Author: Will Ogden Moore, Translated by: 0xjs@黄金财经

AI is one of the most promising emerging technologies of this century, with the potential to exponentially increase human productivity and drive medical breakthroughs. As important as AI may be today, its influence will only grow, with PwC estimating that it will grow into a $15 trillion industry by 2030.

However, this promising technology also faces challenges. As AI technology becomes more powerful, the AI industry has become extremely centralized, with power concentrated in the hands of a few companies, which can harm society. This has also raised serious concerns about deep fakes, built-in bias, and data privacy risks. Fortunately, Crypto and its decentralized and transparent nature offer potential solutions to some of these problems.

In this article, we will explore the problems caused by centralized AI and how decentralized AI can help solve some of its ills, and discuss the current intersection of Crypto and AI, focusing on crypto applications in the field that have shown early signs of adoption.

The Problem with Centralized AI

Today, the development of AI faces certain challenges and risks. The network effects and intensive capital requirements of AI are so significant that many AI developers outside of large technology companies, such as small companies or academic researchers, either have difficulty obtaining the resources required for AI development or are unable to monetize their work. This limits overall competition and innovation in AI.

As a result, influence over this critical technology is mainly concentrated in the hands of a few companies such as OpenAI and Google, raising serious questions about AI governance. For example, in February of this year, Google's AI image generator Gemini exposed racial bias and historical errors, illustrating how companies manipulate their models. In addition, last November, the decision of the six-member board of directors to fire OpenAI CEO Sam Altman exposed the fact that a few people control the company that develops these models.

As the influence and importance of AI grows, many people worry that a single company may have decision-making power over AI models that have a huge impact on society, and may set up guardrails, operate behind closed doors, or manipulate models for their own benefit - but at the expense of other members of society.

How Decentralized AI Can Help

Decentralized AI refers to AI services that use blockchain technology to distribute AI ownership and governance in a way that is designed to increase transparency and accessibility. Grayscale Research believes that decentralized AI has the potential to free these important decisions from closed institutions and bring them into public ownership.

Blockchain technology can help developers gain greater access to AI and lower the barrier to entry for independent developers to develop and monetize their work. We believe this can help improve overall AI innovation and competition and balance the model developed by tech giants.

In addition, decentralized AI can help democratize AI investment. Currently, there are few ways to access the financial gains associated with AI development other than through a handful of tech stocks. At the same time, a large amount of private capital has been allocated to AI startups and private companies ($47 billion in 2022 and $42 billion in 2023). As a result, only a small group of venture capitalists and accredited investors can access the financial gains of these companies. In contrast, decentralized AI crypto assets are available to everyone, allowing everyone to own a part of the AI future.

Where does the intersection of Crypto and AI lie today?

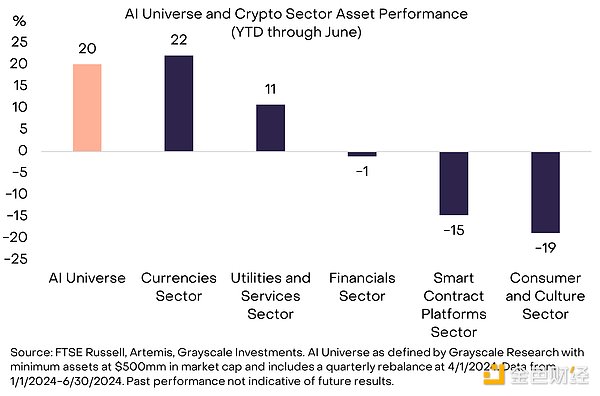

Today, the intersection of cryptocurrencies and AI is still in its early stages in terms of maturity, but the market response is encouraging. As of May 2024, the AI sector of crypto assets has a return of 20%, outperforming every crypto track except the Currencies track (Figure 1). In addition, according to data provider Kaito, the AI theme currently accounts for the most "narrative mind share" on social platforms compared to other themes such as decentralized finance, Layer 2, meme coins, and real-world assets.

Recently, some well-known figures have begun to embrace this emerging intersection and work to solve the shortcomings of centralized AI. In March of this year, Emad Mostaque, the founder of well-known AI company Stability AI, left the company to pursue decentralized AI, saying that "now is the time to ensure that AI remains open and decentralized." Additionally, cryptocurrency entrepreneur Erik Vorhees recently launched Venice.ai, a privacy-focused AI service with end-to-end encryption.

