Author: Nancy Lubale, CoinTelegraph; Compiled by Wuzhu, Golden Finance

A cryptocurrency wallet labeled "German Government (BKA)" has sold another $900 million worth of Bitcoin, raising concerns that the associated selling pressure will push down BTC prices.

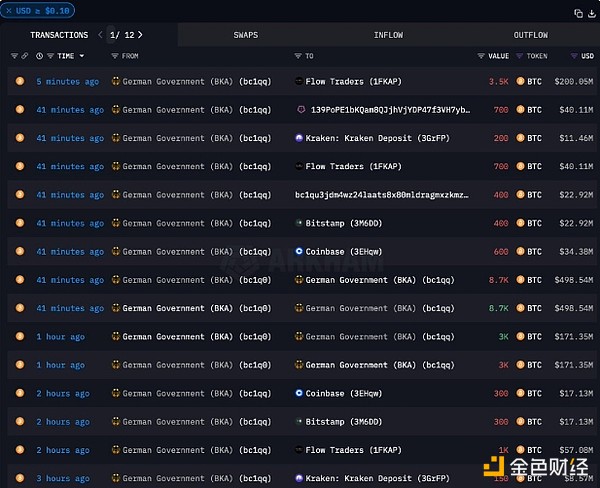

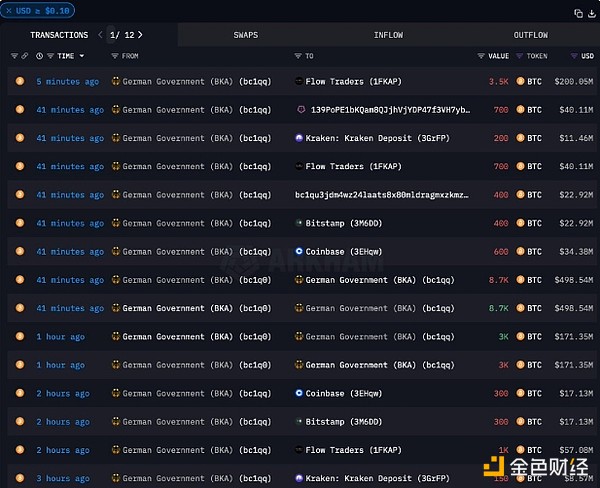

According to on-chain data from Arkham Intelligence,On July 8, a wallet associated with the German government transferred a total of approximately 16,309 Bitcoins to multiple external addresses through multiple transactions.This is the largest single-day Bitcoin flow for the wallet. Some of the transfers were to cryptocurrency exchanges Bitstamp, Coinbase and Kraken, as well as market makers Flow Traders and Cumberland DRW.

In the largest transaction, 3,500 BTC was sent to Flow Traders, 200 BTC was sent to Kraken, 400 BTC was sent to Bitstamp, and 400 BTC was sent to Coinbase.

BKA BTC transfer. Source: Arkham Intelligence

Another 700 BTC, worth more than $38.5 million, was sent to wallet “139Po,” which is currently unknown but has previously received funds from the German government, including 550 BTC on July 2, 500 BTC on June 25, and 800 BTC on June 20.

Following these transfers, the price of Bitcoin fell sharply during the European trading session, falling from a high of $58,200 to a low of $54,278, a drop of as much as 6.75%, shortly after the last set of blockchain transactions dropped the total to 8,700 BTC.

With the latest transfers, the German government’s selling spree is more than halfway complete.

According to Arkham data, Since the sell-off of digital assets began in June, its holdings have been reduced from 50,000 BTC to 23,788 BTC, worth $1.3 billion.

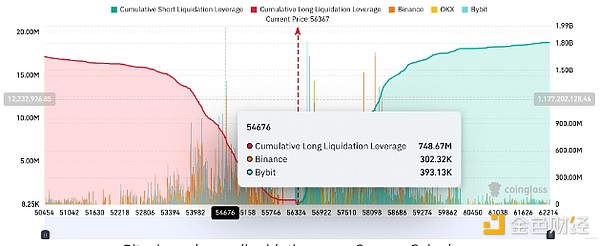

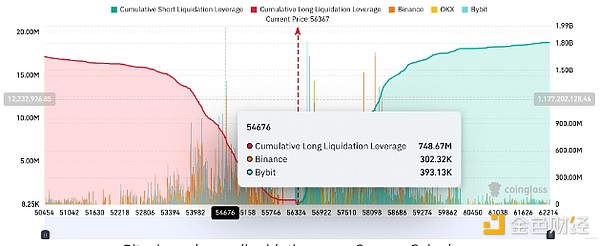

The drop in Bitcoin prices has triggered massive liquidations across the crypto market. According to Coinglass data, a total of $425 million in leveraged positions were liquidated across the cryptocurrency market, of which $216 million were long liquidations.

