Author: Bondin, Unlocks Insights; Translation: Jinse Finance xiaozou

Note: Recently, Hyperliquid TGE and airdropped to the community, and its token HYPE rose from $2 per swipe to a maximum of $9.8, with an FDV of nearly $10 billion. Currently, HYPE is fluctuating around $8.3. This article reviews Hyperliquid's TGE event and the current status of the decentralized perpetual contract DEX landscape.

The cryptocurrency market is beginning to show signs of a bullish trend, with Meme and artificial intelligence attracting most of the current attention. However, Hyperliquid's recent token generation event (TGE) has shifted the focus to decentralized finance (DeFi). The project airdropped more than one-third of its total token supply directly to the community, without allocating to exchanges or private investors, and the token has maintained a steady increase in price since its launch.

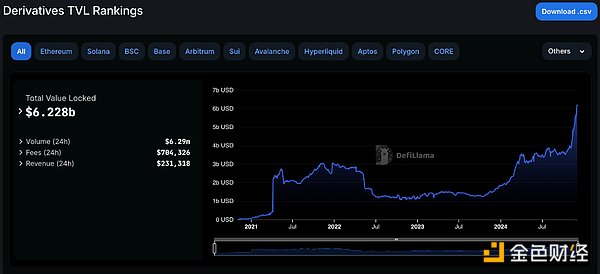

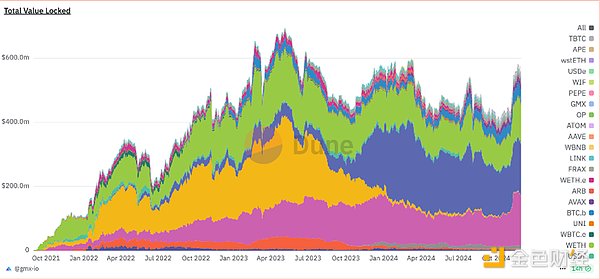

This success raises the possibility of renewed market attention to DeFi, especially decentralized perpetual protocols in the same space as Hyperliquid. Recent data from DefiLlama supports this potential trend, showing a significant increase in the total locked value (TVL) of derivative protocols. This growth highlights the growing relevance of these platforms in the DeFi ecosystem.

In this article, let’s explore:

Hyperliquid: Key features, token economics, and growth potential.

Perpetual Protocols:A closer look at noteworthy protocols in the perpetual space, including dYdX (high market cap), GMX (mid-market cap), and HMX (low market cap), which are screened based on their important metrics in their respective categories.

1,HyperliquidIntroduction

Hyperliquid is a high-performance Layer 1 blockchain designed for a fully on-chain open financial system. Its infrastructure combines the speed of centralized exchanges with the transparency and trustlessness of DeFi, providing fast, transparent and scalable transactions with block latency of less than one second and throughput of up to 100,000 orders per second.

(1)Token Economics

Hyperliquid's token economics emphasize community-driven growth. Its recent Token Generation Event (TGE) introduced the native token HYPE, while more than one-third of the total supply was airdropped directly to the community. Notably, there was no token distribution to private investors or exchanges, ensuring that the value of the project is rooted in community participation.

The main highlights of its token economics are as follows:

Future Emissions and Community Rewards: 38.888%

Genesis Allocation: 31.0%

Core Contributors: 23.8%

Hyper Foundation Budget: 6.0%

Community Grants: 0.3%

HIP-2 Allocation: 0.012%

Community: 76.2%

Founders/Team: 23.8%

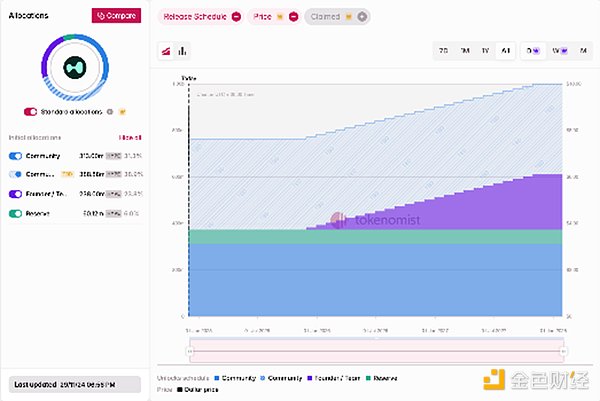

(2) Supply Plan

Hyperliquid's supply plan supports immediate liquidity with a high initial circulating supply while ensuring controlled token emission over time:

Community Allocation: More than 30% of the total supply will enter circulation via airdrop at token launch. The remaining tokens will be gradually emitted over time. A portion of the tokens are allocated to the foundation budget and community grants to support ecosystem development at launch.

