Author: Grayscale Research; Compiler: 0xxz@黄金财经

Key points of this article:

In August 2024, cryptocurrency valuations retreated, while financial market volatility briefly rose. Compared with the broader cryptocurrency market, Bitcoin outperformed, while Ethereum underperformed.

Federal Reserve Chairman Powell hinted at an upcoming rate cut, which could support Bitcoin and other assets that compete with the dollar (such as physical gold).

Although activity on Ethereum's Layer 2 network has increased significantly, Ethereum's expansion strategy may make some investors uncertain about its long-term prospects.

The market value of stablecoins has also been rising in August, some key protocols have been escalating, and the debate over digital privacy has intensified.

Overview

Global stock markets were little changed overall in August 2024, but this masked significant intra-month volatility. On August 2, a weaker-than-expected jobs report sent many risk asset prices lower and equity volatility soared, with the CBOE Volatility Index (VIX) briefly exceeding 65%. However, subsequent economic data showed no further signs of danger, with many market sectors rebounding and the VIX quickly falling back below 20%.

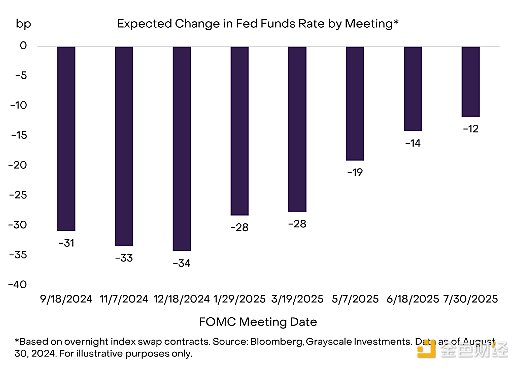

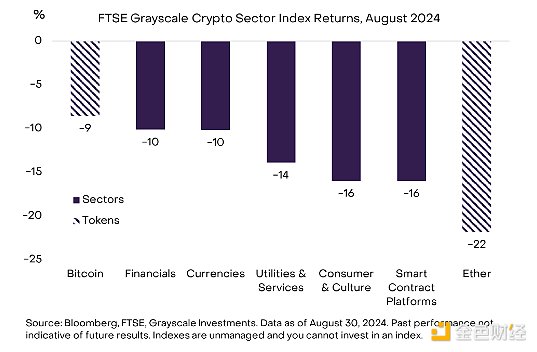

Meanwhile, news of weakening labor market conditions may have influenced the views of Federal Reserve policymakers. In his speech at the Jackson Hole annual meeting on August 23, Fed Chairman Powell said that "the time has come to cut interest rates," which in part reflects the fact that "downside risks to employment have increased." Interest rate futures now imply that the central bank will reduce the policy rate by 100 basis points (bp) at the remaining three Federal Open Market Committee (FOMC) meetings this year (Chart 1).

Figure 1: The FOMC is expected to cut rates by about 100 basis points over the next three meetings

