The recent Polkadot (hereinafter referred to as "Polka") has a lot of stories.

First, the Polkadot treasury operation report for the first half of 2024 on June 29 caused an uproar. The half-year expenditure was as high as 87 million U.S. dollars, and the marketing spent 37 million U.S. dollars. The KOL platform, which pays 300,000 US dollars per month, is obviously watered down. Users jokingly said that it "spends money faster than hackers steal money." Later, the Asian project team madly exposed the scandal, saying that the spiritual leader has a false name and internal politics are full of tricks. For a time, voices criticizing Polkadot were heard endlessly. There are already clues to the facts. As early as a year ago, Polkadot was rumored to have laid off a large number of employees due to poor cost management, which once led to news that developers ran away with their buckets one after another.

However, if the timeline is pulled back to 5 years ago, Polkadot at that time was still a cross-chain star known as the "Ethereum Killer". Developers call it a king-level project with advanced technology, and it is also a "doing" team that is highly praised by the community.

In just a few years, Polkadot has gone from being the envy of everyone to relying on scandal marketing. Polkadot has played a good hand to pieces, which can't help but make people sigh.

When it comes to Polkadot, it is difficult to avoid two key words, one is the founder with an outstanding reputation, and the other is the technologically forward-looking cross-chain star.

Gavin Wood is one of the founders of Polkadot, and before that, he was the first CTO of Ethereum. In many introductions, Buterin proposed However, the designer of the technical architecture, the first founder of the client, and the inventor of Solidity, a high-level language for smart contract development and design, all pointed to Gavin Wood. It is worth emphasizing that the now widely circulated Web 3.0 also benefited from the conceptual clarification given by Gavin Wood in his speech in 2014. The title of technical genius is not an exaggeration at all.

After leaving the Ethereum Foundation in January 2016, Gavin Wood and Jutta Steiner founded the development team Parity Technology and the funding and operation foundation Web3 Foundation. The foundation’s first project at that time was Polkadot.

The original intention of the project is actually quite simple. Gavin Wood bluntly said, "The original design logic did not associate interoperability. We are waiting for the sharding of Ethereum. The technology was launched. But sharding has never been implemented and has not been launched yet. Therefore, I want to make a more scalable Ethereum and push the sharding concept to a relatively extreme level during the design process, so I simply don’t want to shard. Just design independent chains, and different chains can transfer information to each other. The final result is to achieve communication through a shared consensus level. ”

Let’s briefly introduce the background at that time. At that time, Ethereum was prospering due to the rapid development of smart contracts. However, the redundancy brought by Ethereum’s own architecture was doomed to bottlenecks in efficiency and scalability. Let’s compare with a piece of data. Buterin once calculated that the cost of performing calculations or storing data on Ethereum is one million times higher than completing the same calculations or storing the same data on a commercial cloud platform. Among the many technical solutions, in addition to the governance perspective of representative system, layering and sharding are the two most feasible paths. Among them, layering has two types of technologies: state channel and side chain, and sharding takes Rollup as the mainstream direction. , Ethereum was moving towards ETH2.0 at the time and was in the beacon chain construction stage of the Serenity Phase.

In this regard, Polkadot made a choice, proposed a forward-looking technical concept, and built a heterogeneous multi-chain network that uses a layered architecture to separate consensus and calculation. Its main structure consists of three parts, the relay chain, the parallel chain and the transfer bridge. The relay chain is the core of the network, also called the main network, and is a consensus ledger built with blockchain technology. Parachains are isomorphic independent blockchains based on them, while transfer bridges are a special blockchain that allow Polkadot to connect and communicate with external networks such as Ethereum.

I won’t go into too much technical content, but the problems Polkadot is trying to solve can include the following points, namely cross-chain, shard expansion, and multi-chain architecture. , abstract, etc. It can be seen that this is actually something that Ethereum has only begun to focus on in the past two years, but it is an idea that Polkadot began in 2016.

