Author: Climber, Golden Finance

About 20 years later, people will look back and say, "Where were you during the digital gold rush?" - Michael Saylor.

Recently, MicroStrategy has once again become the focus of market attention due to its $42 billion Bitcoin plan, and its market value has successfully surpassed Coinbase due to the rise of Bitcoin.

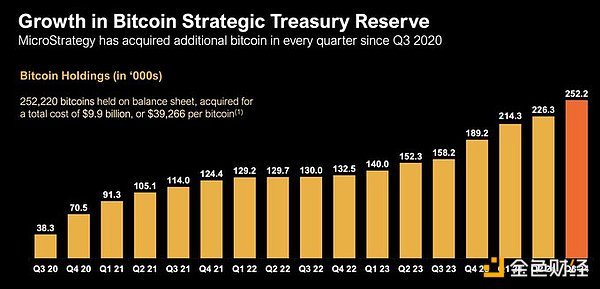

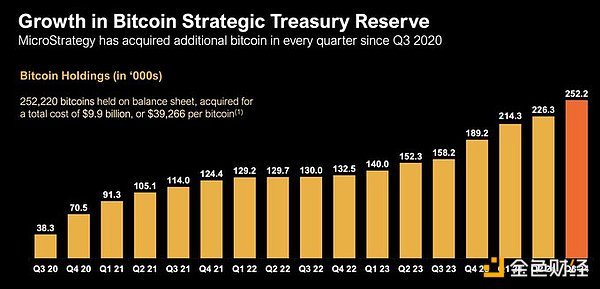

Since Q3 2020, MicroStrategy has continued to buy Bitcoin. In the past year, the company has raised billions of dollars to increase its Bitcoin reserves through the sale of convertible preferred notes, equity splits, leveraged ETFs, etc. Currently, the company holds up to 252,220 BTC, with a BTC yield of 17.8% year-to-date, and its investment in Bitcoin has $8.4 billion in unrealized profits.

All in BTC makes MicroStrategy the best performing U.S. stock since the crypto market crashed two years ago, even surpassing Nvidia, the benchmark of the AI industry. However, the almost all-in investment behavior has also made many analysts worry about whether its high-premium stocks, continuous performance declines and limited cash flow will force it to sell Bitcoin to the market, thereby triggering the risk of a price spiral.

1. Choice is more important than effort: listed companies that have found gold

Microstrategy was founded in 1989 and is headquartered in Washington, USA. It was founded by Michael J. Saylor, Sanju Bansal and Thomas Spahr. Currently, the company is one of the world's largest independent BI (Business Intelligence) companies (NASDAQ: MSTR).

Since its establishment, Microstrategy has maintained 20 years of continuous growth, with annual revenue exceeding US$500 million, mainly from BI software and services. Its main competitors are SAP's Business Objects, IBM's Cognos and Oracle's BI platform.

However, due to the company's own operating reasons and the decline of the industry cycle, Microstrategy performed mediocrely in the first 20 years of the new century, and its stock price has not improved since it fell from its high point.

However, the gears of fate began to turn in 2020, and Microstrategy made the most correct choice for the company so far - adopting an investment strategy in Bitcoin.

According to MicroStrategy's third-quarter 2024 financial results, as of the end of the third quarter, the company held 252,220 BTC, with a BTC yield of 17.8% from the beginning of the year to date. The total purchase cost of Bitcoin is approximately US$9.9 billion, with an average price of approximately US$39,266.

According to Coingecko data, the company is currently the listed company with the most Bitcoin in the world, and this holding also surpasses Grayscale's GBTC.

This business transformation has also brought new vitality to Microstrategy, making it once again a shining star in the financial market.

In the past five years, Microstrategy's stock price has been climbing all the way, rising from around US$15 to US$244.5, an increase of 1490.76%. Not only did the company's stock price exceed the gains of Bitcoin, the S&P 500 Index and major technology stocks, its market value also surpassed Coinbase's $44.87 billion with $49.54 billion.

In addition, as the price of Bitcoin once again broke through $70,000, MicroStrategy's Bitcoin holdings had a floating profit of up to $7.774 billion.

On October 29, Bloomberg ETF analysts said that T-Rex's MicroStrategy two-times leveraged ETF MSTU has risen 225% in just six weeks since its launch, with a trading volume of $500 million (ranked in the top 1% of ETFs) and an asset management scale of $1 billion, exceeding the 1.75-times leveraged MSTR ETF that debuted.

On October 30, Bloomberg reported that MicroStrategy Inc. has outperformed almost all major U.S. stocks, including AI industry benchmark Nvidia Corp, since the crypto market crashed two years ago.

Its high gains were driven by the unconventional decision made by co-founder and chairman Michael Saylor four years ago to buy Bitcoin to fight inflation, a strategy that transformed the little-known enterprise software company into the world's most well-known crypto hedge fund proxy.

