Author: Glassnode, Alice Kohn; Compiler: Deng Tong, Golden Finance

Abstract

The Dencun upgrade on Ethereum introduces new data storage capacity and aims to reduce the cost of its Layer 2 scaling solution.

The upgrade also implements fixed limits on incoming validators to manage the growth of the validator set and maintain efficient node communication.

This change may reduce the new issuance rate of Ethereum, thus affecting Ethereum’s token policy. This could lead to a reduction in Ethereum supply.

Reducing the cost of scaling solutions

On Wednesday, March 13, Ethereum underwent another major update. The Cancun-Deneb (Dencun) upgrade makes significant changes to Ethereum’s rollup infrastructure. The upgrade also makes some modifications to Ethereum’s staking pool to improve node communication and network stability.

In recent years, various solutions have emerged to help the Ethereum network handle more transactions. Roll-up is a blockchain that utilizes a separate execution environment to execute transactions outside of the Ethereum blockchain. They aggregate batches of transactions that occur during a rollup and anchor them into a single transaction, which is then submitted to and verified by the Ethereum blockchain.

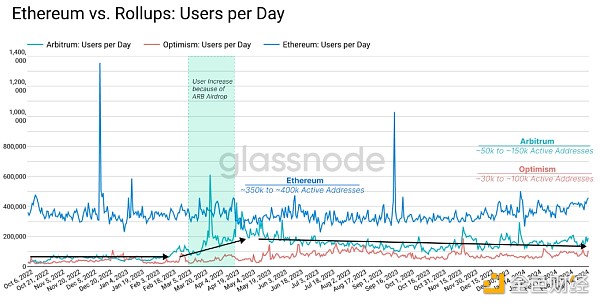

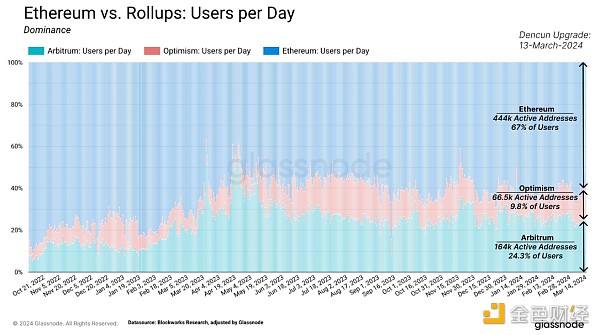

Roll-up solutions have grown in popularity over the past 2 years, with the two leading scaling solutions, Arbitrum and Optimism, seeing an increase in usage of 150,000 and 100,000 daily active addresses respectively. At the same time, the Ethereum mainnet still has the largest number of active addresses, with more than 400,000 active addresses every day.

The main feature of the Dencun upgrade is the creation of additional data storage capacity on the Ethereum network. It introduces a new type of transaction capable of carrying large data packets called blobs.

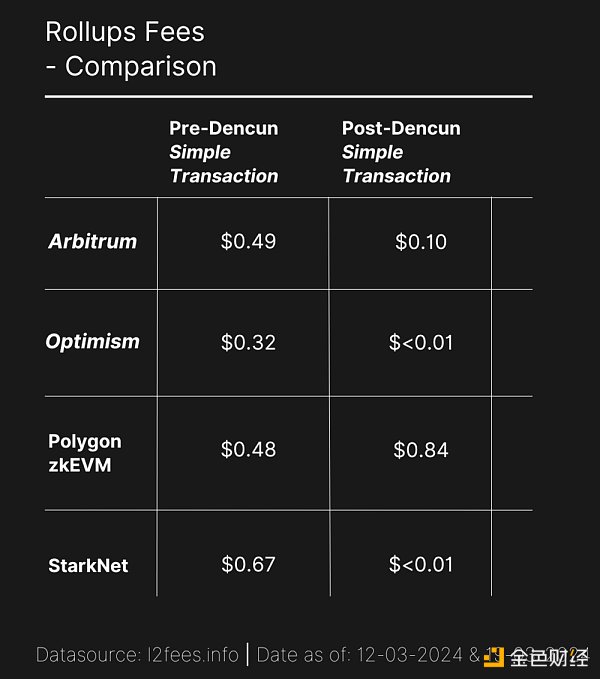

Blobs are temporarily stored in the consensus layer instead of the execution layer, which reduces The cost of fees on the Ethereum network and Rollup itself. As shown in the table below, transaction costs dropped significantly after the upgrade, with transaction fees on Optimism and StarkNet being even less than 1 cent.