The vision is very ambitious, and the project implementation also faces greater challenges. In October 2016, the first draft of Polkadot’s white paper was officially released. Since then, Polkadot has been at a standstill, and the mainnet has been repeatedly delayed. During this period, 300,000 ETH was locked due to a bug in the first private placement. It was not until 2019 that Polkadot began to make rapid progress. In June, Substrate was released, which is an important development component of the parachain. In August, Polkadot test network Kusama was released, laying an important foundation for subsequent development.

Technology is attractive to people, but it cannot attract the enthusiasm of users, and it is also a rootless tree. A closer look at the important reason for the rise of Polkadot lies in telling the Chinese story well.

In 2019, with the development of technology paths, Polkadot also carried out large-scale publicity, learned from the experience of EOS, and aimed at The group is the Chinese people who are famous for their large size. In the first half of the year, the Polkadot China Tour began. The team held frequent sharing sessions in Hong Kong, Hangzhou, Shanghai, Beijing and Chengdu. All core members were present and the scale of the activities was quite large. The background of the founder also helped the development of the project. He is semi-resident in Shanghai and has a Chinese name of "Lin Jiawen", which has attracted many local capitals in Shanghai. Technical experts + large-scale marketing + blue ocean market, all of which have caused Chinese people to quickly pour into the Polkadot ecosystem.

20 years of data show that Chinese developers are particularly active in the Polkadot community. Among the 200 projects donated by the Web3 Foundation, nearly 20% are recipients from China. Relying on Chinese developers, Polkadot's monthly active developers increased by 44% in May 2020, a growth rate that far exceeded that of Bitcoin and Ethereum. For this, PolkaWorld, the Chinese community of Polkadot, also played an important role. Daily reports, weekly live broadcasts, and frequent community reports and activities also became a booster. Foreign mediaDecrypteven reported at the time that Polkadot was supported by Chinese capitalists. “In China, everyone generally believes that Polkadot is similar to a newer and better EOS.”< /strong>

With the support of Chinese people’s traffic and funds, coupled with the benefits of token split, Polkadot has lived up to expectations. By the end of 2020, Polkadot’s governance representative The currency DOT has increased by more than 45% in one year, with a market value of US$4.7 billion, once surpassing Chainlink to become the fifth largest cryptocurrency.

The next development climax comes with the card slot auction. For the project side, if you want to access the relay chain and become a parallel chain of Polkadot, you need to obtain a card slot through which you can connect to the relay chain. However, the number of slots is limited. Polkadot officials expect that at the same time The upper limit of the number of running slots is about 100, so screening is required. In the end, the official decision was made to complete the bidding of pledged DOT on Kusama in the form of a candle auction. The core of the proposal is that the project party pledges DOT to ensure the security of the main network through a large number of lock-ups. The problem is also obvious, sacrificing user liquidity.

But in order to ensure more chips, the project party needs to accumulate more chips. Users can also participate through staking. If the circulation is greatly reduced in a short period of time, DOT will definitely It will also rise accordingly. In November 2021, Polkadot’s first parallel chain slot auction concluded. The winners were Acala, Moonbeam, Astar, Parallel, and Clover. Among them, Acala gathered more than 80,000 members to invest and accumulated more than 3.2 million DOT support. In that month, DOT also reached a record high, rising to $54.98. Polkadot was once again successfully dubbed the Ethereum killer. To date, Kusama has completed 128 slot auctions.

But with the advent of the bear market, Polkadot's fate also took a sharp turn.

After the candle auction, the price of DOT fell rapidly, which made investors doubt the intrinsic value of DOT, and due to the 2-year lock-in period, active The number of users also started to decline.

On the other hand, Polkadot emphasizes technology over experience, its technical architecture is more complex, and its ecological development has gradually begun to lag behind. Compared with its competitor Cosmos and other new public chains, Polkadot has not caught up with the Defi express due to the problem of staking matryoshka. In 2023, the daily transactions of the Polkadot network will only be around 10,000. Even under the wave of inscriptions at the end of the year, daily activity There are only 7-8 thousand users, while the daily active users of Cosmos are around 20K, and the gap is obvious. However, given the large number of infrastructure projects in its ecosystem, Polkadot has become a gathering place for developers.