Michael Saylor and his team also created the concept of "BTC yield", which MSTR regards as a key performance indicator (KPI) to describe the company's performance in acquiring Bitcoin in an added-value manner. The BTC yield in the third quarter was 17.8%. Recently, the company raised the target range of "BTC yield" from the previous 4%-8% to 6%-10%.

And Michael Saylor personally said that he holds more than $1 billion worth of Bitcoin.

2. Buy Bitcoin in full: the biggest win-win

On October 31, MicroStrategy proposed the "21/21 Plan" with a total investment of up to $42 billion. That is, the company will conduct $21 billion in equity financing and $21 billion in bond issuance in the next three years, and use additional capital to purchase more BTC as a financial reserve asset to achieve higher BTC returns.

MicroStrategy has purchased Bitcoin every quarter since Q3 2020, and the company holds a total of 252,220 BTC to date.

In order to raise funds to buy Bitcoin, MicroStrategy has used a variety of channels, such as convertible notes, stock splits, leveraged ETFs, etc.

In September this year, MicroStrategy bought 18,300 Bitcoins for approximately US$1.11 billion in cash, with an average price of approximately US$60,408. The company has since purchased another 7,420 bitcoins for $458.2 million, at an average price of about $61,750. At the current BTC price of about $72,000, the company's bitcoin is worth more than $18 billion.

The company raised a total of $2.1 billion in the third quarter by selling equity and debt, and $800 million in the three months ended June 30.

1. Convertible Senior Notes

MicroStrategy has launched convertible senior notes several times to purchase bitcoin using the net proceeds from the sale of notes. These notes are MicroStrategy's unsecured senior debt and will bear interest.

These notes will also be converted into cash, MicroStrategy's Class A common stock, or a combination of MicroStrategy's Class A common stock and cash, at MicroStrategy's option.

On September 17, MicroStrategy announced plans to privately issue $700 million in total principal amount of convertible senior notes due in 2028 (the "Notes") to qualified institutional buyers under the Securities Act of 1933. The company then issued a statement saying it would increase the convertible senior notes to $875 million.

Throughout September, MicroStrategy completed a total of $1.01 billion in convertible notes at a coupon rate of 0.625% and a conversion premium of 40%.

In June of this year, MicroStrategy also announced the issuance of $500 million in unsecured senior convertible notes to purchase more Bitcoin, and raised the offering price to $700 million a day later. Immediately afterwards, MicroStrategy completed the issuance of $800 million in convertible notes at a coupon rate of 2.25% and a conversion premium of 35%.

In March of this year, MicroStrategy also issued $525 million and $800 million in convertible senior notes, respectively.

In addition, MicroStrategy has proposed a plan to grant purchase options to the initial purchasers of the notes, that is, to purchase an additional total of up to $75 million in notes on the date of the first issuance of the notes and within 13 days thereafter.

Michael Saylor once wrote that the company used the proceeds from the convertible notes and cash to purchase an additional 9,245 bitcoins, approximately $623 million, with an average price of approximately $67,382 per bitcoin.

2. Equity sales and splits

Stock splits are common in listed companies with significant stock appreciation. Splits do not change the company's valuation, but in the case of many retail-oriented trading platforms that offer fractional shares, they may make it psychologically easier for smaller retail investors to buy the stock by lowering the share price.

For example, recently, chipmaker giant Nvidia (Nvidia) carried out a 10:1 stock split after its share price reached four digits. Driven by the rise of the artificial intelligence (AI) sector, its share price has tripled in a year.

In August this year, MicroStrategy announced that it was seeking to sell its Class A shares to raise up to $2 billion to buy more Bitcoin. However, in the regulatory documents submitted to the US SEC, MicroStrategy did not disclose the timetable for stock sales or how much proceeds would be used to buy Bitcoin.

In July, MicroStrategy announced a 1-for-10 stock split, which will make the company's shares more accessible to investors and employees.

3. Leveraged ETFs

On August 15, the SEC approved the first leveraged long MicroStrategy ETF. Asset management company Defiance ETFs also launched the first leveraged MSTR ETF that month.

Competitors REX Shares and Tuttle Capital Management subsequently launched more leveraged products in September, kicking off what Bloomberg ETF analyst Eric Balchunas called the "hot sauce arms race."

On September 28, the leveraged MicroStrategy (MSTR) exchange-traded fund (ETF) broke the $400 million mark in net assets that week, as retail investors continued to flock to this extremely volatile Bitcoin ETF transaction.

As an ETF, BlackRock's Bitcoin Trust has an expense ratio of 0.25%, while MicroStrategy does not charge shareholders such fees. MicroStrategy benefits from the revenue generated by its analytics business, providing financial stability in addition to its Bitcoin holdings. MSTR has the ability to raise funds through debt and equity issuance, while IBIT relies on direct investor inflows.

