be interchangeable with another unit of the same type. For example, fiat currencies are interchangeable, which means that one can exchange a dollar bill for another dollar bill of the same denomination. Blockchains and applications built on them utilize fungible tokens/cryptocurrencies for a variety of purposes, including facilitating trade, securing networks, and decentralizing networks/applications. For blockchains, they use their own native tokens, such as Bitcoin uses BTC and Ethereum uses ETH. For applications, each blockchain has multiple fungible token standards. Common fungible token standards include ERC-20 on Ethereum and SPL on Solana. These types of tokens are used for a variety of use cases, including meme coins and governance tokens. MakerDAO, a DeFi lending platform on Ethereum, is a good example of a protocol that supports the ERC-20 standard. MakerDAO uses its native fungible governance token MKR to manage the issuance of MakerDA0 and DAl stablecoins (another ERC-20 token). In contrast to fungible tokens, non-fungible tokens (NFTs) represent units of data stored on the blockchain and represent unique digital items, such as artworks. NFTs initially became popular on Ethereum using the NFT standard of ERC-721. However, on Bitcoin, there was no widely adopted NFT standard for many years until Bitcoin developer Casey Rodamor introduced ordinal theory. The ordinal contains the original data recorded on the blockchain, and each satoshi (ordinal) is assigned a unique identifier. This is different from NFTs on other blockchains (such as Ethereum, Solana, etc.), which usually keep part of the off-chain data in centralized servers.

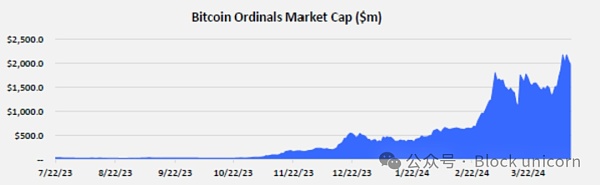

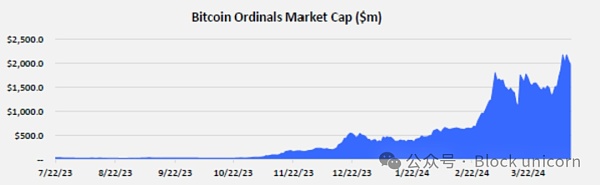

After Casey published the ordinal theory in December 2022, the value of the Bitcoin inscription market has grown significantly to approximately $2 billion as of April 2024.

This growth has prompted many developers to rethink the potential of the Bitcoin blockchain. Among the many developments taking place, perhaps the most important is Casey's Runes, a highly anticipated fungible token standard designed to coincide with the Bitcoin halving (expected to be April 20, 2024).

Runes introduces a new token standard on Bitcoin Layer 1 that improves on Bitcoin's current homogeneous token standard (BRC-20). Runes are designed to be more efficient by utilizing a UTXO-based design (unspent transaction output). UTXO represents a specific amount of Bitcoin that a user has received but not spent. ” The main difference between BRC-20 and Runes is that BRC-20 is designed to leverage existing protocols to meet the need for fungible tokens on Bitcoin, while Runes was designed from the ground up specifically for fungible tokens on Bitcoin.

Unlike Runes, BRC-20 is able to create fungible tokens on Bitcoin, but its design is account-based, similar to Ethereum’s ERC-20. The problem with BRC-20 is that through the destruction and minting process of fungible tokens, a large number of useless UTXOs are generated, which leads to blockchain bloat and increased fees. This is like the concept of a processing plant that generates a lot of useless waste or garbage during operation.

The Runes fungible token protocol has several key improvements:

Avoids the creation of “junk” UTXOs, thereby reducing blockchain bloat and lowering transaction fees

No reliance on off-chain data

No additional native token required

Lightning Network compatible

Improved privacy, data is hidden in UTXO

Opportunities:

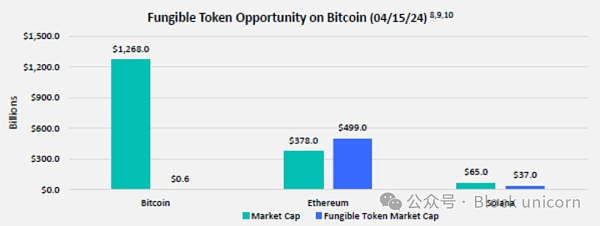

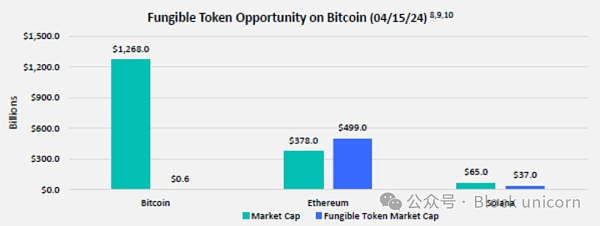

Currently, the market for Bitcoin’s fungible tokens is quite small compared to ETH and SOL; however, with the introduction of a more efficient token standard (Runes), Bitcoin is well-positioned to close the market cap gap for fungible tokens with other blockchains. However, if DeFi on Bitcoin is to see the exponential growth that many in the industry predict, a widely adopted fungible token standard is a prerequisite.

Runes’ homogenous token protocol is expected to launch simultaneously with the halving that will occur on April 20, 2024. We are looking forward to seeing whether Runes can bring to Bitcoin’s homogenous token and DeFi markets what Ordinals did for Bitcoin’s non-homogeneous token market.

JinseFinance

JinseFinance