This article covers the regulatory dynamics and hot event observations of the Web3 virtual asset industry in 2023, focusing on the regulatory enforcement and judicial cases of the virtual asset industry in U.S. jurisdictions, including U.S. securities transactions Commission (SEC) regulatory enforcement against exchanges Kraken, Coinbase, and Binance, Ripple litigation, Grayscale Bitcoin spot ETF litigation, U.S. Commodity Trading Commission (CFTC) regulatory enforcement against DeFi protocols, Uniswap class action lawsuits, etc. These cases have great guiding significance for the virtual asset industry and are expected to shape the future regulatory landscape of the United States and even the global virtual asset industry.

Although the SEC's claims in the lawsuit against Ripple did not receive most support from the courts, the judgment of individual cases did not affect the SEC's decision on the three largest transactions. Kraken, Coinbase, and Binance filed lawsuits. The SEC thus directly raised the most controversial ultimate question in the industry to the US judicial and legislative bodies - "What kind of virtual assets are securities?". I believe this question will be answered in the 2024 US election year.

At the same time, the CFTC has also turned its attention to DeFi after previous regulatory explorations. In this context, the SEC will target CeFi, the CFTC will target DeFi, and FinCEN/OFAC under the U.S. Department of the Treasury will focus on KYC/AML/CTF for global virtual asset circulation. This should be before the 2024 U.S. election year. The regulatory landscape of the virtual asset industry.

From a traditional financial perspective, with the continuous standardization of the market, as well as the clear positioning of Bitcoin products and the continuous recognition of value, Wall Street capital is further promoted of admission. Various traditional financial giants are ready to go forward. When the SEC approves the spot BTC ETF will become a sign of the charge, which is why Grayscale’s victory is so eye-catching.

Before introducing traditional finance, the first thing that needs to be resolved is the biggest uncertainty in the industry - Binance and CZ. As a result, the sky-high settlement case against Binance jointly brought by the U.S. Department of Justice (DOJ), CFTC, FinCen, and OFAC marks the virtual asset industry’s comprehensive move towards implementation and compliance. "Any entity that wants to do business in the United States and benefit from the good financial market in the United States should strictly abide by U.S. laws" This is the strong statement of U.S. Treasury Secretary Yellen.

1. SEC’s soul torture: “What kind of virtual assets are securities?”

After the collapse of FTX and numerous virtual asset platforms in 2022, the U.S. SEC was criticized by the market and members of Congress for failing to regulate this volatile industry in a timely manner. On February 7, 2023, the SEC’s review department announced that it would review “Emerging Technologies and Crypto-Assets” as a priority task [1].

Since then, the SEC has non-stop launched a new round of more stringent and tougher "Regulation by Enforcement" supervision of the virtual asset industry. The target is pointed at the ultimate question of "what kind of virtual assets are securities?"

1.1 Kraken’s Staking Product Settlement and Securities Litigation

Among the SEC’s regulatory enforcement actions, the exchange Kraken is the first to bear the brunt. On February 9, 2023, the SEC issued an announcement announcing that the virtual asset exchange Kraken had agreed to pay US$30 million to the SEC and stop providing its staking interest-bearing product (Staking as a Service) to U.S. customers in order to settle the SEC's unsettled sale of its products. Charges for Registered Securities[2].

SEC stated that “when investors provide assets to such staking services, they lose control of those assets and assume the risks associated with these platforms. , there is almost no protection.” After obtaining the investor’s asset KEY, Kraken will control the investor’s assets and use them for any purpose (lack of disclosure information, investors are unknown), and finally promises investors high returns.

SEC Chairman Gary Gensler also personally appeared in a video to explain why pledged interest-earning products such as Kraken need to comply with the U.S. Securities Act: "When a company or When platforms provide you with these types of products and promise returns, whether they call their services Lending, Earn Rewards, APY or Staking, this act of providing investment contracts in exchange for investor funds should be protected by the federal Securities Act. … This enforcement action should make it clear to the market that service providers that provide pledged interest-bearing products must register and provide comprehensive, fair and true information disclosure and investor protection.”

