Source: Hashrate Index

Hashrate Index’s Q1 2024 report has been released, and given the impact of Bitcoin’s fourth halving, we decided to review the data for the first quarter in this report, as well as analyze the direct impact of the halving.

Bitcoin’s fourth halving has come to an end, and this halving is considered to be the most influential to date. The Bitcoin mining market has never been so large, and the number of stakeholders has never been so high. In addition, Bitcoin has gained unprecedented mainstream acceptance, such as the Bitcoin ETF launched in January this year. Transaction activity based on the Bitcoin network has also reached an unprecedented high, including transaction fees driven by non-financial uses such as Ordinal inscriptions and Runes Protocol, providing support to miners when they need it most.

In this report, we review the first quarter of 2024 through the lens of Bitcoin’s fourth halving, and include data from April and the first week of May to show the direct impact of the halving on network data, computing power prices, mining machine prices, Bitcoin mining stocks and other aspects of the mining industry. The full report can be downloaded here (https://hashrateindex.com/blog/content/files/2024/05/Hashrate-Index-Q1-2024-Report-1.pdf).

In this industry newsletter, we will briefly introduce the data and analysis cases that will be detailed in the report.

Bitcoin's total network computing power first increased and then decreased

In the first quarter of 2024, Bitcoin's 7-day average computing power increased by 19% to 611EH/s. As of May 6, 2024, the value showed 604 EH/s, an increase of 17% from the beginning of the year and a year-on-year increase of 73%.

Figure 1: Bitcoin 7-day average hashrate trend

In the week of April 29, hashrate began to decline gradually. From the above figure, we can see that both the 3-day average and the 7-day average have fallen. As of May 8, Bitcoin's 7-day average hashrate has dropped from 650 EH/s on the day of the halving to 581 EH/s, a decrease of 11%. In contrast, after the halving in 2020, Bitcoin's hashrate dropped by 15%.

Hashrate price hits bottom after explosion

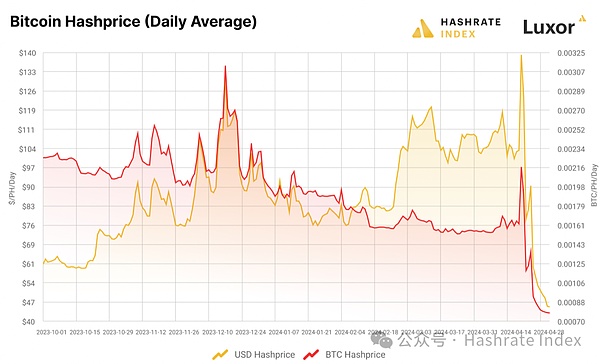

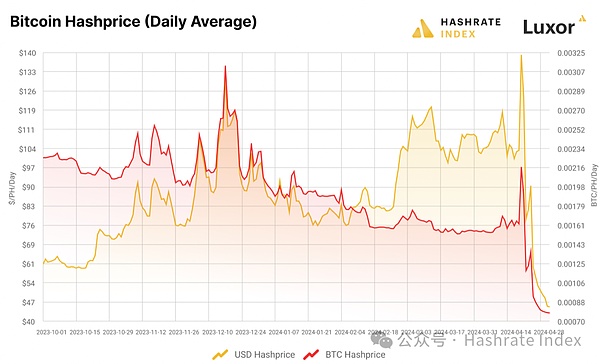

Under the US dollar standard, Bitcoin's hashrate price rose by 11% in the first quarter of 2024 to $109.57/PH/day, a year-on-year increase of 38%. Under the coin standard, the hashrate price fell by 33% to 0.00156 BTC/PH/day, a year-on-year decrease of 44%.

Figure 2: Comparison of hashrate price trends (daily average) under the currency standard and the US dollar standard

As of the time of writing (May 2, 2024), the hashrate price under the US dollar standard was $45/PH/day, setting a record low of $44.43/PH/day on May 1, 2024.

