Author: Interstellar Business School

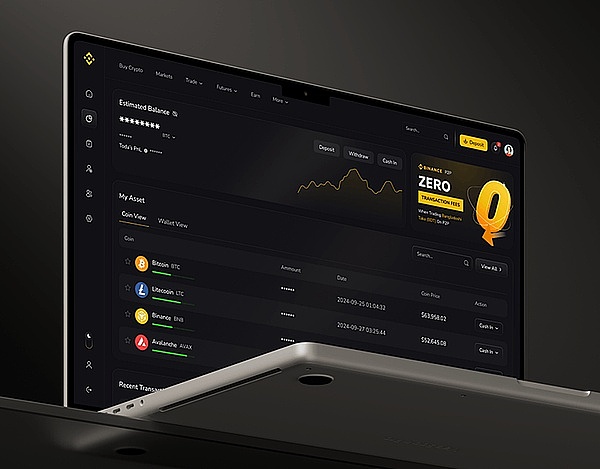

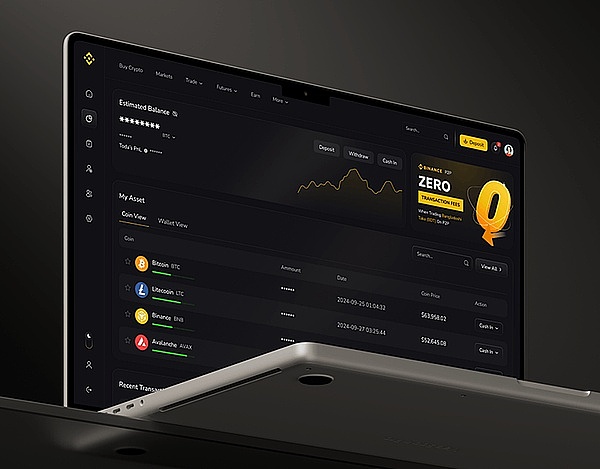

On March 18, 2025, Binance launched Alpha 2.0, an update that directly integrates decentralized trading (DEX) functions into its centralized exchange (CEX) platform and optimizes the on-chain trading experience through Binance Wallet and Binance Pay. From an industry perspective, this is not only a technical upgrade of Binance's ecosystem, but also a positive response to the trend of CEX and DEX integration in the crypto trading market. However, is this move an inevitable development of the industry, or is it a strategy for Binance to consolidate its market position?

Trends and Challenges of CEX and DEX Integration

Since the birth of the cryptocurrency industry, CEX and DEX have always been in a delicate relationship of both competition and complementarity. CEX dominates with high liquidity, convenience and user-friendliness, while DEX attracts users who value privacy and autonomy with decentralization, transparency and user asset control. However, with the rise of DeFi (decentralized finance) and the maturity of blockchain technology, the industry's demand for the integration of the two has become increasingly prominent. The launch of Alpha 2.0 is a microcosm of this trend.

From a technical perspective, Alpha 2.0 relies on the low cost and high throughput advantages of Binance Smart Chain (BSC) to embed DEX's on-chain trading capabilities into the CEX interface, so that users can complete the conversion from fund accounts to on-chain assets without leaving the Binance ecosystem. This model is not the first of its kind in Binance - Uniswap Labs has tried to improve user experience through front-end optimization, and Coinbase is also exploring similar functions in its wallet. But Binance has taken this integration to a new level with its status as the world's largest CEX and the ecological foundation of BSC.

However, this trend also brings challenges at the industry level. First, the integration of CEX and DEX may blur the regulatory boundaries. Against the backdrop of stricter global regulation, the US SEC and the EU MiCA framework have increasingly stringent compliance requirements for crypto exchanges, and Alpha 2.0's hybrid model may face dual pressures from KYC (know your customer) and AML (anti-money laundering) policies. Secondly, concerns about centralization in the industry have never subsided. BSC's node concentration (still 41 as of 2025) is much lower than Ethereum's decentralized network, which may put a question mark on Alpha 2.0's "decentralized" label. In the long run, whether this integration will truly promote the decentralization of the industry or further strengthen the control of the top players still needs time to test.

Reshaping and Risks of the Competitive Landscape

The launch of Alpha 2.0 has had a significant impact on the competitive landscape of the crypto trading market. As the CEX with the largest trading volume, Binance has not only seized the potential user base of decentralized trading by integrating DEX functions, but may also weaken the market share of independent DEXs. Data shows that in 2024, the average daily trading volume of PancakeSwap and Uniswap accounted for 30% and 25% of the DEX market respectively, and Alpha 2.0's low fees (six months of free Swap and Bridge fees, only network gas fees) and seamless experience may attract some users to turn to the Binance ecosystem.