SEC’s logic for determining Kraken’s pledged interest-bearing products as “securities” is as follows: First, Kraken received investors’ funds (complete control); second, the funds were mixed with the fund pool and used by Kraken for a common cause (specifically What it does is unknown); Kraken does promise a return of up to 21% (the return of ETH Staking on the official website of the Ethereum Foundation is around 3%-5%); in the end, investors only participate in investment and achieve it through Kraken’s efforts Return. This satisfies all the conditions of the Howey test, constitutes an "investment contract" and is a securities transaction.

On November 20, 2023, the SEC applied the logic of the above securities identification to the virtual currencies listed on the Kraken exchange. Since the transaction subjects included security tokens (Crypto Asset Securities), the SEC accused Kraken of transferring the exchange, The integration of traditional financial services of brokers and clearing agencies requires registration with the SEC in accordance with legal requirements [3]. This is consistent with Coinbase’s accusations, and both point to the ultimate question of “what virtual assets are securities?”

1.2 Securities litigation against Coinbase, the largest listed compliance exchange in the United States

SEC filed a lawsuit against Coinbase, the largest digital asset compliance exchange in the United States, on June 6. Coinbase became the first virtual asset comprehensive financial service provider listed in the United States in April 2021 and is known for its compliance. This lawsuit reflects the regulatory challenges and compliance framework from the SEC that all virtual asset exchanges need to face [4].

According to the SEC's accusation[5], Coinbase integrates traditional financial services of exchanges, brokers and clearing institutions. Since the transaction targets include securities Tokens (Crypto Asset Securities) need to be registered with the SEC in accordance with legal requirements. As a result, Coinbase's violations include (1) unregistered brokers, including soliciting potential investors, handling customer funds and assets, and charging transaction fees; (2) unregistered exchanges, including providing a platform to aggregate multiple virtual asset purchases. home and seller order matching and execution markets; and (3) unregistered clearing houses, which include holding customers’ assets in Coinbase-controlled wallets and settling customers’ trades by debit.

The SEC also accused Coinbase of offering customers the issuance and sale of unregistered securities through its Staking-as-a-Service Program. The SEC conducted regulatory enforcement against Kraken in February this year for the same reason. In the end, Kraken agreed to pay a settlement of $30 million to the SEC, while Coinbase chose hard steel to the end.

In addition, the SEC also classified 13 tokens on the Coinbase platform as security tokens, including SOL, ADA, MATIC, FIL, and SAND. , AXS, CHZ, FLOW, ICP, NEAR, VGX, Dash, NEXO. It is worth noting that the SEC pointed out that this is a Non-Exhaustive List.

Web3 Comments:

SEC for Kraken and The reason for Coinbase's lawsuit is consistent, that is, because certain tokens on the trading platform are deemed "securities", the trading platform is accused of failing to register exchanges, brokers, and clearing agencies with the SEC. The identification of virtual assets as “securities” has always been the ultimate issue that needs to be resolved by U.S. regulation.

Although SEC Chairman Gary Gensler has so far avoided directly answering the question of whether ETH is a security,Judge Katherine Polk Failla directly stated in the Uniswap case Call ETH a commodity (Crypto Commodities). Considering that the judge also heard the SEC v. Coinbase case, her response to whether virtual assets are "securities": "This situation is not decided by the court, but by Congress". The ultimate question is thrown to the U.S. legislative body—Congress. However, this congressional legislative process will be lengthy, and the 2024 election year will be filled with uncertainty.

However, it is precisely because of this uncertainty that the SEC's regulatory strategy has huge room for development. The SEC will try its best to avoid in-depth treatment of the definition of "securities" (just as Gary Gensler pretended to be deaf and dumb at the hearing), but will use the identification of project tokens as "securities" as a breakthrough, thus opening up a deeper understanding of the project. Level of investigation, such as whether there is money laundering, market manipulation, misleading investors, etc. The best example is the Binance and CZ settlement case at hand.

So, it is not important whether a single project token is recognized as a "security" (such as SEC v. Ripple). What is important is that when the project party is subject to SEC After regulatory enforcement, in addition to paying the penalty and accepting the penalty, the SEC will also require the project party to implement an internal control program.When this internal control program is adopted by more and more project parties, this internal control program will naturally become a regulation . This is how Gary Gensler squeezed out regulations when he previously served as CFTC chairman, which is basically consistent with the current situation in the SEC.