Team Allocation:Locked for one year, then gradually unlocked on a monthly basis over two years, with full distribution completed in 2027-2028. The unlock time on the distribution schedule is 2 years.

The high initial circulating supply promotes liquidity and active market participation from day one, distinguishing it from the general trend of low circulation/high FDV tokens. The year after genesis, when the team tokens begin to unlock, will be a key event to observe their potential impact on the market.

(3) Bullish Catalysts

High Initial Circulating Supply:With over 30% of total supply entering circulation at token launch—and without being allocated to VC or private placement investors—Hyperliquid diverged from the trend of VC-backed tokens with low circulation. With no private entity holding pre-allocated tokens, anyone interested in acquiring HYPE outside of the airdrop had to purchase it directly on the market. This move was strongly supported by the community, sparking bullish sentiment and further boosting market confidence.

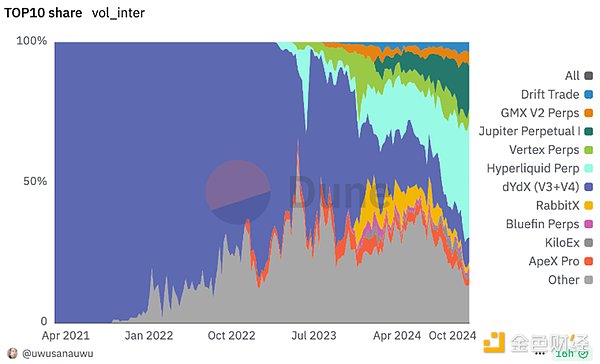

Market Dominance:Hyperliquid has demonstrated impressive growth in user stickiness and trading volume. With over 190,000 total users and over $300 billion in total trading volume, Hyperliquid currently dominates the perpetual protocol market, leading all perpetual protocols with over 35% of trading volume, according to Dune Analytics.

Ecosystem Development:HyperEVM introduced Ethereum compatibility, attracting more than 30 projects, including dApps and GambleFi applications. Collaboration with Ethena and integration with stablecoins such as USDe further enhances utility, liquidity, and developer engagement.

These catalysts highlight the growth potential of Hyperliquid and its leading position in decentralized perpetual trading.

2Explore the current status of the perpetual protocol field

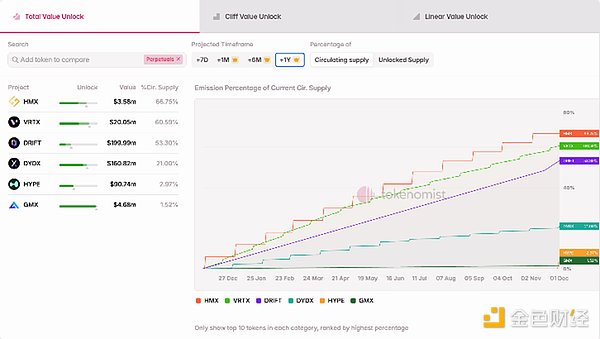

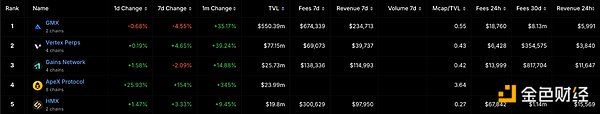

In addition to Hyperliquid, there are several protocols that are actively shaping the perpetual protocol field, driving its development through adoption and innovation. In this section, we will examine the main players in different market capitalizations:

dYdX (high market capitalization): OG leader with a strong user base, focusing on application chains.

GMX (medium market capitalization): leader on Arbitrum, known for its unique liquidity model and stable growth.

HMX (low market capitalization): a protocol that provides high leverage trading with amazing performance valuation indicators.

