Author: James Smith, CoinTelegraph; Compiler: Baishui, Golden Finance

1. What is Dogwifhat (WIF)?

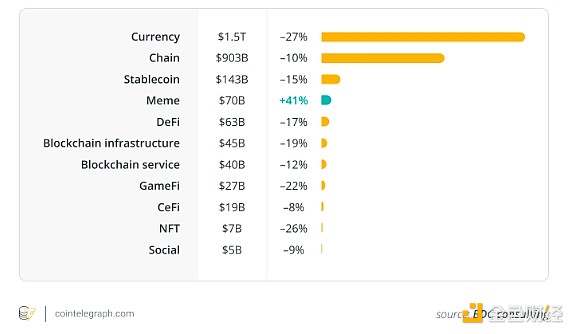

Supported by a community that appreciates the charm and humor of the currency, WIF's trading volume has even surpassed well-known meme coins such as Shiba Inu and Pepe.

Launched in November 2023, Dogwifhat is a Solana-based memecoin with an image of a Shiba Inu wearing a pink knitted hat. Rather than positioning itself as a symbol of progress or a vision of the future, WIF keeps it simple, embracing its meme identity without any grand ambitions. Even the code "WIF" is misspelled with "with", a typical meme form that highlights the fun of the token.

As a memecoin, WIF has no ambitious goals or use cases; it simply adopts a humorous, quirky image of a dog wearing a hat. WIF has a fixed supply of approximately 998.9 million tokens, with no staking or burn mechanism. Its value is derived entirely from community sentiment and speculation, leading to large price fluctuations.

Online hype, social media trends, community awareness, celebrity endorsements, and speculation can cause memecoin prices to rise sharply. Unlike traditional assets, the value of memecoins does not rely on fundamentals, so these price surges are unpredictable.

2. How is Dogwifhat different from other memecoins?

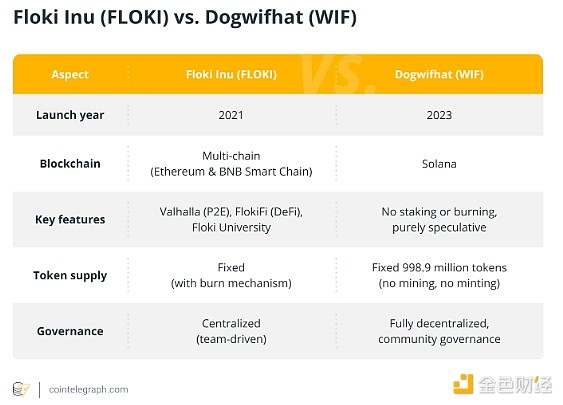

While decentralization should ideally be a fundamental aspect of all blockchain projects, few projects are truly decentralized, let alone memecoins.

Dogwifhat’s governance and structure are in line with the principles of decentralization. No single individual or entity controls Dogwifhat, as ownership has been fully transferred to WIF holders. This eliminates any possibility of influence by the token creator.

In addition to Dogwifhat, another memecoin, Floki Inu, has also been popular recently. Both have attracted the attention of cryptocurrency enthusiasts and memecoin lovers with their unique identities, but both have carved out their own paths with different strategies and communities. Let’s see how these two competitors in the memecoin space differ.

Did you know? The presale of WIF tokens was limited to 29 people, who received 18% of the total supply. Each participant paid 0.6 SOL per wallet, resulting in a large airdrop for these early investors.

3. Dogwifhat's Token Economics

Dogwifhat's token economics model establishes it as a decentralized cryptocurrency where the community of token owners jointly manages the future of the token.

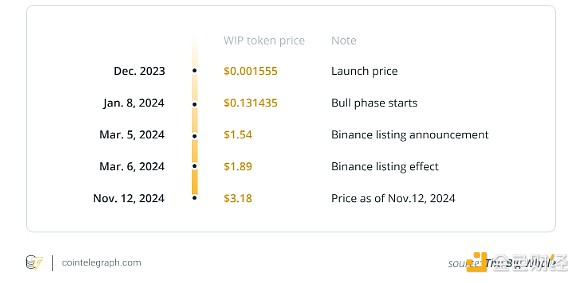

Dogwifhat uses the Shiba Inu mascot to attract memecoin enthusiasts. It has gained a sizable fan base, often attracted by its active atmosphere and emphasis on community. Soon after, its value soared, showcasing the unpredictability of memecoins. On November 12, 2024, Dogwifhat has a market cap of $3.16 billion.

Dogwifhat has a fixed supply of 998.9 million tokens, with the entire supply in circulation. In terms of tokenomics, Dogwifhat follows three core principles — no mining, no minting, and fixed supply. The value of the token is driven by market speculation. The positive sentiment of the altcoin community is the only factor.

As Dogwifhat’s founders, team, and developers have chosen to remain anonymous, their information is unavailable.

Did you know? DEX aggregator data shows that 40,000 to 50,000 new crypto tokens are created every day, with peaks of up to 100,000 during periods of intense hype. Solana leads the way with 17,000 to 20,000 new tokens per day.

IV. Is Dogwifhat suitable for investment?

While Dogwifhat has experienced significant growth since its inception, you should consider the inherent risks associated with memecoins. Despite recent success and positive recognition, you can never be sure that this upward trend will continue.

Like other cryptocurrencies, Dogwifhat is susceptible to unexpected price fluctuations. Memecoins are speculative, making it difficult to predict future price movements. Additionally, as the crypto market continues to develop, new regulations and market trends may affect the long-term viability of Dogwifhat.

Given that Dogwifhat is relatively young and has a small market capitalization, even common market events (such as large-scale buys or sells) can cause large price fluctuations. The lack of underlying utility amplifies the risk profile of Dogwifhat.

Before investing in Dogwifhat or any memecoin, you should conduct thorough research and carefully consider the risks involved.

V. Risks to consider when investing in memecoins such as Dogwifhat

Before investing in memecoins, it is important to understand the associated risks. Here are some risks that are unique to memecoins:

Extreme price volatility: Memecoins are generally more volatile than other cryptocurrencies and often fluctuate with internet hype. When interest fades, they can fall quickly, making any investment highly risky.

Pump and Dump Schemes: Meme coins are susceptible to manipulation, such as pump and dump schemes and canvassing, in which creators artificially inflate prices and then disappear with investors’ funds.

Limited Utility: Unlike mainstream cryptocurrencies that have a specific use case, memecoins often lack real-world applications and rely on community-driven hype. When sentiment changes, their value can suddenly collapse.

Lack of Regulation: Meme coins often lack regulatory oversight. Many meme coin creators are anonymous, meaning investors have little accountability or legal recourse.

Lack of Transparency: Transparency in memecoin projects is often low. Many lack clear information about their team, roadmap, or token economics, making it difficult for investors to fully understand a project before investing.

Notably, some memecoins have risen to fame, only to lose momentum in the market due to lack of utility, fading interest, or manipulation. An example of this is Mooncoin (MOON), which gained popularity due to its community-driven nature and connection to the "lunar" theme in crypto culture. Despite its early popularity, it failed to gain real-world utility and gradually lost traction.

Garlicoin (GRLC), a memecoin created as a joke in 2018, also saw an initial surge in interest before losing momentum and failing to sustain its existence.

These examples highlight the risks of investing in memecoins that lack fundamental support and are driven primarily by social media trends, which can quickly diminish, leading to their decline.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance XingChi

XingChi Huang Bo

Huang Bo JinseFinance

JinseFinance Joy

Joy Miyuki

Miyuki Catherine

Catherine Catherine

Catherine Coindesk

Coindesk