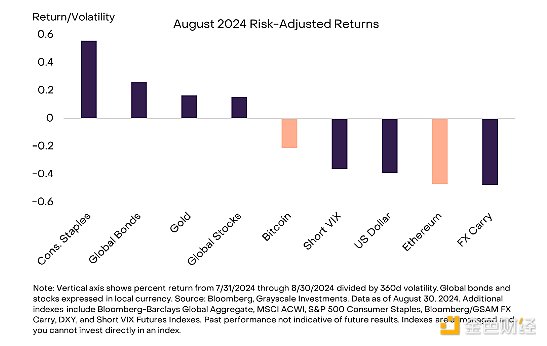

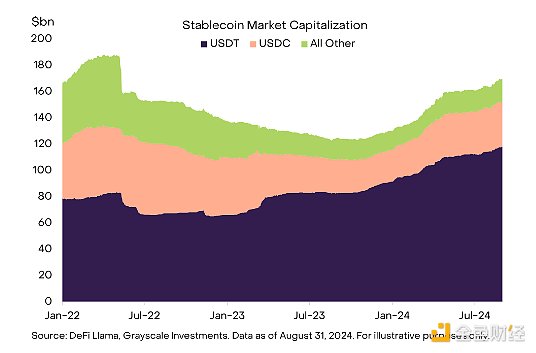

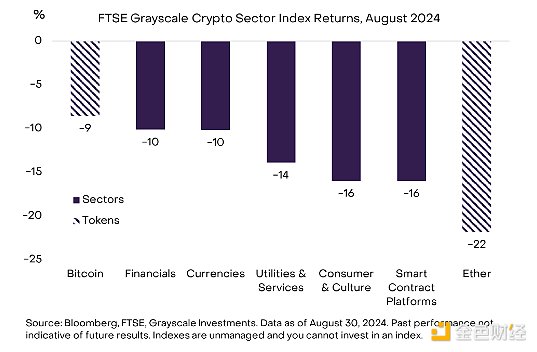

Together, the short-lived volatility and rate cut signals brought many changes to the market (Figure 2). The returns of certain strategies at the center of the storm (including short volatility strategies and FX carry trades) fell sharply, the US dollar weakened against major currencies and gold prices, and defensive assets such as high-quality bonds and consumer staples stocks performed well. Bitcoin fell slightly (-8.5%), while Ethereum fell more (-21.8%) and was one of the assets that performed poorly after risk adjustment (discussed further below). Our Cryptocurrency Sector Market Index (CSMI), which measures the broad universe of investable digital assets, fell 13.2% in August 2024.

Figure 2: Ethereum underperformed during the August pullback

Bitcoin

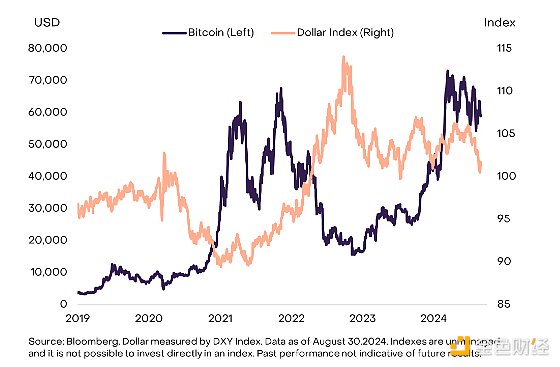

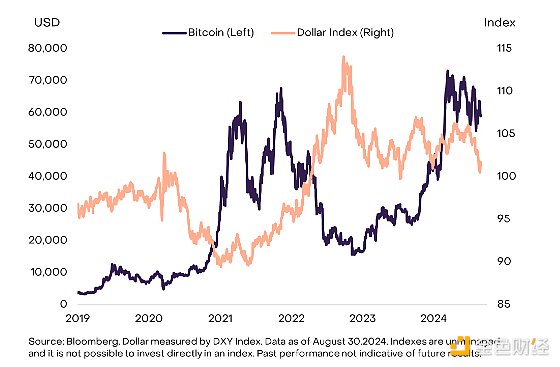

We believe that if the trend of dollar weakness and lower interest rates continues, it should have a positive impact on Bitcoin's valuation. Like physical gold, Bitcoin is an alternative monetary system that competes with the dollar in international markets. Lower U.S. interest rates weaken the dollar's competitive advantage and may benefit assets that compete with the dollar, including other fiat currencies, physical gold, and Bitcoin. Over the past few years, as digital assets have become increasingly integrated with mainstream financial markets, Bitcoin has been negatively correlated with both real interest rate levels and the value of the U.S. dollar (Figure 3). Therefore, those concerned about the impact of a weak U.S. dollar on their portfolios may consider allocating to Bitcoin to diversify their portfolios.

Figure 3: Bitcoin is negatively correlated with the value of the U.S. dollar

Ethereum

As mentioned above, Ethereum significantly underperformed during the early August decline and failed to stage a significant rebound later in the month. We believe this is partly a reflection of long positions in CME-listed futures and perpetual futures. In May 2024, around the time the SEC approved the issuer’s 19b-4 filing for the US spot Ethereum exchange-traded product (ETP), traders significantly increased gross perpetual futures positions and net CME futures positions, perhaps anticipating further price appreciation following full regulatory approval; this approval occurred in July 2024, and the US spot Ethereum ETP began trading shortly thereafter. We believe that excess speculative positioning led to a sharp pullback in Ethereum prices and has limited price recovery since then.