Figure 1: So far this year, the AI track has outperformed almost all crypto tracks

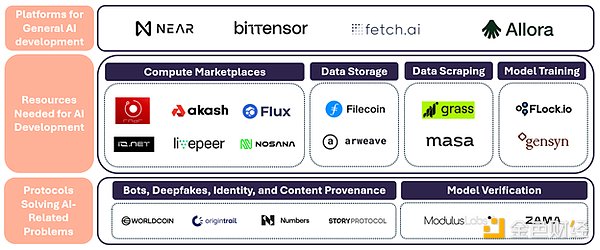

We can divide the intersection of Crypto and AI into three main subcategories:

1. Infrastructure layer: networks that provide a platform for AI development (such as NEAR, TAO, FET)

2. Resources required for AI: assets that provide the key resources (computing, storage, data) required for AI development (such as RNDR, AKT, LPT, FIL, AR, MASA)

3. Solving AI problems: assets that attempt to solve AI-related problems, such as the rise of robots and deep fakes and model verification (such as WLD, TRAC, NUM)

Figure 2: AI and Crypto Market Map

Source: Grayscale Investments

Networks that provide infrastructure for AI development

The first category is a network that provides an open architecture without permission, built specifically for the overall development of AI services. These assets are not focused on a single AI product or service, but rather on creating the underlying infrastructure and incentive mechanisms for a variety of AI applications.

Near stands out in this category, with its founders being the co-founders of the “Transformer” architecture that powers AI systems like ChatGPT. However, the company recently leveraged its AI expertise to unveil efforts to develop “user-owned AI” through an R&D division led by a former OpenAI research engineer advisor. In late June 2024, Near launched its AI Incubator Program for the development of Near-native base models, an AI application data platform, an AI agent framework, and a computing marketplace.

Bittensor provides another potentially compelling example. Bittensor is a platform that uses TAO tokens to economically incentivize AI development. Bittensor is the underlying platform for 38 subnetworks (subnets), each with a different use case, such as chatbots, image generation, financial forecasting, language translation, model training, storage, and computing. The Bittensor network rewards the top-performing miners and validators in each subnet with TAO tokens and provides a permissionless API for developers to build specific AI applications by querying miners in the Bittensor subnet.

This category also includes other protocols such as Fetch.ai and the Allora network. Fetch.ai, a platform for developers to create sophisticated AI assistants (i.e., “AI agents”), recently merged with AGIX and OCEAN, with a combined value of approximately $7.5 billion. Another is the Allora network, a platform focused on applying AI to financial applications, including decentralized exchanges and automated trading strategies for prediction markets. Allora has not yet launched a token and raised a strategic funding round in June, bringing its total funding to $35 million in private capital.

Resources Required for AI Development

The second category includes assets that provide the resources required for AI development in the form of compute, storage, or data.

The rise of artificial intelligence has created an unprecedented demand for computing resources in the form of GPUs. Decentralized GPU marketplaces such as Render (RNDR), Akash (AKT), and Livepeer (LPT) provide idle GPU supply to developers who need compute for model training, model inference, or rendering 3D generative AI. Today, Render is estimated to offer around 10,000 GPUs, focused on artists and generative AI, while Akash offers 400 GPUs, focused on AI developers and researchers. Meanwhile, Livepeer recently announced its new AI subnet initiative, targeting tasks such as text-to-image, text-to-video, and image-to-video by August 2024.

In addition to requiring a lot of compute, AI models also require a lot of data. As a result, the demand for data storage has increased significantly. Data storage solutions such as Filecoin (FIL) and Arweave (AR) can serve as decentralized, secure network alternatives to storing AI data on centralized AWS servers. These solutions not only provide cost-effective and scalable storage, but also enhance data security and integrity by eliminating single points of failure and reducing the risk of data breaches.

Finally, existing AI services like OpenAI and Gemini have constant access to live data through Bing and Google Search, respectively. This puts all other AI model developers outside of these tech companies at a disadvantage. However, data scraping services like Grass and Masa (MASA) can help level the playing field by allowing individuals to monetize their application data by using it for AI model training, while maintaining control and privacy over their personal data.

Assets that attempt to solve AI-related problems

The third category includes assets that attempt to solve problems related to AI, including the rise of bots, deepfakes, and content provenance.

A significant problem exacerbated by AI is the proliferation of bots and disinformation. AI-generated deepfakes have already had an impact on presidential elections in India and Europe, and experts are “very afraid” that the upcoming presidential race will involve a “tsunami of disinformation” heavily driven by deepfakes. Assets that hope to help solve problems related to deepfakes by establishing verifiable content provenance include Origin Trail (TRAC), Numbers Protocol (NUM), and Story Protocol. Additionally, Worldcoin (WLD) seeks to address the bot problem by proving a person’s humanity through unique biometric identifiers.

Another risk with AI is ensuring trust in the model itself. How can we trust that the AI results we receive have not been tampered with or manipulated? There are several protocols currently working to help solve this problem through cryptography, zero-knowledge proofs, and fully homomorphic encryption (FHE), including Modulus Labs and Zama.

Conclusion

While these decentralized AI assets have made initial progress, we are still in the first innings of this intersection. Earlier this year, renowned venture capitalist Fred Wilson said that AI and cryptocurrencies are “two sides of the same coin” and that “web3 will help us trust AI.” As the AI industry continues to mature, Grayscale Research believes that these AI-related crypto use cases will become increasingly important, and that these two rapidly evolving technologies have the potential to support each other’s growth.

There are many signs that AI is coming and will have far-reaching impacts, both positive and negative. By leveraging the characteristics of blockchain technology, we believe crypto can ultimately help mitigate some of the dangers posed by AI.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance dailyhodl

dailyhodl