In 2021, Polkadot will have the second largest developer community after Ethereum, with a total of 1,400 developers at the end of the year, and even in At the end of 2023 after the turmoil, the total number of developers also reached 2,100, firmly at the forefront. Some people have questioned this, saying that Polkadot is completely a developer ghost chain, but it seriously lacks an application ecosystem.

In terms of technology alone, Polkadot has made considerable progress in recent years, such as the successive launch of XCM V3, system parachains, asynchronous support and parallel threads. etc., but in fact, even for developers, Polkadot is not friendly, especially for Asian developers.

Manta, the project that once won the card slot auction, was once the project with the largest TVL and market capitalization/fully diluted market capitalization (non-DOT), but it left Polkadot last year , founder Victor Ji posted on the X platform that he was disappointed with the Polkadot ecosystem and team and was no longer willing to contact it. He also emphasized that thePolkadot ecosystem is highly toxic, has no real value to Web3, and does not focus on users or adoption rates. He also proposed that the Polkadot team funds European/American projects far more than Asian projects, not only There is discrimination and the entire ecosystem is stagnant.

This is not an isolated case. Under the crisis caused by the national treasury, many Asian projects have criticized Polkadot. Harold, the founder of the Din project who was originally the Polkadot ecological data analysis platform Web3 Go, said that as an Asian-led project, it is quite difficult to build in the Polkadot ecosystem and needs to face and solve many additional problems, such as politics, Relationships, small circles.

This situation has actually been known for a long time. Most people have previously revealed that Polkadot has a single-minded behavior surrounding Gavin, and all major paths are decided by him. Perhaps because of this, in October 2022, Gavin announced that he would step down as CEO of Parity and become chief architect. However, there is no doubt that he is still the absolute spiritual leader of the Polkadot project. However, the inaction of the spiritual leader has obviously hindered the development of Polkadot. Internal employees once broke the news, “He does not clarify his priorities and does not help promote Polkadot.”

Another typical example is OpenGov governance. This governance method was completely proposed by Gavin adhering to the concept of decentralization. It removed the meritocratic decision-making model of the previous technical committee and council and was replaced by A wider range of DOT holders decide on treasury development through referendums.

But it is obvious that the firm implementation of completely decentralized governance when the community is not yet mature has also caused chaos and controversy. In September last year, PolkaWorld, the largest unofficial Polkadot Chinese community, announced that it would cease operations after its proposal to apply for official funding was rejected. In its response, PolkaWorld blamed OpenGov for the problem, saying it maintained currency prices and DOT holders tended to reject funding proposals. At that time, Brushfam founder Markian Ivanichok also expressed his disappointment with the Polkadot governance system on X, saying that it was becoming increasingly difficult to raise funds for proposals, and finally the team left the Polkadot ecosystem.

But in this regard, the person in charge of the allocation expressed sarcasm, "In the past two years, Polka has allocated US$694,000 to PolkaWorld, and only after the allocation was stopped ”

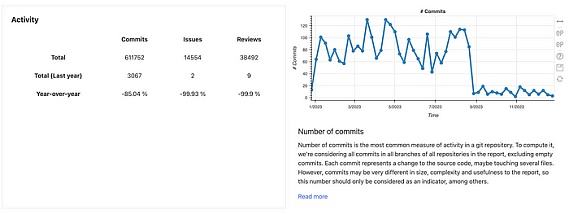

In any case, it can be seen from the above description that in 2023, Polkadot will usher in a wave of team exodus. According to statistics from Electric Capital, most projects experienced a sharp decline in the number of developers in Q4 of 2023. Back to the team itself, Polkadot also experienced turmoil in 2023. In October, Parity announced 30% of its layoffs, which caused Polkadot's code development progress to plummet from September.

But ironically, according to employees, it was Parity's hiring spree that led to its financial woes. Executive compensation was sky-high, often receiving more than $1 million, and even in a bear market, the company spent money like a bull market. No scruples.

If there was no real feeling at the time, then this matter has been completely fulfilled this year. In the treasury financial report on June 29, in just the first half of the year, Polkadot spent US$87 million, which can be described as burning money. Among them, marketing expenses actually reached US$37 million, which is also jaw-dropping. .

A closer look at the whereabouts of the 37 million is even more ridiculous. Judging from the data released by Polkadot, KOL spending is the absolute majority of Polkadot’s marketing, accounting for more than half of the overall budget. In the first half of the year, Polkadot carried out 4 promotion activities for North America and 3 activities for Europe. The number of KOLs in North America was about 40, and that in Europe was about 15. From a budget perspective, the average number of KOLs per promotion activity The budgets are all under $300,000.

However, citing a survey by Rhythm, the number of KOLs fishing in troubled waters is staggering. Some accounts The amount of water injected can be imagined, and there are even fans with robot accounts. As for the investment field, Polkadot’s choice is also very confusing. It even put some general investment and gaming YouTube UP owners, and successfully gained only a few hundred views. The official called it “precisely positioned” High Net Worth Audience”.

Not only does it not care about invalid placement, but media placement and display also demonstrate Polkadot’s quirks. It is listed on the two major crypto price websites Coingecko and Coinmarketcap has spent money to purchase exclusive dynamic logo display services. Coingecko’s exclusive logo dynamic display for half a year costs US$50,000, and Coinmarketcap’s two-year logo dynamic display plus management fees is nearly US$480,000. People can't help but wonder, "Can the cool dynamic logo make DOT move?"

Puzzling also includes PC hardware website placement, European private jet logo printing, and sports sponsorship. Events can easily cost tens of thousands or even millions of dollars. It can already be seen that Polkadot has a cognitive bias towards its own positioning and core group. It is bent on moving closer to Europe and the West, and ignores the Chinese people who had previously placed high hopes on it.

What’s more worth emphasizing is that despite spending so much marketing, people in the industry don’t even feel it. To a little splash. If it is not corruption in the treasury, it can only prove the extreme gap in efficiency on the governance side. However, just a few months ago, Polkadot community members were still saying, “For community participants, the greatest value of Polkadot lies in the treasury. ”

Currently, the total value of the remaining reserves in Polkadot’s treasury is US$245 million, equivalent to 38.2 million DOTs, and from the perspective of income It seems that Polkadot’s network fee income during regular time is only 20,000 DOT per quarter. Regarding the treasury expenditure, Fabian Gompf, CEO of Polkadot development organization Web3 Foundation, refuted the rumors, saying, "This is not an expenditure of the Web3 Foundation, but an expenditure of the treasury on the chain, which is determined by community voting. Even if the foundation does not sell any DOT, it has more than 5 years of operating capital", but it also affirmed that "in the past few months, the on-chain vault has spent too much money on activities that may have lower returns."

Overview of Polkadot On the road to development, it did many things right and made many wrong choices. In terms of ecological development, Polkadot is moving too slowly. After 7 years of development, Polkadot has not even fully developed the mature mainnet system. Even easy-to-use wallets are hard to find, and the cross-chain should have existed 2 years ago. Snowbridge has only started to be put on the agenda this year, and Hyperbridge, another highly demanded hybrid bridge, is not even in this year's plan. On the governance side, Polkadot went too fast and launched a centralized governance framework too early, allowing immature communities to control voting, which made incubation venture capital faces challenges. Others, which are more controversial, include serious centralization, frequent changes in plans, discrimination against Asian teams, and contempt for user experience, not to mention.

Fortunately, the Polkadot team is already making changes. For example, in response to the lack of liquidity and increased development costs caused by card slot auctions, Gavin also mentioned canceling the card slot auction in November last year and shifting the focus to the application side. This year Polkadot also launched the JAM chain accordingly and tried Use Agile Coretime to change the auction model of parachains by purchasing usage time.

I have to deny that Polkadot’s vision is very grand. Even now, we can still feel the difficulty of multi-chain ecology and the market proposed at inappropriate nodes. Does requirement imply error? This question is thought-provoking.

But as projects leave Ethereum and revenue generation is weak, and Polkadot has missed countless hot spots, time may really be running out.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Bernice

Bernice JinseFinance

JinseFinance Joy

Joy Weiliang

Weiliang Olive

Olive