Author: Liu Jiaolian

As BTC (Bitcoin) continued to pull back to the 61k line, and it was about to close down in April after seven consecutive months of gains, Hong Kong listed the spot Bitcoin ETF and Ethereum ETF as scheduled, becoming the first securities market in Asia to launch spot Bitcoin and Ethereum ETFs after the United States launched the spot Bitcoin ETF. This rhythm is in line with the outlook of the 4.10 Jiaolian internal reference "It is said that Hong Kong will list spot BTC ETFs as soon as the end of April".

In addition, unlike the US Bitcoin ETF, Hong Kong has listed both the Bitcoin ETF and the Ethereum ETF at the same time, and supports cash creation and redemption (cash create & redemption), as well as spot creation and redemption (in-kind), which can be said to be a bigger step. This is introduced in the 4.15 Jiaolian internal reference "Hong Kong approves BTC and ETH spot ETFs".

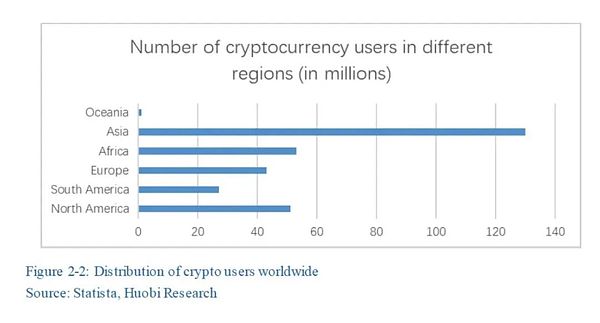

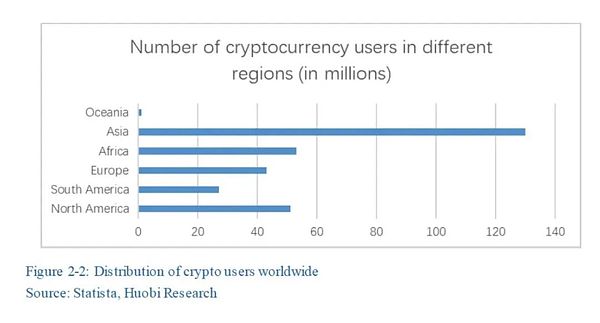

Previously, many community netizens were optimistic about the launch of the crypto ETF in Hong Kong. Because from the data, the largest number of crypto users are in Asia (more than the United States and Europe combined), with a high penetration rate of digital payments and a large number of young people who master technology.

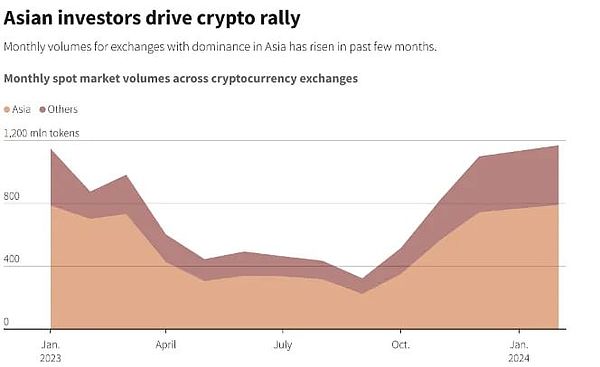

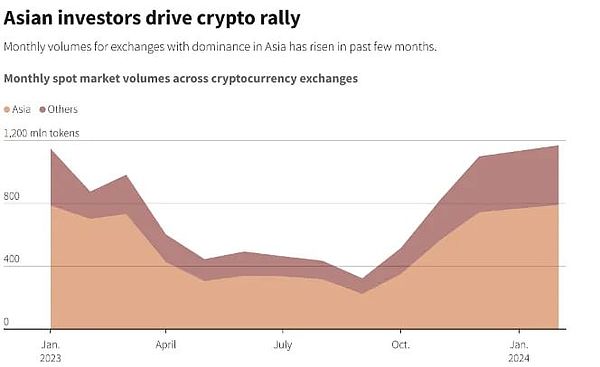

For example, in February this year, 70% of Bitcoin trading volume occurred in Asia. And most of the time, it is Asian forces that dominate spot trading.

However, the timing of Hong Kong's launch of the ETF is not as favorable as the launch of the ETF in the United States in January. Recently, the crypto market has been a spent force, with repeated callbacks, showing a very tired state. Several Bitcoin ETFs in the United States have turned to a state of net outflow and bleeding half a month ago. The 4.26 internal reference "Spot Bitcoin ETF bleeding expanded" introduced this situation.

In the second month after the launch of the US ETF, BTC soared from 43k to 63k in February, closing up nearly 45% in a single month, the largest increase in the past 7 consecutive months of rising months.

The Hong Kong ETF was launched at the end of the eighth month of decline, so it did not take advantage of the momentum.

In addition, the day after April 30 is the May Day holiday. For investors in the traditional stock market, some people's investment habits are to clear their positions before the holiday and spend the holiday with empty positions. This may also affect the enthusiasm of capital participation.

Of course, the most critical thing is that the southbound channel has not been opened. The world's two largest purchasing powers, one is absorbed and digested by the US ETF, and the other is blocked outside the customs. Then it is conceivable how many people and funds can still participate.

Therefore, various factors have caused the Hong Kong ETF to perform poorly in terms of data on the first day of listing. It can be said that it is far from what was expected. It was once expected that the transaction volume would exceed 100 million US dollars, but until the close of today, the actual transaction volume was only 87.5 million Hong Kong dollars, equivalent to a mere 11.2 million US dollars.

Some people on the Internet ridiculed that this amount was not as good as any popular local dog on the local dog chain. And if compared with the volume of 4.6 billion US dollars on the first day of the US ETF listing, it is not even a fraction.

There is no doubt that this is a strategic high ground. The Hong Kong ETF must be established and done well. "If we don't occupy this position, others will; if we don't unite this group of people, others will try to win them over."

JinseFinance

JinseFinance