2. Whether Ripple is a "securities" or not requires further clarification from the court

On July 13, 2023, SEC v. Ripple, a major litigation case in the virtual asset industry that lasted for three years and cost US$200 million, finally came to a "brief" conclusion. In this 34-page ruling [6], the judge pointed out thatRipple’s fundraising activities with institutional investors were investment contracts and the sale of “securities”, while the sale of tokens through exchange program algorithms The behavior does not constitute an investment contract and does not constitute the sale of "securities".

On December 22, 2020, the SEC filed a lawsuit against Ripple and its founders, saying that starting in 2013, Ripple and its founders Ripple's token, XRP, has been offered and sold (offered to Sell or Sold) multiple times, through a variety of methods, in exchange for more than billions of dollars. However, Ripple and its founders did not register their issuance and sale of tokens with the SEC, nor did they obtain any registration exemption from the SEC, thus violating the relevant provisions of Section 5 of the U.S. Securities Act regarding securities offerings.

The judge in this case cleverly avoided the most controversial issue among US regulators - What kind of virtual assets are securities? ? Rather, we will look at whether the different offerings of XRP tokens constitute the offering of “securities” by judging the economic substance of token transactions. The judge held that the underlying objects of most investment contracts are only commodities, such as gold, crude oil, etc., which do not necessarily meet the definition of "securities". The same applies to Ripple’s XRP token.

As for the institutional sales of XRP, due to Ripple’s public announcement and promotion and the rational understanding of institutional investors, the judge believed that this kind of token sale The method meets the Howey test and constitutes an offering of "securities". As for XRP's exchange sales (Programmatic Sales), the way in which secondary market investors expect profits may not necessarily be the efforts of the Ripple project team, but may be more based on the judgment of its market macro environment, the use of trading strategies, etc., so Failure to meet the Howey test does not constitute an offering of "security."

For other distributions, this includes XRP payments to employees and payments to third parties (ecosystem participants). The judge held that this method of offering did not meet the definition of "investment of money" under the Howey test, that is, there was no record of any investment of money or other tangible consideration for Ripple.

This ruling has brought major benefits to the market. Many exchanges such as Coinbase, Kraken, Gemini and Crypto.com announced the reopening of XRP trading, and XRP rose even more. It once reached about 75%, with a market value of more than 42.8 billion US dollars, ranking fourth in the world. However, it should be noted that this ruling was made by the local court and is not binding.

On August 18, 2023, the SEC has formally submitted an interlocutory appeal motion to the Southern District Court of New York, seeking an interlocutory appeal (Interlocutory Appeal) against the summary judgment order in this case. ). The motion was rejected by the court, and there will be another court debate on the appeals related to this case in April 2024.

Web3 Xiaolu Comments:

In this case, we also see that the judge’s idea is to dilute the definition of the token itself (For example, the underlying objects of many investment contracts are "commodities"), and they are more inclined to judge the way tokens are issued and sold (for example, Solo Staking itself does not constitute a "security", but Staking Financial products may constitute "securities"). This may be a regulatory idea in the future.

In addition, the judge’s determination of Other Distributions is consistent with the SEC’s “Analysis of Digital Assets Constructing Investment Contracts” revised on March 8, 2023 Framework for “Investment Contract” Analysis of Digital Assets [7] There are large differences.

SEC believes that in addition to the conventional definition of "money (usually currency)" that we can understand, other definitions of "money" include but do not Limited to: (1) Investors receive digital currency rewards by completing specific tasks (Bounty Program); (2) Investors receive digital currency rewards through air drops. I believe that this conflict will be more fully argued in the appeal case.

Although this case seems to bring a short-term "victory" to Ripple, judging from the lawsuits against large exchanges such as Kraken, Coinbase, and Binance, The SEC is no longer limited to the "security" determination of a single token. The SEC wants to seek an All-in-One answer from Congress.

3. Grayscale wins the SEC lawsuit. How far is it from the Bitcoin spot ETF?

On August 29, 2023, a U.S. federal court ruling allowed Grayscale to win a lawsuit against the SEC’s refusal to apply for a Bitcoin spot ETF. [8]. The move is likely to accelerate the process over the past few months of filings for Bitcoin spot ETFs from traditional financial giants such as Blackrock and Fidelity.