By analyzing their token economics and catalysts, we form a comprehensive perspective on the decentralized perpetual protocol field.

(1)dYdX: OGMarket Leader with AppChain Vision

dYdXAbout:

dYdX has become a leading decentralized perpetual exchange with advanced features and a professional trading experience. The protocol was originally launched on Ethereum and evolved to StarkWare (v3) in 2021 to overcome the scaling issues caused by high gas fees. To fully achieve decentralization, dYdX launched the v4 iteration on a separate dYdX chain built with the Cosmos SDK, ensuring that all components of the protocol are fully decentralized.

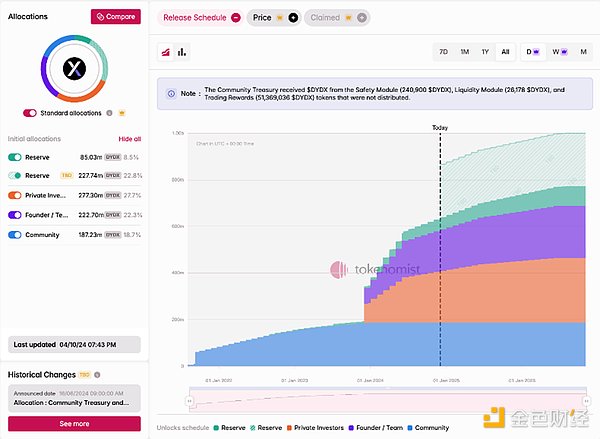

Token Economics:

The DYDX token was launched on August 3, 2021, and its token economics continue to evolve through team decisions and community governance. One point worth noting is the 1-year re-locking mechanism for investor and team tokens, which has greatly boosted market confidence and pushed up token prices.

Team and investor tokens begin unlocking this year, with a significant cliff, and then unlock on a monthly basis until they are fully unlocked in June 2026.

Approximately 20% of the total supply remains unallocated, leaving room for future ecosystem incentives.

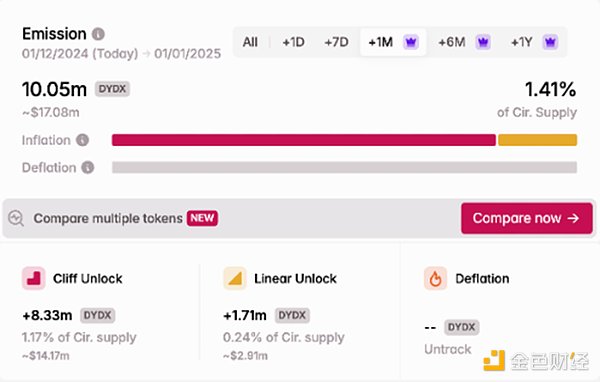

Current token emission is stagnant at approximately 80 million DYDX per month (less than 1% of total supply), ensuring controllable supply growth.

Bullish Catalysts:

Controllable Emission:Stable monthly emission rate of approximately 1.4% of circulating supply ensures limited dilution, providing confidence to long-term holders.

Flexible Allocation:Over 20% of unallocated tokens provide opportunities for future ecosystem incentives, thereby supporting potential growth and adoption.

dYdX Unlimited: The launch of dYdX Unlimited allows users to list and trade on any market, broadening its appeal and creating more trading opportunities within the ecosystem.

(2)GMX:The mid-cap market cap leader on Arbitrum

GMXAbout:

GMX is a decentralized exchange (DEX) operating on Arbitrum and Avalanche, providing spot and perpetual futures trading with up to 100x leverage. Its outstanding feature is the GLP multi-asset liquidity pool, which supports the fees of market making, swap transactions and leveraged transactions, and provides a sustainable and scalable liquidity model.

