DeFi data

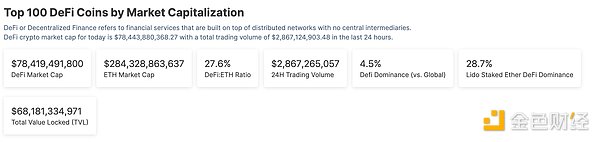

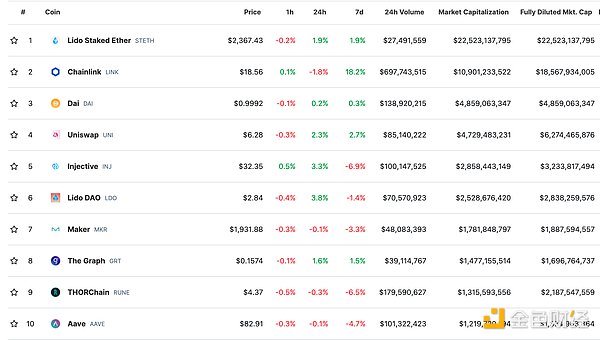

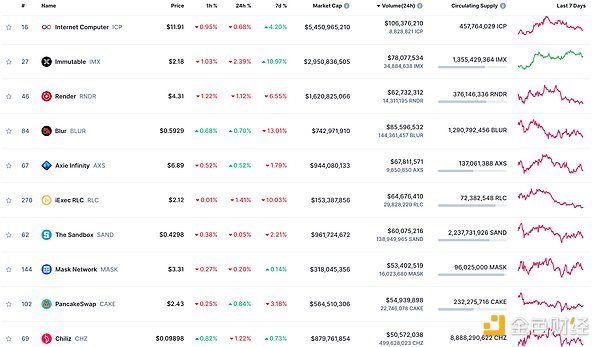

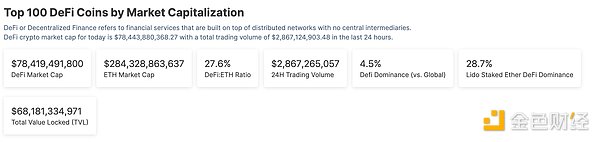

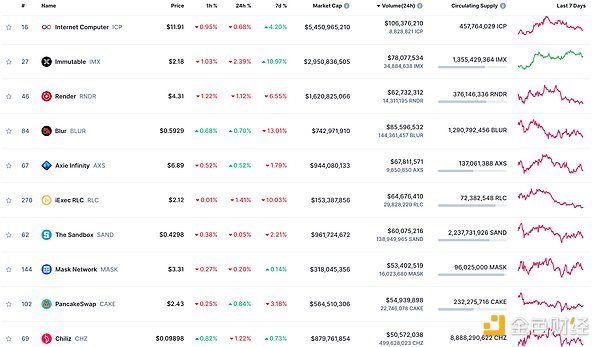

1. Total market value of DeFi tokens: 784.19USD

DeFi total market value and top ten token data source: coincko

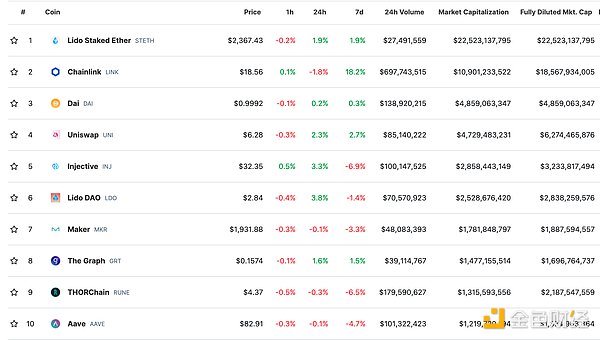

2. The trading volume of decentralized exchanges in the past 24 hours was US$28.672 billion

Past Source of transaction volume data of 24-hour decentralized exchange: coincko