In October 2021, Grayscale first applied to convert its closed-end Bitcoin trust, GBTC, into a Bitcoin ETF. But it was later rejected by the SEC, which said Grayscale failed to answer questions about preventing market fraud and manipulation. Last year, Grayscale filed a lawsuit against the SEC, asking the court to review the SEC's administrative actions.

SEC previously allowed the trading of Bitcoin futures ETFs for the first time in 2021 and said: Futures products are more difficult to manipulate because the market is based on the Chicago Mercantile Exchange (CME) futures prices, while the Chicago Mercantile Exchange is regulated by the CFTC.

In the lawsuit, the judge stated that administrative actions taken by administrative agencies must be treated equally. This is a basic principle of administrative law. The SEC recently approved two Bitcoin futures ETFs and allowed trading on exchanges, but declined to approve Grayscale’s Bitcoin spot ETF. The SEC’s denial of Grayscale’s application was arbitrary and unfounded because the SEC failed to explain how it treated similar ETF products differently. Therefore, the Court found that this disparate administrative action violated administrative law, granted Grayscale’s request, and reversed the SEC’s denial of the application.

Web3 Xiaolu Comments:

Currently the court has not ordered the SEC to approve Grayscale’s ETF application. The ruling document simply said that the SEC's analysis of the "fraud and manipulation" issues was wrong. So what will the SEC do?

One possibility is that the SEC will choose to continue to fabricate a different reason to deny Grayscale's application and force it to proceed with a longer and more expensive process. litigation. It’s entirely possible, but it depends on whether the SEC can swallow the bitter pill of this defeat and Gary Gensler’s determination to continue fighting the virtual asset industry. Another possibility is that the SEC will use this court ruling as a step towards its graceful exit from its opposition to Bitcoin spot ETFs. The SEC can write in its press release: "Although we disagree with the court's decision, we must abide by the law and uphold judicial justice."

Although we see The SEC has delayed multiple negative news of approving Bitcoin spot ETFs, and has seen multiple positive news of active coordination between the SEC and applicant institutions. However, in an interview with CNBC on December 15[9], Gary Gensler said for the first time Responded positively to the matter of Bitcoin Spot ETF: "After the court expressed different views on the SEC's refusal to approve the Bitcoin Spot ETF, the SEC will re-examine the approval of the ETF." It can be seen that this is at least Gary Gensler A change of attitude. The next ETF approval window is January 10, 2024.

4. The ins and outs of the sky-high price settlement between Binance and CZ

U.S. regulation has been paying attention to Binance for a long time. We can see the presence of almost all U.S. regulatory agencies from Binance’s regulatory enforcement, covering the stablecoin regulatory perspective of New York State financial regulation, the SEC’s securities compliance perspective, and the CFTC’s derivatives From the compliance perspective, FinCen’s customer identification (KYC) and anti-money laundering (AML) perspectives, OFAC’s counter-terrorism financing (CTF) perspective, and DOJ’s illegal and criminal perspective, it can be said to be a textbook-level regulatory compliance case.

4.1 New York financial regulators require Paxos to stop planning for its stablecoin BUSD

On February 13, 2023, Binance CZ issued a statement: The New York State Department of Financial Services (NYDFS) instructed stablecoin issuer Paxos to stop minting new BUSD. Meanwhile, Paxos confirmed it had received notice from the SEC regarding potential charges related to its BUSD product.

Paxos is a stablecoin issuer registered in New York State. It holds a New York State Bitlicense virtual asset operation license and is directly supervised by NYDFS. Its BUSD product Built on the Ethereum blockchain, and in accordance with the requirements of the "USD Stablecoin Issuance Guidelines" [10] issued by NYDFS in June 2022, full reserves are made at a 1:1 US dollar asset basis.

NYDFS has the right to require compliance matters such as failure to complete regular user risk assessments and due diligence commitments to prevent the occurrence of bad behavior (such as money laundering). Paxos stops issuing BUSD or directly stops Paxos's Bitlicense license. NYDFS said: This regulatory move is to clarify the unresolved complex issues between Paxos and Binance. Paxos responded to NYDFS’s regulatory measures through its official website, stating that starting from February 21, Paxos will stop issuing new BUSD tokens in accordance with NYDFS’s instructions and working closely with it, and will terminate its partnership with Binance on BUSD.