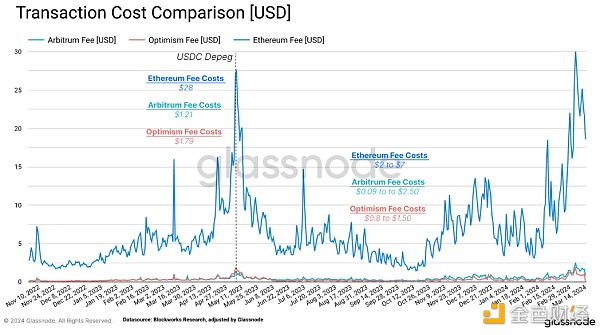

Normalizing to USD allows us to understand how rolling fees perform differently relative to mainnet fees. Since launch, roll-ups have offered cheaper, less volatile fees, with Arbitrum and Optimism charging between $0.10 and $0.30 per trade. By comparison, Ethereum main chain fees ranged from $2 to $7 during the same period.

During periods of high activity, where demand for Ethereum block space surges, fees can rise above $30. Prior to Dencun, rollup fees were partially dependent on mainchain fees, and in similar cases, their fees increased up to $2.50.

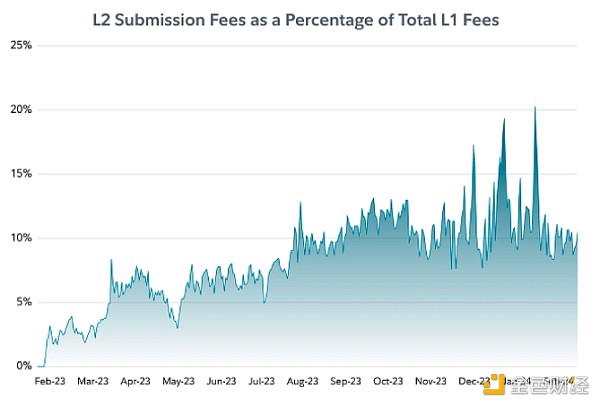

The shared reliance of cumulative fees on the high volatility of the Ethereum fee market tends to result in an overall more expensive and challenging user experience. These Layer 2 solutions also impact the Ethereum fee market by adding new sources of demand for block space. According to a report by Fidelity, transaction fees paid by various Layer 2 chains typically account for around 10% of the total fees paid on the Ethereum mainnet.

Source: Fidelity Digital Assets

Through the Dencun upgrade, separating Layer 2 anchor transactions into Blobs is largely in line with improving user experience, reducing fees, and integrating with the Ethereum Foundation through Rollup Stay consistent with your centered roadmap. It is hoped that lower transaction fees will encourage more users to switch to Rollup, thus increasing the overall transaction throughput based on Ethereum. This strategy aims to improve scalability without affecting the decentralization and security of the main chain.

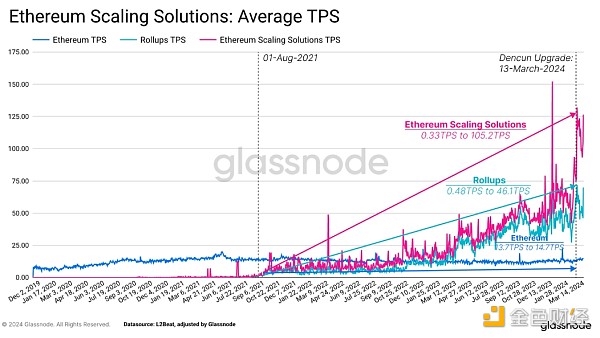

Soon after Ethereum launched its first set of scaling solutions, we observed an increase in average transaction throughput to 105 transactions per second (TPS) in mid-2021. Among them, roll-up accounts for about 46 TPS, accounting for 44% of the total.

