DeFi data

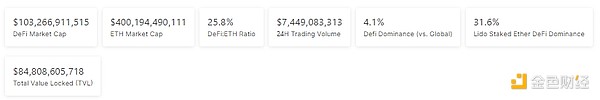

1. Total market value of DeFi tokens: US$103.266 billion

< /p>

< /p>

DeFi total market capitalization data source: coingecko

2. The trading volume of decentralized exchanges in the past 24 hours was US$7.449 billion

< img src="https://img.jinse.cn/7196166_watermarknone.png" title="7196166" alt="0ypz29EbVf1SAABFcPhvRP6wBb8r5X5saXa5QltC.jpeg">

Trading volume data of decentralized exchanges in the past 24 hours Source: coingecko

3. Assets locked in DeFi: US$8.957 billion

DeFi project’s top ten rankings of locked assets and locked positions data source: defillama

NFT data

< p>

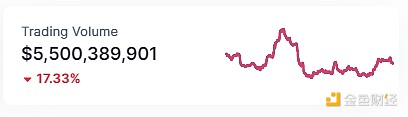

1.NFT total market value: US$53.591 billion

NFT total market value and top ten project data source: Coinmarketcap

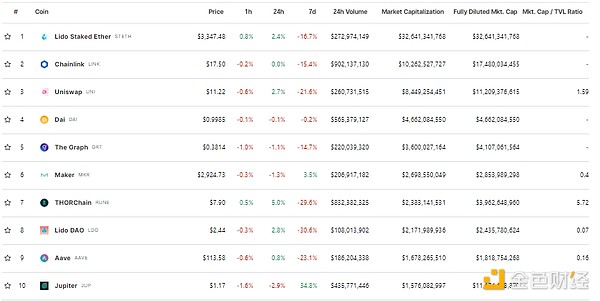

2.24-hour NFT transaction volume: 5.500 billion strong>USD

NFT total market value and market capitalization top ten project data source: Coinmarketcap

3.Top NFT within 24 hours

Top 10 NFT sales within 24 hours Data source: NFTGO

Toutiao< /h2>

SBF: The U.S. prosecutor’s suggestion of imprisonment for up to 50 years distorts reality

According to Bloomberg, FTX founder SBF said that the U.S. prosecutor’s proposal Suggestions that he be jailed for up to 50 years distort reality and paint him as a depraved supervillain. Prosecutors argued that the Fortis co-founder's historic crimes involving more than 1 million victims and more than $10 billion in losses warranted a sentence of 40 to 50 years.

Manhattan federal prosecutors told the judge who will sentence SBF on March 28 that he showed unparalleled greed and arrogance, and that the illegal behavior was based on vicious megalomania and was driven by the defendant's own values. and superiority guidance. The government's request was far less than the 100 years recommended in U.S. criminal sentencing guidelines, but much more than the six and a half years suggested by SBF's lawyers.

The much-hostile memo distorts reality to support its precious narrative of loss and paints SBF as a depraved supervillain; it attributes dark and megalomaniacal motives to him , which is completely inconsistent with the record; it makes doomsday predictions for recidivists; and employs medieval views of punishment to arrive at a proposed sentence equivalent to a life sentence, SBF lawyers wrote. This is not justice.

NFT Hotspots

1. Coinbase CEO: The encryption industry has created multiple mainstream use cases such as NFT and DeSo in the past five years

Coinbase CEO Brian Armstrong posted that authorities have stated that cryptocurrencies have no practical use other than speculation and illegal activities. However, 400 million people around the world, including more than 50 million Americans, have purchased cryptocurrencies, and third-party data shows that illegal activity accounts for less than 0.5% of transaction volume. Over the past 5+ years, the crypto industry has been working hard to build infrastructure to update the financial system and expand the utility of cryptocurrencies, including the following mainstream use cases:

-Digital Dollar: Dollar-backed Stability The current market value of the currency has exceeded 100 billion U.S. dollars;

-Fast and cheap global payments: USD stablecoin transaction volume is close to 9 trillion U.S. dollars per year, more than Mastercard, American Express and Discover combined; ;

-Creative business models such as NFTs, whose total sales have exceeded $62 billion;

-Decentralized social media: although still in its early stages, Decentralized Social (DeSo) ensures that users own their data rather than being controlled by big tech companies and avoid censorship.

Armstrong said that cryptocurrency is not only a new asset class, but also the future of money. This future will be more open, free, efficient, and powered by cryptocurrencies. Cryptocurrency is the most important technology that is renewing the global financial system.

Additionally, Armstrong is calling on the community to support pro-cryptocurrency candidates in the 2024 U.S. election through StandWithCrypto.org.

2. Runestone’s market value surpasses Pudgy Penguins, ranking fourth among all NFTs

According to Coingecko data, the NFT project Runestone has a market value of US$415 million. Surpassing Fat Penguin’s US$315 million, it ranks fourth among all NFTs in terms of market value.

3.NFT perpetual contract trading platform nftperp launched Degen Draw on Blast

NFT perpetual contract trading platform nftperp launched on Layer 2 blockchain Blast A new feature of Degen Draw has been launched on nftperp, and rewards will be provided every week. When trading on nftperp, you can get Raffle Tickets for every 0.1 ETH transaction volume, thus starting to win weekly Blast rewards (including points and Gold), aiming to promote participants Willingness to cooperate or compete.

4.NFT lending protocol NFTfi launches NFTfi Foundation

NFT lending protocol NFTfi announces the launch of NFTfi Foundation, dedicated to developing the necessary resources for a healthy NFT credit market infrastructure. The NFTfi Foundation will manage the NFTfi protocol and develop the NFTfi ecosystem until it can operate independently.

