Source: Liu Jiaolian

I listened to the spring rain in the small building overnight, and sold apricot flowers in the deep alleys the next morning.

Since the halving of Bitcoin (BTC), it has been climbing, from the pre-halving low of 59.5k to the current 66k.

How many people are still looking forward to a bigger retracement? Before and after the first halving, the maximum retracement was -61.4%; the second halving, -43.5%; the third, -56.6%; this time, the fourth, has only completed a retracement of -12%. This time, how will history complete its rhyme?

Recently, the IMF (International Monetary Fund) released a paper titled "Research on the cross-border flow of Bitcoin", focusing on its measurement and driving force.

Some industry media read the title and started to make up their minds, misinterpreting it as the IMF's attitude towards Bitcoin has changed from opposition to support. This is really a slight mistake, but it leads to a huge mistake. Let’s first look at these two sentences in the conclusion of the paper:

“These findings are consistent with a large number of recent studies that Bitcoin helps circumvent capital flow restrictions (Graf von Luckner et al., 2024, 2023; Hu et al., 2021). As the International Monetary Fund (2023a) emphasized, policymakers aimed at managing capital flows should ensure that capital flow management regulations cover crypto assets.”

As netizen Sean Doherty pointed out: “There is no doubt that the only purpose of this paper is to make governments pay more attention to it so that they can try to regulate it into oblivion and prevent it from becoming a real currency - a free currency.”

However, the paper still provides some interesting findings.

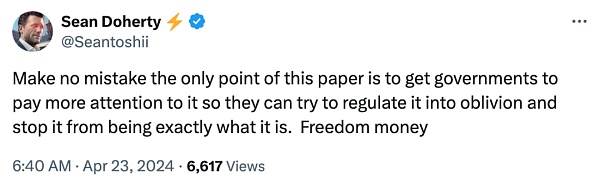

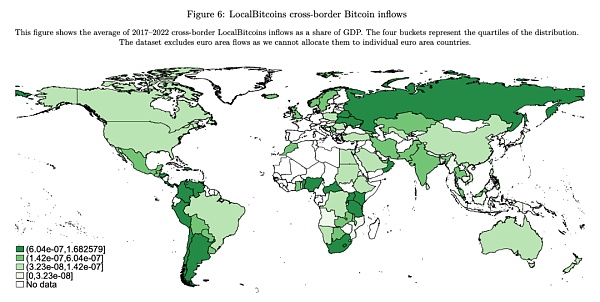

By combining the on-chain data of Chainalysis, an on-chain data analysis company, and the OTC (over-the-counter) trading data of LocalBitcoins, a now-closed Bitcoin off-chain trading platform, the analysis results of Bitcoin cross-border flows were obtained. Then, by comparing the global US dollar capital flow data of the research institution EPFR and IIF (International Financial Institutions), several conclusions were drawn:

First, countries with limited contact with the wider global economy are relatively large users of Bitcoin.

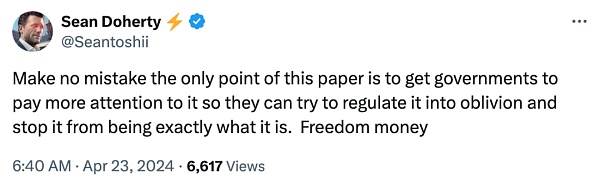

The paper states: "Compared to the gross domestic product (GDP) of some countries, the estimated scale of cross-border Bitcoin flows is quite large, especially in countries with relatively low capital flows."

The above figure is an illustration from the paper, showing the data from LocalBitcoins, which is analyzed and split into the inflow of Bitcoin in various countries (except Europe). The darker the color, the higher the proportion of the inflow value to the country's GDP; the lighter the color, the lower the proportion.

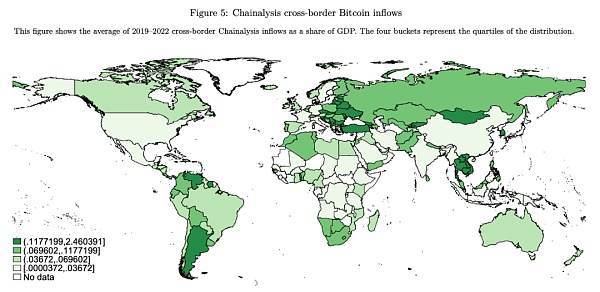

The results of the on-chain flow data analysis are similar (this time including Europe):

Obviously, if we are talking about the impact of Bitcoin on the cross-border capital flows of a country, then the higher the proportion of GDP, the greater the impact.

However, don't forget that the absolute amount of BTC corresponding to the light green (lower proportion) of China and the United States, two of the largest GDP countries, is likely to far exceed the number of small dark green (higher proportion) countries.

