Author: UkuriaOC, CryptoVizArt, Glassnode; Compiler: Deng Tong, Golden Finance

Summary

Net capital inflows into Bitcoin assets have cooled significantly, with few profit and loss events for investors.

Loss events are almost entirely associated with the short-term holder group.

However, a large portion of the supply held by this group is transitioning to long-term holder status, holding for at least 155 days.

Speculative activity in the perpetual swap market has experienced a full reset, indicating that speculative interest and long leverage are cooling.

Liquidity

Net capital inflows into the Bitcoin asset have begun to slow over the past few months. This suggests a certain balance between investor profit taking and loss taking has been reached.

It is worth noting that capital inflows into the Bitcoin market have rarely been so quiet, with 89% of days seeing greater inflows than today (excluding loss-led bear markets). It is also worth noting that similar periods of inactivity often precede significant spikes in future volatility.

The realized market cap remains at an ATH of $619 billion, with net inflows reaching $217 billion since the $15,000 low set in December 2022.

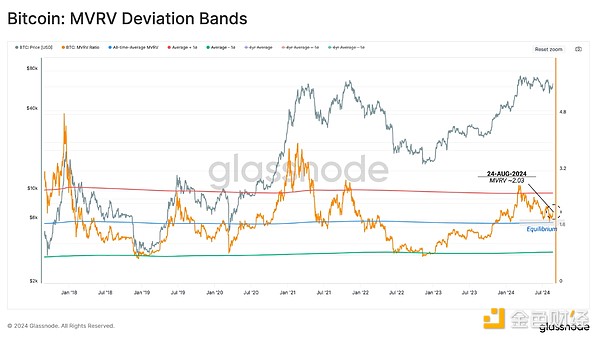

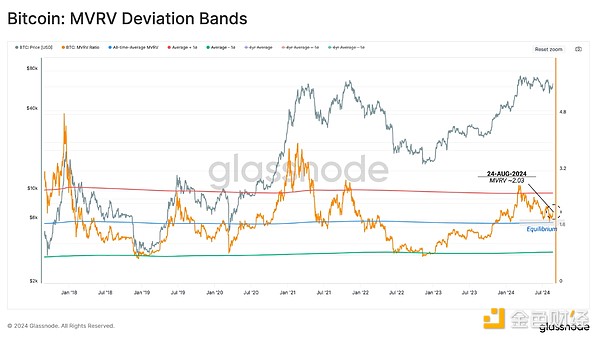

The MVRV ratio is a powerful tool that allows us to measure the average unrealized profit of investors.

Over the past two weeks, the MVRV ratio has tested its historical average of 1.72. Historically, this key level marks the turning point between macro bull and bear trends. Approximately 51% of trading days have MVRV values closing above the average.

This suggests that investors’ profitability has basically returned to a balanced position, and the excitement and enthusiasm after the launch of the ETF has completely cooled down.

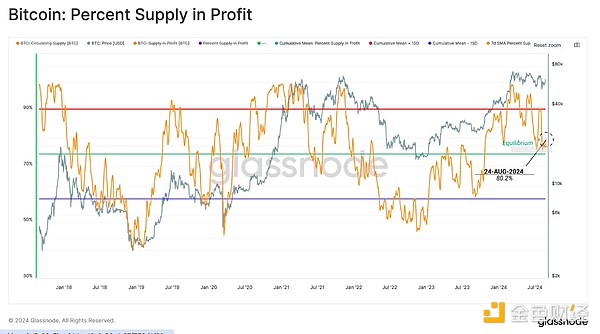

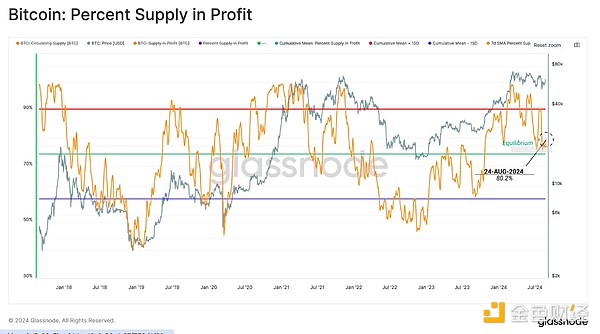

A similar situation is reflected in the Supply Percentage in Profit indicator, which provides a reading of the global profitability of the supply.

Like the MVRV ratio, this oscillator has returned to its long-term average. Similar retests of this level have occurred before, in late 2016, throughout the 2019 volatility, and during the mid-2021 sell-off.

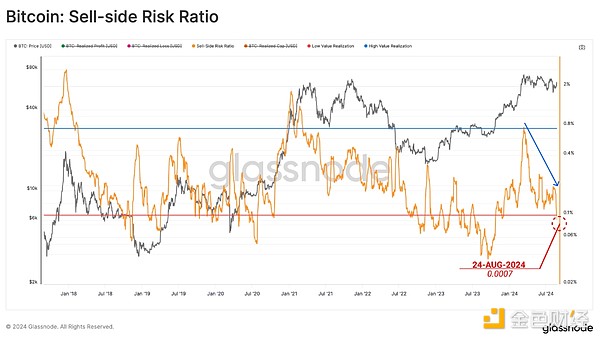

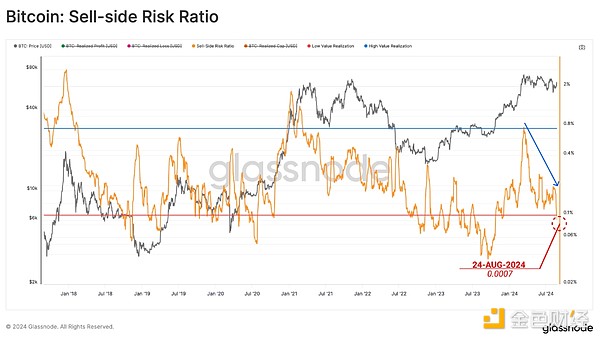

The sell-side risk ratio is another powerful tool that can assess how balanced the market is. We can think of this metric in the following framework:

High values indicate that investors' profits or losses on spent tokens are large relative to their cost basis. This situation indicates that the market may need to re-find equilibrium and often occurs after high volatility price action.

Low values indicate that most tokens are being spent relatively close to their breakeven cost basis, indicating that a degree of equilibrium has been reached. This situation generally indicates that the "breakeven" within the current price range has been exhausted, and generally describes a low volatility environment.

Currently, the Sell Side Risk Ratio has fallen to low levels, indicating that most tokens transferred on-chain are trading close to their original acquisition price. Similar to the previously introduced indicators, this foreshadows a new state of heightened volatility.

Short-Term Pressure

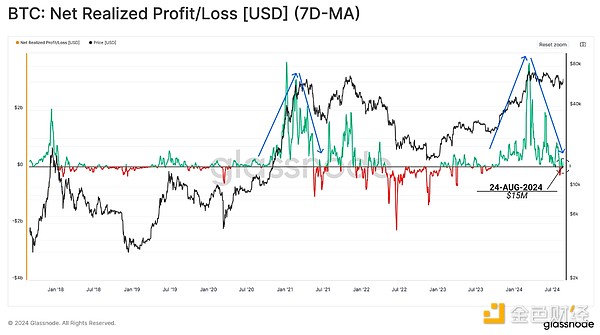

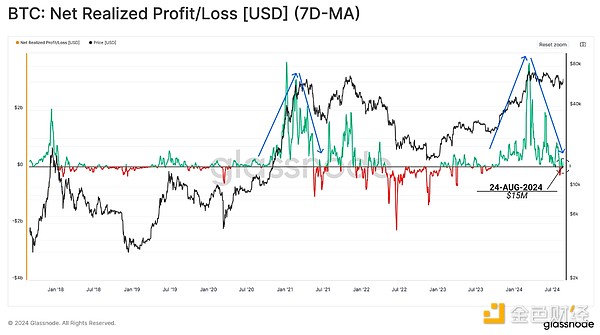

Diving deeper into these profit and loss activities, we can see that the magnitude of net realized profits/losses is declining.

Net realized profits/losses are currently at +$15 million per day, a far cry from the $3.6 billion per day of capital inflows seen when the market hit a high of $73,000 in March. Typically, this indicator returns to neutral levels around inflection points, such as trend continuation or a reversal back into a macro bearish trend.

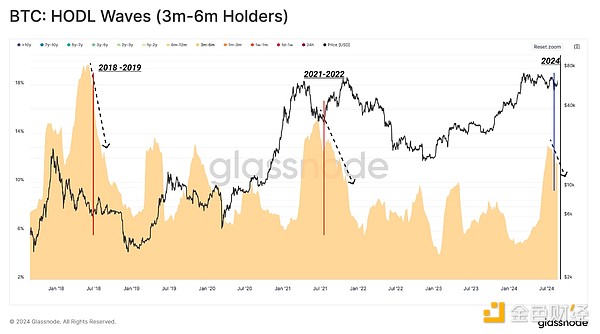

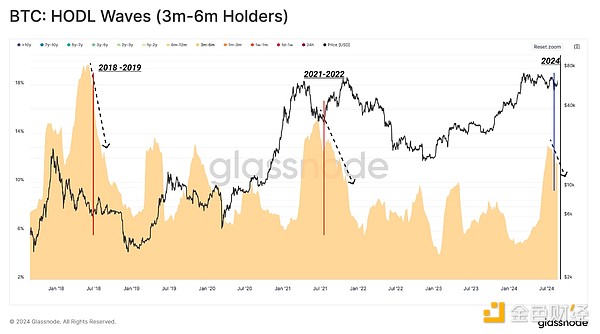

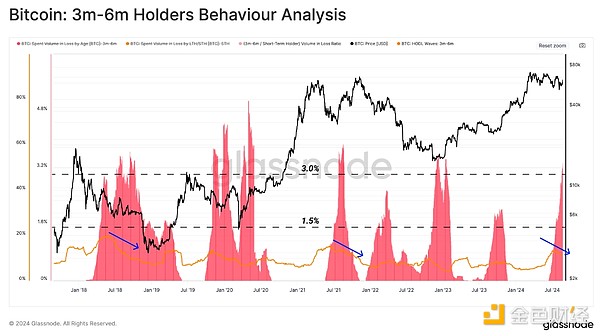

After setting a new all-time high in March, the confidence of new investors was tested during several months of volatile sideways price action. During this process, a large amount of Bitcoin supply remained tightly controlled and in the 3-month to 6-month coin age range.

Historically, supply in this 3-6 month coin age range tends to peak shortly after a major market peak is formed, usually during the subsequent correction. Some of these new investors then decided to continue to hold on during volatile conditions, eventually becoming long-term investors. Many others exited their positions and realized losses.

Currently, 3-6 month old tokens represent over 12.5% of circulating supply, a structure similar to the mid-2021 sell-off, but also similar to the peak of the 2018 bear market.

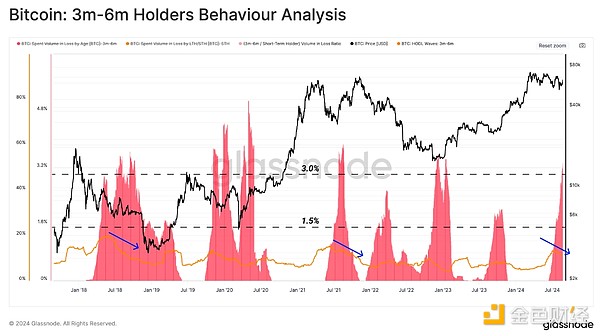

The chart below aims to further break down this group and compare the supply held in the 3-6 month timeframe to the supply that lost money. We start with the 3-6 month held supply shown in (dots), and then overlay the amount of loss-making transfers for this group (squares).

From this, we can observe that since the beginning of July, there has been a significant increase in loss events, while the total supply held has begun to decline. In terms of size, the size of this sell-off is similar to past major market inflection points.

The supply that remains in this holding timeframe is getting closer to entering the long-term holder status, meaning that these tokens are statistically less likely to be spent on a given day.