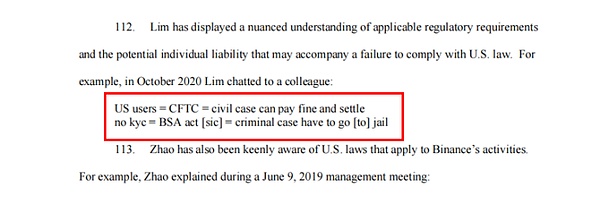

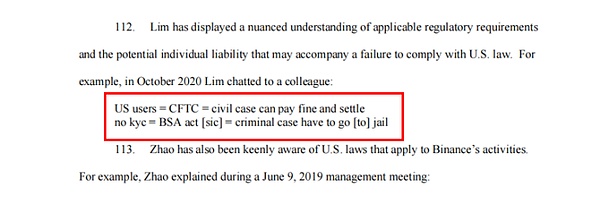

4.2 CFTC accuses Binance and CZ of deliberately evading US laws and illegally operating virtual asset derivatives business

On March 27, 2023, the CFTC announced that it had filed a civil lawsuit in a U.S. court, accusing CZ and its three entities operating the Binance platform of multiple violations of the Commodity Exchange Act (CEA). ) and CFTC regulations[11]. According to the indictment, from July 2019 to the present, Binance offered and executed virtual asset derivatives transactions to U.S. citizens (despite blocking U.S. IP addresses), and at CZ’s direction, Binance directed its employees and customers to circumvent compliance controls ( Including using VPNs, setting up shell companies, etc.), deliberately evading US laws, conducting business in opaque ways, ignoring the regulations of the CEA and CFTC, and at the same time conducting planned regulatory arbitrage to gain commercial interests [12].

CFTC accuses Binance, an entity that provides virtual asset derivatives services in the United States, to register with the CFTC and assume KYC and other compliance obligations, and implement measures aimed at preventing and basic compliance requirements for detecting terrorist financing and money laundering. Binance has never registered with the CFTC.

Therefore, the CFTC accused CZ and its affiliates in civil litigation of violating relevant laws and regulations on futures trading, and of neglecting supervision, failing to implement KYC or Anti-money laundering procedures, as well as the development of substandard compliance plans, etc., we sought civil penalties and permanent trading and registration bans against CZ and its affiliates.

(from CFTC v. Zhao et al, legal opinion given by Samuel Lim, former Chief Compliance Officer of Binance Samuel Lim)

CFTC Chairman Rostin Behnam said: “Today’s enforcement action demonstrates that no jurisdiction, or jurisdiction claimed, can prevent the CFTC from protecting U.S. investors. The CFTC will continue to use all of its authorities to detect and disrupt operations in the volatile and high-risk virtual asset industry. Misconduct in... For years, Binance knew they were violating CFTC regulations but still worked aggressively to keep funds flowing and avoid compliance. This should be a warning to everyone in the virtual asset industry that the CFTC will not tolerate intentional Acts of circumventing US laws."

4.3 The SEC filed 13 charges against multiple entities including Binance and its founder CZ

On June 5, 2023, the SEC filed 13 charges against multiple entities including Binance and its founder CZ, including operating unregistered exchanges, brokerage trading and clearing agencies; conducting false transactions and ineffective supervision of Binance US; and issuing and selling unregistered securities[13].

In the 136-page prosecution document [14], the SEC accused CZ and Binance and other entities from multiple dimensions: Binance is illegal Soliciting U.S. investors to buy, sell, and trade virtual currencies without restricting U.S. investors from accessing Binance.com; Binance issued and sold securities without registration, including BNB, BUSD, and loans known as "Simple Earn" and "BNB Vault" products, as well as the so-called staking investment program offered on Binance. The SEC also pointed out that Binance secretly controlled the assets pledged by U.S. customers in the BAM staking program; multiple entities such as Binance repeatedly misled investors, allowing them to mix customer assets at will or The transfer of customer assets, including to Merit Peak Limited, an entity actually controlled by CZ, echoes similar accusations made by FTX and its founder Sam; multiple entities such as Binance should register as stock exchanges, broker-dealers and clearing agencies Operating without registration; Binance.US lied about preventing market manipulation and allowed wash trading by an undisclosed “market maker” trading company, Sigma Chain, which is also owned by CZ.