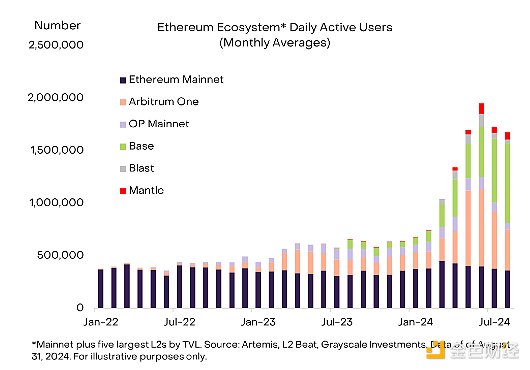

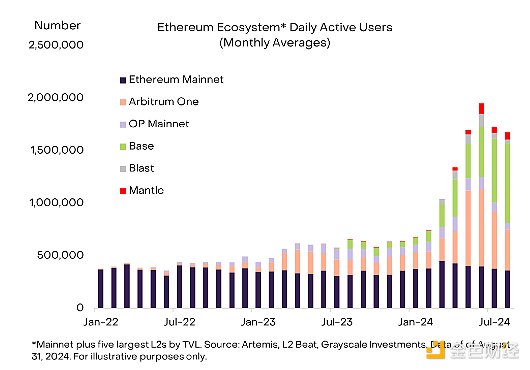

More fundamentally, the Ethereum network is undergoing a major transition that may leave some investors uncertain about its future. As we have extensively reported in previous work, Ethereum intends to achieve greater scale by moving more transactions to the Layer 2 network, which will then be settled periodically to the Layer 1 mainnet. The strategy is working: activity on Ethereum Layer 2 has boomed this year (Figure 4), and major companies such as Sony have announced projects within the ecosystem (see "Exploring the Ethereum Ecosystem" for more details). However, the shift in activity to Layer 2 has also led to lower fee income on Layer 1, which in turn has potential implications for the value of ETH. In addition, uncertainty may have led to relatively low net inflows into the spot Ethereum ETP launched in July. Grayscale Research believes that the current market pessimism about Ethereum is unfounded given that the scaling strategy is clearly working. But it may take some time for market consensus to become more positive.

Figure 4: Ethereum scaling strategy is working

Other Highlight Protocols

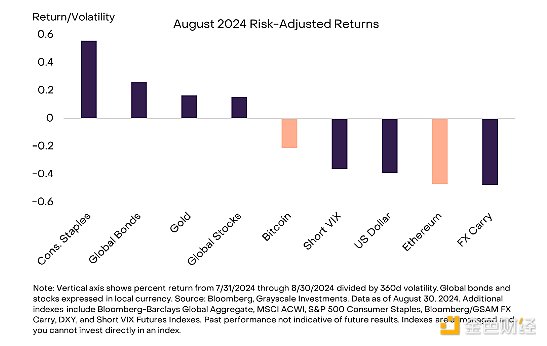

The FTSE/Grayscale Crypto Sector Index Series also fell in August, but the decline was smaller than that of Ethereum (Figure 5). Despite the overall market setback, there are still several noteworthy bright spots, especially in the currency cryptocurrency sector and the financial cryptocurrency sector.

Figure 5: Bitcoin outperformed most crypto sectors

For example, ZCash (ZEC), a privacy-preserving asset in the cryptocurrency space, rose 29.5% in mid-August before retreating later that month. In early August, the founder of ZCash joined Shielded Labs to develop a "Crosslink" hybrid consensus mechanism. Historically, ZCash is a proof-of-work protocol, and this upgrade will add proof-of-stake as a final layer, designed to enhance network security and allow ZEC holders to stake. The move has received a lot of support, including donations from Ethereum founder Vitalik Buterin and others. In addition, the second ZEC halving event is scheduled for later this November, further stimulating investor interest.

