Author: Jason Jiang, OKG Research

Recently, the Hong Kong Treasury and the HKMA jointly issued a consultation summary on the legislative proposals for the regulatory system for stablecoin issuers, which triggered heated discussions in the market. As a global leading Web3 technology company and on-chain data service provider, OKLink continues to pay attention to and deeply participate in the innovation and development of the Hong Kong virtual asset Web3.0 ecosystem, including stablecoins. It was invited to the Hong Kong Monetary Authority for offline exchanges, and based on its own technology and product features, from the perspective of on-chain data and regulatory technology, it submitted policy suggestions and technical suggestions on stablecoin regulation to the Hong Kong government at the beginning of this year.

As stablecoins are increasingly used around the world, the security risks they bring, especially anti-money laundering risks, are also more severe. A report previously released by the United Nations pointed out that stablecoins such as USDT have become one of the common payment methods for money laundering and fraud in Southeast Asia. The "White Paper on Global Virtual Currency Crime Situation and Security Governance" jointly released by OKLink Research Institute and the Key Laboratory of Information Network Security of the Ministry of Public Security of the Third Research Institute of the Ministry of Public Security also found that among all kinds of virtual asset-related risk events, stablecoins are the absolute main force of various criminal funds: more than 50% of virtual asset risk events are related to stablecoins.

Although the above risks may not be directly related to the issuers of stablecoins, they will still cause great damage to the entire stablecoin and virtual asset market, including the issuers. In the communication between OKLink and the Hong Kong Monetary Authority, both parties believe that Web3 on-chain data technology is of great value to the security and compliance of stablecoins.

In the recently released consultation summary, although no specific suggestions were given on the anti-money laundering of stablecoins, it was clearly stated that "separate guidance consistent with the international standards set by the Financial Action Task Force will be issued, setting out anti-money laundering provisions including transaction monitoring and compliance with transfer rules". This shows from another perspective that Hong Kong regulators have realized the importance of anti-money laundering and security issues of stablecoins, and will take more targeted measures.

Regarding the security and anti-money laundering issues of stablecoins, OKLink proposed in its previously submitted policy suggestions that in the process of stablecoin supervision, in addition to having an appropriate regulatory framework, more technical means are needed to enhance the ability of issuers and regulators to deal with various risks such as stablecoin money laundering. However, considering that stablecoin transactions mainly occur on blockchain networks (especially public blockchain networks), on-chain transfers and transactions have strong anonymity and anti-censorship, conventional risk control technologies and systems may be difficult to effectively respond to and combat money laundering and terrorist financing activities.

Therefore, it is recommended that:In addition to completing customer due diligence, transaction monitoring, and meeting telex transfer regulations in accordance with relevant regulations, issuers of legal currency stablecoins should also be encouraged to improve on-chain monitoring mechanisms, and improve on-chain transaction verification, on-chain address analysis, on-chain risk monitoring, and on-chain asset tracking capabilities for legal currency stablecoins by adopting technological solutions such as blockchain analysis tools, and using technical means such as KYA, KYT, and KYE.

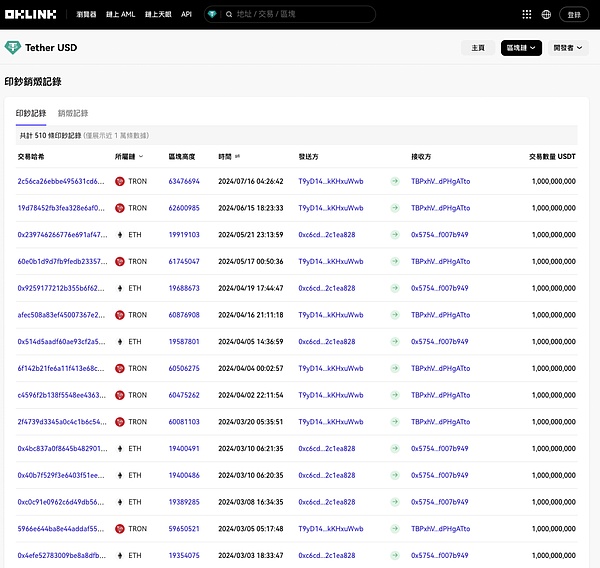

Monitoring the issuance and destruction of USDT based on OKLink

A senior researcher at OKLink Research Institute also stated in an interview with South China Morning Post, Sing Tao Daily and other media:

OKG Research

As one of the first regions in the world to impose supervision on stablecoin issuers, Hong Kong is imposing supervision on stablecoin issuers through a strict but appropriate regulatory framework while maintaining flexibility and openness, striving to strike a balance between effective investor protection and providing potential issuers with greater room for innovation.

However, in the process of meeting regulatory requirements, companies need not only strong capital, but also strong technical capabilities as support to ensure that they can meet regulatory requirements while preventing potential technical and security risks brought about by the issuance of stablecoins.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Alex

Alex JinseFinance

JinseFinance Alex

Alex Davin

Davin