Visa and Mastercard: A Game-Changer for Wallet Holders, But a Threat to Crypto Exchanges?

Visa and Mastercard's crypto partnership: Simplifying conversions, challenging exchanges. Crypto's future: integration with traditional finance.

Huang Bo

Huang Bo

I met Linlin @SunLilin on the X social platform. We were all obsessed with the exploration of Crypto Payment and saw the huge potential impact that Blockchain/Crypto could bring to the world, just like the rising sun in front of me, slowly lighting up the vast Serengeti grassland.

Lilin shared this article he wrote on April 9, 2023 with me, and reproduced it here with permission.

In the brief exchange with Lilin and between the lines of the article, you can see his profoundness and erudition. Lilin said that this was just repeating what others have said, and I said I would continue the relay, "There is always someone who lights up the road ahead at a certain stage. Our best choice is to follow the footsteps of many predecessors, walk at a high level, and prudently practice the power of ideas."

Blockchain technology provides a new perspective to re-examine and process the entire composition of transactions (payment-clearing-settlement). We will no longer be bound by the traditional banking/payment system. The consciousness should change and think in a more fundamental way: What is Crypto Payment? How to build global payment and credit in payment through Blockchain? In the face of a global payment system, what kind of organizational form should be used for governance?

This article seems to be a dialogue between Lilin and Dee Hock in the intersection of time and space, pointing out the direction for those doubts and bringing the power of faith to these directions.

Enjoy the following:

From the beginning of "mixed order" to "VISA" in the Web3.0 generation

At the end of 2017, because I had previously participated in the blockchain business platform of a central securities registration agency and had communicated with SWIFT about blockchain technology, I was invited to attend the SWIFT China Annual Meeting to give a special report on blockchain technology. During the four-hour flight from east to west, I also reread "One From Many-Visa and Rise of Chaordic Organization", the Chinese translation of which is "Invisible VISA: A Mixed Order Organization for the Future", and the author is Dee Ward Hock, who participated in the establishment of VISA and served as its first CEO.

In 2007, when I just joined the Strategy Department of UnionPay, I happened to translate Visa's internal document, called The Power of Ideas. At that time, the layout and thinking of the Internet/mobile payment innovation strategy were also based on the strategic comparison of Visa/American Express, and were deeply influenced by the ideas of Dee Hock's predecessors. After rereading this book ten years later, I found that from the perspective of "decentralized" Blockchain/Crypto, many of his thoughts and expressions have transcended history so profoundly. At this time, the sunlight from the stratosphere passed through the porthole and shone between the lines of the book. I was deeply moved. I felt that if I could concentrate on doing payment and settlement in this life, I would be willing and not ashamed of myself.

He later summarized a paragraph:

"Visa's true and lasting success will belong to two incomparable things:

a. The quality of the cooperative relationship with different partners;

b. The extent to which it successfully provides services to the community as a whole and provides greater benefits."

This should be regarded as the annotated version of the so-called "community is above code" fifty years ago.In that era, Visa was not called Visa. After years of preparation, a new global electronic payment network has gradually led to the rise of many innovative technologies and businesses such as data centers, POS terminals, and credit cards. From the perspective of historical path integrals, its historic creation and construction is far ahead of the electronic cash created by Satoshi Nakamoto/cyberpunks, not to mention the subsequent Blockchain/Crypto wave.

Just as "freedom is not passed down from generation to generation, and individuals of each generation must constantly defend and strive for it", the same is true for the exploration of most basic issues and the acquisition of common sense. Everyone knows that KK is out of control/sovereign individuals/cyber states/programmable currencies and other new products are popular, but Dee, the founder of Visa, has been forgotten by the public and hidden in the corner of time.

Dee has successfully explored and verified many concepts and judgments with the Visa network throughout his life. Including but not limited to:

a. What is currency? What is the "value exchange network" of currency?

b. What is "decentralization"? What kind of organization can become a "decentralized organization"? How to govern a decentralized organization?

These two questions are expressed as the core characteristics of the Web3 generation today, namely Crypto and DAO.

Based on the two books "The Power of Ideas" and "Mixed Order", I have sorted them out, absorbed some of the essence, and added some comments. There is no specific sage who has completely laid the complete path, but there is always someone who lights up the road ahead at a certain stage. Our best choice is to follow the footsteps of many sages, walk at a high level, and prudently practice the power of ideas.