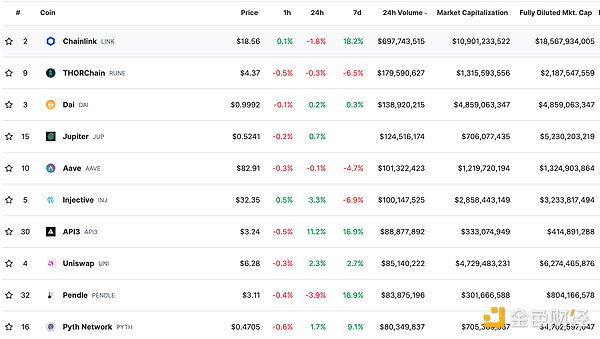

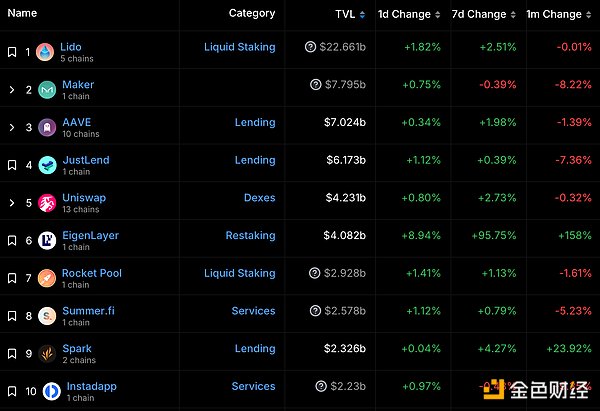

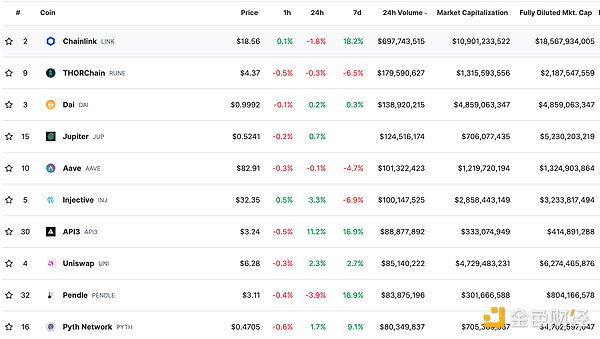

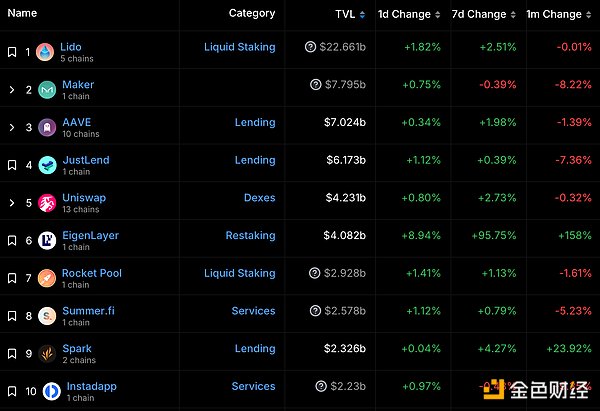

3. Assets locked in DeFi: US$60.881 billion

Data source: defillama

NFT data

1. Total NFT market value: US$33.149 billion

NFT total market value and market value of the top ten projects Data source: Coinmarketcap

