Author: Dilip Kumar Patairya, CoinTelegraph; Compiler: Deng Tong, Golden Finance

1. What are cryptocurrency anti-dumping principles?

Anti-dumping principles are designed to protect cryptocurrency investors from pump-and-dump schemes.

The term "anti-dumping principle" refers to actions taken by project developers, communities or exchanges to prevent financial fraud, where scammers sell their cryptocurrencies when the price reaches a certain level in order to exit the market Huge profits were made before. Since then, the price has fallen sharply, causing other investors to suffer significant monetary losses. Anti-dumping principles are designed to combat this scam.

In the field of cryptocurrency , anti-dumping is different from traditional anti-dumping measures taken by governments to protect domestic industries from foreign imports. The government will impose protective tariffs on imported goods and services to level the playing field for domestic producers and save the domestic economy.

2. What is a pump-and-sell scheme in cryptocurrency?

A “pump and dump” scheme involves an organized entity or group of individuals artificially inflating the price of a cryptocurrency token and then selling its cryptocurrency holdings at a profit, thereby causing investors to lose money .

Fraudsters artificially inflate prices by spreading misleading information about the tokens and orchestrating demand for the tokens by coordinating purchases.

To make a profit, unsuspecting investors pre-acquire assets at lower prices. Scammers then dumped or sold their holdings at inflated prices, triggering a dramatic crash. While the initiators made huge profits, other investors (who believed in the potential of the asset due to artificial hype) lost all their investments.

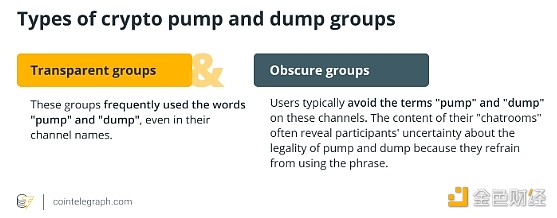

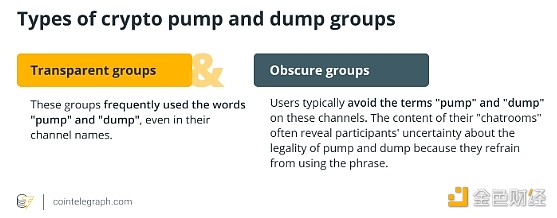

The masterminds of the pump-and-dump scheme took advantage of the largely unregulated cryptocurrency industry. They drive up market sentiment before cashing out the scam tokens, causing other investors to lose money and often lose faith in the crypto ecosystem.

3. How does the anti-dumping plan work?

Anti-dumping measures in the cryptocurrency space help protect investors by imposing limits or fines or setting vesting periods on widespread token dumping.

Anti-dumping regulations restrict the purchase or sale of large quantities of tokens in one transaction, limit orders for the entire supply, apply value limits, or set daily limits or price caps. Sell-offs are often done by fraudulent investors who buy large amounts of tokens to drive up the price significantly and then sell them for huge profits.

Here’s how anti-dumping principles work:

Buy and sell restrictions

In the ever-changing cryptocurrency landscape, projects often take strategic controls to keep their tokens stability and deter market dumping. For example, they incorporate buying and selling restrictions into smart contracts. These technologies are critical for long-term sustainability and investor trust because they reduce the risk of price fluctuations.

Ethereum’s EIP-1559 update changed the fee market mechanism to burn a portion of transaction fees, which can reduce the overall supply over time, potentially increasing value and reducing the incentive to sell.

By incentivizing node operators to participate in the network, Chainlink encourages node operators to retain their Chainlink (LINK) tokens to continue collecting expected rewards, thereby reducing the likelihood of dumping. A certain percentage of Solana’s inflation is earmarked for staking rewards based on a predetermined inflation schedule. Therefore, holders are encouraged to stake their tokens, which reduces the supply of liquidity in the market and discourages dumping.