SEC Chairman Gary Gensler criticized CZ and multiple entities such as Binance for "establishing a network of massive deception, conflicts of interest, lack of disclosure and deliberate evasion of the law." . “As alleged, CZ, as well as multiple entities such as Binance, misled investors about their risk controls and false trading volumes, while actively concealing the platform operator, manipulating its affiliated market makers to conduct transactions, and even using investor-escrowd funds. "They attempt to evade U.S. securities laws through false controls so that they can keep high-value U.S. customers on their platforms. The public should be wary of transferring any of their hard-earned assets to their platforms," Gensler said in the release. Invest in these illegal platforms.”

4.4 Binance’s sky-high settlement with CZ

On November 22, 2023, Binance admitted that it violated relevant anti-money laundering, business compliance and other regulations of the Bank Secrecy Act, Economic Sanctions Act, and announced that it would cooperate with the U.S. Department of Justice (DOJ) and U.S. Commodity Futures Trading The Commission (CFTC), the Office of Foreign Assets Control (OFAC) and the Financial Crimes Enforcement Network (FinCEN) reached a sky-high US$4.3 billion settlement[15].

Press release: Binance’s biggest problem is that it did not strictly implement user identification (KYC)/anti-money laundering (AML)/anti-terrorist financing (KYC) in the early stages of customer expansion and business development. CTF) relevant provisions. Binance’s laissez-faire behavior of putting interests above compliance has resulted in a large amount of funds flowing into the hands of terrorists, cyber hackers and other criminals.

Although Binance has blocked U.S. customers because it is not compliantly registered in the United States, according to the CFTC’s accusation, it still provides important U.S. customers with KYC/AML avoidance /CTF’s measures violate the relevant regulations that need to be followed when conducting business in the United States. This behavior allows customers subject to U.S. sanctions to enter the U.S. financial market through Binance, seriously endangering financial market stability and national security. Note, this is National Security, so it also makes OFAC deeply involved.

U.S. Treasury Secretary Yellen said: "This historic settlement is a historic moment for the virtual asset market. Anyone who wants to invest in the U.S. To develop business, entities that benefit from the sound financial market in the United States should strictly abide by U.S. laws." According to the U.S. Treasury Department announcement, as part of the settlement, Binance will completely withdraw from the United States and appoint a five-year supervisor. Responsible for overseeing the exchange’s sanctions compliance program. During this period, the U.S. Treasury Department will have access to Binance’s records and systems.

Web3 Xiaolu Comments:

After many years of US supervision The investigation did not mention any misappropriation of customer funds by Binance or other serious fraud similar to FTX in the settlement, which is a good thing. More importantly, this settlement gives Binance a green light to expand its business in the United States in the future, which means that this settlement "whitewashes" Binance's previous bad behavior. In the long run, this is a good thing for Binance.

Of course, it is not easy to build a high-rise building in the United States through the "empty shell" Binane US. How to conduct business in the United States in compliance with regulations, establish a controlling entity, Applying for a license takes time, and perhaps the acquisition control method is more suitable for Binance, which has deep pockets.

What needs to be pointed out is that this settlement has nothing to do with the SEC, and the previous SEC lawsuit against Binance still exists.

5. U.S. regulators are actively exploring ways to regulate DeFi

On April 6, 2023, the U.S. Department of the Treasury released the 2023 DeFi Illegal Financial Activities Assessment Report [16], which is the world's first DeFi-based assessment report [16]. The illegal financial activities assessment report is also a response to the virtual asset regulatory framework released by the White House in March 2022.

Under the guidance of this report, U.S. regulation has gradually formed a regulatory framework for DeFi through judicial practice, including the CFTC’s supervision of DeFi protocols from the business compliance level. Regulatory guidance; FinCEN is responsible for preventing and punishing domestic and foreign money laundering activities, combating terrorist financing and other financial crimes, and is responsible for collecting and analyzing financial transaction information, and tracking suspicious persons and activities by studying mandatory disclosure information of financial institutions; OFAC Responsible for the administration and enforcement of all economic and trade sanctions based on U.S. national security and foreign policy; as well as DOJ's punishment of criminal offenders.