Who is the real big player? We should still see clearly.

So, we should question and think independently about the view of the paper that the more capital controls and restrictions a country has, the more people use Bitcoin as a "pressure relief valve". At least, how can the United States, which has always flaunted capital freedom, be the same color (weight) as my country, which has always been complained about by public intellectuals for capital controls?

Seeing this, Jiaolian couldn't help but smile. The meaning of this paper is either to admit that the capital freedom of the United States and my country is the same (public intellectuals are wrong), or to admit that people do not use Bitcoin mainly to circumvent capital controls (the paper is wrong). Choose one of the two. Haha.

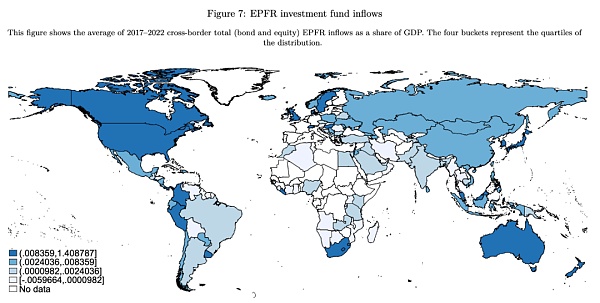

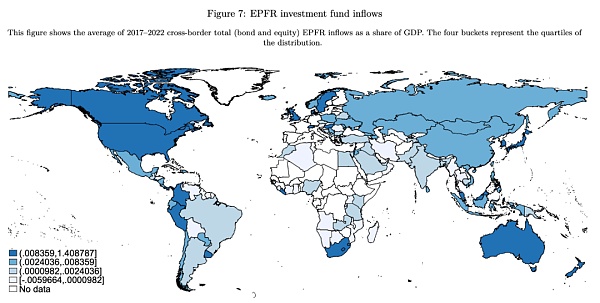

Second, the inflow of traditional US dollar capital in the United States is particularly huge, making it an "outlier".

From the above figure, the US GDP is 1.5 times that of my country, and it does not engage in any manufacturing, but the proportion of US dollar capital inflows to GDP is one percent higher than that of my country. Although Canada and it both have a high proportion of dark blue, how much is Canada's GDP?

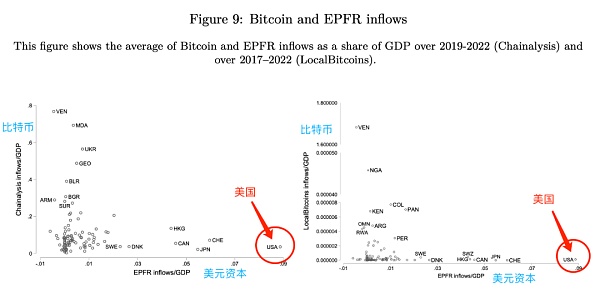

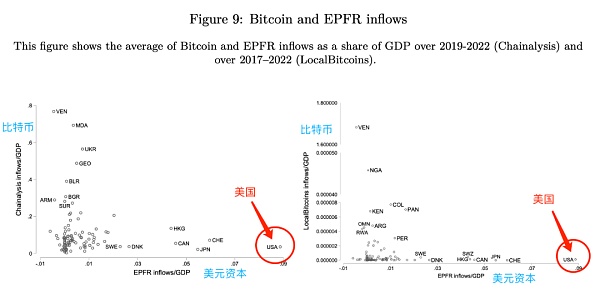

This also leads to the fact that when Bitcoin inflows and US dollar capital inflows are placed in a coordinate system for observation, it can be clearly seen that the United States is an "outlier". (As shown below)

If we think in reverse, using Bitcoin as a reference system, and believe that Bitcoin inflows measure a country's natural demand level for capital inflows, then, under the same demand level (same color depth), does the more excess US dollar capital inflows, the more excessive capital absorption? Originally, it does not need to absorb so much capital for production, but it absorbs it like a capital addict. What is wrong with this economy?

So is this paper also "hinting" us that the so-called "the United States uses the dollar to harvest the world" is true?

Third, the growth of Bitcoin usage is a "symptom" of the imbalance of the traditional global economy.

The surprising side is that Bitcoin has quietly "changed" and has become a graceful lady, even entering the sight of the IMF.

The worrying side is that the IMF's attention to Bitcoin is obviously not well-intentioned.

As one of the tools for maintaining the dollar order after World War II, the relationship between the IMF and Bitcoin is like that between Huang Shiren and Xier. However, Satoshi Nakamoto, who tied a red headband on Xier, is not as weak and bullied as Yang Bailao.

Because every awakened person in the world is Satoshi Nakamoto. If countless Satoshi Nakamoto unite, they will surely be able to defeat Huang Shiren and build a new world.

Brian

Brian