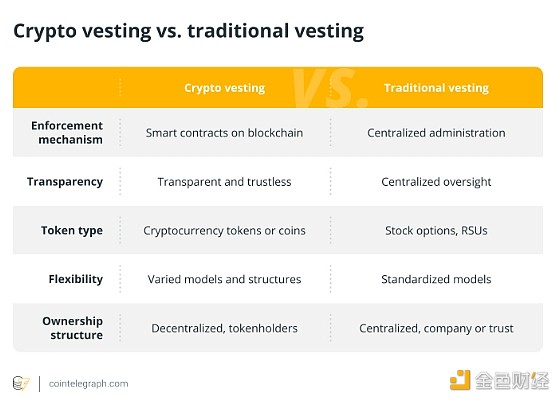

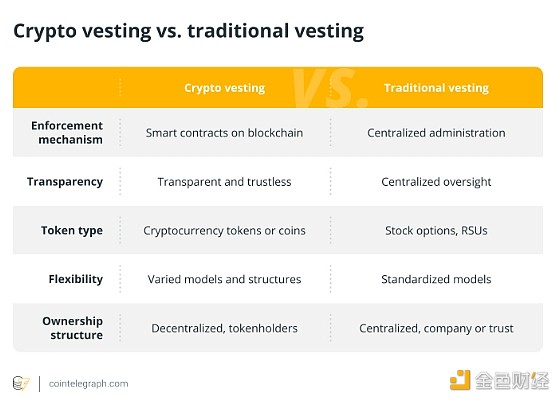

Token vesting

Token vesting requires locking newly created or acquired tokens and releasing them after a predetermined time. Tokens awarded to project founders and initial investors typically vest over time.

This technique prevents tokens from flooding the market and prevents founders from trying to make money quickly and then abandoning the project. Investors should consider the project's vesting schedule.

IV. Investors How to avoid a pump and sell scheme?

Investors should conduct due diligence and choose projects that create value and are transparent. They should avoid projects that promise to get rich quick.

Avoiding harm is often the best way to deal with it. When it comes to cryptocurrencies, investors need to be cautious, conduct adequate research before investing, and avoid projects that appear to be untrustworthy.

Remain vigilant and supervise

Before investing in any project, investors should be alert to the risk of dumping and act with caution. Investors should investigate the project’s founders and their track record, reviewing relevant documents to determine whether there are warning signs.

The Squid token is a good example of a pump and dump scheme where the signs of fraud are clear. The coin dropped from $90 to $0.00079 in just a few minutes. Investigation revealed that the creator of the coin does not exist and is anonymous. The project's website and related documents such as white papers and supplementary materials contain multiple spelling errors.

These warning signs indicate fraud, and if investors were cautious, they could have avoided the scam. Some social media groups say it's coming. Being active in these groups and understanding the warning signs may help prevent this type of fraud.

Ensure the project is audited

Comprehensive smart contract audits help prevent vulnerabilities in the code. Adequate audits emphasize the project's commitment to safety and security protocols. Project owners with fraudulent intentions may intentionally leave vulnerabilities that can be exploited later.

Anti-dumping measures are incorporated through smart contracts and audited by reputable auditors. It's likely that the fraudsters haven't implemented what they claim. If a project is open source, people can look at the code to determine how it works behind the scenes. If investors lack technical knowledge, they can seek help from auditors.

Avoid falling into FOMO

In the cryptocurrency space, “FOMO,” or “fear of missing out,” is a real concern. When digital assets rise in value, many investors feel pressured to take advantage of the trend. This behavior triggered a sharp increase in prices, followed by a sharp decline. For example, Bitcoin’s price recently topped $70,000, driven by factors such as Bitcoin halving expectations and spot Bitcoin exchange-traded fund approvals. Some investors may be affected by FOMO and buy when Bitcoin prices are at their highest, only to end up losing money if the price subsequently falls.

Investors should avoid making large investments in lesser-known cryptocurrencies. In any case, one should not invest more than they can afford to lose.

Consider the Lindy Effect

The Lindy Effect is the idea that the older a non-perishable thing (such as technology) is, the greater its chance of longevity. Technology or projects that have been around for a while will have a higher chance of enduring and maintaining their relevance.

Investors can use the Lindy Effect to evaluate the longevity and potential profitability of cryptocurrency and blockchain projects. If a blockchain project has proven its durability, it is more likely to continue operating and generating profits in the future.

JinseFinance

JinseFinance