More than $189 million in Bitcoin positions were liquidated in the past 24 hours, including $87 million in the past 12 hours alone. Of this, $81 million were BTC long positions, while $107.97 million in BTC short positions were liquidated.

Total cryptocurrency liquidations. Source: Coinglass

Bitcoin appears to have found significant support at the $54,700 mark. However, a break below that mark would result in the liquidation of approximately $750 million in leveraged long positions across all exchanges, according to Coinglass.

Bitcoin exchange liquidation chart. Source: Coinglass

Mt. Gox repayment may bring more Bitcoin selling pressure

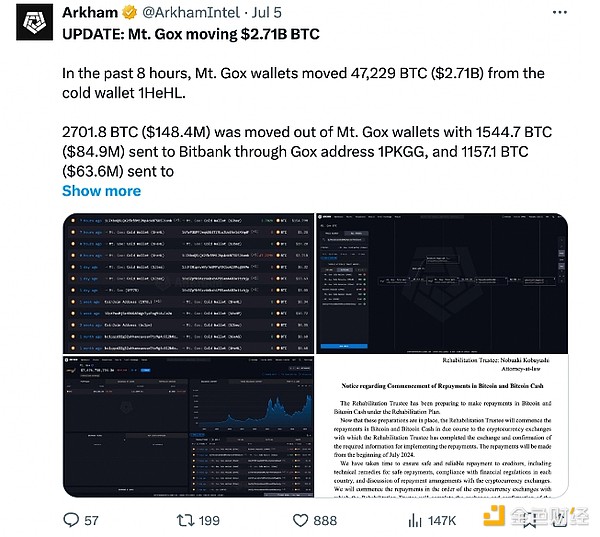

The long-awaited repayment process for creditors of the collapsed cryptocurrency exchange Mt.Gox has begun, with plans to repay in Bitcoin and Bitcoin Cash.

On July 5, Nobuaki Kobayashi, the trustee of the Mt. Gox bankruptcy estate, said in a statement that the company has begun to repay some creditors in the form of Bitcoin and Bitcoin Cash through several designated cryptocurrency exchanges.

The balance that needs to be repaid is as high as $9 billion, including BTC and BCH, as well as other funds held by the trustee.

Crypto exchange Bitstamp plans to quickly repay part of its share of Bitcoin to Mt. Gox creditors, although it has up to two months to complete this work after receiving the Bitcoin, which further exacerbated the selling pressure on Bitcoin.

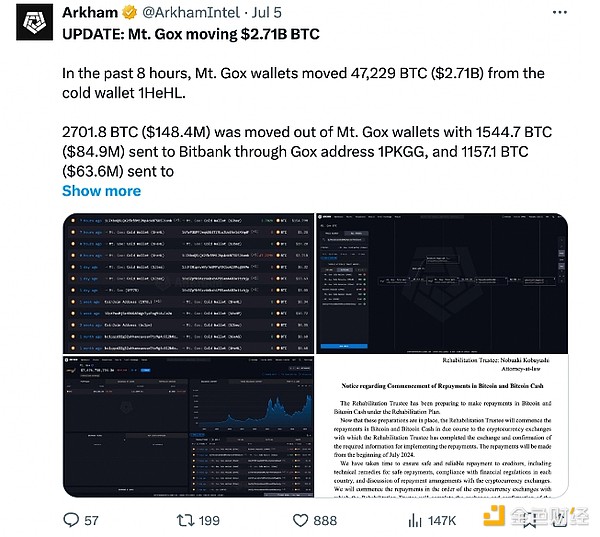

Previously, a small amount of Bitcoin was moved from wallets associated with Mt. Gox, including $2.71 billion from the exchange's cold wallets, reportedly in preparation for repayment, according to blockchain analysis firm Arkham Intelligence.

Source: Arkham

Market participants still expect bitcoin prices to climb again and the bull run to continue once the expected short-term selling pressure from the Mt. Gox repayment and the German government sell-off subsides.

JinseFinance

JinseFinance