As a component of the financial cryptocurrency sector, the Aave Protocol is another highlight. The protocol's weekly number of active borrowers hit a record high, and its governance token AAVE rose 21%. At the same time, a new proposal proposed by the Aave community will deploy a "buy and distribute" model, using Aave's excess revenue to buy AAVE tokens from the market and distribute them to stakers - similar to the smart destruction engine used by the Maker Protocol. The proposal is expected to go live by the end of 2024, but it still needs community approval. In related news, the Maker Protocol rebranded to Sky and introduced a number of other project updates related to its Endgame strategy.

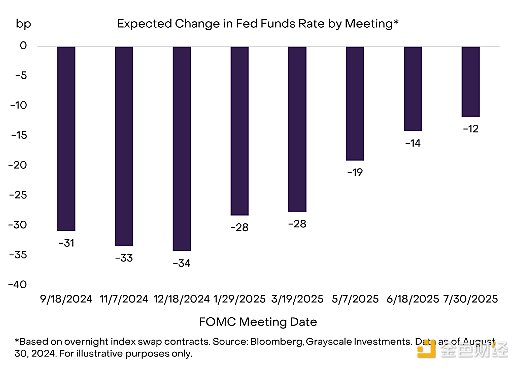

Stablecoins

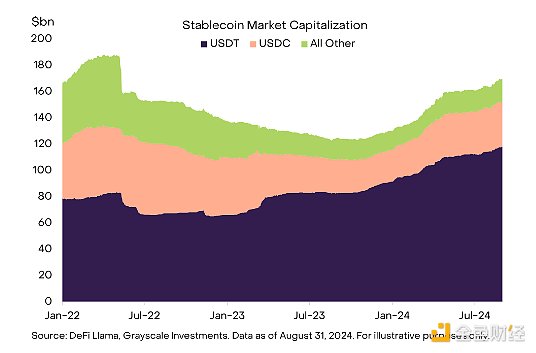

The market capitalization of stablecoins has risen again in August and is now approaching its previous all-time high (Figure 6). Importantly, Apple's software update could lead to greater adoption of stablecoin payments in developed markets. Circle CEO Jeremy Allaire said that tap-to-pay using Circle's USDC stablecoin will soon be available on iPhones, thanks to Apple's decision to open NFC payments to third-party developers. This feature is independent of Apple Pay and does not involve a direct relationship between Circle and Apple, enabling USDC transactions with taps, with FaceID confirmation and blockchain settlement. Separately, Latin American e-commerce platform Mercado Libre announced the creation of its own stablecoin pegged to the UAE dirham, while stablecoin issuer Tether said it would create a token pegged to the UAE dirham.

Figure 6: Stablecoin market cap rises

Durov and TON

Finally, there has been growing attention on the potential connection between blockchain technology and digital privacy following the arrest of Telegram founder Pavel Durov in France at the end of the month. French authorities said the charges were related to “failure to mitigate the abuse of encrypted messaging applications” that were used for criminal activities. TON, the asset that powers the Open Network, a smart contract platform natively integrated with Telegram, fell more than 20% following the news before recovering slightly in the following days.

Elsewhere in the smart contract platform cryptocurrency space, Near Protocol launched Nightshade 2.0, designed to make the blockchain faster, while Stacks Protocol launched its long-awaited Nakamoto upgrade.

Bitcoin Outlook

Since the first quarter, the price of Bitcoin has remained in a fairly narrow range, with the cryptocurrency market benefiting from positive fundamental news on the one hand and selling pressure on the other. Grayscale Research believes that the selling pressure from the German government, Mt.Gox Asset Management and other institutions has basically passed, and the improvement in fundamentals should become increasingly apparent.If the US labor market remains stable, the Federal Reserve's rate cuts and US political changes surrounding the cryptocurrency industry may allow prices to retest all-time highs later this year.

We believe that the main downside risks to valuations are further increases in unemployment and a possible recession. Investors should therefore keep a close eye on upcoming labor market data, including the next monthly jobs report, scheduled for September 6. However, even if recession risks emerge, Grayscale Research believes that tolerance for a deep economic downturn is very low, and we believe that policymakers have an incentive to print money and spend at the first sign of trouble. The unregulated approach to monetary and fiscal policy is one reason some investors choose to invest in Bitcoin; therefore, a period of economic weakness could strengthen the long-term investment thesis for Bitcoin.

JinseFinance

JinseFinance