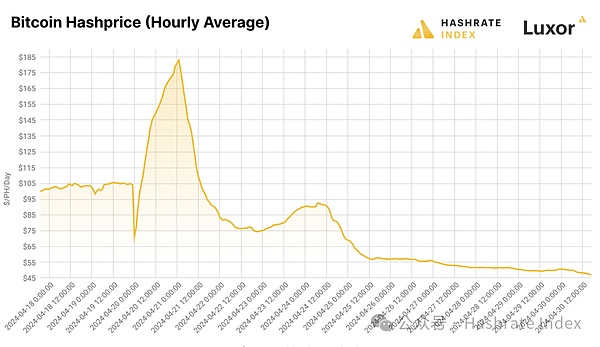

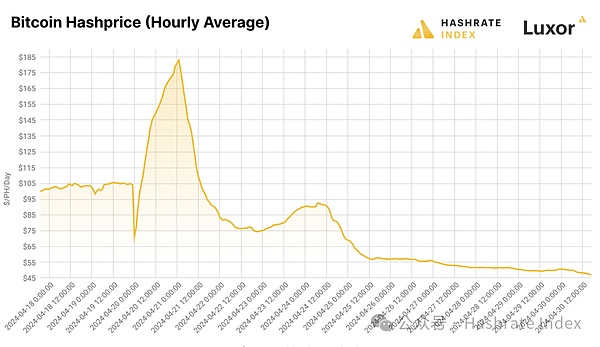

As shown in the figure below, the hashrate price under the US dollar standard fell to $71.40/PH/day at the time of halving, but thanks to Runes, the hashrate price quickly recovered to more than $100/PH/day and reached a peak of $183/PH/day on the second day after the halving, which is also the highest level since April 2022 (all times in the figure below are Coordinated Universal Time). As the transaction volume under the Runes protocol dropped sharply, the price of computing power also fell, and fell below $50/PH/day for the first time on April 28, 2024.

Figure 3: Changes in the average hourly computing power price in US dollars from April 18 to April 30, 2024

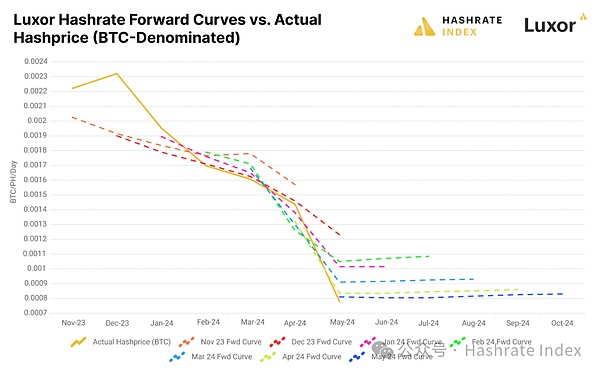

Forward computing power premium at the lowest historical level

The computing power price in US dollars is currently below the historical low, but computing power traders believe that it has bottomed out (at least in the short term). It is worth noting that as of May 6, 2024, Luxor’s hash rate futures are trading in contango until October 2023, meaning that the hash rate price for these futures contracts (they are essentially futures contracts, albeit traded over-the-counter rather than on an exchange) is higher than the current spot price.

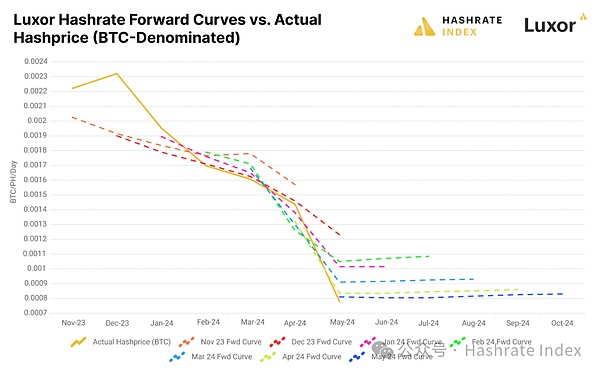

The chart below shows the Bitcoin-denominated price curve for Luxor’s hash rate derivatives contracts from November 2023 to May 2024. We derived this forward curve by averaging the lowest ask and highest bid in Luxor’s hash rate futures order book during the first trading week of each calendar month. So, for example, for the November data point, we took the average of the ask minus the bid for the first trading week of the November, December, January, February, March, and April futures contracts. These futures prices were then compared to the monthly average of hash rate prices.

Figure 4: Luxor forward computing power curve and actual computing power price comparison under the currency standard

