Chainalysis, invested by the US FBI, recently released a report.

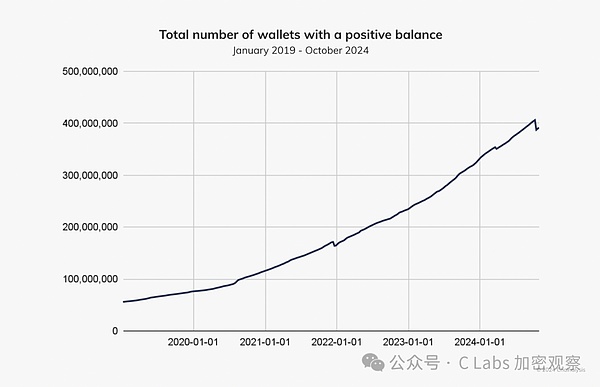

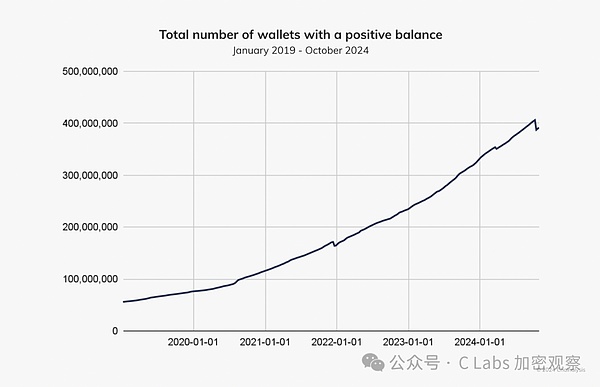

According to this report, the number of active addresses with a global wallet balance greater than zero has exceeded 400 million for the first time:

It is generally believed that active users on the chain are already senior users of encryption. From the curve, the number of active addresses on the chain is also growing exponentially.

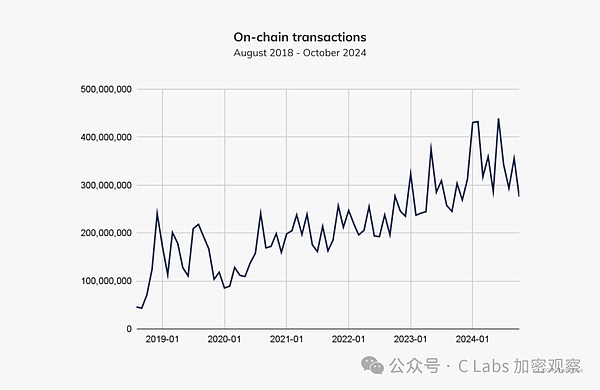

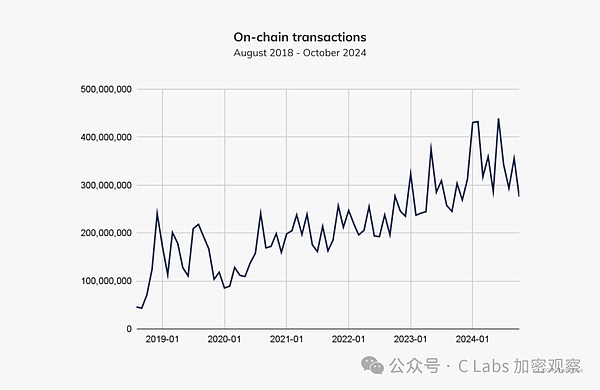

Along with the growth of on-chain addresses, there are also on-chain transactions. Now each address will trade 10 times a month on average, which is quite frequent.

