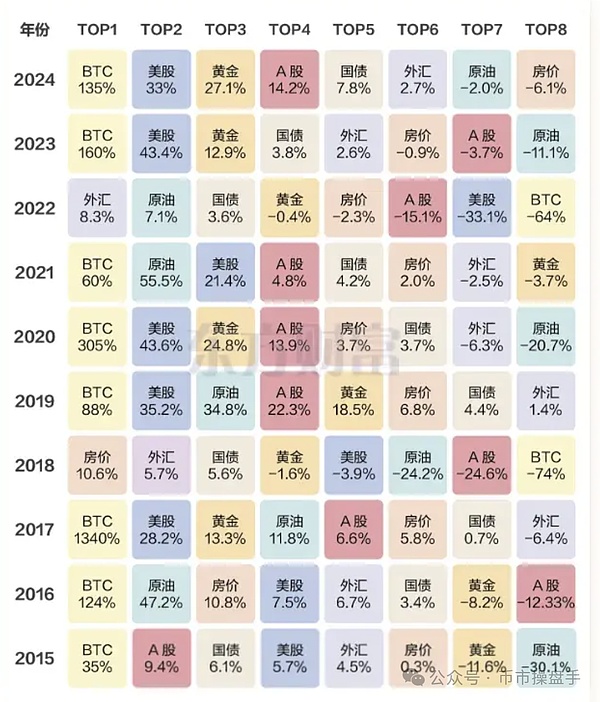

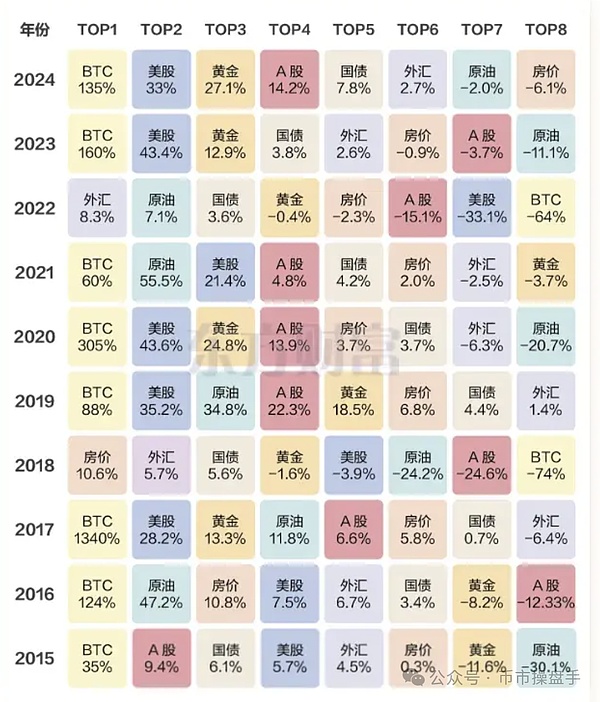

In 2024, Bitcoin became the world's best performing asset with a 135% increase. However, the market is no stranger to Bitcoin's stunning performance. After all, in the past decade, Bitcoin has topped the throne of the world's strongest asset eight times. It is no exaggeration to say that long-term holding of Bitcoin has become the best winning strategy in the past decade. Looking ahead to 2025, almost most institutions are highly optimistic about the Bitcoin market in 2025. According to Coindesk, CoinShares, Galaxy Digital, VanEck, Bitwise, Standard Chartered Bank and other eight institutions predict that the lower limit of Bitcoin's target range in 2025 is US$150,000. So, can Bitcoin continue its glory in 2024?

The author believes that Bitcoin still has the potential to hit a record high in 2025, but the author's optimism about the market is different.

As we all know, the optimistic expectations of most institutions are mainly based on the fact that the proportion of Bitcoin in institutional investment portfolios will further increase, and the basis for this expectation to be realized requires Trump to fulfill his promise to include Bitcoin in the national reserve. According to the World Gold Council, as of September 2024, the US gold reserves will be 8,133.5 tons, worth about $700 billion. Considering that the circulating market value of Bitcoin is about one-tenth of gold, the theoretical size of the US Bitcoin reserves will reach $70 billion. Even if the US government has obtained about $20 billion worth of Bitcoin through law enforcement, its theoretical purchase space can still reach $50 billion.

In addition, US pension funds generally allocate 1%-2% of their funds to gold, with a scale ranging from $400 billion to $800 billion. However, pension funds have almost zero allocation to Bitcoin (only a few hundred million dollars). If the national level takes the lead in allocating Bitcoin, pension funds and large enterprises will inevitably follow suit, which will bring huge increments to the crypto market.

It can be said with certainty that the inclusion of Bitcoin in the national reserve will boost the crypto market no less than the approval of the Bitcoin ETF. As long as this goal is achieved, it is a natural thing for Bitcoin to break through $150,000 in 2025. However, the crux of the matter is that it is not easy for Trump to make Bitcoin a national reserve.