How Runes affect transaction fees

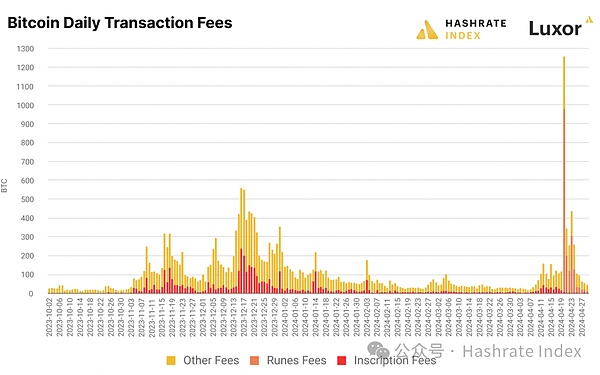

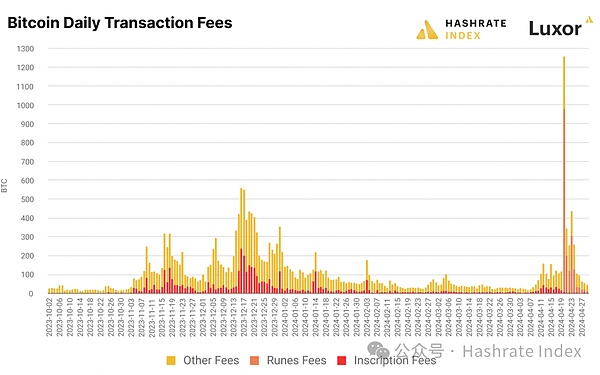

Miners should thank Runes for their amazing contribution to maintaining the computing power price bubble in the days after the halving. This new standard of so-called interchangeable tokens was launched on block 840,000 (the block that triggered the halving) and was responsible for facilitating the transaction of 36.75 BTC out of 37.63 BTC, making the value of the block a record $2.6 million when it was mined.

According to Matt Kimmell's Dune Dashboard data, from the halving to block 841539, Runes generated 1819.8 BTC in transaction fees, worth $117 million, accounting for 43% of all transaction fees earned by all miners during that time period. In contrast, miners earned 23,445 BTC in transaction fees for the entire year of 2023, with a total value of $797.7 million.

Figure 5: Bitcoin Daily Transaction Fees

As shown in the above figure, Runes transaction activity has decreased significantly. In fact, as of April 30, 2024, miners have earned most (87%) of transaction fees in the first four days of Runes' launch.

Mining machine market gradually slumps before halving

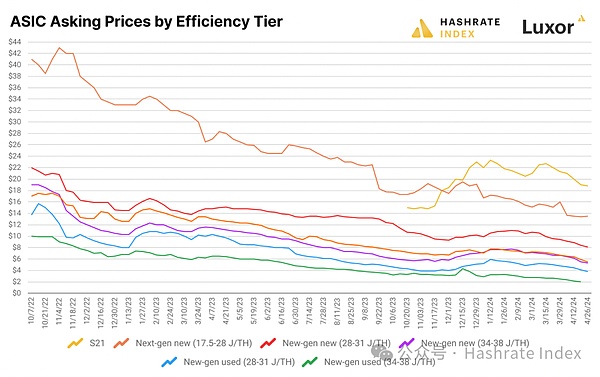

As expected, the mining machine market cooled down significantly before the halving. Despite the record high price of Bitcoin and the average hashrate price reaching $91.14/PH/day in the first quarter of 2024 (a 13% increase from the average level in the fourth quarter of 2023), mining machine prices have been trending down and procurement has stagnated in the weeks before and after the halving.

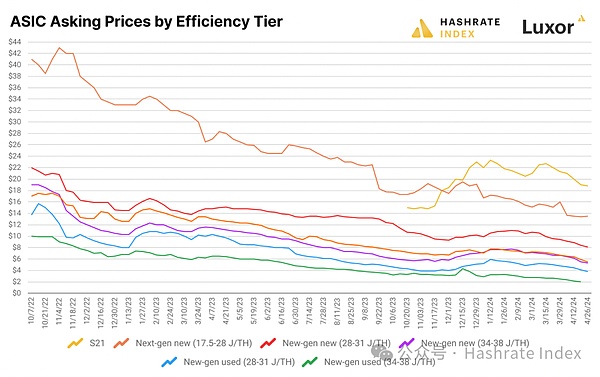

Figure 6: Price trends of mining machines with different energy efficiencies

Compared with the fourth quarter of 2023, despite further growth in hashrate prices and a higher quarterly average, prices of mining machines of all energy efficiency levels fell in this quarter and continued to fall around the halving in April, as miners and mining machine traders priced in the impact of the halving on hashrate prices.