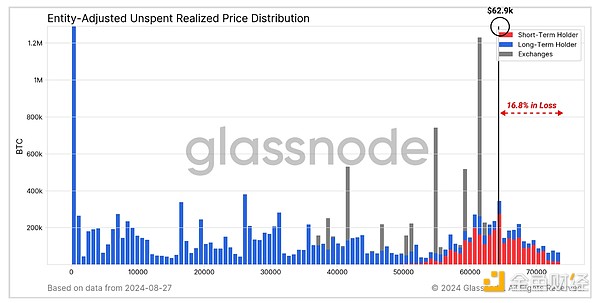

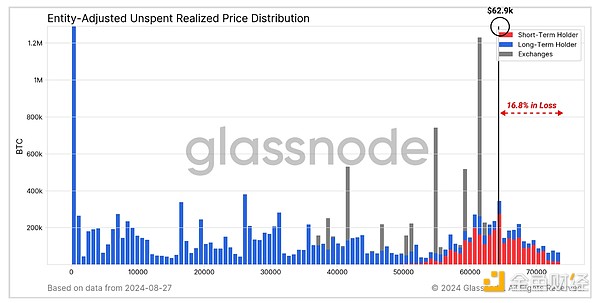

Another way to visualize the migration of tokens to LTH status is through the URPD indicator, which distinguishes between long-term and short-term holders. Here we can see that over +480k BTC was acquired above the current spot price and is now classified as LTH supply (blocks).

This also means that these LTH tokens are now in an unrealized loss.

Short-lived volatility

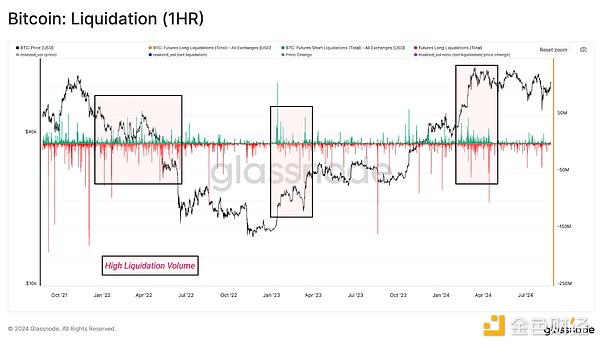

In this final section, we will add analysis of the perpetual swaps market which provides insight into speculation and leverage demand in the Bitcoin market.

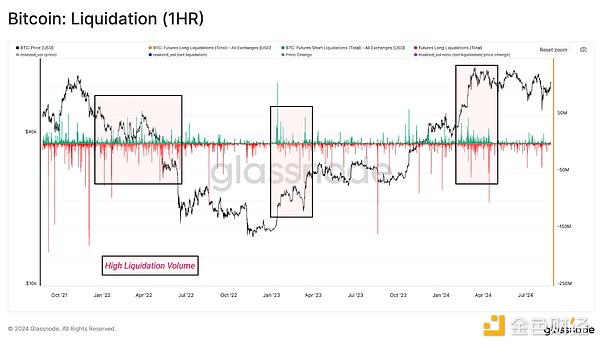

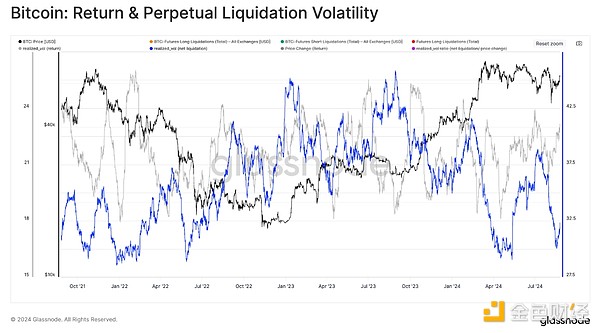

Overall, liquidations have clearly declined in recent months, especially relative to the excitement of setting all-time highs in March. This suggests that speculative demand has fallen and indicates that the current market mechanism is more spot-based.

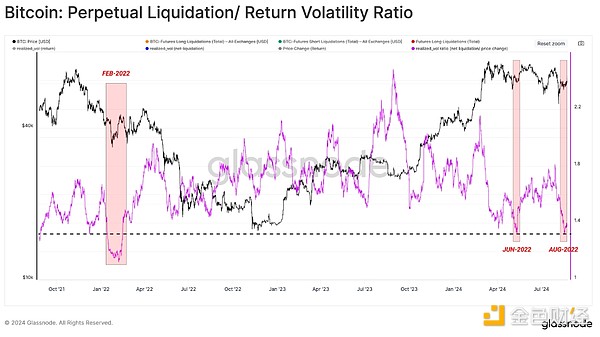

If we compare monthly price volatility to Net Liquidation Volume, we can see a strong correlation between the two factors. This highlights that market volatility is often exacerbated by the squeeze of leveraged positions, as traders find themselves in an offside position when the market moves.