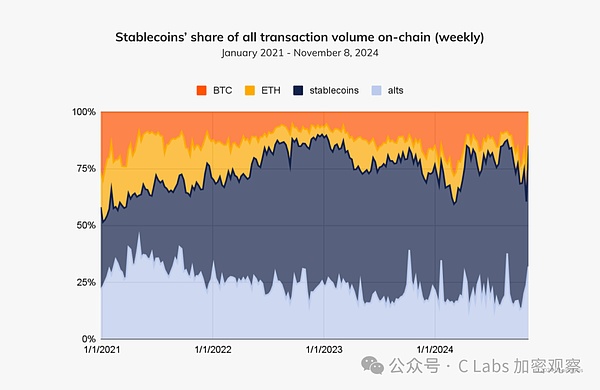

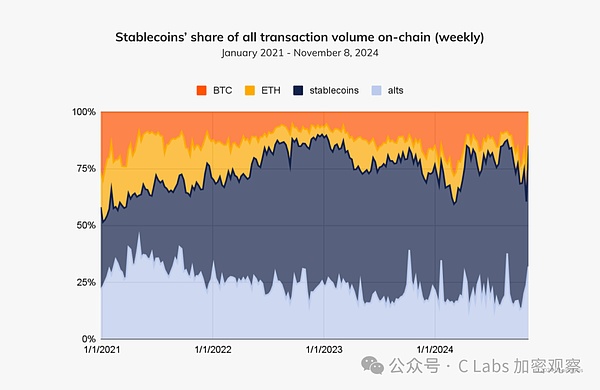

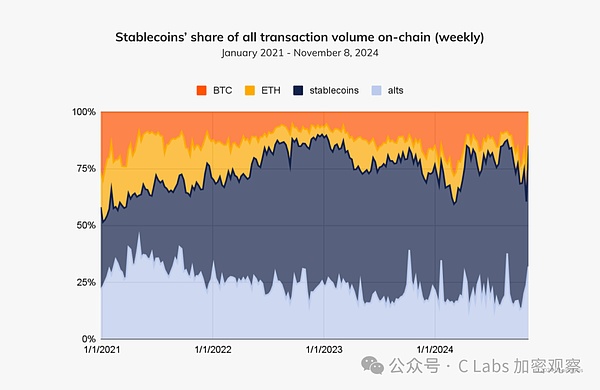

Maybe many people think that the transactions of these on-chain wallets are mainly for meme coins.

But it is not:

The most important on-chain transfer behavior is to transfer stablecoins, which accounts for half of all on-chain transfer funds.

This trend is related to the increasing popularity of encrypted payments, and now many services are gradually accepting cryptocurrencies.

Alts (other tokens) represented by meme speculation account for no more than 25% of on-chain transactions, even lower than the proportion in 2021.

Considering that there will be a large number of money-grabbing parties and project parties in Alts, meme may account for less than 10% of the total transaction volume of the entire chain

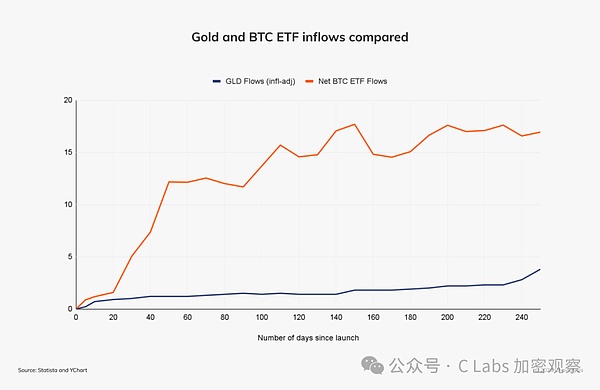

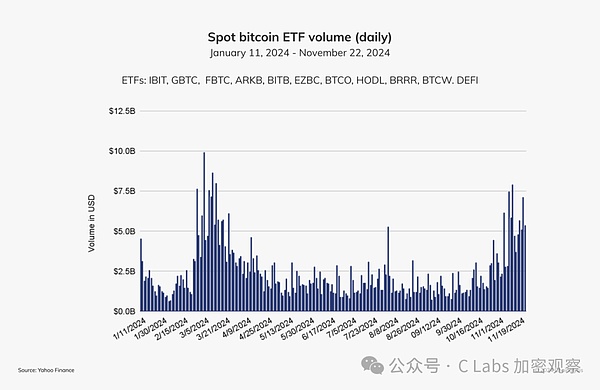

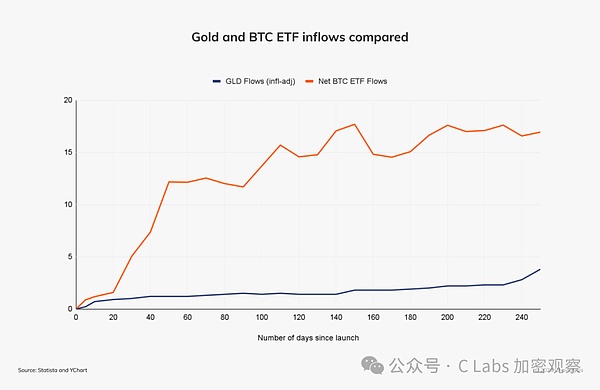

At the same time, the performance of Bitcoin spot ETF is much better than that of gold spot ETF in the same period, with a net inflow of more than 15 billion US dollars in the first 240 trading days.