Bitcoin mining companies have to compete with AI data centers for power resources

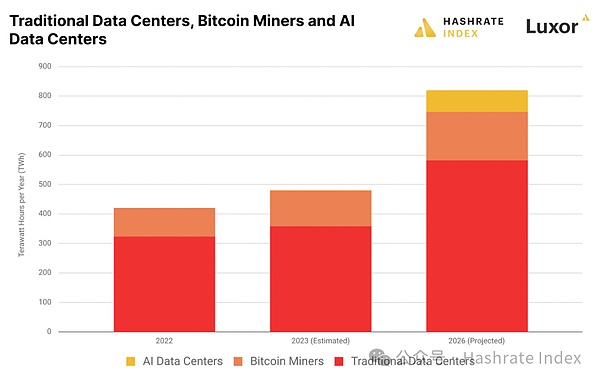

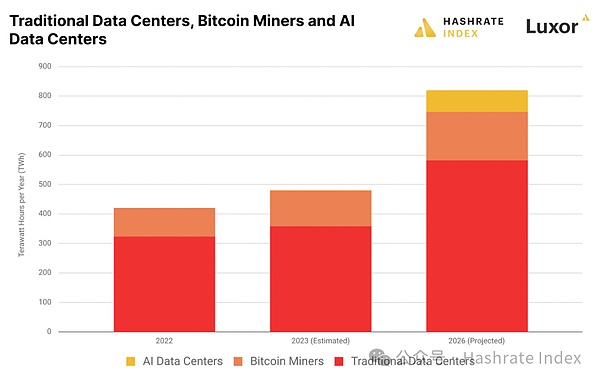

In 2023, AI data centers had relatively low energy consumption, but this will change in the coming years as global AI demand increases and new AI data centers are put into operation around the world. Bitcoin miners will compete with these data centers for power resources, which may curb the growth of Bitcoin's global hashrate.

According to a recent IEA report, global AI datacenter energy consumption could grow 10-fold by 2026. The following chart shows energy consumption for traditional datacenters, Bitcoin mining farms, and AI datacenters in 2022, with estimates for 2023 (since there is no clear public report on the number of datacenters for that year), and forecasts for 2026. For Bitcoin mining data, we used Cambridge University’s Bitcoin Electricity Consumption Index. For AI data, we used the IEA report’s forecast for 2026, and we estimated 2023 data based on Chat-GPT’s daily electricity consumption, and extrapolated the overall AI computing industry based on Chat-GPT’s market share. For traditional datacenters, we used the IEA data for 2022 and the forecast for 2026, and estimated 2023 energy use based on IDC’s annual growth rate for datacenter energy use.

Figure 7: Energy consumption of traditional data centers, Bitcoin mines, and AI data centers

Hash rate growth will be the theme of mining in 2024

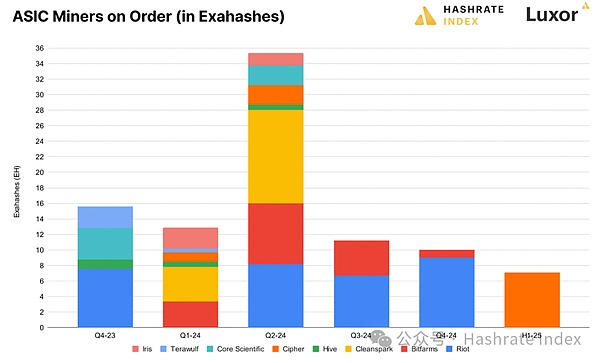

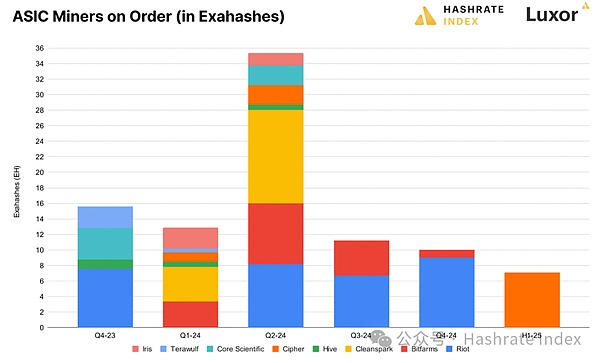

In 2023, listed mining companies took the initiative to order a large number of next-generation mining equipment, including S21, T21, M50 series, M60 series, S19k Pro and S19 XP. These orders will be delivered in batches throughout the year, and many mining companies have also invested funds to purchase additional equipment at forward fixed prices. Assuming that these miners are able to deploy these equipment after delivery, rather than leaving them in inventory as in the past large-scale mining machine orders, these listed companies will bring a large amount of computing power, and 2024 and 2025 will witness this tide of computing power coming online. For example, the total computing power of mining machine purchase orders of listed mining giants in 2024 reached 76.6 EH/s, of which 12.9 EH/s should be delivered in the first quarter of 2024 (assuming the delivery time remains unchanged).

Figure 8: Distribution of Bitcoin mining machine purchase orders (EH/s)

JinseFinance

JinseFinance