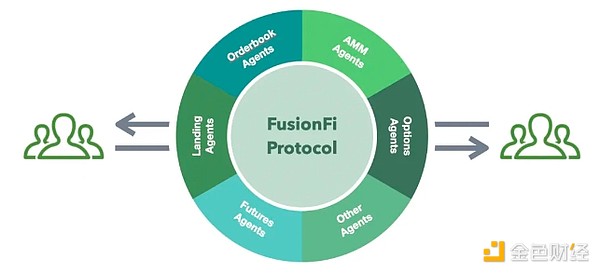

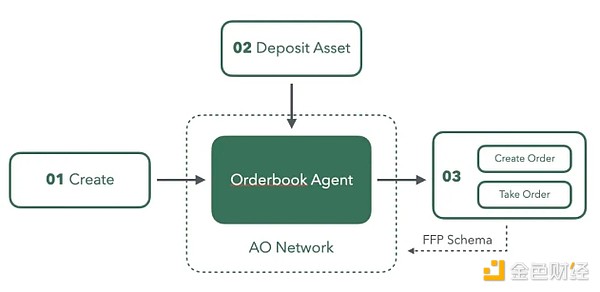

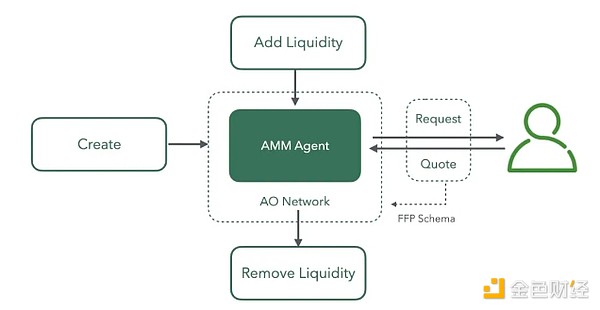

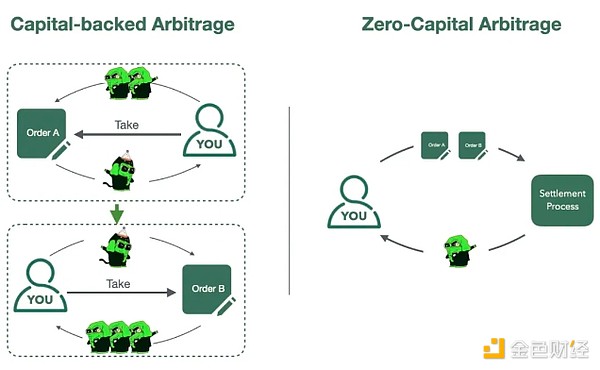

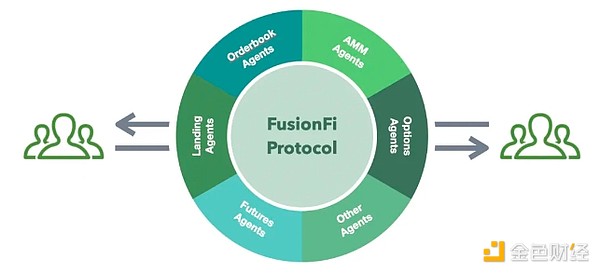

Permaswap recently released an AgentFi demonstration use case based on FusionFi Protocol (FFP) on AO, adding a new case of creating an automated market maker agent (AMM Agent) and performing arbitrage operations. With FFP, developers can create an AMM agent pool with a few lines of code to achieve asset exchange. As a standard protocol on the AO network, FFP provides interoperability support for different types of Agents.

This article will first sort out the core concepts of AgentFi and sovereign finance, and then introduce two typical Agent examples, Orderbook Agent and AMM Agent, to show how the FFP protocol integrates two different transaction processes, and then use this to illustrate the key role that FFP can play in the future financial ecosystem.

Basic Concepts

AgentFi introduces the concept of "agent" on the basis of DeFi, allowing users to deploy their own smart contract agents (Agents) to automatically manage interactions with the protocol. Through Agents, users can autonomously and automatically perform various financial operations, such as asset management, strategy execution, etc.

Traditional DeFi protocols use smart contracts to implement operations such as asset exchange and lending, but these assets are usually concentrated and locked in a single smart contract. On the one hand, users must entrust their funds to the contract, and on the other hand, users lose the flexibility to customize related functions and parameters. AgentFi breaks this limitation, allowing each user to have an independent agent with financial functions and conduct personalized financial business through it. In other words, AgentFi allows users' agents to become independent financial entities, allowing individuals to formulate financial rules, such as asset exchange, loan agreements, and asset issuance rules, to achieve personalized financial management and break through the limitations of traditional centralization. This is sovereign finance! Unlike the traditional centralized system where the central bank controls financial rules, sovereign finance allows users to formulate and control financial rules themselves, no longer relying on a single contract or central institution provided by developers. The foundation of AgentFi: performance and flexibility One of the reasons why traditional DeFi protocols centrally manage funds is the performance limitations of Ethereum: it cannot provide independent agent computing power for each user. Therefore, platforms like Compound and Uniswap have optimized their code to adapt to the limitations of blockchain. In addition, traditional blockchain smart contracts have low flexibility and are difficult to modify or redeploy, which limits the computing flexibility of agents.

AO, as a decentralized global super parallel computer, provides independent computing units (called processes), each of which has independent computing resources, solving performance bottlenecks. At the same time, the contract code running in the process is controlled by the process owner and can be flexibly updated and upgraded, providing a solid foundation for the flexibility of AgentFi.

JinseFinance

JinseFinance