This provides early signs of success for a Rollup-centric roadmap and similar Layer 2 scaling solutions. However, there is still a significant difference compared to Ethereum's largest competitor, Solana (which averages about 2.6k TPS), which is largely a function of modular (e.g. Ethereum) vs. monolithic (e.g. Solana) design architecture .

Pledge pool adjustment< /h2>

The Dencun upgrade also introduces new technical changes that affect stakers on Ethereum and are primarily designed to improve the user experience:

Permanent signature exit enhances delegated staking participants (e.g. liquidity staking pool) user experience. Currently, the signing keys required to authorize users to withdraw from the staking pool are the responsibility of the validator operator. This arrangement makes stake owners dependent on the goodwill of the validator operator when they want to exit their positions. After the Dencun upgrade, validator operators can sign voluntary withdrawals in advance, allowing equity owners to unilaterally withdraw their equity.

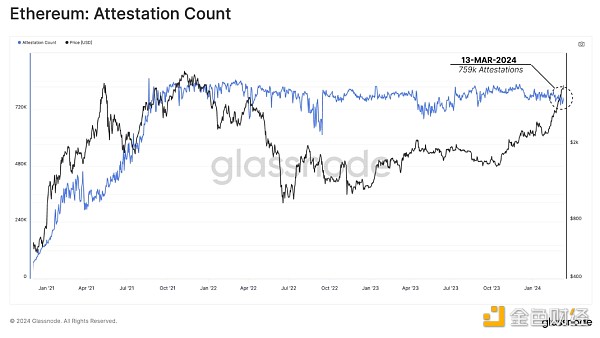

Increase the attestation window to take the time for validators to vote on the correctness of the block Extended from 6.4 minutes to 12.8 minutes. This allows more proofs to be collected, which can speed up the block confirmation process. Currently, the number of attestations is approximately 759,000 attestations per day.

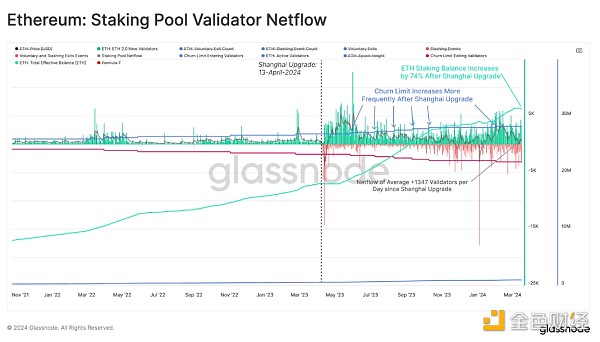

A fixed limit on new validators has also been added to slow down the growth of the validator set. Currently, the churn limit dictates how many new validators can enter or exit the staking pool each day. This limit increases by one step with the defined increment of the total number of active validators.

After the Shanghai upgrade, the number of active validators has increased significantly, with an average of +1,347 new validators every day. However, as the number of validators increases, a side effect is noticed that node communication slows down.

The Dencun upgrade now introduces a limit of 8 new validators per ~6.4 minute period to replace the churn limit Function.

Slowing growth in the validator set and effective staking balance has a secondary impact on Ethereum’s token policy. The current rate of ETH issuance depends on the number of active validators, which may slow down the rate of new ETH issuance as fewer people now have access to the staking pool.

