DeFi data

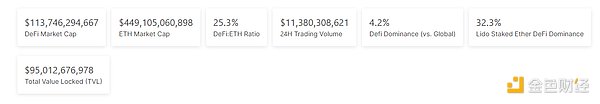

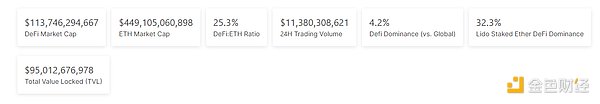

1. Total market value of DeFi tokens: US$113.746 billion

DeFi total market capitalization data source: coingecko

2. The trading volume of decentralized exchanges in the past 24 hours was US$8.558 billion

Decentralization over the past 24 hours Exchange trading volume data source: coincko

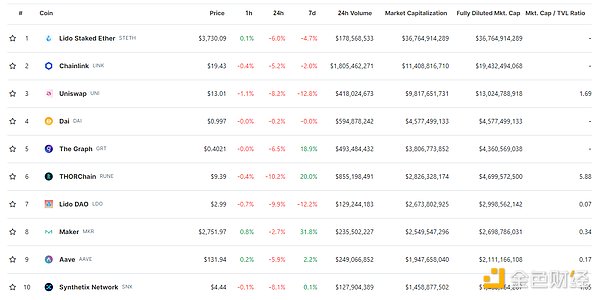

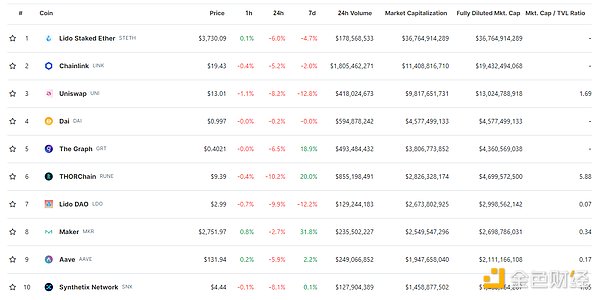

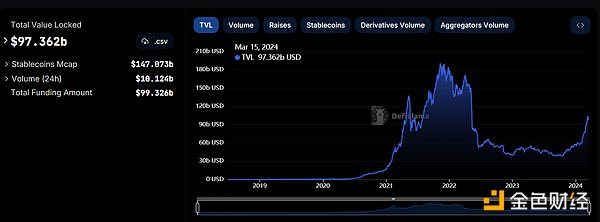

3. Assets locked in DeFi: $9.736 billion

DeFi project's top ten rankings of locked assets and locked positions data source: defillama

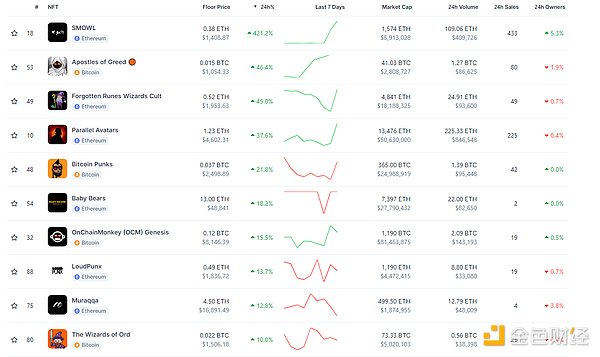

NFT data

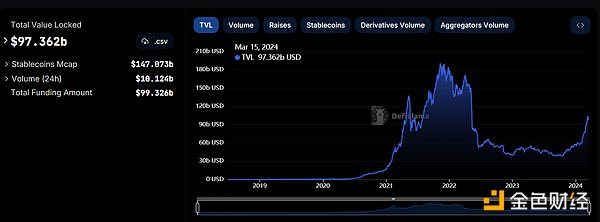

1.NFT total market value: US$7.477 billion

Data source of NFT total market value and top ten projects by market value: Coinmarketcap

2.24 hour NFT transaction volume: 330 millionUSD< /strong>

NFT total market value and market value of the top ten projects Data source: Coinmarketcap