DeFi's financial stability, opacity caused by data anonymity, lack of integrity in the market, and hacker network security have all posed challenges to the current regulatory framework. How to determine the responsible subject of DeFi projects, how to solve project abuse, regulatory arbitrage, etc. These issues are all issues that regulators urgently need to respond to.

OFAC has issued a review on the coin mixer DeFi protocol Tonardo from the perspective of AML/CTF since August 2022. After Cash launched economic sanctions, the CFTC further expanded the regulatory dimension of DeFi projects on the chain in its successful case against Ooki DAO [17]. The CFTC directly defined the DAO on the chain as an unincorporated organization on the grounds that the business of Ooki DAO was illegal, setting a precedent that the DAO on the chain could bear legal responsibility as the subject of the lawsuit. What is even more frightening is that, All members participating in governance may bear joint and several liability for the DAO. After DAO can be sued, the chain is no longer a place outside the law, and regulatory law enforcement agencies can use this as a breakthrough to supervise DAO, DeFi, and DEX projects on the chain.

5.1 The U.S. Department of Justice files criminal charges against the founder of Tornado Cash

On August 23, 2023, the DOJ filed criminal charges against Tornado Cash founders Roman Storm and Roman Semenov, accusing the two of conspiring to launder money, violating sanctions and operating an unlicensed money transfer business during the operation of Tornado Cash [18 ].

Tornado Cash was once a well-known currency mixing application on Ethereum. It aims to provide users with privacy protection for transaction behavior. It obfuscates the source of virtual currency transactions, destination and counterparty, thereby achieving private and anonymous transactions. On August 8, 2022, Tornado Cash was sanctioned by OFAC, and some on-chain addresses related to Tornado Cash were included in the SDN list. It is illegal for any entity or individual to interact with the on-chain addresses in the SDN list. .

OFAC stated that since 2019, the amount of money laundered using Tornado Cash has exceeded US$7 billion. Tornado Cash has provided substantial support for illegal network activities in the United States and abroad. These actions may pose a significant threat to the national security, foreign policy, economic health, and financial stability of the United States and are therefore subject to sanctions by OFAC.

DOJ said in an August 23 press release: Defendants and their co-conspirators created the core functionality of the Tornado Cash Service to pay for critical infrastructure operating expenses to Promote your services and get millions of dollars in return. The defendants knowingly knew the illegality of the transactions and chose not to implement legally required KYC/AML compliance measures.

Web3 Comments:

DOJ, OFAC It is understandable that DeFi protocols and developers that threaten national security will be sanctioned, but when there is no threat to national security, should the developers of decentralized protocols bear responsibility for evil third parties, or be responsible for the resolutions resulting from loose community voting? , remains an open question.

The court gave different answers in the Uniswap case and the CFTC’s settlement of three DeFi protocols.

5.2 Uniswap’s winning investor—the first referee in the context of decentralized smart contracts

In April 2022, a group of investors took Uniswap developers and investors to court collectively, accusing the defendants of failing to register in accordance with the U.S. federal securities laws and illegally listing "fraudulent tokens" that caused investment If the person suffers damage, he shall seek compensation for damages[19].

Presiding judge Katherine Polk Failla said that the real defendant in the case should be the issuer of the "fraudulent token" rather than the developers and investors of the Uniswap protocol people. Due to the decentralized nature of the protocol, the identity of the issuer of the fraudulent tokens was agnostic to the plaintiffs (and equally agnostic to the defendants). The plaintiff can only sue the defendant in the hope that the court will transfer its right of recourse to the defendant. The reason for the prosecution is that the defendant provided the convenience of issuance and trading platform to the fraudulent token issuer in exchange for the handling fees generated by the transaction.

Taken together, the judge believes that the current virtual asset regulatory system cannot provide a basis for the plaintiff’s claims, and according to the current U.S. securities laws, the development ofUniswap The authors and investors shall not be liable for any damages caused by the use of the protocol by third partiesand the plaintiff's lawsuit was therefore dismissed.

Web3 Xiaolu Comments:

The case is In the first judgment in the context of centralized smart contracts, the judge admitted that there is currently a lack of judicial precedents related to DeFi protocols. No court has yet made a ruling in the context of smart contracts in decentralized protocols, and no court has found a way to hold the defendant legally responsible under the securities law. way.

