Original link: https://research.kaiko.com/insights/mica-is-reshaping-eur-stablecoin-markets

Compiled by Aiying Team

The European Crypto Asset Market Regulation (MiCA), which came into effect at the end of June, is profoundly changing the euro stablecoin market. The implementation of this regulation has triggered a series of large crypto exchanges to adjust their product services, including delisting some stablecoins. In early October, Coinbase announced that it would delist USDT for European users by the end of the year, and similar moves have also occurred in several other major centralized exchanges.

Long article analysis of Circle's historical opportunity and starting point for issuing USDC and EURC under the MiCA Act

In-depth analysis and latest adjustments to the restrictions on the use of stablecoins under the EU MiCA Act

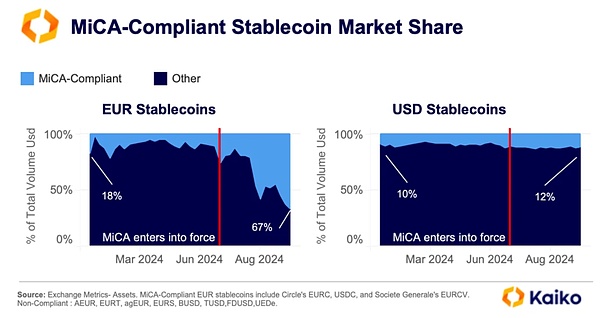

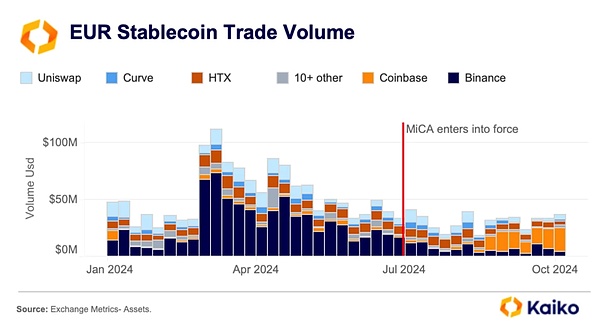

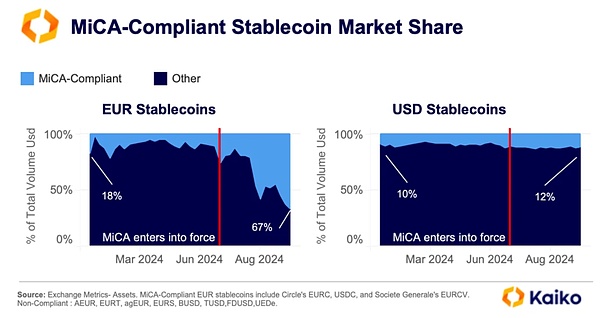

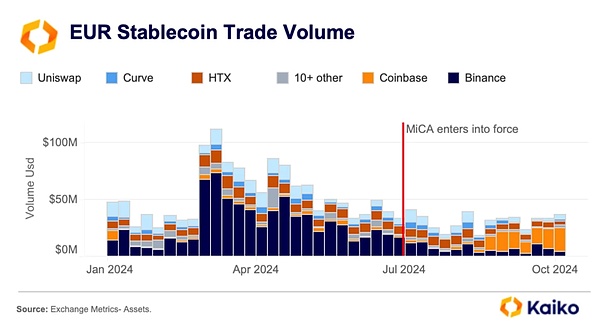

Three months after the implementation of MiCA, the European stablecoin market has changed significantly, especially the impact on euro stablecoins. Currently, the market share of euro stablecoins that meet MiCA regulations (such as Circle's EURC and Societe Generale's EURCV) reached a record high of 67% last week. This change is mainly due to Coinbase, which surpassed Binance in August and became the main market for euro stablecoin transactions. Meanwhile, Binance is promoting euro stablecoins that do not meet MiCA standards, mainly through a zero-fee model, mainly for non-European users.

From the perspective of US dollar stablecoins, the largest US dollar stablecoin that meets MiCA standards is USDC, and its market share has also increased, from 10% to 12%, although the increase is relatively mild.

Overall, since the implementation of MiCA, the weekly trading volume of euro stablecoins has basically remained at around $30 million, far lower than the $100 million level in March this year. This shows that despite the regulatory changes, the market demand for euro stablecoins has not increased significantly, and the change in market share is mainly caused by MiCA forcing exchanges to delist.

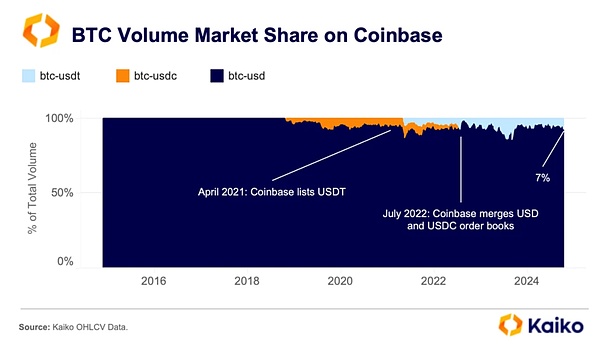

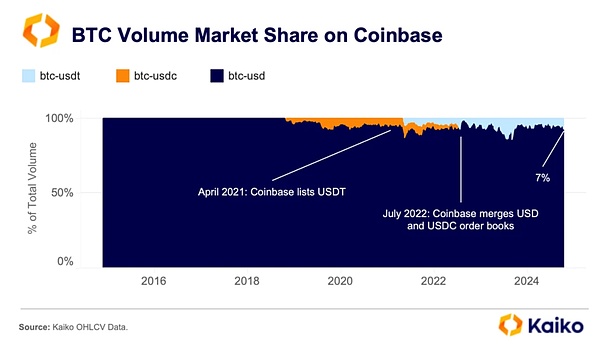

Whether the share of the US dollar stablecoin market will change remains to be seen. Coinbase is about to delist USDT for European users, which may bring some gains to regulated US dollar stablecoins. Looking back at history, although USDT does not meet the MiCA standards, its global popularity is very fast. Since its launch on Coinbase in 2021, USDT's share of the BTC-USDT trading pair has risen rapidly from 1% to more than 5%, and surpassed BTC-USDC at the end of 2021. Although Coinbase merged the order books of USD and USDC in July 2022 to enhance liquidity, USDT's market share remained at around 10% by the second quarter of 2023.

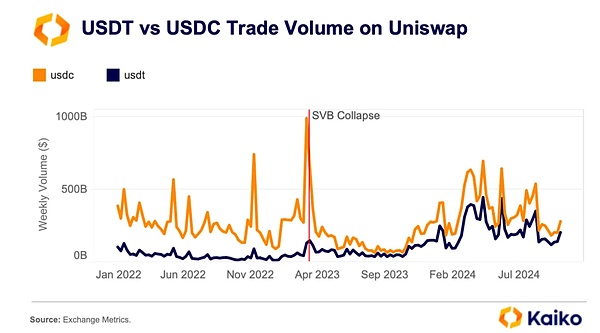

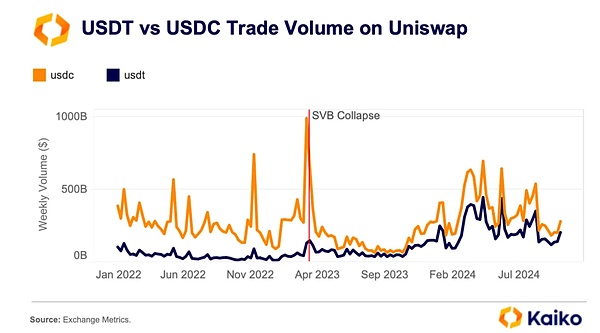

MiCA may also affect the competition of stablecoins on decentralized exchanges (DEX). Since DEXs are not regulated by the new MiCA rules, they still allow USDT trading, which may attract some traders seeking liquidity - after all, USDT is still the most liquid stablecoin on the market. This trend was particularly evident after the US banking crisis, with USDT usage growing on Uniswap, the largest Ethereum DEX.

In contrast, USDC's dominance on Uniswap has declined significantly. Since the collapse of Silicon Valley Bank (SVB), one of Circle's main partner banks, caused USDC to depeg dramatically, its market share on Uniswap has dropped from nearly 90% in 2022 to about 55% last week.

In summary, the implementation of MiCA has not only had a profound impact on the market landscape of euro stablecoins, but is also gradually affecting the market share of US dollar stablecoins, especially in the field of decentralized finance (DeFi), where USDT is constantly strengthening its dominance.

Banking Circle launches EU's first compliant stablecoin EURI: Technological innovation and market opportunities under the MiCA framework

French Financial Authority: Starts accepting applications for CASP licenses under the MiCA Act, Bybit withdraws from the French market due to lack of license

Key dates, compliance strategies and transitional arrangements for Web3 companies under the European MiCA Act

In-depth analysis and latest adjustments to the EU MiCA Act's restrictions on the use of stablecoins

Aaron

Aaron