Note: The following paragraphs starting with "DEE" represent the quoted text in the original book; the paragraphs starting with "Lilin" represent my personal comments.

(Again: Actually, there is no need to comment. The truth is between the lines.)

1. About Currency

DEE: "What if most data starts moving as fast as electron pulses - radio waves - or even light beams? Obviously, everything seems to be moving in this direction, and the pace is accelerating. Our old views are gradually disappearing, and traditional concepts are beginning to change. It makes us seem to see things with different eyes, even with a different mentality, and even beyond the first two: seeing everything with a different consciousness. This is simply exciting."

left;">DEE:"Money will become alphanumeric data in the form of regular energy pulses, and will move around the world at the speed of light through countless paths throughout the electromagnetic spectrum, and at negligible cost. Any institution that can move, manipulate and guarantee this alphanumeric data in the form of regular energy, and at the same time, these alphanumeric data are widely used and trusted as equivalent measures and exchange media, then such institutions are banks. We can also go further and say that these inherent properties of money may lead to the generation of a new form of global currency."

Lilin:This gave rise to different "alphanumeric" currencies, as well as different "equivalent measures and exchange media". In the "online/mobile banking" era that we once cheered for but have long been accustomed to, there were banks/payment institutions as agents to record, keep and transfer money. But Blockchain has changed everything.

DEE:"If electronic technology continues to develop, then it seems obvious that the 200-year-old oligarchic control of the banking industry over the custody, lending and exchange of currency will be irreparably destroyed. The state's monopoly on currency issuance and control will also be eroded. Banks or governments may traditionally be the last liquidators people rely on - the last processors of the huge and growing number of monetary value transfer businesses. But it doesn't matter. In the new system, the advantage will fall to those organizations that are best at processing and guaranteeing alphabetic value data in the form of regular energy particles."

Lilin:Although Dee cannot foresee all technological creations, he still gives a great guess: the new form of infrastructure represented by Blockchain and its organization are indeed "best at processing and guaranteeing "value data", and "regular energy particles" appear in the form of Crypto/Token.

Lilin:Although Dee cannot foresee all technological creations, he still gives a great guess: the new form of infrastructure represented by Blockchain and its organization are indeed "best at processing and guaranteeing "value data", and "regular energy particles" appear in the form of Crypto/Token.

2. About credit cards and the nature of their business

DEE:"What is the nature of the credit card business we are engaged in? Is credit really the nature of our business? When a customer hands a merchant a plastic card to pay, what is the essence of this transaction? Obviously, it means that the merchant is willing to sell goods to those prospective customers who hope to buy its goods. In this sense, the credit card replaces the driver's license, social security card, ID card or other means of confirming identity. In this way, the first major function of the credit card is to allow the seller to identify the buyer, and also to allow the buyer to identify the seller. ”

Lilin:Dee is good at thinking about the essence of the business first. No matter what kind of transaction terminal, medium and form it is, the essence of the transaction is the "trust" and "performance" of the two parties to the transaction. Behind trust, there is a series of "authorization" or "delegation", and there is also "verification" for both parties to the transaction. Does it sound familiar? Don't Trust, Verify It!

This leads to the second question, why is the existing financial system "centralized"? Because the institutions that can be "trusted", as the objects of "authorization"/"delegation", must meet certain qualifications or certificates, that is, the so-called "licensed institutions". All financial games are "inter-institutional" businesses between these institutions, and institutions that cannot obtain licenses for various reasons are of course not included. Going back to the origin of each transaction, everyone will of course choose the "agent" they trust, and those who are not qualified will naturally try to subvert and innovate, which is the so-called "financial innovation".

But in fact, the financial system has long been "decentralized", and its scope is limited to institutions. In order to prevent a single institution from completely controlling all transactions and thus tampering with/forging/destroying the transactions themselves, it is necessary to decouple financial institutions. The premise or essence of decentralization is to identify the risk responsible subjects of the entities and agents of the "authorization"/"entrustment" parties, and continuously decouple their transaction associations. Make "trust" more "simple" and "object-oriented". "Because of trust, it is simple"? In fact, "because of simplicity, there is trust."