Section 12(a)(1) of the Securities Act gives investors the right to sue for damages due to violations of Section 5 (Registration and Exemptions of Securities) of the Securities Act. Right to compensation. Because the complaint was based on the regulatory dilemma of whether virtual assets are "securities," the judge said: "This situation is not decided by the court, but by Congress." The court refused to extend the Securities Act to the plaintiff. alleged conduct and concluded, citing a lack of relevant regulatory basis, that "investor concerns are better raised with Congress rather than with this Court."

In any case, while laws are currently being formulated around DeFi, regulators may one day address this gray area. However, the Uniswap case does provide the virtual asset industry with a sample of how to respond to regulation, namely thatdecentralized exchange DEX cannot be held responsible for losses suffered by users due to tokens issued by third parties. This actually has a greater impact than the Ripple case and is good for the industry.

5.3 The CFTC turns its attention to DeFi and may be a more terrifying regulator than the SEC

< p style="text-align: left;">On September 7, 2023, the CFTC once again focused its regulatory enforcement on DeFi and imposed sanctions on Opyn, Inc., ZeroEx, Inc., and Deridex, Inc., three companies located in the United States. The blockchain company imposed penalties, and the company eventually accepted the penalty and settled [20].

Press release: Opyn and Deridex developed and deployed DeFi protocols and websites respectively, providing token derivatives trading and perpetual contract trading respectively; ZeroEx developed and deployed In addition to the protocol (0x Protocol) and DEX applications, there are some leveraged/margin tokens deployed by unaffiliated third parties on DEX for investors to trade. The above transactions can only be provided to retail users on registered exchanges that comply with the provisions of the U.S. Commodity Exchange Act (CEA) and CFTC. However, the three have never registered to illegally provide services, nor have they performed the KYC required by the Bank Secrecy Act.

According to the charges, the CFTC required three developer-operated companies, Opyn, ZeroEx and Deridex, to pay civil penalties and require them to cease violations. CFTC Director of Enforcement Ian McGinley said: “Once upon a time, there was an inherent idea among DeFi project parties that the chain was a place outside the law. However, this is not the case. The DeFi industry may be innovative, complex, and constantly evolving, but law enforcement We will also keep pace with the times and actively pursue those illegal and unregistered platforms that allow US users to trade derivatives."

Web3 Xiaolu Comments:

CFTC members proposed in their objection statement: If a DeFi protocol is developed and deployed for legitimate purposes, but is used by an unrelated third party for purposes that violate CEA and CFTC regulations, then who should respond Take responsibility? Are developers of DeFi protocols forever liable? These questions have actually been answered in previous Uniswap cases. The court told us from a judicial perspective: Uniswap developers and investors should not be liable for any damage caused by third parties using the protocol, because the underlying smart contract of Uniswap and the third party The token contracts deployed by the three parties are completely different.

There is a huge space here that needs to be fully discussed and debated. The perspective of most lawyers on this issue is consistent with the perspective of the judge in the Uniswap case, that is, the evil third party should be held responsible for the damage caused, rather than the developers who cannot control the evil third party to commit the infringement. The developers are just Just post the submitted code.

However, combined with the DOJ’s criminal charges against the founder of Tornado Cash, the CFTC v. Ooki DAO case, and the CFTC’s regulatory enforcement this time, it can be seen that supervision is not Think so. The CFTC will still attribute the responsibility of evil third parties to developers, even if developers cannot control the behavior of evil third parties. For example, in the regulatory enforcement against ZeroEx, the supervision did not consider whether the protocol developers were related to the listed derivatives tokens, or whether the protocol developers had the ability to control the listing of the derivatives tokens.

Previously, through the case of Ooki DAO, the CFTC realized the identification of DeFi business violations and the responsibility for the DAO on the chain and the voting members within the DAO. After DAO can be sued, the chain is no longer a place outside the law. Supervision and law enforcement agencies can use this as a breakthrough to supervise DAO, DeFi, and DEX projects on the chain. This case is the CFTC’s further expansion in the field of DeFi regulatory enforcement.

Full text complete

This article is for study and reference only. I hope it is helpful to you and does not constitute any legal or investment advice, not your lawyer, DYOR.

Bernice

Bernice