Recently, the Hong Kong Securities and Futures Commission (SFC) has once again revealed a number of suspicious virtual asset trading platforms and issued a warning to the public. This sends a clear signal to the market: the Hong Kong government is closely following the latest developments in the field of cryptocurrency and strictly cracking down on illegal financial activities to ensure market fairness and transparency.

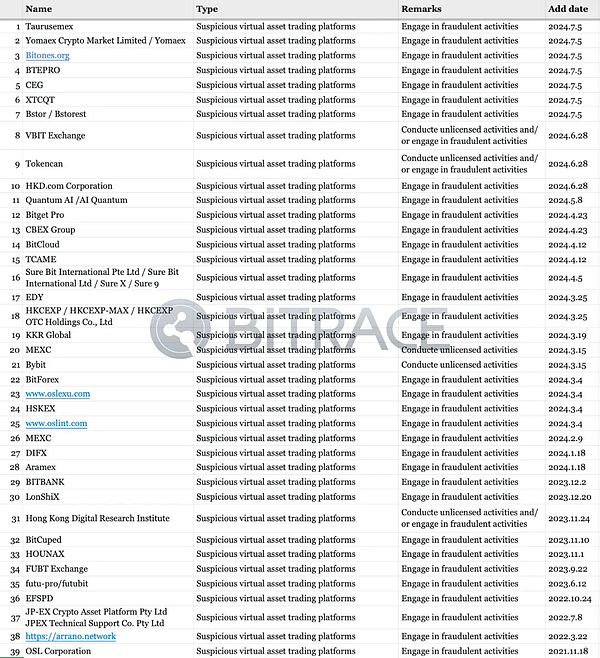

Since 2021, the SFC has disclosed a total of 39 suspicious platforms related to the crypto market, and exchanges MEXC and Bybit are also listed. What are the suspicious virtual asset trading platforms defined by the Hong Kong Securities and Futures Commission, and why are these platforms warned?

What are "suspicious" virtual asset trading platforms?

Bitrace divides the suspicious platforms disclosed by the SFC into three categories: platforms established to carry out fraudulent activities, platforms that have real business but part of the business involves fraud, and platforms that have real business but have not obtained a license.

This table is compiled based on the warning list disclosed by the SFC

1. Platforms established to carry out fraudulent activities

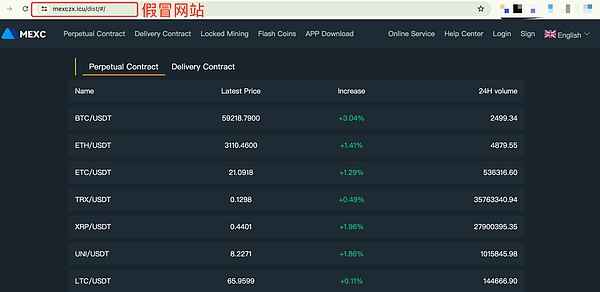

Such platforms were warned by the Hong Kong Securities and Futures Commission for impersonating official exchanges and fabricating false corporate information to induce users to invest. Take the platform impersonating MEXC that carried out fraudulent activities as an example. The website claimed to be a virtual asset trading platform entity and was suspected of operating a fake website as shown in the figure to engage in fraudulent activities. The victims were asked to deposit funds into a designated bank account for investment purposes, but encountered difficulties in withdrawing funds.

The fake MEXC website posted on the SFC website

This type of website has frequently appeared in a large number of investment and financial fraud activities such as "foreign exchange investment" and "cryptocurrency quantitative investment", causing great financial losses to innocent overseas Chinese, foreigners, and local non-professional investors.

2. Platforms with real business but some of the business involves fraud

The typical representative of this type of platform is JPEX. Last year, the Hong Kong Securities and Futures Commission pointed out that the cryptocurrency trading platform JPEX claimed that it had received investment from a Hong Kong listed company and claimed to have obtained a license to operate a virtual asset trading platform, which was suspected of false advertising. The next day, JPEX restricted users from withdrawing coins with high handling fees. In addition, the exchange offered extremely high returns for some of its products, but some investors complained that they failed to successfully withdraw virtual assets or their account balances were changed, and eventually the thunder quickly broke out.

Such institutions are often not used only to carry out fraudulent activities. They usually have normal main businesses, but in the process of carrying out some commercial activities, they intentionally or unintentionally violate the bottom line of the law.

3. Platforms with real business but no license

According to the information disclosed on the SFC official website, the official exchanges MEXC and Bybit have launched business with Hong Kong investors as the sales target without obtaining any license from the Hong Kong Securities Regulatory Commission, and therefore have been included in the Hong Kong Securities Regulatory Commission's warning list (No. 20, 21).

Although this does not mean that the business activities of the relevant trading platforms in other regions are not compliant, it still caused negative damage to the relevant brands in public opinion. It can be seen that compliance is the cornerstone of the operation of centralized trading platforms.

Is Hong Kong's regulatory policy effective?

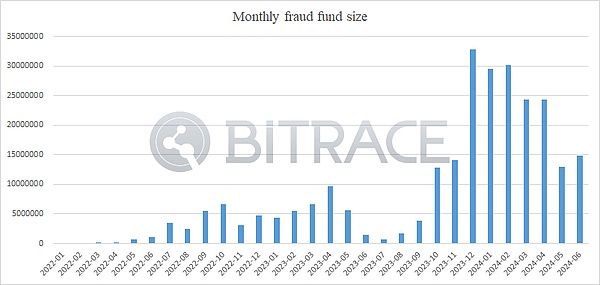

Bitrace has long been concerned about the virtual asset trading market in Hong Kong. According to the capital risk audit of the local VAOTC group business addresses, the scale of crypto funds (USDT) associated with fraudulent activities entering the Hong Kong cryptocurrency secondary market through over-the-counter trading channels has been significantly reduced since the first quarter of 2024, and the current monthly capital scale has been halved compared to the peak.

The reason may be that on February 8, 2024, the Hong Kong government plans to establish a virtual currency over-the-counter trading platform (VAOTC) licensing system, requiring all VAOTCs to apply for licenses from the customs, resulting in the crowding out of some risky funds, which shows that the intervention of local supervision has promoted the maturity of the Hong Kong cryptocurrency market.

Finally

The Hong Kong Securities and Futures Commission is gradually building a compliant cryptocurrency regulatory environment to provide security for investors and promote the industry to develop in a more mature and standardized direction. For local operators who are committed to compliant operations, this will also be a good time to build brand trust and business security moats.