Since hitting the bottom on August 5, Bitcoin has shown a slow upward trend as a whole, with new breakthroughs almost every month. At the same time, as the expectation of liquidity easing becomes clearer, the past week has seen a surge in altcoins represented by MEME, AI and MOVE language public chains, and the market's money-making effect is gradually emerging.

Different from the previous style of fast pull and hard work, the rhythm of this round of market is very slow. Not only has Bitcoin repeatedly pulled and washed three times, but the altcoin market is also basically dominated by rotation, and there are almost no general market rises in the market. Although this slow-heating state makes it impossible for most people to make a quick profit, it also reflects the sustainability of the rising market. After all, under the pattern of stock, every concentrated outbreak of bullish sentiment is often a signal that the market has reached a staged peak. Therefore, repeated washing and steady progress are the most ideal forms of slow bull and long bull.

Although Bitcoin is still 12% away from its historical high, the futures holdings of the entire network have reached a record high. The rapid surge in futures positions means that both long and short parties have stronger expectations for the upcoming market change, and both have begun to deploy their troops and prepare to compete, so the recent intraday game has become extremely fierce. For example, on October 15, the intraday volatility of Bitcoin was only 3.2%, but the amount of liquidation reached 360 million US dollars, and the amount of liquidation in just one hour from 21:00 to 22:00 reached 220 million US dollars. Obviously, the main force is taking advantage of the impatience in the market to repeatedly harvest high-leverage positions. What's more interesting is that among the 93,000 liquidation accounts in the entire network, long accounts account for about 60%, which also verifies the phenomenon that longs are more likely to lose money in a bull market. In the long run, although the current position has a higher winning rate, the author does not recommend investors to participate in high-leverage transactions during the change period.

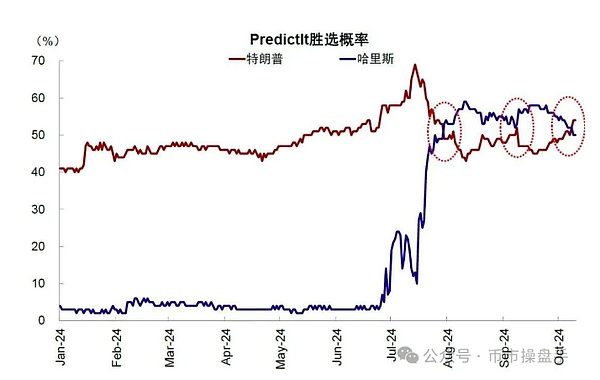

From a trading perspective, the current rise in Bitcoin has largely benefited from the increased probability of Trump being elected as the new US president. PredictIt gambling data shows that Harris' lead has been narrowing since late September, and was overtaken by Trump on October 14, with the latter's winning rate reaching 54%. This point in time is highly consistent with the start of Bitcoin's rise. On October 15, the results of opinion polls in various states in the United States showed that Trump's support rate in seven key swing states, including Michigan, Pennsylvania, Nevada, North Carolina, Georgia and Arizona, has surpassed Harris. If the election situation is consistent with the polls, Trump will eventually get 302 electoral votes, exceeding the 270 votes required to win. Affected by this, Bitcoin continued to rise during the session, breaking through the key pressure level of $66,500.

Although Harris has frequently sent friendly signals to the encryption market recently, these empty words pale in comparison to Trump's heart-touching promises and deep interest binding. First, Trump promised to take measures to ensure the United States' leadership in the field of cryptocurrency, planned to include Bitcoin in the national reserve, and fired SEC Chairman Gary Gensler, who was called the "crypto killer". Secondly, Trump himself is deeply involved in the crypto market. Not only has he issued NFTs many times, but he has also frequently promoted the WLFI tokens issued by his family on social media recently. In addition, Musk, Trump's largest funder and advisory member, is also a supporter of Bitcoin and Dogecoin. After the media disclosed that Musk spent $75 million to support Trump, Dogecoin soared by more than 12%. Therefore, it can be foreseen that whether it is to fulfill his campaign promises, expand family income, or give back to supporters, Trump has enough motivation to introduce policies to boost the crypto market after his election.

At present, the U.S. stock market's enthusiastic bullish sentiment on Bitcoin is vividly demonstrated in the valuation deviation of MicroStrategy (MSTR). According to data disclosed by MSTR, the company holds a total of 252,220 bitcoins, worth approximately $17 billion, while the company's current total market value is $37.8 billion. Referring to the 3 to 5 times EV/Revenue multiples of mature business intelligence companies such as Tableau and Qlik, the valuation of MicroStrategy's main business is between 1.5 billion and 2.5 billion US dollars. Even if the upper limit of 2.5 billion US dollars is taken, the market premium rate for MSTR's Bitcoin assets is still as high as 107.65% [(37.8 billion - 2.5 billion - 17 billion) / 17 billion]. This shows that investors who currently buy MSTR shares still expect Bitcoin to rise more than double. In fact, similar phenomena have occurred in the history of US stocks. For example, the premium rate of Grayscale Bitcoin Trust once reached 80% in 2020, and then the price of Bitcoin soared.

In terms of operation, although Bitcoin has risen by 38% since its low on August 5, the current chip structure of Bitcoin is relatively stable due to the very sufficient wash during the rebound. Even if there is a short-term adjustment, it is likely to unfold in a very mild way. For trend investors, this fluctuation can be completely ignored.

Hui Xin

Hui Xin

Hui Xin

Hui Xin Jasper

Jasper Davin

Davin Aaron

Aaron Joy

Joy Hui Xin

Hui Xin Jasper

Jasper Jasper

Jasper Jixu

Jixu Hui Xin

Hui Xin