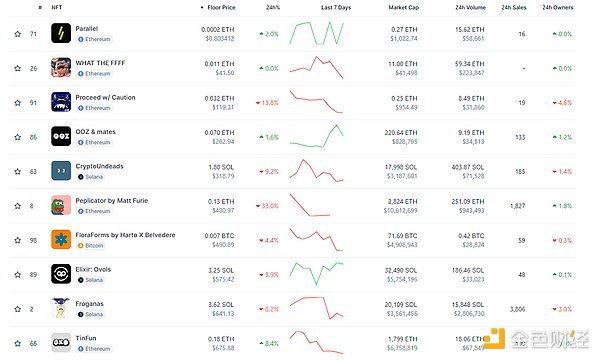

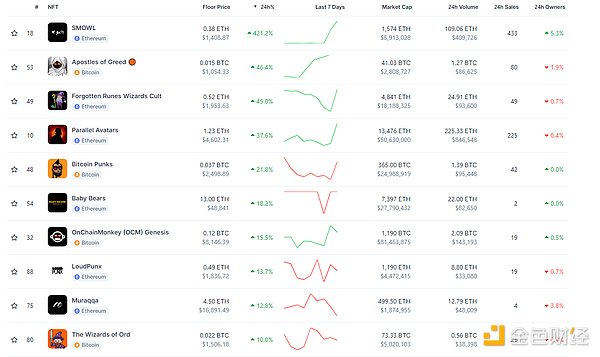

Top NFT in 3.24 hours

The top ten NFTs with the highest sales growth within 24 hours Data source: NFTGO

Headlines

Bank for International Settlements research: DeFi borrower behavior is key to measuring tokenization risk< /p>

News on March 14, a study by the Bank for International Settlements (BIS) concluded that borrower behavior in the DeFi field and DeFi market dynamics when designing and managing platforms involving tokenized assets is an important consideration.

It noted that because DeFi borrowers face huge losses in automatic liquidations (collateral is automatically sold when a borrower’s position becomes too risky), they often avoid over-leveraging. Borrowers took a conservative approach and had sizable cushions.

Additionally, DeFi users tend to deposit more money if they have had higher returns in the past. The study’s authors, Lioba Heimbach and Wenqian Huang, said their findings may be relevant to understanding financial stability concerns raised by DeFi. It conducted the study using data from the Ethereum blockchain, focusing on loan elasticity and strategic substitution behavior

NFTHotPoint

1.NFT card game Parallel will be available on Solana The AI survival simulation game Colony will be launched on Solana

NFT card game Parallel will launch the AI survival simulation game Colony on Solana, and a Colony white paper has been released.

DeFi Hotspot

1. The DeFi protocol MOBOX was attacked, causing a loss of approximately US$750,000

According to ChainAegis monitoring, the DeFi protocol MOBOX was attacked due to a vulnerability in the borrowing function in the contract, resulting in a loss of approximately US$750,000.

2. Inscribe builds a pledge system based on the DOGE ecosystem

According to news on March 15, Inscribe, the inscription aggregation platform of the dog chain ecosystem, is currently building a staking system based on its own DOGE Layer2 builds a pledge lending system that serves DOGE ecological assets. Based on this lending application, users can participate in DOGE lending, and the collateral can be deposited directly in the cooperative ecological application. At the same time, Inscribe users can also use assets including inscriptions as collateral to borrow DOGE and pledge them in the cooperative ecological program. .

Inscribe exchange is the Inscribe aggregation platform of GouChain ecology. It is built on the non-directional asset trading protocol and aims to provide a CEX-like trading experience in a decentralized manner, making Inscribe assets easier to access and trade. Through this cooperation, Inscribe will further expand its influence in the field of digital asset trading and provide users with richer and more convenient services.

3. Binance Web3 wallet has completed Solana network integration

Binance Web3 wallet has completed Solana network integration. The update helps users easily manage and trade Solana Network tokens through the Binance Web3 wallet and access multiple Solana Network dApps. New Solana network dApps include: Drift, Dual Finance, Jito, Jupiter, Magic Eden, MarginFi, Orca, PsyOptions, Pyth Network and Raydium.

Disclaimer: As a blockchain information platform, Golden Finance publishes articles for information reference only and not as actual investment advice. Please establish a correct investment philosophy and be sure to increase your risk awareness.

Miyuki

Miyuki