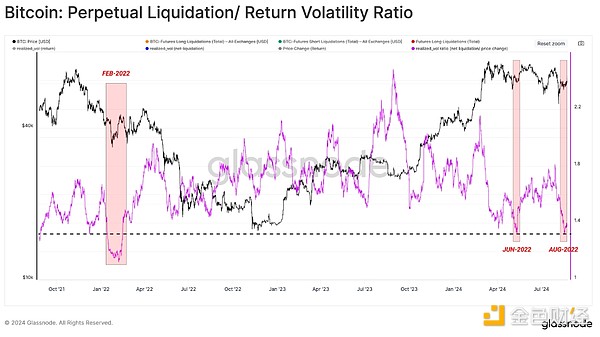

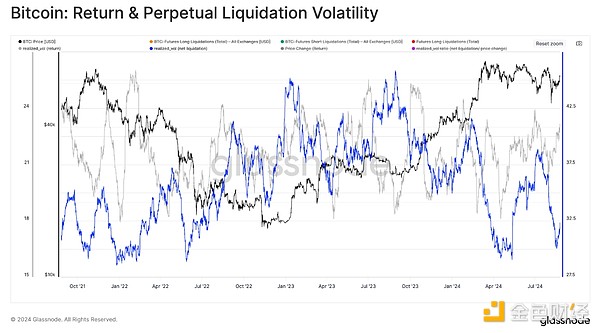

We can also study the ratio between price and net liquidation volume volatility to understand the market's appetite for leverage.

We find that this ratio is falling to its lowest level since February 2022. This reinforces the view that traders are less willing to take high-risk positions, suggesting that speculative interest has significantly reset.

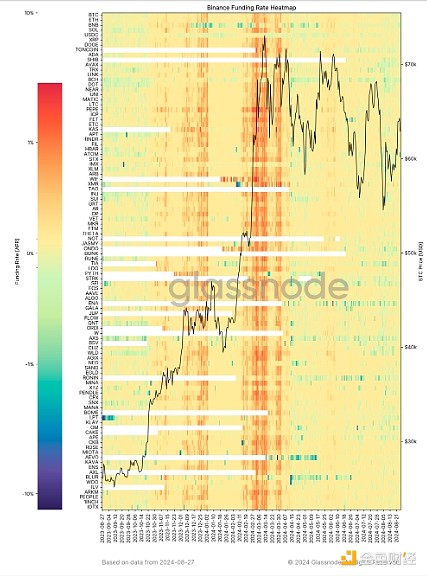

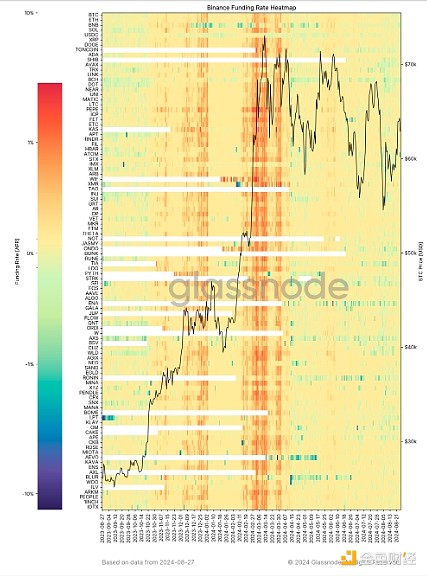

This phenomenon can also be seen in the broader digital asset ecosystem, with a large number of tokens now showing neutral funding rates. This emphasizes the view that there has been a major reset in speculative interest across the market, so the spot market is likely to dominate in the short term.

Summary

A certain degree of balance has emerged in both the on-chain space and the perpetual futures market. This can be observed through the reduction in profit-taking and loss-making activities and the return to neutrality of funding rates across the entire digital asset space. This shows that there has been a significant decline in speculative activity by market investors, regardless of the instrument or asset class.

In addition to this, the market has been in a structured and orderly downward trend for more than 5 months as consolidation and accumulation have arrived. However, as a matter of historical preference, periods of calm market structure are short-lived and often precede expectations of heightened volatility.

JinseFinance

JinseFinance