DeFi Hotspot

1.Alipay plans to use Avalanche to launch a Web3-based coupon program

Avalanche announced that the Alipay ordering solution "Alipay+ D-store" and its cooperative e-wallets are using Avalanche to implement a coupon program that supports Web3. It is reported that the relevant coupons are supported by the Avalanche subnet and are designed to allow Alipay and other brand experience solutions powered by Web3 technology.

Avalanche emphasized that the project is still in the first stage of the proof-of-concept (POC) phase, and the plan hopes to roll out to more than 2,000 stores, aiming to roll out coupons to 100 million users.

2. Crypto-Friendly Bank MELD Plan to Provide Tokenized RWA Lending Products to Retail Investors

Crypto-Friendly Bank MELD Plan Tokenized RWA lending products will soon be available to retail investors. A spokesperson for the bank informed that it has partnered with the eponymous L1 blockchain and signed a memorandum of understanding with DeFi platform Swarm Markets.

3.DEX trading volume on Solana has exceeded Ethereum in the past 7 days

Data tracked by DeFiLlama shows that based on Solana DEX trading volume increased by 67% in 7 days, reaching $21.3 billion. During the same period, Ethereum-based de-DEX transaction volume increased by 3% to $19.4 billion. There are 17 DEXs on Solana, and Orca accounts for 88% of the total trading volume. On Ethereum, Uniswap leads among 46 DEXs.

4. Sui mainnet has been upgraded to version V1.20.1

According to official news, Sui mainnet has been upgraded to version V1.20.1. At the same time, Sui The protocol is upgraded to version 38. Other upgrade highlights include: If no arguments are supplied when using the sui client ptb command, the help menu will now be displayed. Supports writing and executing Programmable Transaction Blocks (PTB) from the CLI. Reject the use of variable Random for the entry function of the Publish command. A new command has been added to the CLI: sui client balance, which displays the balance of an address.

5.ParaSwap: A critical vulnerability in Augustus V6 was discovered, and it is recommended to revoke V6 contract permissions

DEX aggregator ParaSwap stated that it had been discovered A critical vulnerability affecting users who approved the Augustus V6 contract, an aggregation smart contract. ParaSwap has suspended the V6 API and is conducting white hat attacks to ensure the safety of funds. The funds are now safely held in secure wallets starting with 0x66E90 and will be returned to users soon.

In addition, users must revoke their permissions on the AUGUSTUS V6 contract. Four addresses are currently affected, with a total loss of $24,000.

Game Hotspots

1.Immutable, King River Capital and Polygon Labs set up US$100 million Web3 Game Fund

Web3 game development platform Immutable and venture capital firm King River Capital have joined forces to form the US$100 million "Inevitable Games Fund" (IGF) with the assistance of Polygon Labs. IGF will provide high-growth opportunities to professional and sophisticated investors in the Web3 gaming space.

2. Web3 game platform Portal announced that the staking function will be opened on Thursday

Web3 game platform Portal officially stated that staking will be open on Thursday. Stake PORTAL tokens and level up to gain exclusive access to minting and pre-sales of upcoming games.

3.Saga announced the establishment of Web3 game publishing department Saga Origins

Saga announced that its Saga Origins game publishing department will be Saga Layer-1 blockchain protocol publishes games. During GDC 2024, the company also announced that it will launch its mainnet in April, allowing game makers on its platform to publish their games.

4. The Bitcoin game ecological project TREX20 completed US$1 million in financing, with Normie Capital and others participating in the investment

The Bitcoin game ecological project TREX20 announced the completion of US$1 million. US dollar financing, Normie Capital, Marshland Capital, Moonrock Capital, Oddiyana Ventures, TripleGemCapital, NxGen.xyz, X21 Capital, Nabais Capital, etc. participated in the investment. TREX20 stated that it is now ready to launch native tokens through Launchpad, aiming to provide support for the gaming ecosystem based on the Bitcoin blockchain, and will also build an independent BRC20 NFT market.

5.Gamified market and liquidity solution Eeesee receives strategic investment from Animoca Brands

Eeesee announced today that it has acquired Animoca As part of the partnership, Animoca Brands will provide Eesee with its industry expertise and connections, supporting Eesee’s goal of improving the efficiency and experience of digital asset transactions in a Web3 environment.

It is reported that Eeesee has previously raised more than $3 million in funding from well-known cryptocurrency influencers such as SevenX Ventures, Maven Capital and Momentum 6, as well as Ivan on Tech, Pentoshi Gmoney and other well-known cryptocurrency influencers.

Metaverse Hotspots

1.South Korean Metaverse platform Carrieverse announced the completion of a new round of financing, Alpha Token Capital participated in the investment

Carrieverse, the South Korean metaverse platform, announced the completion of a new round of financing. Alpha Token Capital, a cryptocurrency venture capital company headquartered in Dubai, participated in the investment and reached a strategic investment partnership with it. Details The amount of investment has not yet been disclosed. It is reported that Alpha Token Capital will invest in CVTX, a virtual asset issued by Carrieverse, which is the governance token of Web3 gaming platform Cling. In addition, this investment is Alpha Token Capital’s first investment in the Korean token market.

Disclaimer: As a blockchain information platform, Golden Finance publishes articles for information reference only and not as actual investment advice. Please establish a correct investment philosophy and be sure to increase your risk awareness.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Davin

Davin decrypt

decrypt Bitcoinist

Bitcoinist Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph