Author: Malte Kliemann Source: coindesk Translation: Shan Oba, Golden Finance

The topic of on-chain governance has always been controversial. While off-chain governance is often considered unwieldy, on-chain governance allows developers to build increasingly complex protocols that allow users to influence the direction of the network. But these are essentially games, and if misconfigured or provided with the wrong incentives, it can lead to disaster for the entire chain.

In "What is Futarchy? - The Future of Transactions," Gnosis co-founder Freiderike Ernst highlights the standard approach to on-chain voting. Since the "one vote per person" paradigm is vulnerable to Sybil attacks on permissionless networks (one person can spread their funds across multiple accounts and cast multiple votes), a user's voting power is usually calculated by the tokens they hold. Weighted by quantity. Lottery and token management registries use the same approach to avoid Sybil attacks.

Robin Hanson proposed a new governance model called futarchy, in which decisions are not based on voting but on prediction markets of organizational welfare measures As a result, this welfare measure is an indicator of the network's growth or demise. Market participants will place bets on the future value of welfare measures.

Betting is typically implemented using outcome tokens, each of which represents a specific outcome of the market and whose monetary value is determined by the final welfare indicator. Good predictions are rewarded and bad predictions result in losses.

Using outcome tokens, participants can even bet on the value of welfare measures based on the implementation of policies. For example, participants can place a bet that pays out profits if the policy is implemented and welfare measures increase by a certain amount, but has no effect if the policy is not implemented.

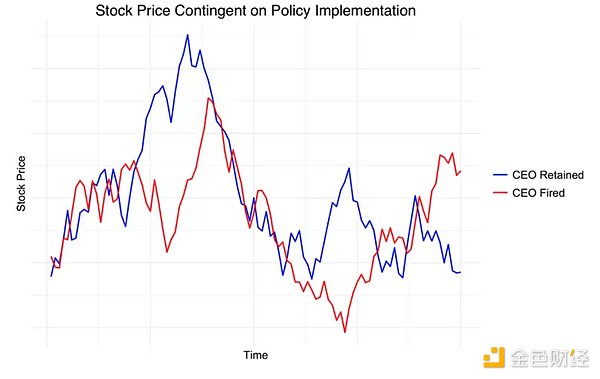

For a public company that chooses stock price as a measure of welfare and considers firing its CEO, the result is that the organization gets two predictions that the CEO will be fired. The future stock price at the time of dismissal and the future stock price at the time the CEO was fired. is retained. As can be seen from the picture below:

With futarchy, decisions leading to the highest possible welfare measures are implemented. Because the stock price forecast for eventual CEO firing is higher than the forecast for CEO retention, the CEO is fired. This removes all emotion from the decision-making process, allowing organizations to make rational decisions based on what is often called the "wisdom of crowds" to enhance their values.

Market makers for prediction markets

Implement market makers to facilitate interactions between participants Transactions come with some challenges. If we wanted to use futarchy to evaluate more complex contingencies, the market would quickly grow to tens of thousands of tokens. Here, the "weak market problem" surfaces: there are not enough players to correctly correct the probabilities of so many outcomes. The natural solution is an automated market maker (AMM).

A simple solution is a cost function implementation of the logarithmic market scoring rule. Unfortunately, this implementation does not allow for ad hoc changes in liquidity, often resulting in markets that are either too shallow to accommodate all participants, or too deep to actually produce meaningful results. The Liquidity-Sensitive Log Market Scoring Rule (LS-LMSR) alleviates this problem, but this solution introduces new flaws, the most serious of which is the arbitrage vulnerability, which appears in all scoring rules except LMSR. City business.

Cryptocurrency mainstays such as Balancer and other constant function market makers (CFMMs) better handle the liquidity aspect by allowing LPs to dynamically deposit and withdraw liquidity, And is more familiar to cryptocurrency natives, but suffers from the same issues as LS-LMSR. However, it turns out that during prediction markets, Gnosis seemed to have found a CFMM implementation of LMSR that combined the best of both worlds.