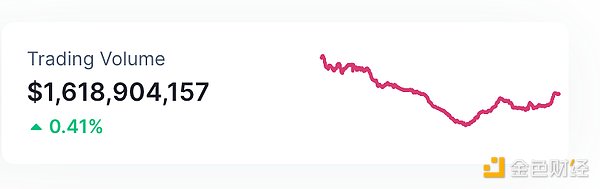

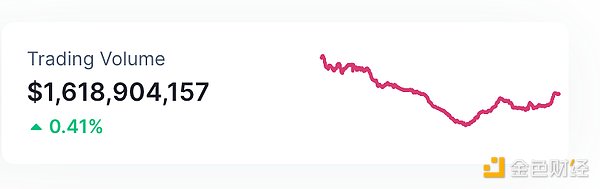

2. 24-hour NFT transaction volume: 1.618 billionUSD

24-hour NFT trading volume and top ten projects data source: Coinmarketcap

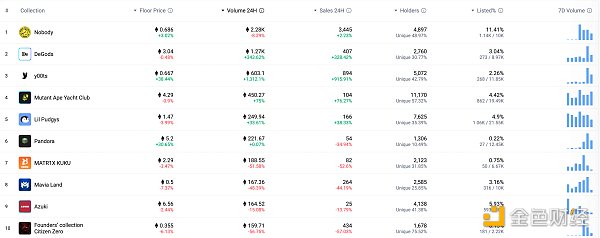

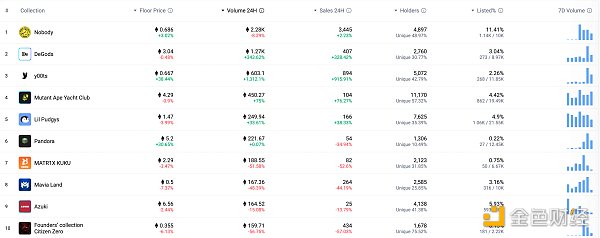

3. Top NFT within 24 hours

< /p>

< /p>

Top 10 NFT sales within 24 hours Data source: NFTGO

Headlines

Report: The average return of crypto investors in 2023 is US$887.6

Golden Finance reported that data from cryptocurrency tax software provider CoinLedger showed that cryptocurrency investors received an average net gain of nearly US$900 from selling cryptocurrencies in 2023, with The contrast is stark with 2022, which saw several cryptocurrency companies collapse and investors lose billions of dollars.

CoinLedger analyzed reports from its 500,000 users and found that the average cryptocurrency investor made $887.60 in realized gains in 2023, with things improving as the industry begins to recover, CoinLedger added: This is in line with 2022 In stark contrast, the median cryptocurrency investor realized a loss of $7,102 that year.

NFTHotPoint

1. Taproot Wizards new Bitcoin NFT transaction price has tripled

Golden Finance reports that investors who bought newly minted “Quantum Cats” NFT images from Bitcoin Ordinals project Taproot Wizards have sold them for twice the initial selling price, indicating support for the original The enduring need for digital art on the blockchain.

Data shows that the lowest available price for Quantum Cats listed on NFT marketplace Magic Eden is 0.243 BTC ($10,481), while the main mint’s fixed price at the end of Monday was 0.1 BTC each.

DeFi Hotspot

1. aelf mainnet has been upgraded to version V1.7.0

According to news on February 7, aelf mainnet has been upgraded to version V1.7.0. It is reported that this version allows adjusting the maximum period for claiming governance rewards, thereby improving user experience.

2. Sushi announced the launch of ZetaChain

< /p>

Golden Finance reported that Sushi is now online on the ZetaChain network, and users can now trade and provide liquidity on ZetaChain through Sushi V2 and V3 AMM.

3. Ethereum core developers: Ethereum in the long run L1 is not a place for daily users to conduct transactions

Golden Finance reported that Ethereum core developer eric.eth said on social media that the most important thing about Ethereum is vitality. Without it, you cannot join the world financial system. Trust can quickly be broken by downtime. But the fees are too high, and in the long run, Ethereum L1 is not a place for everyday users to conduct transactions. It will be the DA/settlement layer. L2 will (and is) solving the high fee problem. But the user experience of L2 is terrible, this is a problem that can be easily fixed, it has improved 10x in the last 2 years alone, and the wallet will finally remove the pain point.

4. Data: EigenLayer TVL exceeds US$4 billion

According to news on February 7, according to DefiLlama data, the total lock-up value (TVL) of the liquidity re-pledge protocol EigenLayer has exceeded 4 billion US dollars and is currently 4.04 billion US dollars.

5.DWF Ventures: Bitcoin L2 project in less than a year It has risen to 25 within a period of time

Golden Finance reported that DWF Ventures stated on the X platform that although Ethereum has led Layer 2 for three years with 38 L2s, it is not Within a year, the number of Bitcoin L2s had soared to 25. According to the list compiled by it, these Bitcoin L2 include BEVM, BiopDAO, Dovi, Elastos, Interlay, Map Protocol, Omni Layer, Rootstock, SatoshiVM, Stacks, U Protocol, b²network, Bison Labs, BOB, Botanix Labs, Chainway, Lighting Network , Liquid Network, LumiBit, Merlin Chain, RGB Network, Rolkit, ROLLUX, ROOS, Rosetta Network.

Metaverse Hotspots

1. Dalian: Prevent illegal fund-raising in the name of "virtual currency", "metaverse", "wealth sharing" and other names

Golden Finance reported that the Dalian Financial Development Bureau issued the "Risk Tips on Preventing Illegal Fund Raising in the Names of "Virtual Currency", "Yuan Universe" and "Wealth Sharing", pointing out that strengthening risk prevention awareness and identification capabilities, and establishing correct investments Concept, beware of personal property losses.

Disclaimer: As a blockchain information platform, Golden Finance publishes The content of the article is for informational reference only and does not serve as actual investment advice. Please establish a correct investment philosophy and be sure to increase your risk awareness.

JinseFinance

JinseFinance

< /p>

< /p>