Considering that the US gold spot ETF was approved in 2004, 20 years earlier. Considering that the US GDP has only increased by 2.4 times compared with 20 years ago, the performance of Bitcoin spot ETF has exceeded that of gold ETF even considering the level of economic development.

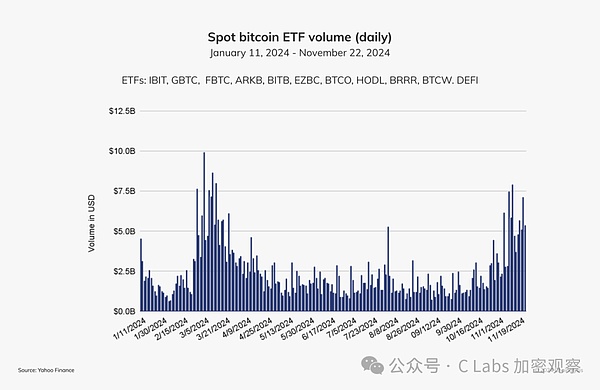

There are now two peak inflow periods in Bitcoin spot ETF: the Bitcoin halving in March and the election in November.

These two time periods coincide with the two periods of Bitcoin's major surge this year, and can be said to be the largest buyers of Bitcoin's rise this year.

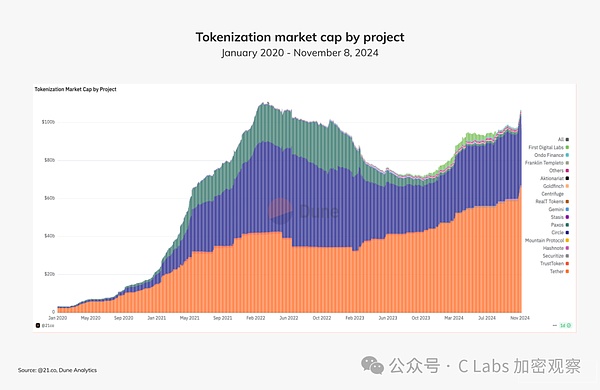

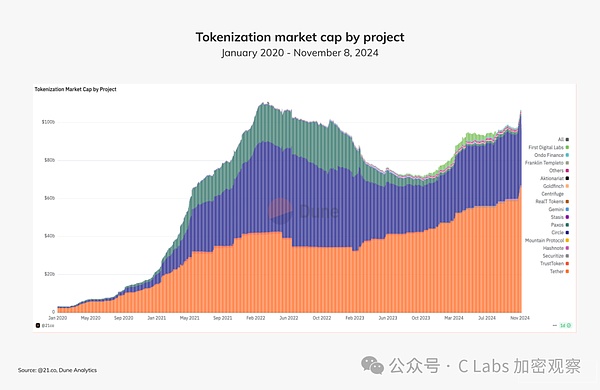

Although the scale of on-chain assets is getting bigger and bigger, the trend of another type of asset that everyone is paying attention to: real-world assets (RWA) is becoming more and more extreme.

RWA's on-chain assets are now mainly stablecoins USDT and USDC issued by Tether and Circle. Other types of on-chain assets are almost dying out from the data.

The total scale of RWA assets is not even as good as the peak in 2022.

Defi also performed poorly. Various defi assets did not surpass the defi summer peak as the on-chain activity increased.

Therefore, I will post this picture again, and everyone can take a close look. The main conclusions are:

1. Bitcoin's on-chain activity is still quite stable, and there will be a market for BTCFi in the future

2. Ethereum's on-chain activity is almost extinct, and now it is estimated that centralized exchanges are the ones that are more hyped

3. Stablecoins are becoming more and more accepted, but the monopoly of giants such as Tether and Circle is obvious, and the others are just players who are trying to get attention

4. There are not as many meme scenarios as imagined

That's all~

Brian

Brian