Author: Marcin Miłosierny, Glassnode Analyst; Translation: Golden Finance xiaozou

I believe everyone has seen a lot of discussion about the indicators and data about the Bitcoin halving, which reveal the strategic significance of the Bitcoin halving. This pre-programmed event, scheduled for April 19, 2024, will reduce the block reward from 6.25 BTC to 3.125 BTC, fundamentally affecting Bitcoin's inflation rate and potentially its market availability.

The Bitcoin halving occurs every four years and is a key mechanism for managing Bitcoin's scarcity and ensuring its status as an anti-inflation asset. As the Bitcoin halving draws closer, traders and investors, especially those with long-term trading strategies, will find it helpful to understand its impact on historical prices and put this historical data in the context of current market dynamics. Understanding these factors will be key to effectively navigating the post-halving market landscape, especially when determining entry and exit opportunities.

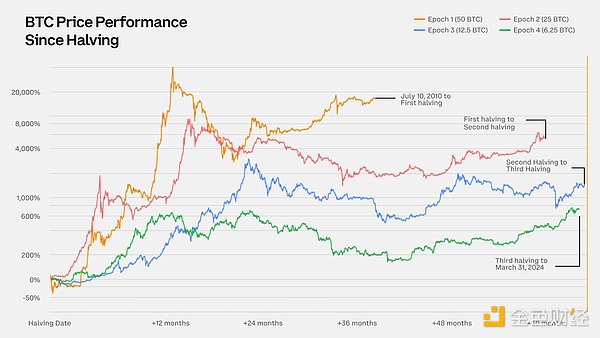

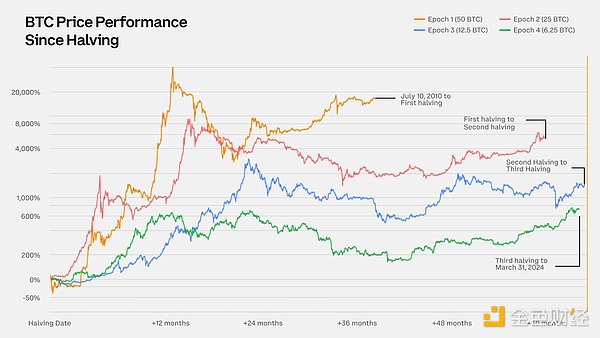

1. Historical Impact on BTC Prices

Previous Bitcoin halvings have consistently led to significant increases in Bitcoin prices over the following 12 months, a trend that is critical for investors. Specifically:

After the first halving, Bitcoin prices soared by more than 1,000%.

After the second halving, Bitcoin prices rose by 200%.

After the third halving, Bitcoin prices rose by more than 600%.

These significant price increases highlight the huge impact that Bitcoin halving events can have on supply and demand dynamics and market pricing. As we get closer to the fourth halving, these historical patterns provide valuable insights for predicting potential market trends and preparing investment strategies accordingly.

2. Market dynamics that change as the market evolves

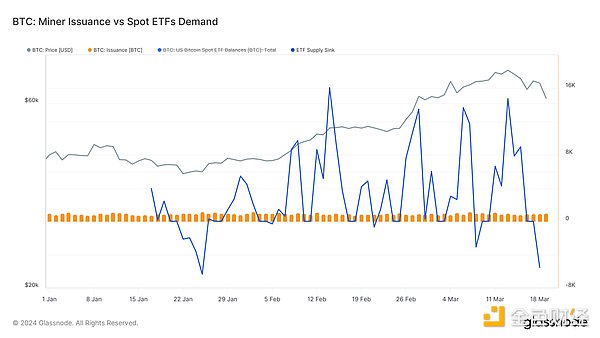

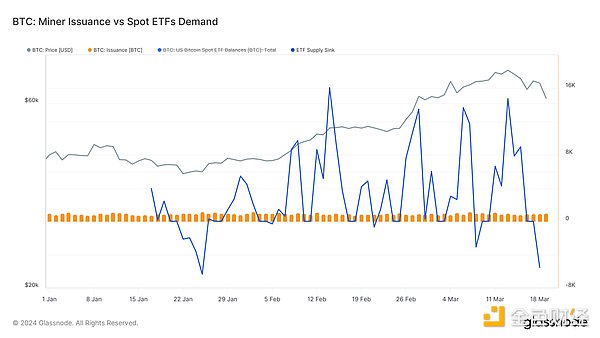

Compared with past halving events, Bitcoin's market dynamics have matured significantly, and the direct impact of new Bitcoin issuance on market prices may be reduced. This change is mainly driven by increased institutional demand and widespread adoption of Bitcoin ETFs.

The main differences include:

Miners' daily Bitcoin issuance now competes with the massive absorption of Bitcoin ETFs. For example, while miners add about 900 BTC to the market every day, Bitcoin ETFs often buy more BTC, greatly affecting supply levels and market liquidity.

In short, ETF inflows and outflows have already had a significant impact on the availability and demand of Bitcoin and will continue to do so for the foreseeable future. Given these factors, ETFs are key market participants and ETF activity may overshadow the historical impact of the halving. For traders, this means that ETF trends may provide key data points for making informed decisions, as market behavior may no longer be predictable after the halving.

3. Conclusion

With the fourth Bitcoin halving rapidly approaching, the digital asset market will be affected by a combination of established cyclical events and changing investment behaviors.

Historically, halvings have resulted in a reduction in the supply of new Bitcoins, leading to sharp market rallies, and prices may rise due to increased demand.

This time, however, the market situation will be more complicated due to the high level of institutional involvement through ETFs and the significantly different activities of long-term investors and "smart money".

Together, these factors suggest that the market's reaction to the upcoming halving event will be more nuanced:

ETF Activity: Carefully monitoring ETF inflows and outflows is critical. A decrease in ETF purchases could signal an impending market downturn.

Market Dynamics: Increased selling by long-term holders could indicate that prices are near a peak, which could have implications for overall market stability and price levels.

Halving Psychology: Be wary of the potential sell-off surrounding the halving event. Traders should consider strategically adjusting their positions to account for the expected volatility.

By paying close attention to these key factors, traders can be better prepared to respond to market changes and be able to capitalize on new opportunities.

JinseFinance

JinseFinance