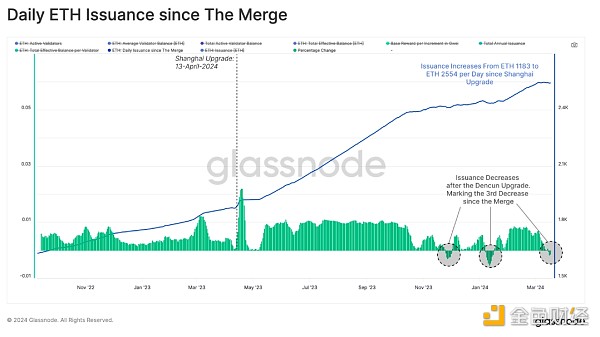

Since the Shanghai upgrade, the issuance has increased from ETH 1183/day to ETH 2554/day as the validator set has increased. It's still early days, but shortly after the Dencun upgrade we saw a third drop in issuance rates.

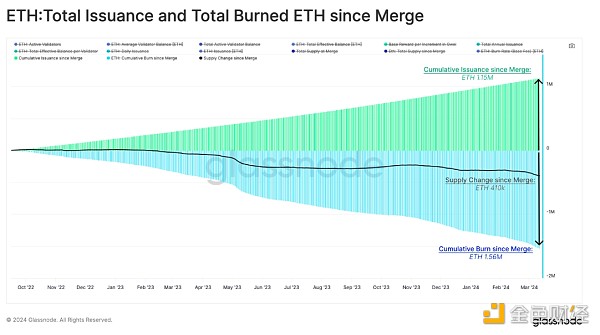

A possible slowdown in issuance could also result in a net reduction in Ethereum supply, as more ETH is burned through transaction fees than is newly issued. Since the merger, we have observed a net decrease of 410,000 ETH in the total circulating supply of ETH.

Dencun upgrades to ETH The combined impact on supply remains to be seen, as there are now a number of interacting changes:

Layer 2 anchor transactions have now been moved to blob data structures, eliminating approximately 10% of the fee congestion pressure. This may result in a slight reduction in the amount of ETH burned.

Reduced Layer 2 fees may attract more people to use the Ethereum main chain and scaling solutions, which may increase fee pressure.

Issuance growth rate may decrease due to fewer new validators being able to enter the staking pool.

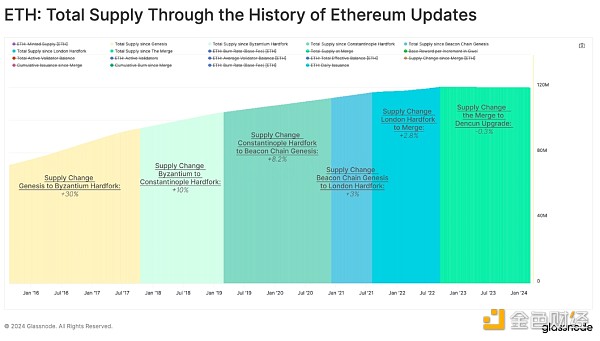

Throughout its history, Ethereum has gone through six major updates, but not all of them directly addressed changes in ETH supply. However, it’s clear from the last four upgrades that the growth in ETH supply has slowed. After the merger, it even turned slightly negative. The chart below shows these different upgrade events and the relative changes in the circulating supply of ETH.

Summary

The Dencun upgrade is a major enhancement to the Ethereum network by creating additional data storage capacity through Blob transactions. This upgrade effectively reduces the cost of various scaling solutions, thereby improving user experience and potentially increasing total transaction throughput by encouraging the use of Rollup.

This upgrade may also affect Ethereum’s token policy by restricting the entry of new validators, which It will slow down the growth of the validator set, thereby slowing down the issuance of new ETH. While lower issuance means that supply may decrease, new blob structures may also result in There are fewer transactions at the execution layer, thereby reducing the destruction of ETH and potentially mitigating the impact of reduced issuance.

All in all, this development continues Ethereum’s trend of slowing its supply growth and executing on its Rollup-centric roadmap. It can be seen that the last four upgrades have caused a slowdown or even a slight reduction in the ETH supply since the merger.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Nulltx

Nulltx