Source: Blockchain Knight

The following is the total increase in whales’ BTC holdings since the beginning of 2024, based on on-chain data.

On-chain analysis company Santiment published an article on X discussing the changes in BTC "shark" and "whale" holdings this year.

One of the more interesting metrics is the “supply distribution”, which shows the total amount of BTC currently held by different wallet groups on the network. Addresses are divided into different wallet groups based on the amount of BTC in their current balance.

Two groups are particularly relevant in the context of the current topic: "sharks" and "whales".

"Sharks" usually refer to investors holding 100 to 1,000 BTC, while "whales" refer to investors holding 1,000 to 10,000 BTC.

Since both groups hold large amounts of BTC, they have a certain amount of influence in the market. Of course, the "whales" are the more powerful of the two groups because they hold larger amounts.

Generally speaking, individual moves by members of these groups will not have much noticeable impact on the market, but when these investors act as a group, the scale becomes large enough , thereby bringing shock waves to Crypto assets.

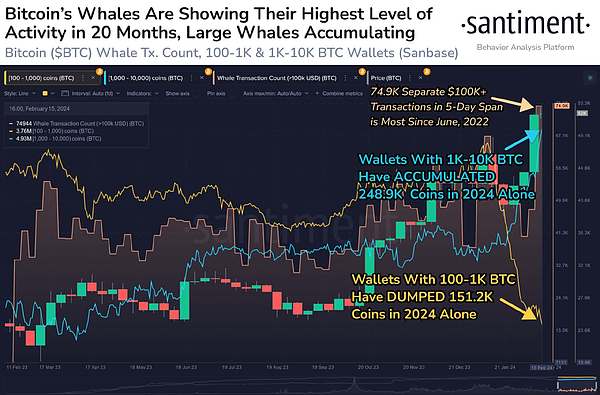

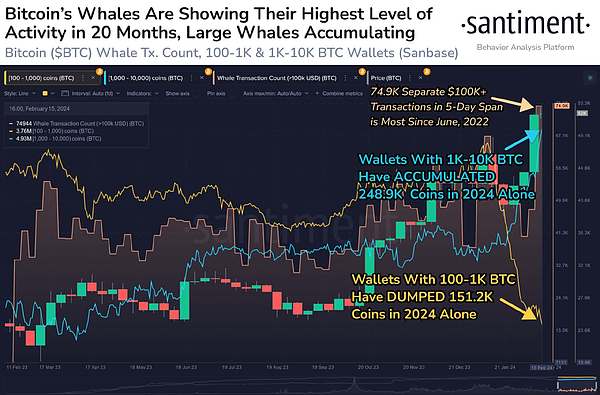

The chart below shows the BTC supply distribution trend for these two types of investors over the past year:

As shown in the figure above, since the beginning of this year, the BTC held by "whales" Supply has been rising sharply. During the same period, the BTC supply of "Sharks" decreased significantly.

The 1000-10000 BTC wallet group added a total of 248,900 BTC, while the 100-1000 BTC wallet group sold 151,200 BTC.

Based on current asset prices, the values of these two transactions are approximately US$13 billion and US$8 billion respectively.

Obviously, while "sharks" participated in some of the selling, buying by the more influential "whales" more than made up for the losses. On a net basis, these large holders have accumulated $5 billion worth of funds for the market.

In fact, some of the apparent selling by the “Shark Group” may simply be because some members of the group bought enough BTC to cross the 1,000 BTC threshold and become part of the “Whale Group” One member.

Regardless, The strong accumulation of "whales" is naturally a positive sign for Crypto assets, as it shows that these huge holders have given Crypto assets a boost during their recent bull run. Support.

In the chart, Santiment also attached data for another indicator: the number of "whale" transactions. This indicator recently reached its highest value in 5 days since June 2022, showing how these large investors have stepped up their activity.

JinseFinance

JinseFinance