DEE: "Obviously, credit cards ensure that both buyers and sellers can exchange value safely: merchants provide goods or services, customers sign and confirm on the sales bill, and this bill is stored by the merchant as a voucher for monetary credit. The seller receives the payment in local currency, and the buyer will pay in his own country's currency in the future. It can be seen that the second main function of credit cards is to serve as a guarantor of value data. DEE: Obviously, the credit card system ensures that buyers and sellers do not have to understand each other's language, laws, currency, customs or culture to initiate the exchange mechanism. In fact, many issuing banks allow customers to pay for transactions for a period of time after the transaction (banking jargon calls it "deferred credit"), but this is just an auxiliary service, not the main function of credit cards. When a credit card is placed on a card reader and swiped, it only creates a financial information in the form of alphanumeric data - replacing paper and pen. In this way, the third main function of credit cards is the creation and transfer of valuable data. left;">Lilin:Blockchain technology provides a new perspective to re-examine and process the entire composition of transactions (payment-clearing-settlement), allowing us to forget the various technical gimmicks in Layer0/1/2 and cryptography and the concepts that seem to emerge in endlessly but are actually repetitive. Only by starting from the business itself can the ecosystem truly prosper. Looking back, no one will remember the complicated and sophisticated concepts of WCDMA/CDMA2000/TD-SCDMA on the eve of 3G. Everyone only cares about what time my takeaway will arrive. Although it was hard to get a ticket to the 3G conference at the China World Trade Center that year, it was far more popular than today's consensus conference and various Web3 summits.

DEE: When we abandon traditional views and challenge mechanistic models of reality, we are no longer bound by the jargon of banking and payment systems. Then we start to think in a more fundamental way, and another shift in consciousness occurs. This idea seems ordinary and obvious now, but it was quite revelatory at the time. We are not in the credit card business. The name "credit card" comes from banking jargon, which is actually a misnomer. This card is just an instrument that carries a symbol of monetary value exchange. It is a coincidence of time and circumstances that it is a plastic card. We are really in the business of monetary value exchange.

3. About Payment Clearing Networks

DEE:"Old Monkey Mind and I began to quickly put these fragmented thoughts together. If our business is to ensure and process the exchange of value between buyers and sellers, then where and when will the buyers and sellers trade? As the development of modern transportation has greatly reduced time, buyers can appear anywhere and at any time, all over the world, day and night. With the development of catalog mail order and electronic markets, sellers can provide goods or services to customers anywhere and at any time without having to appear in person. Therefore, the demand for electronic value exchange will arise 24 hours a day, 7 days a week, at any time and anywhere in the world. ”

Lilin:This has been achieved in the Crypto era pioneered by Bitcoin at a speed that is unimaginable in the traditional world. The fundamental transformation of Crypto comes from the change in financial infrastructure: the clearing time has been changed from T+N to 1 second in theory, which makes the traditional large-scale credit transactions that require the intervention of investment banks become fast, flexible and liquid retail transactions; the concept of time has been eliminated and replaced by block height, which infinitely breaks the pricing monopoly brought by global time zones.

The 7*24-hour trading envisioned by Dee has been fully evolved: from the global trading of the analog era, it has entered the real digital era. Its significance is similar to the transition from analog communication networks to digital communication networks. Although the signal is still not very good, LTE has given a direction for progress. Humans only need to conceive scenarios and invest in infrastructure without thinking, and no longer need to worry about what the excess bandwidth can be used for. Although there are always people who like to worry in every era.

DEE:”Exciting insights come one after another. Any organization that can guarantee, transmit, and process transactions in regular electronic form anywhere in the world, 24 hours a day, seven days a week, will have access to a market far larger than we can imagine—the one in which all the world’s value exchanges take place. The necessary technology has already been invented, and it will accelerate its adoption exponentially as its cost decreases exponentially. But there is a problem: no bank can do it, no large corporation can do it, not even a country can do it. In fact, we can’t think of any existing organization that can do it. I intuitively estimated the financial resources of all the banks in the world, and found that the financial resources of most countries pale in comparison. So if the banks were linked together, they could do it, but how? It would require an extraordinary organization to link these extremely complex and diverse institutions and individuals in a completely new way. ”

Lilin:Dee’s technical limitations obviously led to his over-optimism, just like the physicists in the golden age claimed to have solved all physical problems. But the foresight judgment is that only an extraordinary organization can manage global wide-area transactions, not any single country/institution. From the history of Crypto evolution in the past nearly 15 years, the fundamental reason is that under the conditions of globalization, no single entity can reach such a "consensus", but Bitcoin appeared at the right time.

4. Organization

DEE: "We must establish a global organization that connects a large and complex system composed of theoretical learning and experiential learning shared by people, as well as individuals and groups of any kind from all walks of life who are concerned about the failure of the system and are committed to doing their part to improve this situation. This organization must self-organize in accordance with the principles it believes in, and at the same time make itself a successful example of a mixed-order organization. The purpose of this organization should be to develop, spread and implement the concept of a new, more chaotic organization. If this global organization can be carefully conceived and properly established, it will be able to organically integrate into the fruits of its labor. "

Lilin:"Chaotic" may give the future direction of DAO. Absolute "decentralization" only means the dissolution and non-existence of order. It is always necessary to clarify the subject of risk responsibility, which is the basic path to build "consensus" and achieve "republican" innovation.

DEE:" Dee racked his brains. He knew clearly that most companies adopted the rigid hierarchical system of "command and control" that he hated. Now he and his "monkey-like ideas" will put aside all this and directly cut into the essence of the company: what is the core of the company? Dee wrote in his memoirs: "The essence of a business company or other organization is the idea. All institutions are nothing more than different people who put their talents together for a common goal. An ancient and authoritative thought concretizes this concept as "community." "Community", haha, "community means common goals."

This also means common beliefs, common values, and common ideas and principles. Are these the ideal genes that constitute a company? Can these become the DNA-like cornerstones needed to establish a new financial institution?

left;">Dee saw a way forward: If we start working on common goals, common ideas and principles, where will this path lead? A few hours later, Dee went to meet his companions with a head full of ideas. He said: Today we are no longer talking about banks, money and credit cards; we are talking about ideas, principles and common goals. ... Find the common ground that can unite banks into an autonomous organization, which will develop into a data clearing agency as Dee envisions. In the scene Dee described, when discussing ideas and principles, he and his colleagues did not seem like four bankers talking about money and cooperative institutions. They seemed more like Thomas Jefferson, James Madison, James Monroe and Alexander Hamilton discussing the basic principles of the Declaration of Independence and the U.S. Constitution. In fact, Dee would later call their small group the "Fathers of Visa."

"What ideas and principles did he and his companions finally reach? As Dee wrote in his memoir, the four men came up with a big list:

Article 1: This organization is owned by all members, and there is complete equality among them. No single member has control or privileges.

Article 2: All members have equal rights and obligations.

Article 3: This organization is open to all qualified members.

Article 4: Power, responsibilities, and resources should be appropriately divided and shared.

Article 5: Authority is equally shared by all independent agencies.

Article 6: To the greatest extent possible, ensure that everything is voluntary.

Article 7: All members have equal rights and obligations.

Article 8: All members have equal rights and obligations.

Article 9: All members have equal rights and obligations.

Article 10: All members have equal rights and obligations.

Article 11: All members have equal rights and obligations.

Article 12: All members have equal rights and obligations.

left;">Article 7: This organization should change naturally and should not be forced to change;

Article 8: Management agencies should be parallel, flexible and permanent.

Lilin:The establishment of Visa certainly depends on more complex factors. But why do similar creative constructions appear again and again in modern society represented by the United States, especially Silicon Valley? (Visa's headquarters is in SF, which is another story and can be written in another article.)

In this sense, Satoshi Nakamoto's retreat and disappearance just perfectly solved the St. Martin/Washington problem, which led to the subsequent "emergence". Eastern societies prioritize achievements and wealth in this lifetime or even in the next five or ten years, and thus will forever lose the opportunity to reach the source of innovation, not to mention global leadership and pricing power. This not only explains the true status and long-term positioning of Chinese society in the Crypto world, but also explains the illusion of all the "independent innovation" in the past forty years. Today, the surging domestic LLMs have once again embarked on the path of the predecessors of Hongqi/Loongson. Of course, they have different profit models:)

DEE: If we extract their essence, their basic concepts and principles are:

"Cooperation", "Partnership", "Procedural Democracy", "Equality", "Power Sharing", "Openness", "Trust", that is, the spirit of community.

Dee is happy that he and his colleagues have outlined a vision and the principles that guide the realization of the vision: to create a democratic and autonomous banking cooperative organization through which banks can jointly manage and clear credit card transactions occurring anywhere in the world. In the short term, the cooperative could process bank card transactions for America, but in the long term, it could develop into what Dee envisioned: a leading global digital transaction processing system.