From the perspective of market competition, this is a typical "ecological lock-in" strategy. Through Alpha 2.0, Binance concentrates user funds, transactions, and asset management on its own platform, reducing the possibility of users flowing to competitors (such as Coinbase, Kraken or Uniswap). Especially for early projects in the BSC ecosystem, Alpha 2.0 provides a low-cost, high-exposure listing channel, which may further consolidate Binance's leadership in the token distribution market. However, this centralization may also trigger backlash. Some users on the X platform have pointed out that Alpha 2.0 "essentially monopolizes DEX and wallet order flow", which may increase the market's vigilance against Binance's hegemony.

In addition, the market impact of Alpha 2.0 also needs to consider external variables. In early 2025, the global crypto market showed a growth trend driven by institutional adoption and loose regulation (such as the support of the Trump administration in the United States for crypto), and the price of Bitcoin has exceeded $100,000. Alpha 2.0's low-cost transactions and early project screening functions may amplify its appeal in this bull market. However, if the market turns to a bear market, users' interest in high-risk early assets may decline, and the actual effect of Alpha 2.0 will be tested. The response of competitors will also be crucial-if Coinbase or Uniswap launches similar features, the market may usher in a new round of technological arms race.

Sponsored Business Content

Convenience Improvement and Trade-offs

For ordinary users, the greatest value of Alpha 2.0 is that it lowers the threshold for participating in on-chain transactions. Traditional DEX transactions require configuring wallets, paying gas fees, and dealing with complex interfaces, while Alpha 2.0 simplifies this process through Binance Pay and the "Alpha" tab. Users only need to operate in the familiar CEX interface to enjoy BSC's fast transactions and low fees (the average gas fee per transaction is about US$0.01, much lower than Ethereum's US$5-10). In addition, the functions introduced by Binance, such as currency address audit and social media heat screening, provide users with a relatively reliable window for early project investment, avoiding the risk of blindly chasing meme coins.

However, this convenience is not without cost. First, the security of user assets depends on Binance's custody mechanism, rather than being completely in their own hands. This is contrary to the principle of DEX "your key, your asset", which may make senior crypto users feel uneasy. Although Binance emphasizes its multi-signature and audit measures, the FTX crash in 2022 still reminds the market that CEX's security promise is not absolutely reliable. Secondly, although the screening mechanism of Alpha 2.0 reduces the cost of "minesweeping", it may also limit the user's freedom of choice. Which projects can enter the Alpha list is largely determined by Binance, which may lead to information asymmetry in the market and even breed suspicion of insider trading.

From the perspective of user behavior, Alpha 2.0 may further divide the market. New users may flock to it because of its simplicity, while experienced users who are accustomed to self-management may continue to favor independent DEX. This division has been reflected in the X community: some users call it "Coinbase's thigh-slapping thing", believing that it has realized the vision of "allowing 1 billion people to access crypto assets"; others are worried that this is "CEX expansion in the guise of DEX". User acceptance will depend on how Binance balances convenience and transparency.

Potential Impact and Future Outlook

In general, the launch of Alpha 2.0 has duality in terms of industry, market and user levels. From an industry perspective, it promotes the integration trend of CEX and DEX, but also exposes the contradiction between decentralization and efficiency; from a market perspective, it strengthens Binance's competitive advantage, but may trigger regulatory and antitrust pressure; from a user perspective, it improves participation and convenience, but sacrifices some autonomy.

In the short term, Alpha 2.0 may succeed due to the current bull market and the vitality of the BSC ecosystem. The 2024 BNB Chain report shows that BSC has reached 1.12 million daily active users and the number of unique addresses exceeds 486 million. Alpha 2.0 is expected to further activate this user base. However, the medium- and long-term impact depends on several key factors: first, regulatory attitude. If global compliance requirements for CEX intensify, Alpha 2.0's hybrid model may need to be significantly adjusted; second, technological competition. If other platforms launch more decentralized or lower-cost solutions, Binance's first-mover advantage may be weakened; third, user trust. If there are security incidents or screening disputes, Alpha 2.0's reputation will be damaged.

In the future, Alpha 2.0 may become a watershed in the crypto industry. If successful, it will prove the feasibility of CEX and DEX integration and encourage more exchanges to follow suit; if it fails, it may become a lesson for Binance's overexpansion. Regardless of the outcome, this attempt reflects the core proposition of the crypto market in 2025: how to find a balance between efficiency, decentralization and compliance.

In short, Binance Alpha 2.0 is not a simple functional update, but a microcosm of the evolution of the crypto industry. It is not only a product of technological progress, but also a strategy for market competition, and a response to user needs. However, its success or failure depends not only on Binance's execution, but also on industry trends, market dynamics and user choices. In 2025, when cryptocurrencies are developing rapidly, Alpha 2.0 may only be a starting point, but it undoubtedly provides the industry with a sample worth observing - where the road to integration leads, time will give the answer.

Weiliang

Weiliang