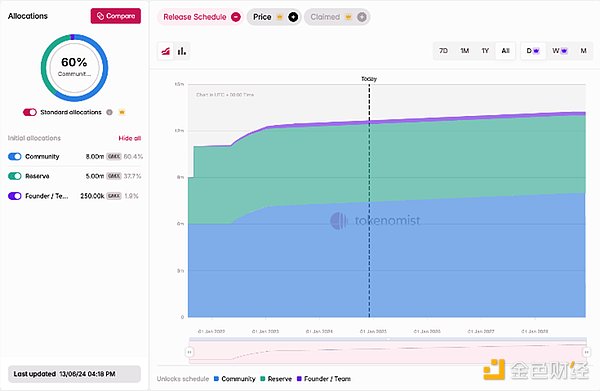

Token Economics:

Founders/Team: 1.9%

Reserves: 37.7%

Community: 60.4%

Bullish Catalysts:

Low Supply Emission:GMX has one of the most conservative supply schedules in the perpetual protocol space with an annual emission rate of only 1.5%, minimizing inflation and preserving token value.

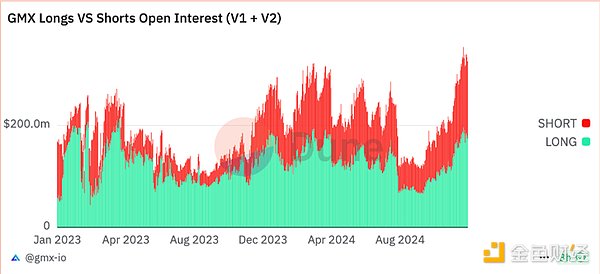

Growth in Key Metrics:GMX has recently demonstrated strong growth trends, including a recovery in TVL, a significant increase in open interest over the past three months, and a 130% increase in 30-day returns driven by increased trading activity and strong fee generation.

(3)HMX: A low-market-cap project with strong indicators

HMXIntroduction:

HMX is a decentralized perpetual contract trading platform running on Arbitrum, providing users with the ability to trade cryptocurrencies and commodities with high leverage. It supports multi-asset collateral and full margin trading, improving capital efficiency and user flexibility

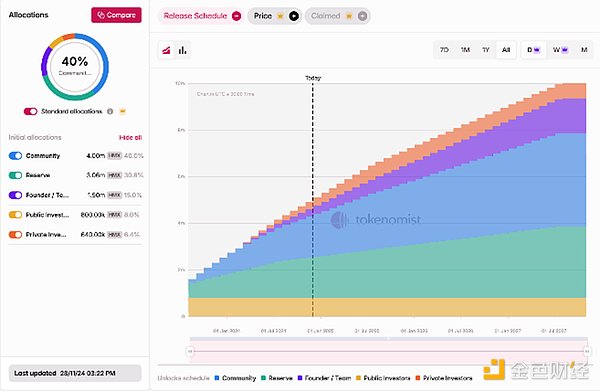

Token Economics:

HMX launches a Token Generation Event (TGE) via a public sale in August 2023.

Team and Private Equity Investors:A 6-month cliff period is followed by a 42-month team unlock period and a 12-month investor unlock period.

Community Allocation:Allocated to platform rewards based on a detailed schedule.

Reserved Allocation:For ecosystem growth initiatives such as marketing, partnerships, and exchange listings. These tokens will not enter circulation directly after unlocking and will only be used when needed.

Bullish Catalysts:

Growth Potential:HMX has half the market cap/TVL of GMX, with a PE ratio of 0.39x (annual expenses: $14m) and a market cap of only around $5.5m, while GMX has a PE ratio of 3.4x (annual expenses: $90m) and a market cap of over $300m. Its fundamentals are strong and its valuation is much lower than GMX and dYdX ($1.2bn), showing huge room for growth.

High Fees and Yields:HMX ranks second in the Fees and Yields dimension, showing strong user stickiness and platform efficiency despite its lower TVL.

HMX’s recently announced roadmap introduces significant updates to enhance its ecosystem and competitiveness:

CLOBModel:To be launched in Q1 2025, the model will bring deeper liquidity, better price discovery, and advanced trading capabilities.

Improved Token Economics:Includes token burning, governance-driven inflation, and airdrop activities to increase demand and user engagement.

Rebranding:The new brand will reflect HMX’s position as an innovator in the perpetual DEX space and its transformative power.

3Conclusion

The perpetual protocol space is gaining momentum in the DeFi space, led by innovative platforms such as Hyperliquid, dYdX, GMX, and HMX, all of which are driving growth through their own unique features and strategies. As the space continues to develop, it will play a key role in decentralized trading.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Bernice

Bernice JinseFinance

JinseFinance