Dee believed that the new cooperative would not be controlled by Bank of America or any other bank. Instead, it would be a cooperative that operated on a foundation of mutual trust, with people and their respective banks coming together for the common good and benefit - the greater good being their customers and the community. Others largely agreed with Dee's ideas, so there was another principle that, although not explicitly stated, was imprinted in their philosophy and principles: "independence"

Dee knew that the fusion of a network of relationships and expert resources (that is, building the Visa community, rather than any hardware or software, or any metric of transaction volume or member profits) would have a more profound impact on its ultimate goal.

Dee died on July 16, 2022 at the age of 93.

The story is far from over.

Even at the beginning of the story, there is another great clue that is hidden and glorious. The Italian who founded BOA Bank of America: the legendary A.P.GIANNINI.

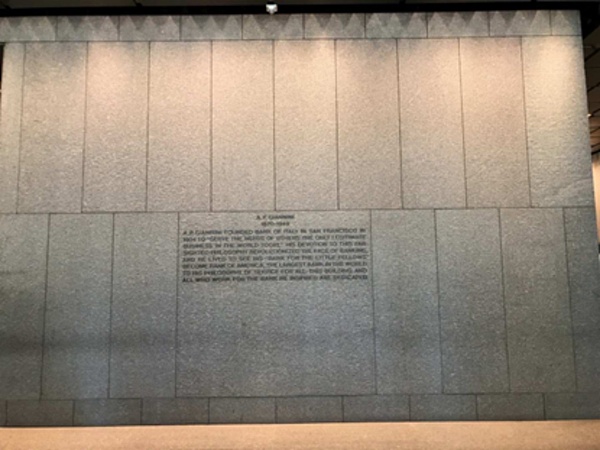

On July 21, 2018, I was in a meeting in San Francisco and came across 555 California Street.

The legend has left, but the legend will never end.

In the past ten years, I have met many of the world's top/or at least first-class economists, as well as a large number of leaders/experts in the Crypto industry, and found that most people have never figured out the difference between "clearing" and "settlement", and they are all referred to as "payment". Countless generations of people will forget the true meaning of "learning": just as we cannot talk about the evolution of science without going back to the history of science, we cannot truly understand the great significance of Crypto's transformation and the glorious monument on the journey without going back to the history of payment settlement and currency.

Fortunately, my partners and I have not forgotten this. The "power of ideas" is different from the "beliefs" that need to be recharged. We can only do what we want without going beyond the rules. Fortunately, in the past five years, a robust, stable, and scalable public ledger infrastructure and almost all the surrounding tools/technical middleware have been completed and tested in practice.

Based on this, business-oriented payment and clearing are imminent, just like the eve of the mobile Internet in 2005-2010, the new payment and clearing infrastructure is on the way, which means that the new globalization 2.0 and its business wave are obvious. It will be fully unveiled in 2023, which is the prelude to the new generation of global financial infrastructure.

Currently, Lilin is building a fully digital public infrastructure PlatON, practicing the power of his beliefs, let us wait and see.

Visa and Mastercard's crypto partnership: Simplifying conversions, challenging exchanges. Crypto's future: integration with traditional finance.

Huang Bo

Huang BoVisa launches Web3 loyalty program with SmartMedia, enabling digital wallets, gamified rewards, and immersive experiences. Expanding into crypto, it seeks to redefine customer engagement and loyalty in the evolving digital economy.

Xu Lin

Xu LinPayments company Visa has said it is not slowing down with its cryptocurrency plans—despite news reports hinting otherwise amid a brutal bear market.

decrypt

decrypt Coinlive

Coinlive Yesterday Visa published a thought leader article on automating blockchain payments where digital currency is held in a self-custodial wallet.

Ledgerinsights

LedgerinsightsVisa said that StarkNet, a layer 2 blockchain built on top of Ethereum, may help bridge the gap between crypto and the real world.

Others

OthersStrike announces an $80 million fundraise to help it expand its payments technology to larger institutions.

Beincrypto

BeincryptoEveryone would agree that the world is becoming increasingly digitized, with the aptly named ‘Web 3.0’ era seemingly just around ...

Bitcoinist

BitcoinistIn the eyes of a thousand people, there are a thousand kinds of Web 3.0.

Ftftx

Ftftx Nulltx

Nulltx