Currently, there are three main ways for Trump to quickly establish a national reserve of Bitcoin:

First, the Federal Reserve purchases Bitcoin through open market operations and includes it in its balance sheet. This move only requires the approval of the FOMC, without the approval of Congress.

Second, after taking office, Trump signed an executive order instructing the U.S. Treasury to use the Exchange Stabilization Fund (ESF) to directly purchase Bitcoin.

Third, the Ministry of Finance established a special government Bitcoin investment plan and clarified the source of funds (such as issuing government bonds or fiscal transfers), which was then implemented after approval by Congress.

From the current situation, the possibility of Bitcoin being included in the national reserve through the Federal Reserve is very small. First, the Federal Reserve's open market operations mainly involve government bonds and government-backed securities, and there is almost no record of buying gold, let alone buying highly volatile assets such as Bitcoin.

Secondly, on December 20, Federal Reserve Chairman Powell made it clear at a press conference after the monetary policy meeting that the Federal Reserve had no intention of participating in any government plan to hoard Bitcoin. He emphasized that such issues should be the responsibility of Congress, and the Federal Reserve did not seek to amend existing laws to allow the holding of Bitcoin. Powell's statement was interpreted by the outside world as a tactful opposition to the Bitcoin national reserve plan.

The establishment of a special fiscal investment plan is considered to be a more long-term legally supported solution. However, the use of fiscal revenue involves budget allocation and the issuance of bonds involves government financing, both of which require congressional approval. This makes the implementation of the fiscal plan long and full of uncertainty.

On the whole, the second way - Trump instructs the Treasury Department to use the Exchange Stabilization Fund (ESF) to buy Bitcoin through an executive order - is the most feasible option within the scope of the US President's authority. However, even if this approach is theoretically feasible, it still faces multiple challenges, especially congressional oversight and political risks.

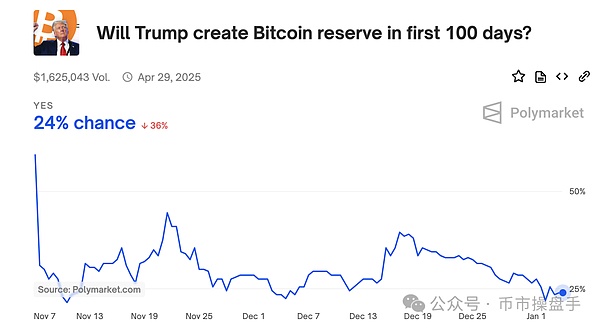

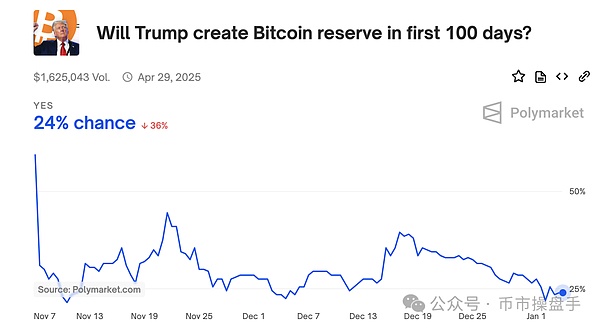

To some extent, the Fed's attitude reflects the position of Wall Street. It is feasible for these vested interests to increase their income by increasing Bitcoin business, but it is almost impossible for them to give up their financial dominance and pave the way for Bitcoin. As predicted by David Sacks, the White House encryption director, it may take a catastrophic sovereign currency crisis for the market to recognize Bitcoin's status as a mainstream currency. Therefore, after Powell's speech, PolyMarket's trading pricing showed that the probability of Bitcoin becoming a US national reserve fell from 36% on December 20, 2024 to 24% on January 3, 2025.

In the macro sense, 2025 is also the year when black swans are most likely to appear in the global capital market.

First, affected by the rebound in inflation and the increase in tariffs, the market generally lowered the Fed's expectations for interest rate cuts next year, and even some Wall Street institutions have given predictions that interest rate hikes will begin in the second half of next year. Therefore, the yield on the US 10-year Treasury bond continued to rise against the backdrop of the Fed's interest rate cuts, exceeding the federal funds rate for the first time in nearly two years. This has formed a significant crowding-out effect on the liquidity of risky assets.

Secondly, against the backdrop of the Fed's balance sheet reduction, the United States' expansionary fiscal policy is a key factor supporting the prosperity of the U.S. stock market and consumer market. If the new government significantly cuts government spending, the market will face the risk of losing momentum support.

Of course, the author does not think that the positive effects of Trump's new crypto policy have been fully digested by the market. However, these positive factors have brought more trading opportunities to the market, such as opportunities for Bitcoin band operations and opportunities in certain crypto segments (such as asset tokenization, AI Agent, DeFi, etc.). In terms of operation, the author tends to believe that Bitcoin will rise by 30% to 40% in 2025, with a corresponding target range of US$122,000-US$130,000. Therefore, it is also a relatively stable strategy to appropriately reduce positions above US$122,000.

Anais

Anais