Author: Hedy Bi

It is not new that Bitcoin spot ETFs have been approved. According to Reuters yesterday, at least three offshore Chinese asset management companies will soon launch Hong Kong virtual asset spot ETFs (Bitcoin spot and Ethereum spot ETFs). The Hong Kong government's strong support for Web3 and the frequent favorable policies have become the expected consensus of the industry. OKLink Research Institute observed that the approval of Hong Kong Bitcoin and Ethereum spot ETFs did not cause a big sensation in the market like the approval of the US Bitcoin spot ETF, but when we accepted media inquiries, we learned that everyone is more concerned about how much money it brings behind it and its more far-reaching significance. Through this article, the author explores the following questions from the perspective of "Hong Kong stock traders":

1. When calculating the scale of inflows, why do institutions attach so much importance to southbound funds?

ETFs were first included in the "Stock Connect" in July 2022. The program allows investors in mainland China and Hong Kong to buy, sell and settle stocks listed in each other's market through stock exchanges and clearing houses in their own markets, and therefore there are two categories of southbound funds (from mainland China to Hong Kong) and northbound funds (from Hong Kong to mainland China).

If southbound funds are approved, the virtual asset market represented by Bitcoin will become a new financial market for both China and the United States.According to public data from the China Securities Regulatory Commission, as of December 31, 2023, although there are only 8 southbound qualified ETFs available for mainland investors to choose from, their daily trading volume is as high as 108.3 billion yuan (about 15 billion US dollars), which means that 5% of the eligible ETFs that can be traded by southbound funds have attracted 16% of the capital inflows of the Hong Kong Stock Exchange (RMB channel).

However, we also note that the number of eligible ETFs that enter the Hong Kong ETF market through the Shanghai-Hong Kong Stock Connect/Shenzhen-Hong Kong Stock Connect channels is quite limited. In addition, the Hong Kong Securities Regulatory Commission proposed in its 2024 outlook to consolidate Hong Kong's position as the world's leading offshore RMB center through "Swap Connect", "HKD-RMB Dual Counter Model" and Dual Counter Market Maker Mechanism. Considering the current attitude of the mainland towards virtual asset trading, after communicating with relevant financial markets in Shanghai and Hong Kong and Web3 industry insiders, OKLink Research Institute concluded that it is extremely unlikely that Hong Kong Bitcoin and Ethereum spot ETFs will be approved and opened to mainland investors in the short term. Based on the comprehensive opinions of various regulatory agencies and industry insiders, we believe that under the current circumstances, mainland residents cannot invest in Bitcoin and Ethereum spot ETFs through the Shanghai-Hong Kong Stock Connect/Shenzhen-Hong Kong Stock Connect.

However, the funds cashed out through the Shanghai/Shenzhen-Hong Kong Stock Connect can only return along the original route in the local settlement system, that is, the RMB funds flow in and out through the Shanghai/Shenzhen-Hong Kong Stock Connect, and will not remain in the Hong Kong market in the form of other assets, which means that offshore RMB is not within the channel of the Shanghai/Shenzhen-Hong Kong Stock Connect.

2. US Bitcoin ETF vs. Hong Kong ETF, is Hong Kong still attractive?

We noticed that Eric Balchunas, a senior ETF analyst at Bloomberg, believes that US$500 million will be a rather optimistic figure. However, we firmly believe that the potential of the Hong Kong virtual asset ETF market far exceeds this figure.This article will analyze the risk preferences of Hong Kong ETF investors, the situation of the Hong Kong virtual asset market before the announcement of the news, and the ETF settings of the two places:

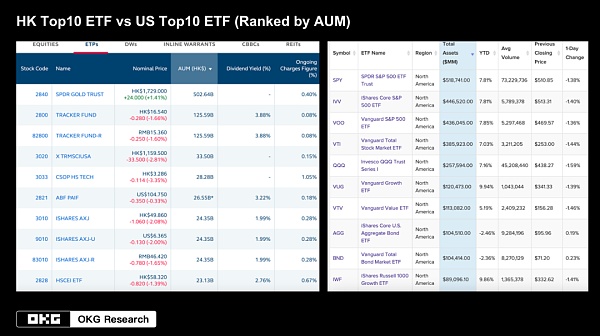

Eric Balchunas used the ETF market size for comparison. It is true that the overall size of the Hong Kong ETF market is much smaller than that of the United States, but we also found an interesting phenomenon. Among the top ten ETFs in Hong Kong, the ETF ranked first by AUM accounts for 54% of the total AUM, while the US is 20%. This means that investors in the Hong Kong ETF market are unevenly distributed, with more than 50% of investments concentrated at the top. In addition, the ETF ranked first in AUM in the Hong Kong market is also the gold-based ETF (SPDR GOLD TRUST) used as a comparison by Bitcoin investors, with an AUM of approximately US$69.8 billion, while the top ETF in the US ETP market is the S&P500-based ETF, with an AUM of approximately US$518.7 billion, and SPDR GOLD TRUST AUM accounts for 13.5% of the top US ETF. Therefore, it can be concluded that the head effect in the Hong Kong ETF market is more significant, and compared with US ETF investors who are more willing to invest in US stocks (such as S&P500 as the underlying), Hong Kong investors are more interested in investing in gold. This shows that investors in the two markets have different understandings of risk preferences and economic cycles. The Hong Kong market will have a greater acceptance of Bitcoin as "digital gold".

Data source: HKEX, ETFdatabase

Hong Kong people seem to have a higher enthusiasm for Bitcoin. At the end of last year, when OKEx Cloud Chain Research Institute conducted a field survey in the virtual asset OTC market in Hong Kong, it was found that as of January this year, there were at least 200 physical crypto OTC exchange shops in the virtual asset market in Hong Kong. According to our calculations, the average annual transaction volume of the exchange shop channel is more than US$10 billion. Before the ETF channel, Chainalysis also made an estimate of the Hong Kong market: Although Hong Kong's population is much smaller than that of the United States, Hong Kong's active over-the-counter cryptocurrency market drove a transaction volume of US$64 billion during the bear market last year (June 2022 to June 2023). Compared with other parts of Asia, Hong Kong dominates large institutional cryptocurrency transactions. Of Hong Kong's annual virtual asset transactions, 46.8% are institutional transactions of more than $10 million, which is higher than the global average for similar transactions. Data source: Chainalysis In addition, in terms of the redemption mechanism, since Hong Kong has a comprehensive regulatory system in the virtual asset market, the physical redemption mechanism will be more beneficial to "Crypto-native" investors. The four methods of currency in cash out, currency in currency out, money in currency out and money in cash out are more flexible than the cash redemption mechanism (the last one) in the United States, and there is also room for arbitrage. In addition, we believe that for Hong Kong investors who already hold BTC and ETH, the probability of obtaining illegal funds when exchanging Bitcoin for fiat currency is reduced to a greater extent, thereby protecting investors' assets.

As for the Ethereum spot ETF, although the current market value of Ethereum is US$371.7 billion, compared with the Bitcoin market value of US$1.25 trillion, as the issuer, it is more motivated to promote it. Because in addition to the benefits brought by price increases, the Ethereum spot ETF also has additional returns brought by staking. As early as February 7, 2024, local time, Ark Invest submitted an updated S-1 revised application form, adding "the sponsor may pledge part of the trust assets on one or more trusted third-party pledge platforms from time to time."

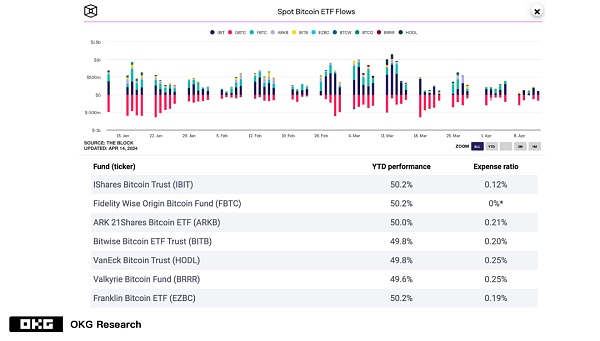

For qualified investors in Hong Kong, especially large-scale transaction investors, so far we understand that Hong Kong's management fees are not advantageous. However, there are other factors to consider for capital inflows. FBTC, which currently has a fund fee rate of 0, is not ranked first in terms of capital inflow. This may be related to the fact that FBTC uses self-custody rather than third-party (coinbase, gemini) custody.

Data source: The Block, Public Info

Hong Kong's layout of Web3 and opening of the ETF channel, which is more familiar to the public, is more meaningful. This is not only a favorable adjustment to the balance sheet of financial institutions due to the "shrinkage" of overall assets, but also a strategic strategy for staying at the "table" or even the leading party of the new financial table. With the fundamental benefits such as Bitcoin halving, we will wait and see the future potential of Hong Kong's virtual asset spot ETF!

Xu Lin

Xu Lin

Xu Lin

Xu Lin Cheng Yuan

Cheng Yuan Bitcoinist

Bitcoinist Bitcoinist

Bitcoinist Bitcoinist

Bitcoinist Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph