Source: Grayscale; Compiled by: Deng Tong, Golden Finance

Ahead of the June 2024 U.S. presidential debate between Biden and Trump, voters expressed concerns about uncertainty: wars raging around the world, political discourse continues to be deeply polarized, and the U.S. economy continues to inflate, among other things. Amid this uncertainty, crypto assets are increasingly influencing elections, as the latest survey conducted by Harris Poll on behalf of Grayscale found. Key takeaways include:

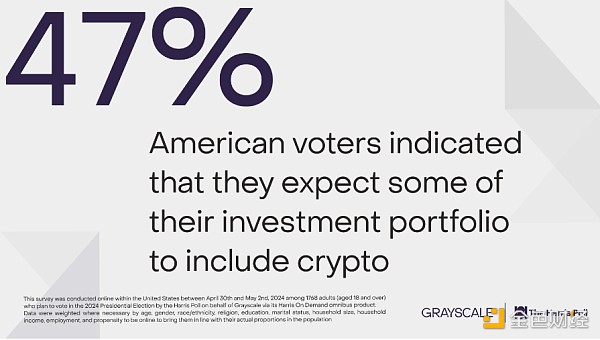

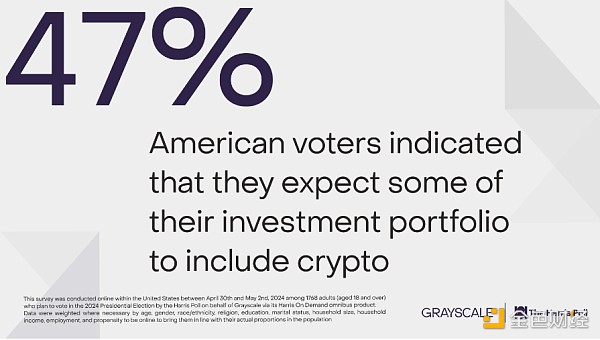

We believe that Bitcoin’s relevance is increasing due to macro dynamics and Bitcoin’s own maturity, with nearly half of voters (47%) now expecting part of their portfolio to include cryptocurrencies (up from 40% at the end of last year).

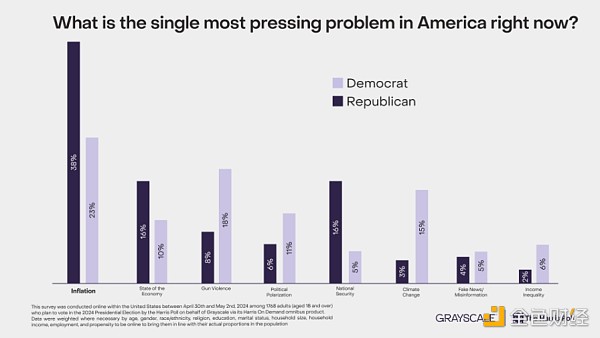

As in the first phase of this year’s poll, respondents ranked inflation as their top issue in the election (28%), again highlighting the potential value of assets with transparent and hard supply caps like Bitcoin.

Trump strongly supported cryptocurrencies on the campaign trail, and recent crypto bills FIT21 and SAB 121 have received bipartisan support in Congress. Harris Poll data supports the view that cryptocurrency is a bipartisan topic, with similar rates among Republicans (18%) and Democrats (19%).

The headlines are already brewing: Will November be “Bitcoin Election Month”?

Growing Interest in Crypto Assets

Grayscale believes that interest in Bitcoin is growing due to macro developments and Bitcoin’s maturation as an asset. Over the past six months, voters have shown increasing interest in Bitcoin (41% now vs. 34% in November 2023) due to geopolitical tensions, inflation, and dollar risk since the first phase of this survey. Notably, inflation is the top issue in the election so far, according to voters (28%), highlighting the potential value of an asset like Bitcoin that has a transparent and hard supply cap.

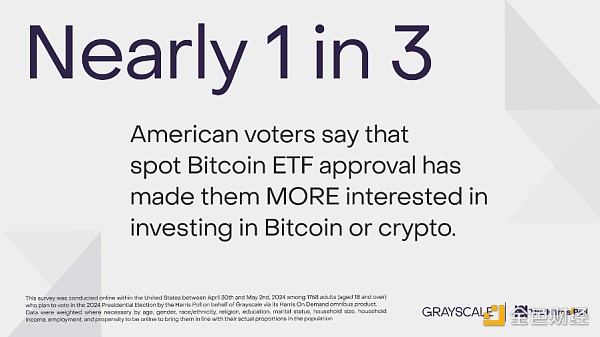

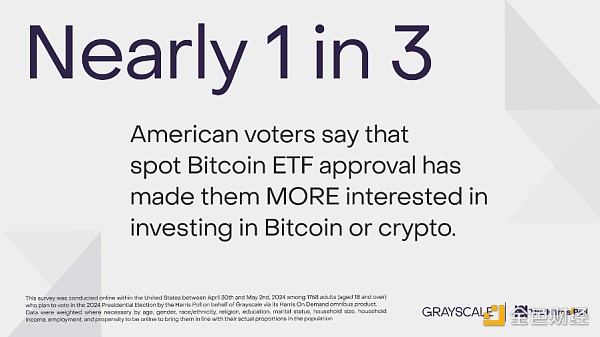

Importantly, the Grayscale team added some new questions to the survey for consideration, and the Harris Poll found that Bitcoin-related events, including the January 2024 U.S. spot Bitcoin ETF approval and the April 2024 halving, made voters more interested in investing in Bitcoin and other crypto assets (18% and 20%, respectively). The approval of a Bitcoin ETF, in particular, made 9% of retired voters more interested in investing in Bitcoin or crypto assets.

Figure 1: Voters are increasingly concerned about Bitcoin

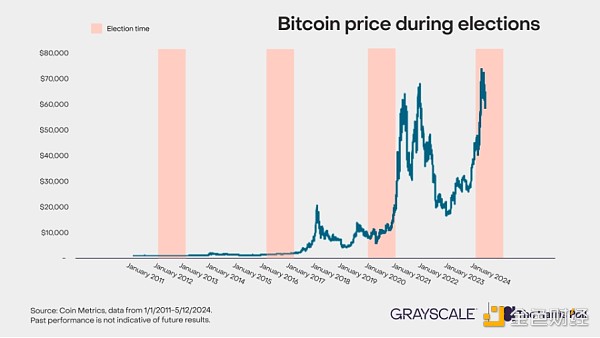

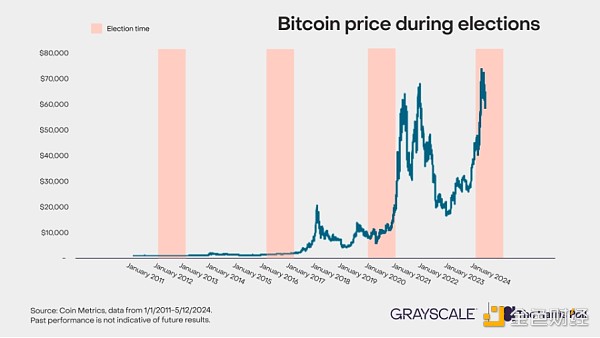

2024 has been a banner year for Bitcoin so far. The price of Bitcoin hit an all-time high on March 13, 2024; moreover, the price of Bitcoin has been higher every day so far in 2024 than in previous election years. The headlines are already brewing: Will November be "Bitcoin Election Month"?

Figure 2: Bitcoin price is higher than ever during an election

The growing interest in cryptocurrencies is not limited to Bitcoin. Instead, it extends to a broader view of crypto assets, both in terms of general interest and willingness to invest. Nearly a third of voters (32%) said they were more willing to learn about cryptocurrency investing or actually invest in cryptocurrency since the beginning of the year. Voters are also more likely to view cryptocurrency as a good long-term investment opportunity than in November 2023 (23% vs. 19%) and increasingly expect to have cryptocurrency in their portfolios (47% vs. 40%).

Figure 3: Voters increasingly expect their portfolios to include cryptocurrencies

Cryptocurrency is a bipartisan issue

Despite Trump’s greater support for cryptocurrencies during the campaign, data shows that cryptocurrency is a bipartisan issue, with similar rates among Republicans (18%) and Democrats (19%).

Voters are split on which political party is more supportive of the industry, as equal shares of voters (30% each) believe that the Democratic and Republican positions on cryptocurrency policy are the most favorable. These findings suggest that support for cryptocurrency is not entirely biased toward one party, but rather indicates a balance of interests across the political spectrum. This is consistent with recent bipartisan support in Congress for SAB 121, which would allow financial institutions to act as custodians for digital assets, which could increase accessibility for cryptocurrency investors.

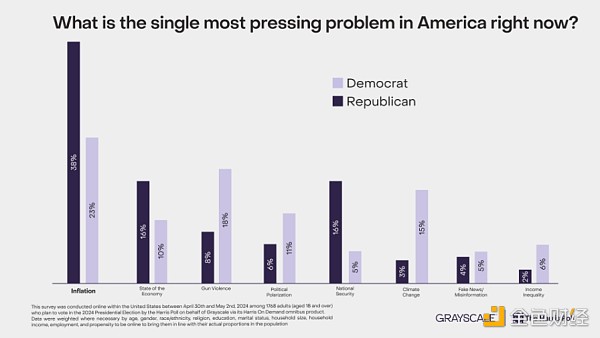

Nevertheless, Republican voters tend to cite inflation and economic issues as the most pressing issues facing the country (54% vs. 33% for Democrats). While ownership levels are similar across parties, Republicans appear to place greater importance on issues related to Bitcoin and cryptocurrencies (inflation and the economy), while data shows that Democrats are more concerned about issues such as gun violence, climate change, and income inequality relative to Republicans, as shown in Figure 4 below. This may explain why Trump has recently leaned toward supporting cryptocurrencies in his campaign.

Figure 4: Most pressing issues facing each political party

Conclusion

America is at a fork in the road. Both candidates have different macro policies on government deficits and debt, inflation and Fed independence, and the U.S. role in the world; positions that all have direct implications for the dollar and Bitcoin.

As voters become more interested in cryptocurrencies, it will be important to see how the next administration takes this emerging digital asset. This will be especially important in capturing the votes of younger people, as 62% of Gen Z and Millennial voters believe that cryptocurrencies and blockchain technology are the future of finance. Regardless, as November approaches, it’s clear that all policymakers and candidates preparing for the 2024 election will be increasingly considering cryptocurrencies.

Alex

Alex