Author: Blockchain Knight

Crypto prediction markets are growing with the development of platforms such as Polymarket.

Castle Capital points out in its latest in-depth investigation report that prediction markets enable users to bet on future events using Crypto assets, moving traditional gambling to a decentralized space.

This shift allows participants to trade with each other rather than with centralized institutions, thereby increasing transparency and resistance to manipulation.

Castle Capital outlines how prediction markets have historically been centralized, limiting user participation and flexibility.

The introduction of blockchain technology has made these markets decentralized, allowing users to create their own markets and conditions.

Since the launch of another prediction market, Augur, in 2015, prediction markets have been recognized as a prominent application of blockchain technology, although mainstream attention has only recently intensified.

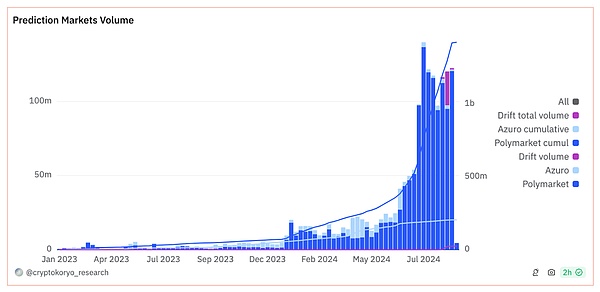

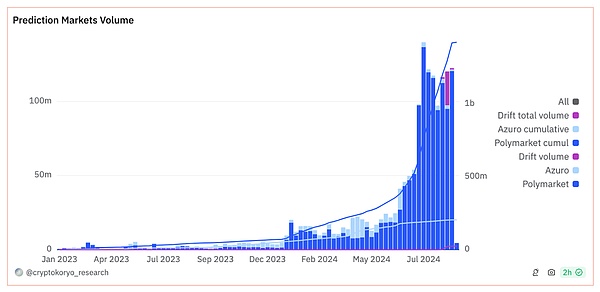

The total value locked in the industry has reached $162 million, with user participation and trading volume increasing significantly.

Platforms such as Azuro and Polymarket have facilitated this growth by offering different approaches.

Polymarket is based on Polygon and operates on an order book model, focusing on major political and news-related events.

Currently, Polymarket has processed more than $1.4 billion in trading volume, becoming a key betting platform for events such as the US presidential election.

Castle Capital explained that Azuro uses a peer-to-peer pool design that allows users to provide liquidity to pools that serve multiple markets. This model spreads risk and improves capital efficiency, and is mainly aimed at sports betting.

Azuro has processed more than $200 million in prediction volume, attracting users who place repeat bets on various sports events.

Both platforms aim to expand market share.

Polymarket seeks to reduce its reliance on political events by adding more diverse markets, while Azuro reportedly plans to add political and news markets in addition to sports markets.

The development of these platforms highlights the growing interest in decentralized prediction markets as a tool to measure public sentiment.

Castle Capital outlines the challenges that still face mainstream adoption, including liquidity issues, regulatory uncertainty, and the need to improve user experience.

Ensuring reliable ordering and data accuracy is critical, as is addressing the scalability issues of blockchain networks. Overcoming these obstacles will require innovation and collaboration with regulators.

As Castle Capital points out, prediction markets have the potential to provide accurate public sentiment on a variety of topics, moving beyond seasonal hype and becoming an indispensable tool for decision-making.

Integrating artificial intelligence and expanding market offerings may enhance their usefulness and appeal.

Prediction markets can provide news organizations with decentralized sentiment data and influence political discourse.

With platforms like Azuro and Polymarket as examples, the future of prediction markets seems promising.

Their continued growth and adaptability are likely to solidify their position in the Crypto asset space, providing valuable insights and opportunities for users who predict future events.

Castle Capital's report noted that the development of prediction markets reflects the general trend of increasing adoption of decentralized applications.

However, it remains to be seen whether these platforms can maintain their momentum, meet future challenges, and gain mainstream acceptance.

Anais

Anais