Author: Michael Nadeau, The DeFi Report; Translator: Baishui, Golden Finance

Over the past year, we have been speculating that the crypto industry is approaching a turning point in its technological revolution.

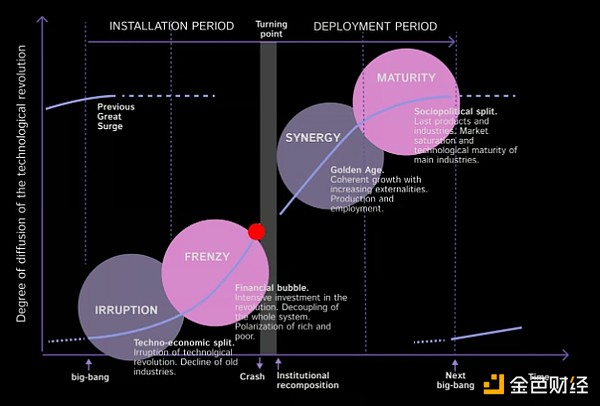

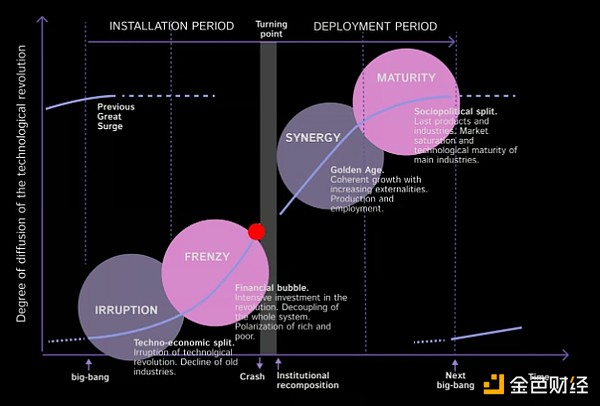

Our thinking is influenced by the framework proposed in Carlota Perez's book "Technological Revolution and Financial Capital".

The core idea is that revolutionary technologies typically go through 4 different stages in their implementation and deployment: 1) the outbreak stage, 2) the frenzy stage, 3) the synergy stage, and 4) the maturity stage.

Between the frenzy and the synergy is the turning point.

Turning points typically occur during the aftermath of a “mania” period (2021 for crypto). This is after financial leverage has been removed, consumers have been harmed, fraud has been exposed, and lessons learned (2022/2023).

These “sobering” periods, which tend to be focused on regulation and policy development, mark the end of the setup period — and the beginning of the new technology deployment period.

Given the events of the past week, we believe it is now safe to officially declare that we have entered the inflection point phase for crypto. Note that the red dots above touch on manias and turning points. We think both are likely to occur simultaneously in this cycle + the one after.

So this week we have a report to share as the crypto industry enters a new paradigm.

What Happened?

The political fallout kicks in.

It’s stating the obvious here, but the Democratic Party appears to have miscalculated the popularity of crypto in the US. When you combine this with Biden’s poll performance + Trump’s recent alignment with the industry, you see for yourself the political game theory at play.

Right now, both parties appear to be courting the US crypto industry.

But as we wrote over a year ago, this has always been the case. Why? It’s estimated that over 50 million people in the US own cryptocurrency—a uniquely bipartisan user base. And because crypto is financial in nature, the industry is turning Americans into single-issue voters.

This is why the Democrats’ strategy means nothing to us. They really screwed up on this one.

It all started when President Biden installed a puppet at the SEC to try to hobble the industry with “enforcement regulation?”

Next, we saw the FDIC Chairman run “Operation Choke Point 2.0.”

Then came Senator Warren’s “Anti-Crypto Army?”

All seeking control. All losing strategies.

Meanwhile, the rest of us have been watching our industry teeter on the edge of its seat at the mercy of political winds and unelected bureaucrats.

It’s frustrating, to say the least.

But at the same time, democracy is winning.

To those who work in and support the industry. You’ve all shown that you have a voice. You have agency. And you should be proud of yourself.

Together we made this happen.

Policymakers are listening.

So, for now, it looks like the Democrats (broadly) are no longer against cryptocurrencies:

12 Democrats (including Senate Majority Leader Chuck Schumer) voted last week to repeal SAB121 (an SEC rule designed to prevent banks from offering custody of crypto assets).

71 Democrats (including Nancy Pelosi) voted last week to pass the sweeping legislation, the FIT21 Act, through the House.

The Democratic-led SEC (which is supposed to be independent) approved an ETH ETF.

Last week, Martin Gruenberg (the architect of Operation Choke Point 2.0) was forced to resign as FDIC Chairman.

While the battle is not over, it looks like we have “crossed the chasm” as cryptocurrency is becoming a major industry in the U.S.

Last week solidified that.

ETH ETF

We’ve been expecting an ETH ETF ever since the Bitcoin product was approved. But we certainly didn’t expect it to go through last week.

From what we can tell, the SEC didn’t expect it either.

How it happened:

From what we can tell (James Seyffart interviews Ryan Sean Adams), the SEC’s Division of Trading and Markets was prepared to reject the ETH ETF Form 19b-4 about a week before approval. But it seems that somehow the agency started reaching out to issuers who were just as surprised. Everyone was caught off guard. It makes no sense.

This leads us to believe that the decision to approve the ETF did not come from the SEC. It could be coming from somewhere else (probably the White House).

Right now. We have not heard from Gary Gensler on this topic. But we know that the decision was not made via a vote of 5 SEC Commissioners - as was the case with the BTC ETF. Again, this suggests that the decision could be coming from somewhere outside the SEC.

If that is the case, who is running the SEC? I know about 50 million Americans would like to know.

Is it possible that Chairman Gensler could step down? We will see. I can imagine that the rest of the SEC staff may have a hard time trusting his judgment right now.