MicroStrategy's successful model has also strengthened other institutions' confidence in Bitcoin. For example, in August, Bitcoin mining company Marathon Digital recently sold $300 million in convertible notes to purchase 4,144 Bitcoins; South Korea's National Pension Service (NPS) invested in Bitcoin through MicroStrategy.

Three, huge concerns: leverage and bubbles

MicroStrategy founder Michael Saylor once publicly stated that four years after adopting the Bitcoin strategy, MicroStrategy's performance has surpassed every company in the S&P 500 index. In fact, since 2020, BTC prices have continued to rise and continue to hit record highs. This has also brought high returns to MicroStrategy, and the company currently has $8.4 billion in unrealized profits on Bitcoin.

In July this year, Michael Saylor said at the Bitcoin 2024 conference that by 2045, Bitcoin will rise to $13 million, $49 million in a bull market, and $3 million per coin even in a bear market. In addition, he also said that Bitcoin adoption will enter a high-growth phase from 2024 to 2028

It is precisely because of the confidence in the long-term future of Bitcoin that MicroStrategy has chosen to continue to increase its investment in Bitcoin. There are also different voices in the market about MicroStrategy's "All In BTC" behavior.

The CEO of Two Prime Digital Assets believes that MicroStrategy's plan to raise $42 billion to acquire more Bitcoin is a "win-win". More and more investors are considering how to invest in Bitcoin in the event of further depreciation of the US dollar, which is one of the reasons for the recent strength of Bitcoin prices, which may stimulate more institutional interest in Bitcoin and related investments.

The CEO of CryptoQuant said that Michael Saylor has proved that Bitcoin is the best strategic asset for listed companies. Bitcoin has risen 237% in two years, while MicroStrategy's stock price has risen 669%. Both saw similar declines during the bear market, but MSTR's rebound was three times stronger than Bitcoin.

However, some institutions have expressed concerns, especially whether MicroStrategy will choose to sell Bitcoin due to the company's declining performance.

On October 28, Steno Research reported that MicroStrategy's Bitcoin holdings were at a premium of nearly 300%, but it was difficult to sustain.

Analysts said that the effect of MicroStrategy's recent stock split is weakening, and the launch of U.S. spot Bitcoin ETF options will reduce investor demand for the company's shares.

In addition, the report mentioned that during the 2021 crypto bull market, the company's premium mostly remained below 200%. As the regulatory environment becomes increasingly friendly to Bitcoin and cryptocurrencies, investors may prefer to hold Bitcoin directly rather than MicroStrategy shares.

JPMorgan Chase has also warned that MicroStrategy's previous move to buy $2 billion in Bitcoin could exacerbate the recession. This is because the company's purchase of Bitcoin through debt has added leverage and bubbles to the current cryptocurrency craze and increased the risk of more severe deleveraging in a potential future recession.

In fact, MicroStrategy's market value is at a huge premium to the net asset value of its underlying Bitcoin assets, with the asset premium rate soaring to 175.08%, and the current stock market value relative to its Bitcoin net asset value (NAV) ratio is 3.007.

The valuation of MicroStrategy's main business is between $1.5 billion and $2.5 billion. Even if the upper limit of $2.5 billion is taken, the market's premium rate for MSTR's Bitcoin assets is still as high as 175.08%. This shows that investors who currently buy MSTR shares still expect Bitcoin to rise by nearly 1.75 times, that is, Bitcoin will reach $195,000.

MicroStrategy's large holdings in Bitcoin and its high debt levels have led some market participants to question whether the company will be forced to dump Bitcoin on the market, triggering a price spiral. MicroStrategy founder and executive chairman Michael Saylor previously said he had no intention of selling the company's Bitcoin.

In response, BitMEX Research analysts said the company is highly unlikely to be forced to sell its Bitcoin holdings. If Bitcoin prices remain strong, bondholders may choose to convert to stocks, making forced sales of Bitcoin less likely. While interest payments could theoretically put pressure on MicroStrategy, cash flow from its software business should be enough to cover these costs without selling Bitcoin, even if prices fall.

However, in April this year, Michael Saylor made a profit of $370 million from the sale of company shares. In addition, MicroStrategy lost $53.1 million in the first quarter of this year. The net loss in the second quarter was $102.6 million, and the revenue in the third quarter was $116.1 million, down 10.3% from the third quarter of 2023, and about 5.22% lower than analysts' expectations.

Conclusion

There is no doubt that MicroStrategy is successful at this stage. The continuous rise of Bitcoin has brought a steady stream of investment income to the company, and it has also increased its stake in Bitcoin through debt and leverage under positive feedback. 99% of the total amount of Bitcoin is expected to be mined by January 2, 2035. If Bitcoin can really rise as expected, then MicroStrategy may become the most relaxed high-market-value company in the history of the US stock market.

However, we cannot ignore the concerns of analysts. MicroStrategy is still exposed to multiple risk factors. When the company's liquidity is tight, it may not choose to sell Bitcoin. I just hope that the next black swan will not come too fast, too fierce, or too urgent.

Anais

Anais