A few additional notes on ETFs:

We are still waiting for each issuer's S1 form to be approved before we can begin trading. This could take another 4-6+ weeks.

The approval of the 19b-4 form solidifies ETH’s status as a digital commodity (which could have significant implications for other crypto assets as well as the Coinbase and Uniswap lawsuits).

The 19b-4 approval does not include staking. Therefore, the SEC may still consider staked ETH to be a security.

Market Outlook

Forecasting ETH ETF Flow

Bloomberg's ETF experts (James Seyffart and Eric Balchunas) predict that ETH ETF flow will account for about 10-20% of BTC ETF flow.

What's the logic?

Currently, institutions have less interest in ETH.

ETH is more difficult to understand than BTC.

ETH futures ETF trading volume is smaller than BTC (10-20%).

ETH spot volume is smaller than BTC (~50%).

ETH accounts for ~1/3 of BTC’s market cap.

Let’s assume this view is correct. BTC ETFs have seen ~$13B in net inflows since launch. If ETH gets 10-20% of net inflows, that would imply $1.3-2.6B in net inflows.

Our Take:

Given that BTC traded at ~$40K after the ETF launch and rose to $70K two months later (a 75% gain), we expect a similar move for ETH (driving the asset past its all-time high of $4,800).

That being said, ETH has several characteristics that set it apart from BTC. Here are a few things to keep in mind as we look at potential outperformance for ETH:

ETH does not face the same "structural selling pressure" as BTC does, as ETH validators do not incur operating expenses like Bitcoin miners do (forcing them to sell a portion of their mined tokens).

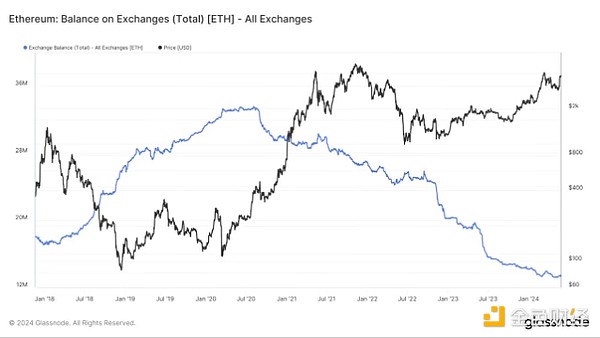

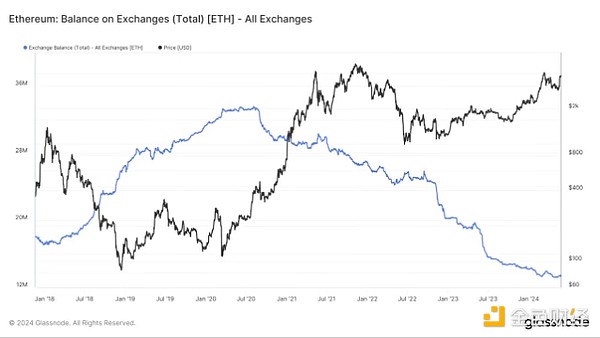

Currently 38% of the ETH supply is "soft locked" on the chain - earning income in staking contracts, DeFi applications, as collateral, etc.:

Data source: Glassnode

Data source: Glassnode

ETH is more reflexive than BTC. This reflexivity can be expressed by price action leading on-chain activity, which leads to more ETH being burned, which can further drive the narrative, more price action, more on-chain activity, and more ETH being burned. We think this will eventually lead to Larry Fink on national television talking about Ethereum and its potential to be the new rail for finance.

ETH is a technical play on web3 growth. A “call option” or “high growth index for web3 adoption”. Whereas Bitcoin is “digital gold”. For this reason, we believe ETH ultimately has a larger addressable market than BTC.

ETH has superior network effects and fundamentals while providing a yield to stakers of the asset (not available to BTC holders).

Given the structural differences, we think it is prudent to ask the following questions:

What percentage of BTC ETF holders could be rebalanced into ETH?

What percentage of investors could seek a 50/50 allocation of BTC and ETH?

What percentage of investors could choose ETH directly over BTC?

If momentum hits, will ETH see a “reflexive flywheel” kick in?

How many institutions are currently on the sidelines because they missed out on BTC? Will they go all-in on ETH?

What would happen if ETH got 40-50% of BTC ETF flows?

What would “altcoin rotation” look like among ETF holders during this cycle?

Given our fundamental view on ETH, we believe it is more likely that ETH will outperform Bloomberg's forecast of 10-20% net inflows into BTC.

A simple framework for thinking about potential ETH (and BTC) valuations this cycle:

Crypto market cap $10 trillion;

BTC peaks at 40% (43% in previous cycle);

ETH peaks at 45% of BTC market cap (50% in previous cycle);

= ETH market cap at cycle peak = $1.8 trillion

= Price/ETH at cycle peak is $14,984 (3.9x)

*Assuming no change in supply as of today

For reference, Bitcoin with a market cap of $4 trillion would be valued at $202k/BTC (2.8x). Finally, the $10 trillion total market cap assumes the same growth rate of the 2017/2018 cycle compared to the previous cycle (388%).

* Bitcoin price is $150,000 (2.1x) and ETH price is $11,200 (2.9x), all else being equal.

Broader Market Perspective

We try not to get overhyped or overconfident, but it’s hard to imagine a more bullish outlook for crypto right now. Everything seems to be in place, including:

Innovation cycle.

Macro/liquidity cycle.

Election cycle.

Bitcoin halving cycle.

BTC and ETH ETFs.

We have now removed a key barrier as the market no longer needs to worry about Gary Gensler scorching the industry.

As a result, we are increasingly confident that the cryptomarket will continue to climb in the second half of the year and could peak in 2025.

Huang Bo

Huang Bo